Summary

Inflation was the big surprise in 2021. At the beginning of the year, the average US inflation forecast by economists for the end of 2021 was around 2%, while the latest reading in December came in at 7.0% YoY, the highest level since 1982.

Psychological forces could have played a major role in underestimating inflation. Today, few people have memories of the ‘70s great inflation period (less than 25% of the US population is aged 55 years and above). This may explain why the recollection of the past decade of secular stagnation could have led people to believe that the inflation pick-up expected in the post-Covid reopening phase of the economy was going to be short-lived, while it was not.

Indeed, this psychological dimension is a major driver of inflation expectations, but monetary forces also play a key role. On this front, the traditional relationship between money creation and inflation appears to have been dormant over the past decade, further complicating the forecasting of inflation dynamics. Yet, assessing the future direction of inflation, inflation expectations and monetary policy is now the most important task for investors. These will drive not only short-term opportunities, but may also signal a change of economic and financial regime, which will have profound implications on strategic asset allocation.

Money and inflation

On the monetary front, inflation relates to the concept of money velocity (V)1. This depends on P = the general price level, T = the total amount of goods and services produced and M = the total amount of money in circulation, and can be expressed by the quantity equation V = PT/M postulated in the Quantity Theory of Money.

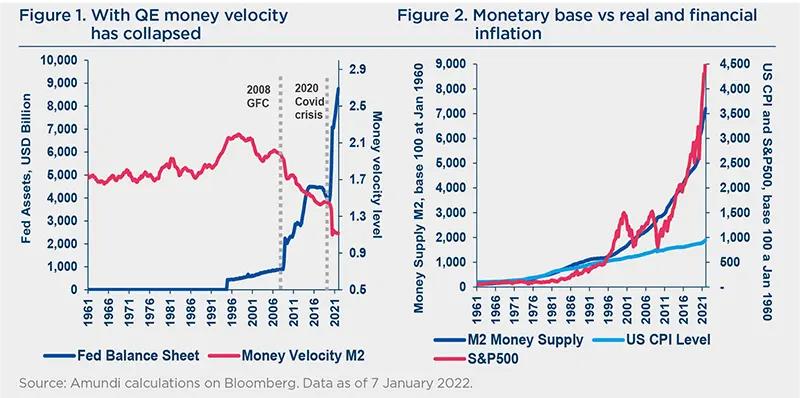

The velocity of money formula shows the rate at which one unit of money supply currency is transacted for goods and services in an economy and it is usually calculated in an indirect way. Traditionally, the velocity of money is assumed to be more or less constant, hence implying that inflation will rise when the monetary base expands. Yet, this stable relationship recently appeared to have vanished. Since the late ‘90s, the velocity of money continued to fall and after the Great Financial Crisis (GFC) the velocity started to move below its long-term range. The Covid-19 crisis exacerbated this trend, reflecting a low level of activity, along with monetary and budgetary expansion.

Among the reasons for this trend were the rapid expansion of central banks’ balance sheets following the GFC in 2008 and the Covid crisis in 2020, which somewhat transferred the inflation dynamic from the real sphere to the financial sphere.

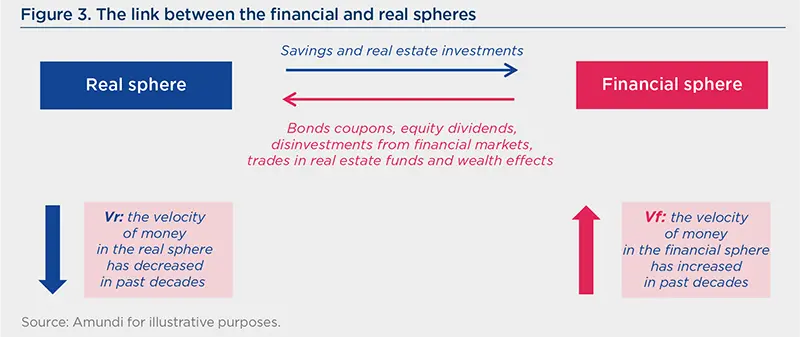

Indeed, there is a strong linkage between the real and financial spheres. This is also the reason why a financial crisis quite often leads to an economic recession. Households’ savings feed financial markets, while any financial asset disinvestment or investment payments (such as stock dividends and bonds coupon) transfer money back into the real economy where they can be deployed or moved back into the financial markets again. There is also a wealth effect coming from rising investment values that can have an indirect effect on the real economy affecting consumption and investment behaviours. The quantitative equation has not failed. If we consolidate the financial and real spheres into one unique notion of V, the velocity of money appears more stable. An inflationary process has effectively taken place, as higher levels of money M are reflected by increases in asset prices. In fact, excess liquidity in the real sphere (money in excess of what is required to finance a given level of transactions in goods and services) typically occurs at the bottom of the activity cycle (low activity) when monetary accommodation helps transfer excess liquidity into the financial sphere. This excess is eventually absorbed back into the real sphere as the price of liquidity (i.e. rates) increases, unless additional monetary/budgetary action further delays this process.

