Summary

The rise of the narrative concept and how it can help financial market understanding

A narrative is a popular story that arises from the public consciousness of market events. The most viral and intense of these may dominate public attention. Narratives are rooted in popular beliefs and are not necessarily from economists’ minds.

Hence, by definition, a multitude of narratives may circulate in social interactions. They may evolve overtime and some of them may be picked up by central banks. Narratives can have different natures. For example, on top of the economic narratives, we introduce also the concept of societal narratives (environmental and social) as well as a geopolitical risk narrative.

While narratives have been around for a long time, even before their economic conceptualisation by Nobel prize winning economist Robert Shiller few years ago, their impact has not been yet fully exploited.

To assess the narrative evolution, we have conducted an analysis on the evolution and impact of some pre-defined narratives using the Global Dataset of Events Language and Tone (GDELT)1 , a database that “monitors the world's broadcast, print and web news from nearly every corner of every country”.

Making use of this data, we have been able to calculate daily volume and sentiment measures associated to some of the topics mentioned, which are then aggregated under themes. The combination of different themes constitutes a story. We have, therefore, defined four economic narratives that are currently in the economic spotlight. For example, the combination of macroeconomic imbalances and rising inflationary pressures, notably via the commodity price channel, has resonated with market players and echoes the 1970s.

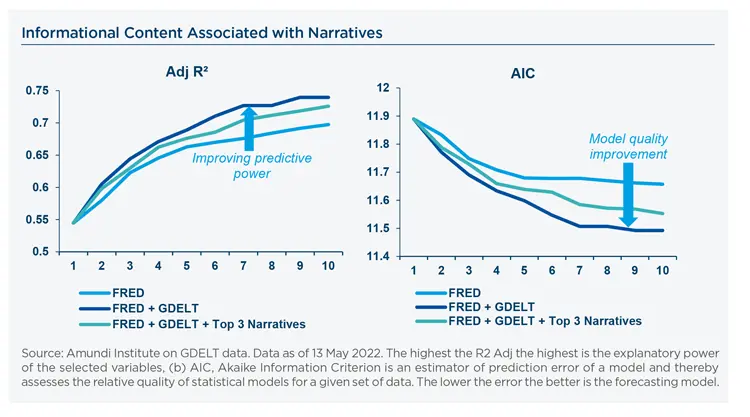

Our analysis suggests that narratives complement traditional macro variables when it comes to explaining financial market behaviour.

Employing alternative data (such as the GDELT metrics to elaborate the dynamics of narratives) can enrich pure macro models, by improving their predictive power but also by enhancing their quality.

When forecasting weekly S&P500 moves, our analysis shows that narrative metrics can increase the explanatory power compared with models solely based on macroeconomic variables, and that the diversification of families of data enhances the quality of forecasting models for equity markets.

Originally, macro variables were a short cut to the appraisal of macroeconomic environments. Alternative data can dismiss this shortcut, switching from a top-down to a bottom-up approach. Such datasets present the advantage of constituting a more direct and often more reactive measure.

News-related metrics allow us to take the pulse of what is at the forefront of world discussion but also gauge the sentiment linked to these topical themes. When aggregated at the narrative level, they constitute a powerful tool to assess which story is dominating social interactions in real time. Our results advocate for the inclusion of such metrics to augment traditional macroeconomic models when forecasting equity market moves.

