Summary

In late June, an exclusive group of professionals from 17 pension funds from around the globe gathered ahead of the annual Amundi World Investment Forum. It provided participants with an opportunity to connect, exchange ideas and participate in discussions on the pressing issues facing the pension industry as we face a world in flux.

Drawing on the results of Amundi’s “Decoding digital investments 2025” report, which surveyed retail investors across 25 countries, discussion kicked-off with a taking a step back to look at retirement savings in general, where it ranks in importance for savers and their savings expectations.

Investment from individuals is driven by a wide range of factors – but long-term financial security in retirement is the key motivation for investing globally, regardless of geography and demographics.

Globally, an average of 41% of respondents cite securing a comfortable retirement as their primary motivation to invest. Overall, Asia and Scandinavia place greater emphasis on a comfortable and early retirement and funding long-term care needs1.

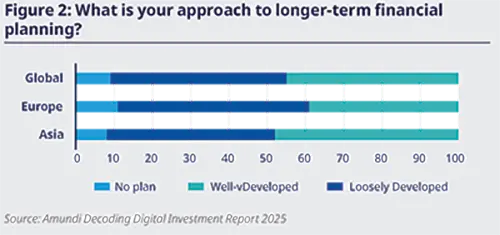

Yet, despite this underlying incentive, the survey found that individual investors are still underprepared for retirement. Many investors hold unrealistic expectations about when they will retire and what income they will need for retirement. Despite the clear importance to investors of all ages to achieve a financially secure retirement, the study shows that only 46% globally have a well-developed long-term plan to achieve their goals (Figure 2).

The study also finds that globally investors expect to require only 55% of their current household income in their retirement. However, the data shows a sharp increase in the expectations from people aged 50+, as the proportion of expected income needed in retirement rises to 65%, reflecting perhaps an increasingly realistic viewpoint on expenditure as individuals near retirement age.

Insight into the trends driving retirement savings and member expectations allows pension funds to better support members in saving for retirement and assist them in better understanding their pension benefits.

Main themes for retirement in 2025

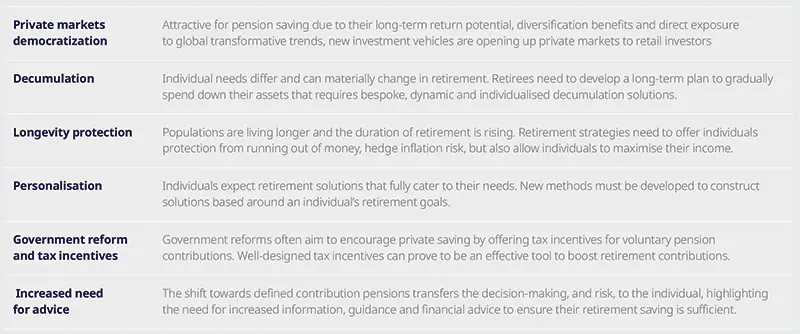

Discussions moved to the themes influencing decision making and investment strategies for pension funds this year. When devising solutions for pension funds, Amundi’s experts highlighted six themes that are recurrent in our discussions, analysis and planning:

Turning to the pension professionals in the room, we asked the attendees what their own concerns are for pension funds in this unsettled environment. Several themes arose:

A major concern was the perceived overallocation to the US, as well as high idiosyncratic risk within the US allocation. For example, in the MSCI World, the individual weight of certain of the Magnificent Seven stocks exceeds the total weight in Japanese stocks.

There was a perception that the c. 70% allocation to the US today will not continue, especially in light of fast-growing emerging markets and a European consumer market that rivals that of the US.

Private markets are a core building block in the search for yield, but concerns are surfacing about future performance.

The transition to defined contribution pensions, especially in Europe is ongoing and will have profound implications on the pension landscape.

Geopolitics takes a centre stage in guiding investments, but a challenge remains on how to focus on long-term trends, while still managing short-term noise. The consensus was that we are shifting towards a multipolar world.

Geopolitical concerns appeared as a common theme from all the attendees, regardless of region, pension structure or provider type. The discussion turned to a deeper look at the geopolitical shifts that are underway, as our experts provided insights into what to look out for on the world stage for the rest of the year.

The Great Diversification is Underway

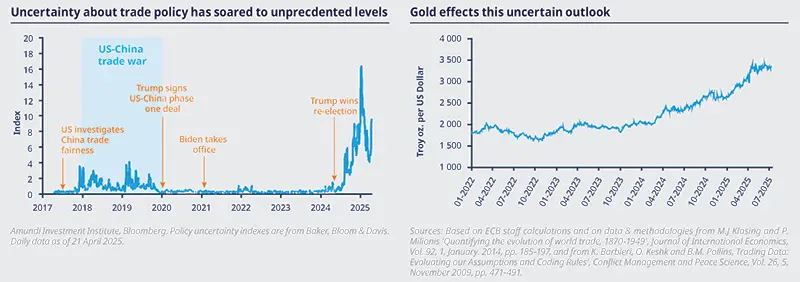

We are now in a riskier, messier, and more fractious world. Many of the shifts we are seeing are not short-term noise, but are long- term trends. While the US President is not the cause of the geopolitical shifts underway over the last few years, his administration is accelerating some drivers. For example, tariffs are intensifying economic friction, while the reduction of US commitments to Europe’s security, and ambitions in space are contributing to a new arms race.

