Summary

Gold prices may fluctuate in the short term, but metal is expected to

potentially provide stability, over the medium term, as a result of

geopolitical tensions and deteriorating government finances.

- Gold prices have remained resilient this year, rising around 30% year to date.

- The recent uptick in gold prices, along with the USD, was led by escalating geopolitical tensions.

- Investors should look for sources of portfolio stability as geopolitical tensions stay high.

Gold prices have rebounded partially over the past few days due to escalating geopolitical tensions between Russia and Ukraine. Metal fell in the aftermath of Donald Trump’s victory in the US elections, which triggered an upward move in the US dollar and bond yields. Markets believe that the policies of President-elect Trump could push up inflation, causing the Fed to rethink its interest rate cuts. The sustainability of this rebound in the near term depends on the potential trajectory of interest rates. Falling rates may increase the appeal of gold as it is not an income-generating asset. In the long term, expansionary fiscal policies (stimulus) and a deterioration in government finances put downward pressures on government-backed currencies such as the dollar, fueling demand for an alternative store of value. Buying by global central banks will also affect prices.

Actionable ideas

- Gold

Escalating geopolitical tensions and potential concerns over economic growth underline the need to explore potential sources of portfolio stability such as gold.

- Multi asset investing

A cross asset approach may allow investors to maintain portfolio stability in times of market stress, and also potentially benefit from opportunities that may enhance returns through equities and EM assets.

This week at a glance

Most global equities rebounded, led by strong US economic data and expectations of pro-growth policies in the US. This led to a fall in long-term US and European bond yields. In Europe, geopolitical tensions escalated owing to the Russia/Ukraine war, leading to an uptick in gold prices.

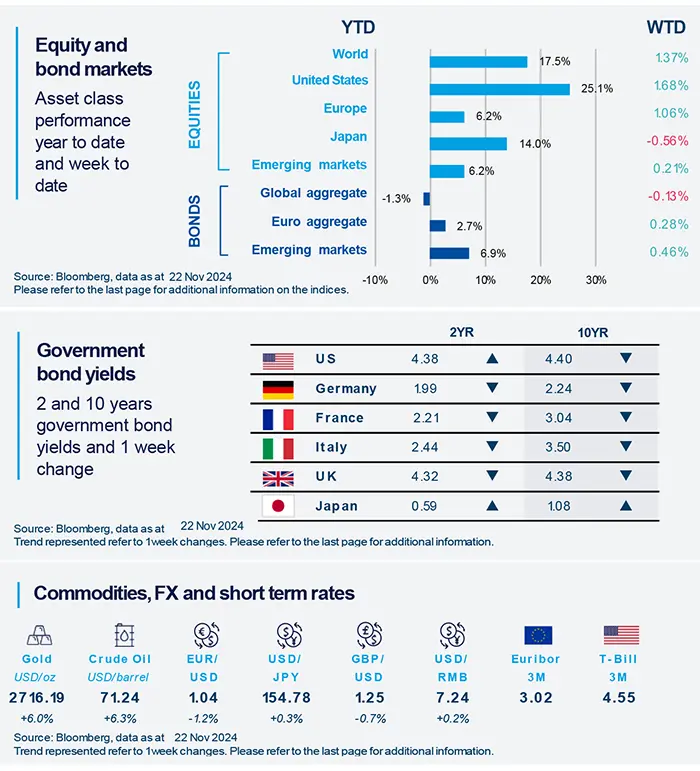

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as 22 November 2024. The chart shows the S&P 500 index and the S&P equal weighted index.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US labour market is mildly decelerating

Weekly data for initial jobless claims, people filing for unemployment insurance for the first time, dropped to its lowest since mid-April in the week ending 16 Nov. However, separate weekly data for continuing claims (all unemployed individuals who qualify for unemployment insurance) rose to a three-year high, indicating a cooling labour market. This also shows that it is taking longer time for unemployed workers to find a new job.

Europe

Eurozone wages grew at a strong pace in third quarter

The ECB negotiated wages indicator rose 5.4%, year-on-year, in the three months ended 30 September. We think wages are still catching up to the loss in purchasing power suffered during the inflation surge of recent years. This increase was largely driven by negotiated pay increases in Germany. Looking ahead, we, along with the ECB, expect the pace of wage growth to moderate progressively in 2025 and 2026.

Asia

Inflation came in above expectations in Japan

The national CPI (consumer price index) inflation rose in October, driven by a rebound in the services component. In addition, the recent preliminary purchasing managers index for November shows a robust hiring pace. Collectively, this indicates that moderate inflation is taking root in Japan, paving way for interest rate hikes in the coming months by the Bank of Japan. We think a December hike is highly likely.

Key dates

|

26 Nov US FOMC meeting minutes, Brazil inflation |

27 Nov US FOMC meeting minutes, Brazil inflation |

29 Nov EZ CPI, India and Canada GDP |