Summary

- Unexpected political turmoil: the declaration of martial law by South Korea’s president came as a surprise to global markets. The move, as described by President Yoon, was aimed at clearing out pro-North Korea supporters and saving his government against multiple impeachments against his cabinet officials. However, this emergence restriction did not last for long after the Parliament voted against the decision, forcing Yoon to withdraw the martial law. Normality has since returned, but the cloud of political uncertainty has not fully dissipated.

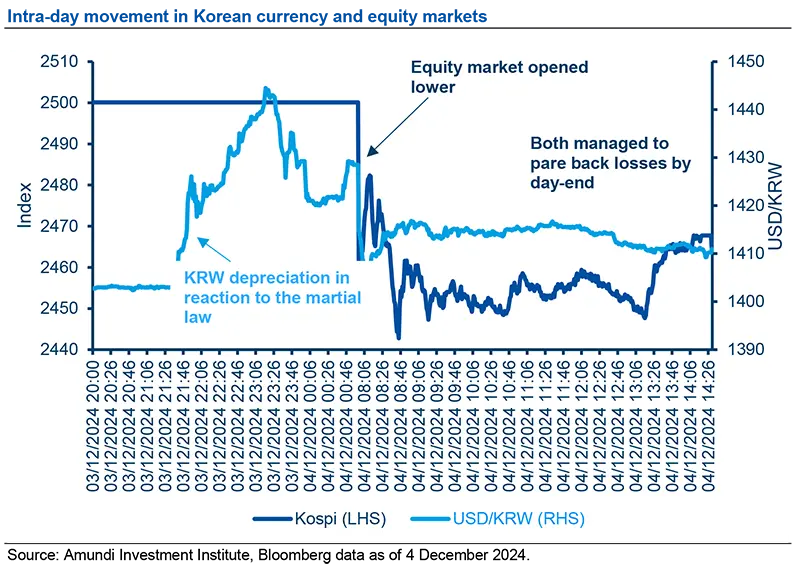

- Markets taking it in its stride: The negative knee-jerk reaction was moderated by the short-lived curfew and central bank pledging to keep liquidity abundant. The equity market pared opening losses, while the Korean won has managed to recoup most of the lost ground. Bond markets were little changed, with Korea’s sovereign CDS a touch higher, but remaining low in absolute terms.

- Rising political uncertainty warrants caution: The quick resolution to the current crisis does not mean political stability is fully restored. The process of impeachment and the transition to the next government all point to heightened political uncertainty in the coming weeks and months. This is happening at a time when the Korean economy is already weakening, with tariff risks still looming large. While we remain long-term positive on Korean assets, recent developments warrant some short-term caution.

What happened – the political background

In a significant political development, South Korean President Yoon declared emergency martial law on December 3, 2024, accusing the opposition of engaging in "anti-state activities" and plotting rebellion. This declaration followed the opposition Democratic Party's actions in the parliamentary budget committee, where they pushed through a downsized budget bill and submitted impeachment motions against key government officials.

The martial law was framed by President Yoon as a necessary measure to eradicate pro-North Korean forces and protect the constitutional order. However, this move was met with widespread criticism, with opposition leaders labelling it as unconstitutional and detrimental to public interests.

However, within hours since the restrictions were imposed, South Korea’s parliament successfully convened on the morning of December 4 and voted 190-0 to lift the martial law. Normality has since resumed, with businesses, schools and markets opening business-as-usual

Market reaction has been broadly contained, but political uncertainty will bring some volatility in the coming weeks.

Market reaction – panic averted

Markets are well behaved against the first martial law enactment in more than 40 years. The Kospi opened yesterday 2% lower, but managed to narrow the loss to 1.4%. The Korean won dropped almost 3% in reaction to the news, but also pared most of the loss after the curfew was lifted. Bond markets were little changed, with Korean’s sovereign CDS spreads widening by only 2 basis points. The muted market reaction was primarily due to the short-lived crisis, with the Bank of Korea pledging to boost liquidity also helpful to stabilize investor sentiment.

Next step – impeachment and rising political uncertainty

President Yoon is likely to face impeachment if he does not step down. In fact, the latest news suggests that the opposition parties have already filed an impeachment motion, which will request 2/3 of the parliament (200 votes) to succeed. Currently, wider opposition parties control 192 of the 300 seats parliament. It’s worth noting that 18 members of the ruling party sided with the opposition to vote against the martial law. So if 8 of those 18 vote in favour of impeachment, the bill will pass.

If impeached, the President will lose power immediately with the Prime Minister taking over. It may be a few months before the constitutional court rules on the impeachment, after which a byelection will take place. Political uncertainty will likely remain elevated in weeks/months to come.

Investment implication – short-term caution warranted

Despite the quick resolution to yesterday’s event, we have become more cautious on the short-term outlook for the Korean markets. Rising political uncertainty is adding to an already slowing economy with tariff risks looming large. If the impeachment process starts, political momentum could swing towards liberal opposition party, with their leader JM Lee seen as less hawkish towards North Korea and less pro-business. Concerns over changes in the country’s foreign and domestic-economic policies could weigh on the economy and markets.

South Korea is also among the most export-dependent economies in Asia and is heavily reliant on Chinese demand, so US tariffs could be damaging. While the country could benefit, to some extent, from tech supply chain reshuffle, rising domestic political instability, on top of the well-known risk associated with North Korea, could make multi-national companies rethink about its reliability.

These near-term risks need to be weighed against medium-to-long-term positives of innovative quality of Korean Inc. whose stocks are priced at a discount to global and regional peers. These hidden values are supposed to be unlocked by policies encouraging listed companies to raise shareholders’ returns through, for example, the “Value Up” program rolled out by Yoon’s administration, but the coming political changes could cast some doubts over these policies. Our long-term constructive stance on Korean assets, therefore, needs to be tempered by some short-term caution as Korea navigates through rising political, geopolitical and economic risks.

Our long-term constructive stance on Korean assets, therefore, needs to be tempered by some short-term caution as Korea navigates through rising political, geopolitical and economic risks.