Hence, in our view, V should consider the transactions (real and financial) per unit of money (i.e. transactions based). This means the general price level (i.e. all prices in both the real and financial spheres) depend on the general/total V. V in the real sphere fuels inflation in the price of goods and services, V in the financial sphere fuels inflation in asset prices. Higher/lower V in one sphere comes at the expense of lower/ higher V in the other – although sequences of simultaneous expansion/contraction can happen (expansion where the excess liquidity is sufficient to finance both spheres).

The psychology of inflation

Inflation has also a critical psychological dimension that depends on powerful forces of memory and forgetfulness. In particular, when there is a progressive or sudden shift of focus in the most recent data it can revive some long-term memory patterns and can activate the inflationary process back into the real sphere. As we will see in the following section, this is likely where we are today.

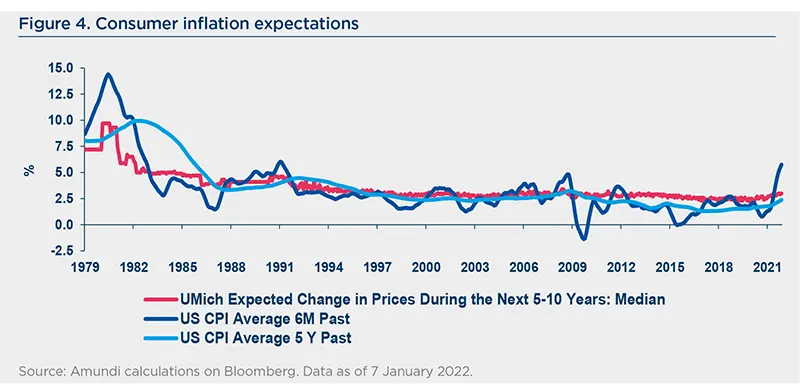

Looking at consumer inflation expectations for the next five to ten years (the red line in the chart), we see that they have been aligned to medium-term average inflation levels (5 year average, the light blue line). But they have also been driven, in some periods, by short-term inflation trends (6 month average, the dark blue line).

In the early ‘80s, at the peak of the inflation cycle, short-term inflationary trends were a major driver of expectations. This trend also continued in the following few years, when consumers assessed the efficacy of the monetary policy actions (amid Volcker’s arrival at the helm of the Federal Reserve (Fed) in August 1979) and they expected inflation to trend much lower compared to what 5-year average inflation implied. Forgetfulness was at play during this transition phase, as the credibility of Volker’s action won over recent inflation memories.

After this turning point, inflation expectations remained well anchored at around 3%. We also notice that they tended to be skewed upwards: consumers worried more about higher inflation than disinflation. Any period when inflation trended lower did not change expectations (2010-2020). In contrast, periods when short-term inflation overshot the longer-term average saw expectations start to drift higher.

This is where we are today. Short-term inflation readings currently overshoot the long-term average by the widest margin since 1981.

Median consumer expectations for the year ahead are at 4.9%, the highest since 2008, and are above the median economist estimates at 4.35%. Nevertheless, long term consumer inflation expectations remain well anchored and similarly financial markets’ inflation expectations, despite surging, have not de-anchored.

In particular, when looking at the recent trend in market implied inflation expectations for the next five to ten years (the 5 year-5 year inflation breakeven, the green line), it remains within its historical range. In addition, it stands below the 2-year and 5-year breakeven inflation levels, signalling that the market believes the inflation rise is temporary and that we are not moving towards a permanently higher inflation regime.

This indicates that the Fed has been effective in giving the impression that it is managing inflation risk before it has actually started.

As inflation proves to be more persistent and disinflation/deflation memories fade, market attention will likely return to past inflationary episodes, such as the ‘70s (perhaps forgetting the past decade and recollecting long-term dormant memories).

This process is not linear; it can be brutal at times and self-sustaining. In a regime shift, characterised by deviations from a “normal, reference, stable” environment, there can rapidly be an increased focus on the most recent data, especially if it continues to confirm strong divergences from previous patterns. This is precisely where we are today with inflation.

What may lie ahead?

