Summary

Solid US corporate profits and decent economic data have driven equity markets to record highs. With US markets back to extremely expensive levels, the market could see rotations towards other less expensive sectors and regions.

US markets reached new record highs last week on the back of AI-driven euphoria and corporate earnings above expectations.

While markets have been driven by the large cap and tech sectors, this is also increasing concentration risks.

With some areas of the US market back to extremely expensive levels, the market could see rotations towards other less expensive sectors and regions.

The S&P 500, the primary US equities index, touched record highs recently, led by the technology sector and the optimism around the artificial intelligence (AI) boom. A better-than-expected corporate earnings season and hopes of interest rate cuts by the Fed also supported sentiment. However, this continued uptick over the summer is fanning worries about increasing concentration risks in the US where a handful of stocks/sectors are driving returns. Additionally, the impact that new import tariffs may have on corporate earnings is still uncertain. Tariffs essentially act as a tax on consumers’ disposable income and given that the US consumer is a key pillar of the country’s economic growth, we think any weakness here could affect the economy. With uncertainty ahead, markets are expected to remain highly sensitive to macro data and Fed actions.

Actionable ideas

US equities outside megacaps

The cheaper names outside of large cap growth stocks may offer a good way to play the US growth and earnings resilience.

Global equities

Countries like the UK, Japan and Europe offer potentially attractively-priced businesses that rely on strong business models and domestic consumption. Such an approach could allow investors to explore global opportunities.

This week at a glance

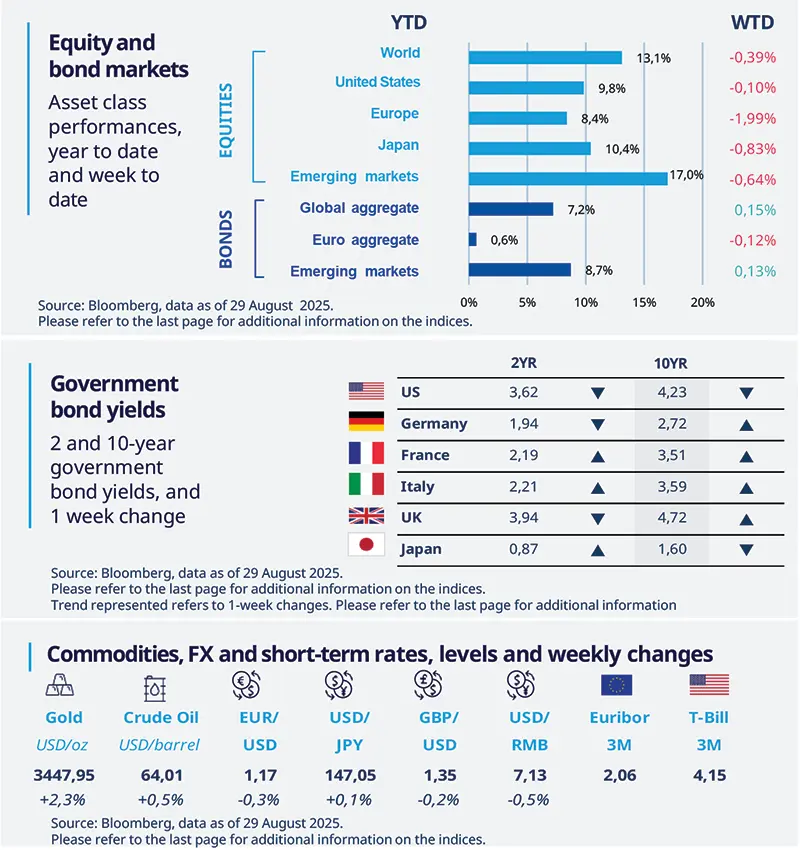

Global stocks declined last week led by the US, Europe and Japan. In Europe, political stability in France was in the limelight. US bond yields fell amid expectations of rate cuts by the Fed, whereas European yields were mixed. In commodities, gold and oil prices ended the week higher.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 29 August 2025. The chart shows the US Dollar Index.

1Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US economic activity shows resilience

The second reading of the Q2 real GDP growth came in above previous estimates, suggesting stronger underlying spending momentum. The data showed upward revisions to business fixed investment and consumer spending. Economic activity has been resilient, despite the significant increase in policy uncertainty in the first half of the year.

Europe

August soft data slightly subdued

Business and consumer survey from the European Commission came in weak but still indicated an expansion. While sentiment in the industrial sector, the most exposed to US import tariffs, inched higher, services and construction sectors’ sentiment declined. Consumer confidence weakened, supporting the view that household spending could stay modest, whereas savings rate may stay above average in the short-term.

Asia

US imposed secondary tariffs on India

The US President implemented 50% tariffs on India, including 25% secondary tariffs for buying Russian oil. The move is in stark contrast to the efforts of the previous US administrations to establish closer strategic ties with India. We think this will affect Indian exports to the US and the country’s economic activity. However, we expect the negative impact should be partly offset by measures like the reform and reduction in the goods and services tax that will boost domestic consumption.

Key dates

01 Sep UK consumer credit, EZ labour data, Indonesia CPI | 03 Sep Fed beige book, EZ PPI, |

US labour markets, Germany |