A look at the recent evolution of narratives

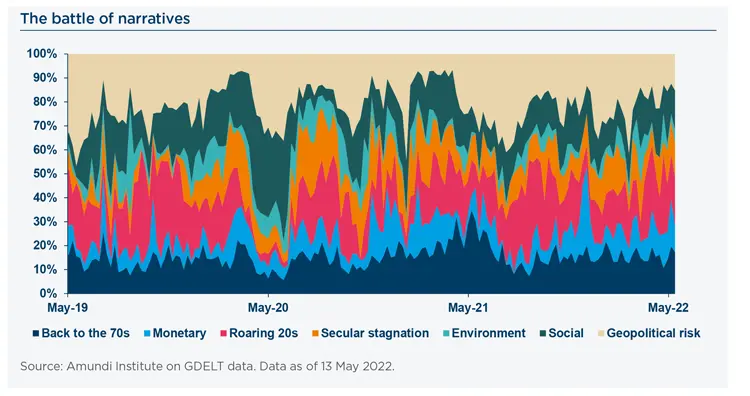

When looking at the evolution of narratives over the past two years, we see a strong dynamism with some narratives dominating during certain periods of time. Before the pandemic hit, the roaring 20s was the most popular narrative in the US, notably driven by innovation and technology themes. When the Covid-19 outbreak became a worldwide pandemic in Q1 2020, and financial markets dipped, the sentiment associated with the roaring 20s clearly deteriorated, dragged down by poorer growth prospects. The social narrative gained traction and following the murder of George Floyd at the end of May 2020, it remained dominant for a few months fostered by the themes of living together, discrimination, inequality and unrest. However, moving towards the summer of 2020, the pandemic started to exhibit longer than expected consequences, which were initially perceived as being deflationary due to a contraction in demand and therefore favoured the return of the secular stagnation narrative which dominated that summer. The Covid-19 crisis actually started to inflate prices shortly after, amid supply chain disruptions, fostering fears of a back to the 70s scenario. Hence that narrative intensified.

The geopolitical risk narrative has remained among the most dominant narratives throughout the past two years. This narrative covers different themes relating to international tensions, as well as local events. In fact, national matters could spark social unrest and eventually trigger defiance in other countries which then become geopolitical issues. At the end of 2021, the monetary narrative shifted towards a re-anchoring and normalisation of central banks’ policies, dominating other narratives.

The Russian invasion of Ukraine set the stage for a resurgence of the geopolitical risk narrative. Alongside this, it has reaffirmed the back to the 70s story, which is not only characterised by inflation, but also by higher fragmentation and a new geopolitical order. Indeed, our geopolitical risk narrative has worsened everywhere, but the magnitude has been uneven across countries. This is particularly true in Europe, where Germany was most severely impacted given its closeness and sizeable economic ties with the belligerent countries. This fragmentation was further strengthened by uneven inflation dynamics at a regional level. As a result, while the pandemic initially strengthened the equity cross-country correlation (being a global economic shock), the Russia-Ukraine war has led to a significant reduction in such co-movement.

In the first quarter of 2022, we witnessed the back to the 70s narrative strengthening, driven by skyrocketing commodities prices and central bank hawkishness in recognition of persistent inflationary pressures. The fears of secular stagnation came back sporadically, but eventually did not materialise and faded away rapidly.

Since the end of March, the roaring 20s narrative has been dominating. Yet, most recently, uncertainty driven by the conflict and the economic impact of lockdowns in China have raised fears of stagflation, hinting at a back to the 70s scenario and the greater relevance of monetary policy.

The volatile economic environment we are currently living in is also highly dependent on geopolitical developments, notably the Russian invasion of Ukraine, and calls for the close monitoring of economic narratives in the upcoming months to see whether one outstrips the others.

How narratives can be applied from an investment perspective

Narratives can have negative and positive perception from public opinion, but most importantly they can have different effects on financial market behaviour.

Our analysis shows that the roaring 20s is a narrative that generally embodies a positive sentiment, owing to its underlying themes (such as innovation, growth or new technology) being mostly well perceived by the public.

We believe another narrative that could sustainably turn into positive territory in the future, is the environmental one. This forecast could materialise if the sentiments associated with themes such as green finance, sustainable growth or natural resource management increase over the longer term.

Other narratives are perceived as having rather negative connotations. Although obviously less constructive, monitoring their evolution can be insightful for an investor keen to mitigate risks. Information from these narratives, and their battle, can potentially secure the better timing of strategy implementation or signal turning points for the latter. For instance, if the geopolitical risk narrative was to worsen it could act as a signal to reduce active risk in a macrodriven portfolio.

The study of how narratives affect financial market behaviour is at an early stage and deserves greater attention from researchers. The definition of a dataset to monitor narrative evolutions and the confirmation that narratives have predictive power on equity returns is a first step in this direction.

1 https://www.gdeltproject.org/