We believe we are in the process of transition towards a new economic and financial market regime, where resurgent inflation is a key aspect. Inflation, GDP levels, M (the monetary mass), its velocity (V) and debt are all interconnected variables and will be key in assessing the shift towards this new regime.

In this new regime, governments will take over the control of money while maintaining widespread and double-digit monetary growth for several years, as part of a broader transition from free market forces, independent central banks and rule-based policies to a command-orientated economy.

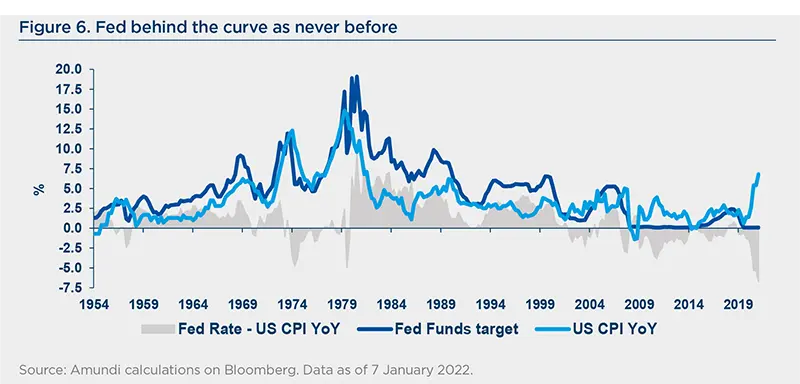

Huge fiscal accommodation will be needed to finance the post-Covid-19 recovery, which has already driven debt to historical highs. Additional money creation, for example to finance the energy transition, will likely be required down the road, as humanity faces the great challenge of fighting climate change. This additional fiscal expansion will need to come under a continuation of the financial repression environment, with central banks continuing to stay behind the curve to allow a further debt expansion at sustainable costs.

This could build the conditions for the simultaneous financing and expansion of both the financial and real spheres and should lead to an increase in asset prices and in the prices of goods and services for some time at least.

This scenario might see another lag before rising inflation translates into higher interest rates (as rates could be capped for some time) before authorities lose control of yield curves, thus leading to a new monetary order (another feature of the new regime). This will only happen when psychological forces start to focus on the most recent readings and start to question the credibility of central banks.

As of now, this is not yet happening. Communication is a key driver behind the psychological dimension of inflation and, in this respect, the Fed has done a great job. Yet, we recognise that the Fed is behind the curve as never before and therefore any further price pressure and/or delay in the hiking cycle could be the trigger for questioning its credibility. So far, talk has been enough to fuel market trust, but markets will assess whether the Fed is really walking the talk as we move ahead.

Investors need to rethink their strategic asset allocation in order to adapt to a world of heightened uncertainty regarding inflation and central banks’ reactions. Traditional benchmarks face challenges: on the bond front, it will be centred on the duration challenge (global indices with high duration and low yield); on the equity front, it relates to concentration risk (particularly in the US) around ten high growth names with high valuations and high sensitivity to rate hikes.

In 2022, the environment may still be supportive for risk taking. With central banks perceived as credible, real interest rates remain low and nominal rates are capped, leading to a continuation of the “buy the dips” attitude. However, the time to focus on the inflation resilience of portfolios is now, as an inflation surprise may materialise.

In fixed income, investors should move to unconstrained and short duration and consider adding an allocation to inflation assets, higher yielding assets with lower duration risks (for example in the emerging market bond space, high yield or subordinated). Divergences in central banks’ actions and inflation dynamics may provide relative value opportunities (i.e. yield curve, FX), which were limited in world of synchronised central banks.

Equity markets remain favoured versus bonds. In this space, investors should look at companies with higher pricing power being aware of the current high market valuations and high margins that will start to reverse towards normality.

At a portfolio construction level, correlation dynamics will also become more unstable, with possible positive equity/bond correlation during periods of inflation risk. This calls for adding additional sources of diversification in the form of lowly correlated strategies, liquid alternatives and real assets, especially the ones that can benefit from periods of higher inflation (real estate, infrastructure).

Longer term, the psychological dimension of inflation could lead to an increase in the velocity of money in the real sphere, as consumers disinvest in anticipation of future consumption, worrying about inflation. When this happens, inflation in the real economy will further rise, expectations will become de-anchored and central bank credibility is lost. This will be the time when the regime shift is complete, leading to a quick re-adjustment of risk premia.

_____________________

1. See also Discussion paper n.52 - December 2021 by Pascal Blanqué, “Money and its velocity matter: the great comeback of the quantity equation of money in an era of regime shift”.