Summary

2025 will continue to offer opportunities and investors will need to assess the impact of Trump's policies.

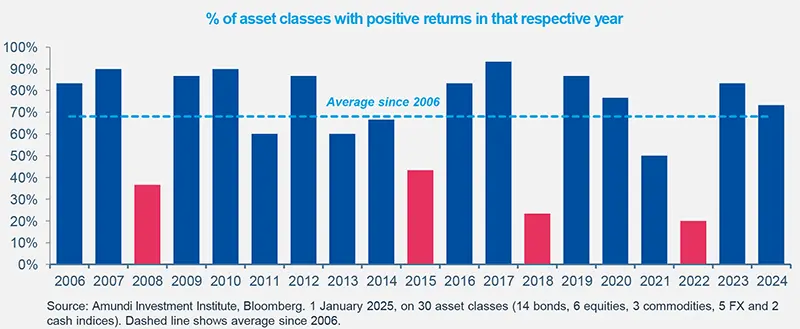

- Negative years like 2018 and 2022 are often followed by strong recoveries, as seen in 2023 and 2024.

- Over 70% of asset classes analysed were positive in 2024, with US equity, China equity, and gold leading.

- We expect 2025 to continue to offer opportunities, but the results will likely be less strong.

2024 Winners

US equities

US equities have reached multiple highs in 2024, bolstered by Fed rate cuts and most recently by expectations of a positive impact from tax cuts and deregulation following Trump's victory.

Gold

Gold has experienced very strong performances driven by ongoing geopolitical risks and expectations of lower interest rates, which have enhanced its appeal as a potential store of value.

A year at a glance

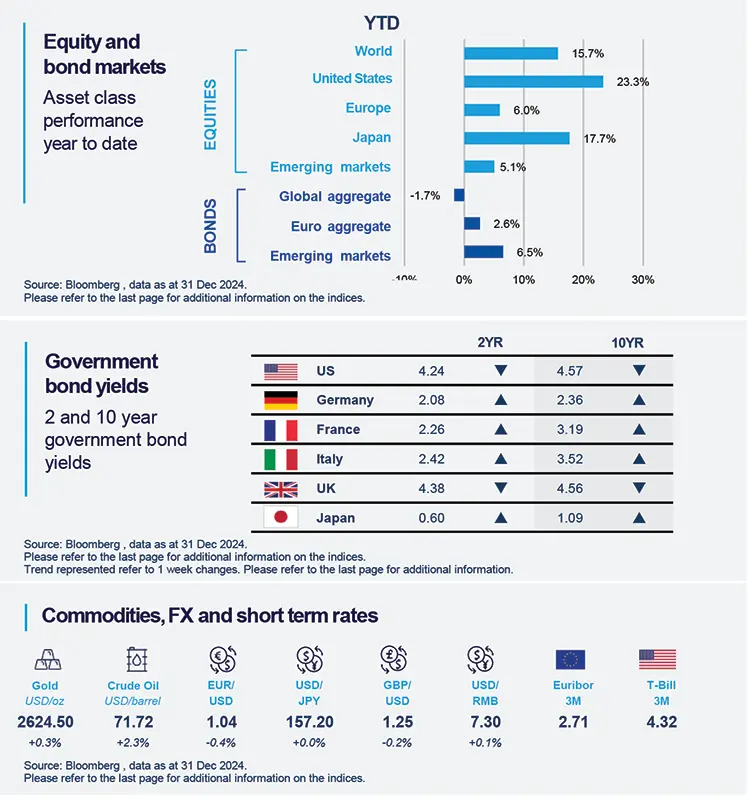

With the global economy remaining resilient, slowing inflation, and central banks cutting rates, most asset classes have benefitted in 2024, particularly global equities. Bond yields closed the year at levels around the highest seen over the past quarter.

2025: resilient multi-speed growth outlook

UNITED STATES

Soft landing expected

The US economy is transitioning to slower growth with rising uncertainty on growth and inflation.

To watch: Trump 2.0 policies and inflation path.

EUROPE

Europe’s path to recovery

Expect modest growth with inflation back to target. Divergences across countries are set to continue.

To watch: Policy action to raise potential growth through productivity.

JAPAN

Economic growth set to improve

The Bank of Japan will monitor wage trends and stay ready for further hikes.

To watch: Political developments, and impact on economic policy.

CHINA

China’s new normal

Expect more policy support to mitigate downtrend and impact from tariffs.

To watch: fiscal impulse size and allocation.

INDIA

Resilient (but normalising) economic growth driven by domestic demand and investments.

To watch: fiscal impulse size and allocation.

EMERGING MARKETS

Robust and broadbased growth, with a substantial premium vs Developed Markets with winners and losers.

To watch: Tariffs, monetary policy, fiscal policy.

Key dates

7 Jan US Job Openings and Labour Turnover Survey (JOLTS) | 7 Jan Euro Area inflation and unemployment rates | 8 Jan Japan Consumer Confidence, US FOMC minutes |