Summary

The US-China trade announcement is welcome news, but policy uncertainty

remains. As we wait for developments after the 90-day pause, we see opportunities in the broader global equities space.

The trade deal -- even if temporary -- should support economic growth in both countries.

For the relief rally to continue, more clarity on trade policies is needed from both sides.

We think uncertainty will remain high and investors should maintain a global approach.

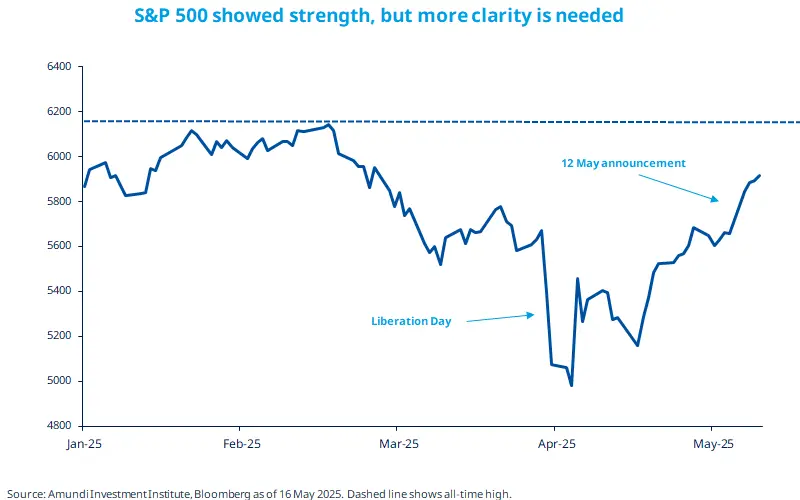

The United States and China agreed to reduce trade tariffs substantially after their negotiations. The headline tariffs on Chinese exports to the United States have been reduced from 145% to 30%. The United States cut significantly ‘reciprocal tariffs’ introduced in April and decided for a 90- day truce on some of the remaining ones. China responded with its own cuts on duties on US exports to the country. This truce prompted a relief rally across multiple asset classes, with the S&P 500 index now above Liberation Day level and only around 3.5% lower than its all-time high hit in February. This is positive for economic activity in both countries, but uncertainty remains on future negotiations. In addition, we should wait and see what happens after the truce ends in mid-August. Hence, we stay vigilant on more policy decisions in the coming weeks.

Actionable ideas

Global equities

Markets in regions such as Europe, the United Kingdom, and Japan look attractive amid rotations out of expensive segments.

EM equities

EM equities offer robust opportunities based on good economic growth prospects, especially across Latin America and EMEA.

This week at a glance

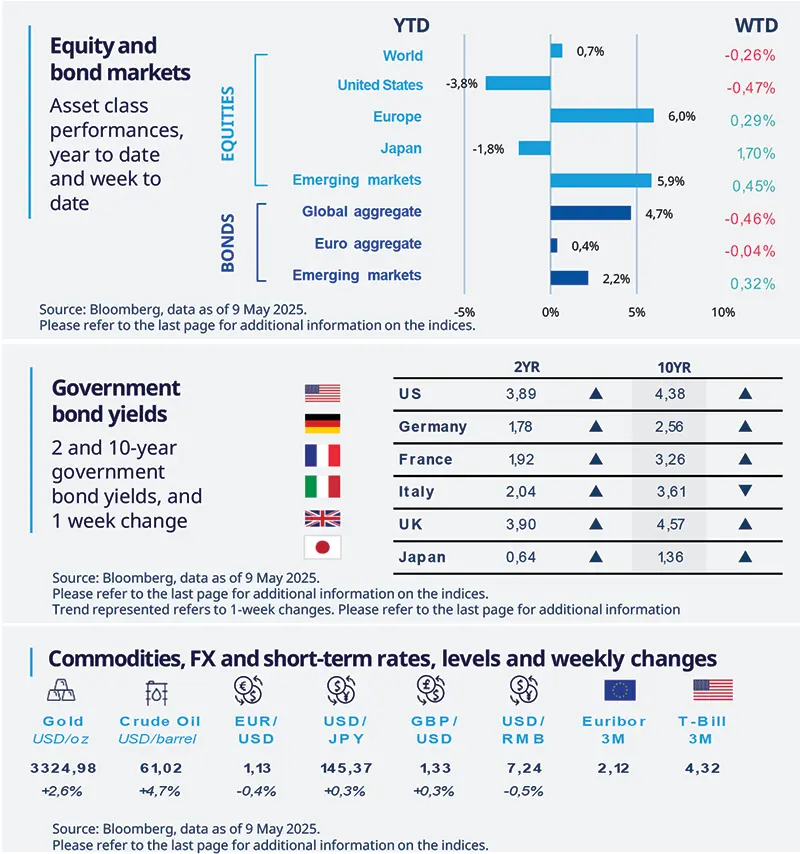

Global stocks rose on the back of optimism around the outcome of the US-China truce to reduce trade tariffs. Markets believe lower import duties will be supportive of economic growth in both countries. Accordingly, most bond yields rose, and prices of the safe-haven gold fell amid these positive developments.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 16 May 2025. The chart shows the level of the S&P 500 index.

Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US inflation below expectations in April

CPI decelerated in April to 2.3%, year-on-year, the third consecutive deceleration this year. At the moment, there is no clear sign of a significant tariff impact in April data, but it may show up in the next few months. Front loading of imports (importers rushing to buy goods before tariffs had set in) and the delays and exemptions on tariffs may also delay the final impact (of these import duties) on goods. We stay vigilant on inflation.

Europe

Eurozone first quarter GDP a bit milder-than-expected

The Eurozone economy expanded at 0.3%, quarter on quarter, as per the second estimate released recently. We expect growth to continue at a modest pace in the region. While the ECB is likely to maintain its stance on policy easing, we think the uncertainty related to trade and policy could weigh on sentiment and business investment.

Asia

Japanese economy contracts in the first quarter

The Q1 GDP data for Japan came in at -0.2%, quarter on quarter, as weak exports weighed on the overall output. This number doesn’t yet include the complete impact from US tariffs, and marks the first contraction in the economy since the first quarter last year. We believe while one data point doesn’t make a trend, the Bank of Japan will assess incoming data and will balance this with still high inflation to make policy decisions this year.

*Diversification does not guarantee a profit or protect against a los

Key dates

19 May EZ CPI (final), China retail sales

| 21 May Japan trade balance, UK CPI, South Africa CPI | 22 May PMI – EZ; UK; India, Chicago Fed National Activity, Mexico GDP |