Summary

- The main global theme to follow is the monetisation of AI capital expenditure (capex) programmes. To date, the US tech winners have been those companies that are engaging in substantial AI investments. The question is how and/or when will these be monetised.

- US: We expect a reset of the US tech sector valuation levels. While tech earnings will continue to grow, we anticipate that the earnings growth for the broader market to accelerate, leading to a narrowing of the valuation gap between the tech winners and the rest of the market. We remain concerned about the high US tech sector valuation levels, in particular those of the mega caps names. Conversely, the outlook for tech companies, beyond the AI capex beneficiaries, is mixed, offering some opportunities among the most cyclical companies that are trading at multi-year lows.

- Europe: We believe the recent under-performance of select European Tech companies is currently offering attractive investment opportunities for a structurally growing sector, given depressed valuations. Many of these are at multi-year cyclical lows, and we believe that the share prices are not reflecting an expected recovery in corporate spending that should materialise from next year, as AI adoption broadens out.

- Asia: We have a positive outlook for the Taiwanese and Korean semiconductor companies. We seek to diversify away from monothematic AI plays and, instead, focus on investment cases built both on AI and a broader based upcycle in 2025, following disappointing demand in 2024 (ex. AI). Both Taiwan and Korea offer opportunities in diversified investment cases at affordable valuation levels. The Korean large memory chip manufacturers should benefit from AI growth whereas the Taiwanese manufacturing sector is profiting from producing cutting-edge AI processors. Elsewhere, China’s rising competitiveness in selected segments remains difficult to navigate given US politics whilst Chinese tech stocks are more expensive than those listed in Taiwan, or Korea.

What has driven the share price outperformance of the US tech sector to date?

The tech sector continued to outperform in 2024, with a YTD performance of +34% versus a +25% for the S&P 500 Index. Over the past two year, the tech sector’s outperformance has been driven by superior earnings growth, expectations of lower US interest rates and the start of a cycle of investment in AI technologies. In fact, large AI capex programmes have been the biggest tailwind for the US market. Within the sector, notable examples of AI winners include the four major hyperscalers (Microsoft, Google, Amazon, Meta Platforms) that are expected to spend close to USD 200 billion on capex this year. With a few exceptions, these programmes have driven the market more than any idiosyncratic AI monetisation.1

1. In the recent quarterly results, there has been two examples of stocks which were driven higher by demonstrating some initial monetisation of their AI capex (a leading e-commerce company, an internet search engine company).

Outperformance of the US tech sector in 2024

Source: Amundi Investment Institute, Bloomberg. Data as of 22 November 2024

AI insights from the recent earnings season that capture winners and losers

Examples of communication from AI winners with large capex programmes:

- A provider of social networking, advertising and business insight solutions (US listed, communication services) - "We are growing our infrastructure investments significantly this year and we expect significant growth again in 2025."

- A large computer software company (US listed, tech) - "We ran into a set of constraints, which are everything, because data centres do not get built overnight. So, there is data centres, there is power, and these have been the short-term constraints."

- A leading e-commerce company (US listed, consumer discretionary) - "We expect to spend about $75 billion in 2024. I suspect we will spend more than that in 2025. And the majority of it is for cloud services and specifically, the increased bumps are really driven by generative AI."

Examples of communication from companies facing challenges:

- A semiconductor company supplying the industrial, automotive and personal electronic sectors among others (US listed tech) - "Three markets that are already in the midst of a cyclical recovery […] That is personal electronics, enterprise systems and communication systems for us, coming from a very low trough, but showing momentum. And I think that we are in the process of strengthening. [… Industrials] revenue peaked in the third quarter of 2022. We have seen eight quarters of decline. We are more than 30% down versus the peak […] I don't think we have a lot left. I think the inventory correction is still ongoing, but I do expect that to start to recover […] On the automotive market, […] I would say upper-single digit, somewhere between 5% to 10% versus the peak on automotive." "I think the inventory correction [in Industrials] is still ongoing, but I do expect that to start to recover […] most of the sectors are either still searching for a bottom or hovering at a very low level. So, it's about time, but we have not seen it yet."

- A supplier of semiconductors and sensors (US listed tech) - "The demand environment remains muted with ongoing inventory digestion and slow end demand."

