Summary

The size, timing, and targets of Trump's tariffs remain highly uncertain. Market

sentiment leans towards optimism. The high valuations of US equities, along with early signs of a weakening US dollar, favour a global equity approach.

- Markets cheered Trump's first week of his second presidency, as he appeared open to tariff negotiations.

- In early 2025, market sentiment remains supportive, as does the economic backdrop.

- Global equities rose in the week while the dollar slipped as investors sought opportunities elsewhere.

Following the US elections, the initial market reaction reflected a sense of US exceptionalism, marked by rising equities and a stronger dollar.

Trump's first week as President aligns closely with his campaign agenda—immigration control, tax cuts, deregulation, and increased protectionism. While not all details have been disclosed, market sentiment remains positive. Equities have rallied, backed by some optimism that not all US imports will be subject to tariffs, and President Trump's stance on tariffs towards China could be softer than initially expected and the US dollar weakened.

We live in a phase of uncertainty regarding policy and tariffs, but the overall economic outlook remains resilient. We look for potential opportunities across global equity markets.

Actionable ideas

- Global Equities in the spotlight

Diversification* remains the name of the game amid high policy uncertainty. We favour global approaches and we look at potential opportunities in Europe and in Emerging Markets.

- US equities look at opportunities beyond the mega caps

Investors could find potential opportunities beyond the mega caps in stocks that may benefit from Trump policies and a resumption in industrial demand and economic growth.

This week at a glance

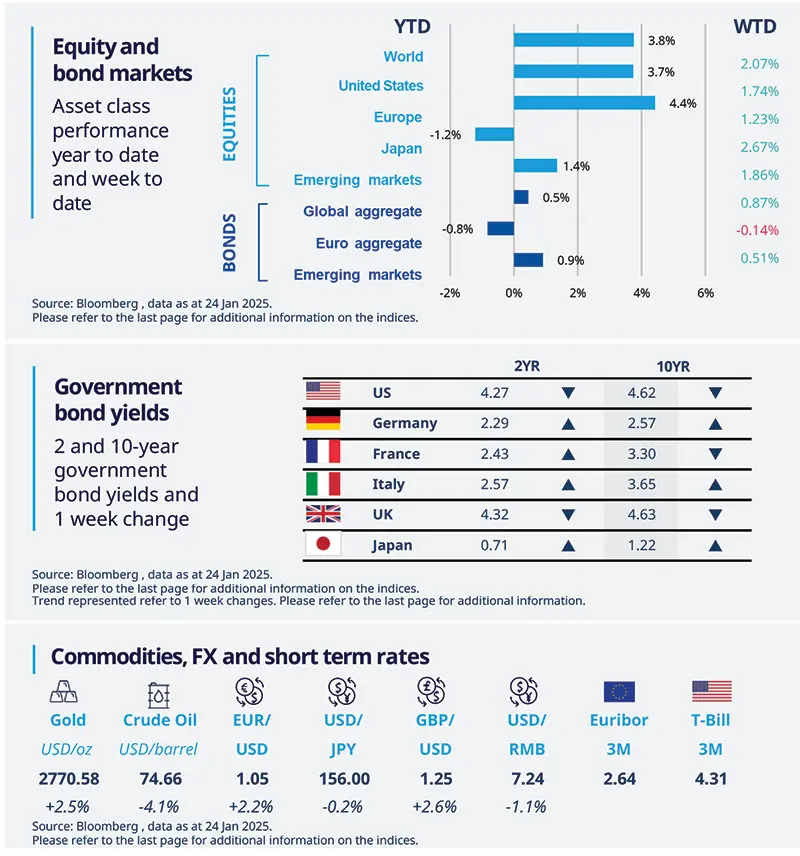

Equity markets gained across the board, from Asia to Europe, supported by expectations that Trump could move slowly on tariffs. The appetite for riskier assets also supported emerging market currencies, while the dollar moved lower. Gold rose close to its previous highs.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 24 January 2025. The chart shows US CPI YoY growth. *Diversification does not guarantee a profit or protect against a loss.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US labour market under the spotlight

The rebalancing of the labour market has progressed thus far, and according to the latest data, it has become relatively more difficult to find a job when actively looking for one. In particular, since mid-2024, continuing unemployment claims have drifted steadily to a higher average than pre-COVID levels. Recent initial weekly claims, on the other hand, likely jumped due to the effects of the wildfire emergency in California.

Europe

Eurozone PMIs indicate stabilisation in growth

The latest HCOB PMI data for the euro area shows a stabilisation in growth, with the Composite PMI rising to 50.2 in January from 49.6 in December, surpassing economists' expectations. This increase, primarily driven by the manufacturing sector, marks the second consecutive monthly rise. Trump’s policy uncertainties appears limited, but challenges remain as details of his plans are still pending.

Asia

Bank of Japan hike

Bank of Japan (BoJ) hiked its policy rate by 25bp to 0.5%. Since last summer, Japan started to register positive real wage growth alongside inflation driven by domestic demand. This favourable wage-inflation dynamic supports the BoJ for further rate hikes this year. We anticipate one additional hike of 25bp later in the year, which would raise Japan's policy rate to 0.75%.

Key dates

29 Jan Fed interest rate decision | 30 Jan ECB interest rate decision, US Initial Jobless Claims | 31 Jan US Core PCE |