The US continues to undermine its safe-haven status, and the diversification trend is playing out across asset classes and geographies:

Central bank reserve managers expect the share of the USD in global reserves to fall to around 55% in the next decade, while the renminbi’s share is expected to increase to 5.6%.

The renminbi has now surpassed the USD in China’s cross- border transactions.

Payment systems and platforms bypassing the USD and SWIFT are mushrooming in Asia and are being developed by BRICS members.

Gold prices are at an all-time high.

Demand for Eurozone bonds has been steadily increasing while European assets are attracting more capital flows.

64% of Chinese FDI was allocated to emerging markets in 2024, but 53.2% of China’s investment in high-income countries was allocated to Europe.

Source: Amundi Investment Institute, Bloomberg, OMFIF, Mercator Institute for China Studies.

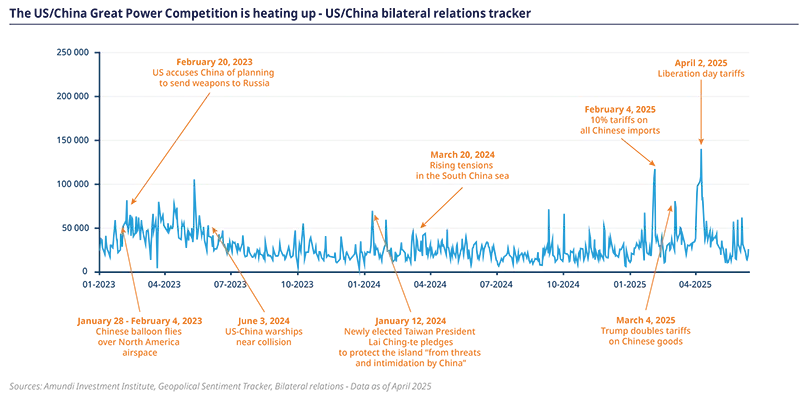

The great-power competition with China continues

The US-China relationship will continue to decline for as long as China poses a strategic economic, military and technological threat to the US. Analysis comparing the US and China in various categories ranging from technology to industrial and military capabilities suggests that China is ‘catching up’ with the US in many areas and leading in others (e.g. rare earths).

2027 will be a pivotal year for China’s military capabilities as this is when China could take on the US. The US is preparing for this, in particular a naval war.

Winners and losers’ will not be clear until tariff negotiations and the re-routing process are completed but Europe is likely to remain a net winner from US uncertainty. While political risks remain, Europe is growing more united, as leaders understand they are stronger together than as individual member states.

Improving EU-UK ties is a case in point. The EU is amplifying its trade relations, as recent deals with the UK and Mercosur, and progress on a trade deal with India, illustrate. There is momentum towards single and financial market integration and creating an environment that could make the euro more attractive.

Developments in the Russia-Ukraine war only emphasise the need for Europe to step up its own defence. Europe is rearming in the face of the threat from Russia, but funding remains an Achilles heel. Across developed markets, we will see continued fiscal expansion to fund defence capabilities, which add to stagflation risks.

Europe is vulnerable, stemming from increased geopolitical risk and debt concerns: both increase fragility. The EU will have to provide more clarity on how spending needs (e.g. defence, infrastructure, technology) will be funded despite constrained fiscal space. Reforms and reducing bureaucracy are essential to further integration, but political hurdles are abundant.

Conclusion In a world marked by geopolitical shifts and economic diversification, pension funds must rethink traditional strategies to safeguard retirement outcomes. Embracing private markets, personalised decumulation, and longevity risk management will be key drivers in the years to come. Furthermore, navigating regulatory reforms and enhancing member engagement through tailored advice will help pension funds meet evolving retirement expectations and ensure long-term financial security for their beneficiaries. |

1. Amundi Decoding Digital Investment Report 2025 - conducted with a total number of 11,355 retail investors surveyed across 25 countries spanning 4 continents during the period December 2024 to January 2025. Countries interviewed: Austria, Belgium, Brazil, China, Denmark, Finland, France, Germany, Hong Kong, India, Italy, Japan, Korea, Malaysia, Netherlands, Poland, Singapore, South Africa, Spain, Sweden, Switzerland, Taiwan, Thailand, UAE and UK. https://www.amundi.com/globaldistributor/article/embracing-new-digital-…

Read more