- A large chip manufacturer for the automotive, industrial and communication industries (European listed, tech), “Currently, there is hardly any growth momentum in our end markets except from AI, the cyclical recovery is being delayed. The inventory correction is continuing. Short-term ordering patterns and inventory digestion are clouding visibility on demand trends beyond the next couple of quarters. We are therefore preparing for a muted business trajectory in 2025.”

- A leading AI memory producer (Korea listed, tech), “Our capex/sales ratio will be under mid-thirties in 2025-2027 (it was 35% in 2021-2023).” The quote reflects the ambiguity of capex discipline and shareholder return, versus the necessities of competitive pressure and eventually diminishing returns on AI.

What is the outlook for the US tech sector?

On a cap-weighted basis, the sector and related exposure are expensive, but there are large differences in valuation levels and earnings growth strength among tech stocks. The question is how and/or when will the large current AI capex programmes be monetised. The semiconductor companies are the obvious early beneficiaries of AI, but the outlook for other tech companies, beyond them, is mixed, with many facing uneven demand, similar to companies in other industries exposed to the challenging demand environment. However, there may be some attractive opportunities to be found among the most cyclical companies that are trading at multi-year lows. As regards the impact of AI growth elsewhere, the high-power usage of AI and the build out of data centres is boosting demand for electrification, construction and commodity products that sit within many other sectors (e.g. industrials, materials).

Despite the overall high valuations, there are opportunities to be exploited within the tech sector, as well as in other areas that could benefit from AI adoption

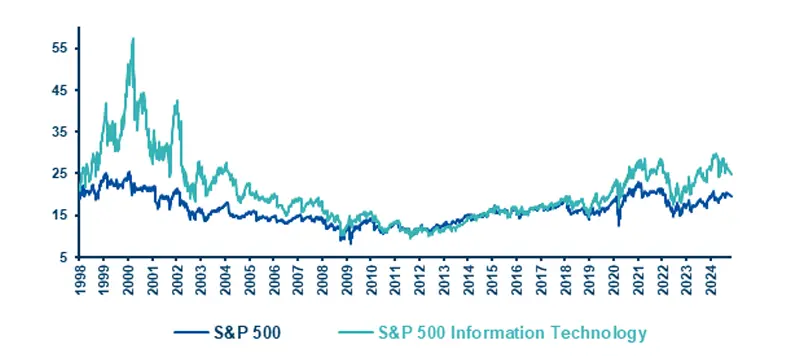

US tech valuation levels on a 12-month forward P/E

Source: Amundi Investment Institute, Bloomberg data as of 15 November 2024.

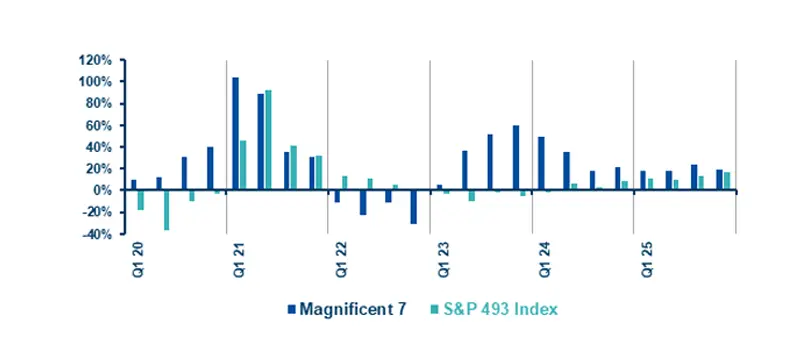

Overall, while tech earnings will continue to grow, we expect the earnings growth for the broader market to accelerate, narrowing the wide valuation gap between the Magnificent 7 and the rest of the market.1 This will result in a reset of sector relative valuation levels.

1. The magnificent 7 include Amazon, Apple, Google, Meta, Microsoft, Nvidia and Tesla.

We expect the earnings growth for the broader market to accelerate, narrowing the wide valuation gap between the Magnificent 7 and the rest of the market.

Earnings growth % year-on-year: Magnificent 7 versus the S&P 493 Index

Source: Amundi Investment Institute, FactSet, 5 November 2024.

What is the outlook for the European tech sector?

Despite current challenges in the semiconductor industry, robust AI infrastructure investments signal a transformative opportunity, with future growth driven by the intelligent industries and electrification.

The European tech sector has not participated much in the AI rally, under-performing the wider market this year (up c. 1% YTD versus c. 5% for STOXX Europe 600 Index). European tech companies have limited direct exposure to AI (in contrast to many US peers), but rather are more exposed to the EV supply chain and semiconductor equipment area. Although the whole industry declined post covid, as demand for consumer electronics normalised, the European companies suffered relatively more, as they did not benefit from the GenAI euphoria which followed.

Having enjoyed a solid first half of the year, there was a summer sell-off driven by macro weakness in specific end-markets for most of the large European tech companies. In particular, issues in the semiconductor industry saw certain projects from large customers pushed out to later years. Currently, a decline in corporate technology budgets post Covid and an uncertain environment (automotive and industrial datapoints have been negative) has adversely impacted business and consumer confidence. This is resulting in a cut in spending on discretionary items such as software innovation, although investments into AI infrastructure are on the rise. Companies and governments are increasingly investing in the infrastructure needed to develop and implement the new technology. Given this backdrop, we are constructive on select European semiconductor companies which are set to benefit from the AI infrastructure build. While most companies are still in the discovery phase for AI adoption, trying to find commercial use cases for the new technology, we expect AI traction and implementation in Europe (the US is already seeing greater AI deployment than Europe) to improve next year, with corporate spending on software and hardware devices set to increase.

Looking to the longer term, we anticipate that the sector’s outlook will be driven by strategic spending focused on the intelligent industry (e.g. internet of things, factory automation etc) and electrification themes (e.g. growth in hybrid/electric vehicles, smart grids, renewable energy). Although the tech companies are experiencing tough conditions currently, they have healthy revenue pipelines in these areas. Furthermore, for some of the auto/industrial exposed stocks, valuations are at multi-year cyclical lows and are not factoring in a spending recovery. We believe attractive opportunities lies in these areas, in out-of-favour, less crowded names.

What is next year's outlook for the semiconductor companies in Asia?

In Asia, we seek opportunities among the semiconductor companies in Taiwan and Korean.

Overall, the Asian tech sector’s performance has been positive both in absolute and relative terms versus the Asian market over the past two years. Similarly, to other regions, the sector suffered post Covid, but capacity cuts and capex discipline allowed investors to anticipate the next upcycle. In 2024, the sector has been driven exclusively by higher AI expectations, with some periods of doubt during the summer caused by concerns about the sustainability of such high expectations.

We are positive on the 2025 outlook for the Taiwanese and Korean semiconductor companies. In Korea, there are large memory chip manufacturers which will benefit from AI growth. Given recent comments from the US hyperscalers (Amazon, Microsoft, Google and Meta Platforms) and Nvidia, we expect robust AI demand next year. Turning to commodity DRAM (dynamic random-access memory) products, we are cautious as there is greater competition and a catch-up in higher-end technology (excl. High Bandwidth Memory (HBM)) from China.1 Elsewhere, Taiwan offers many investment cases combining leading competitive positions in the semiconductor ecosystem. These are leveraging off AI and, at the same time, will be playing a W shaped smartphone replacement upcycle and a PC replacement cycle next year.

Turning to China, it has been restricted by the US, and hence has focused on mature technologies such as power semiconductors. This has depressed prices in this segment while automotive OEMs are sourcing these semiconductors from this region. China’s progress in leading semiconductor technologies (e.g. logic, memory process) is faster than expected. Hence, US containment on China’s market share in these products is only partially effective at best, if not counterproductive, as China may excel on efficient algorithms.

To conclude, we prefer to diversify risk away from monothematic AI plays. Specifically, leading memory players are building up capacity in HBM memory (supports the training of AI models) and there could be a risk of over-capacity. Alternatively, both Taiwan and Korea offer opportunities in diversified investment cases at affordable valuation levels. As regards China, its rising competitiveness in selected segments remains difficult to navigate under US politics while tech stocks tend to be more expensive than those listed in Taiwan or Korea. Finally, there is a greater focus on geopolitics among investors, and share price volatility could increase in 2025 as Trump’s government is inaugurated. The issues are tariffs, revisions to the US Chip Act and a fall in China-US relations. These factors could hurt the semiconductor supply chain globally.

1. High Bandwidth memory is a standarised stacked memory technology that offers data channels.