Summary

Key takeaways

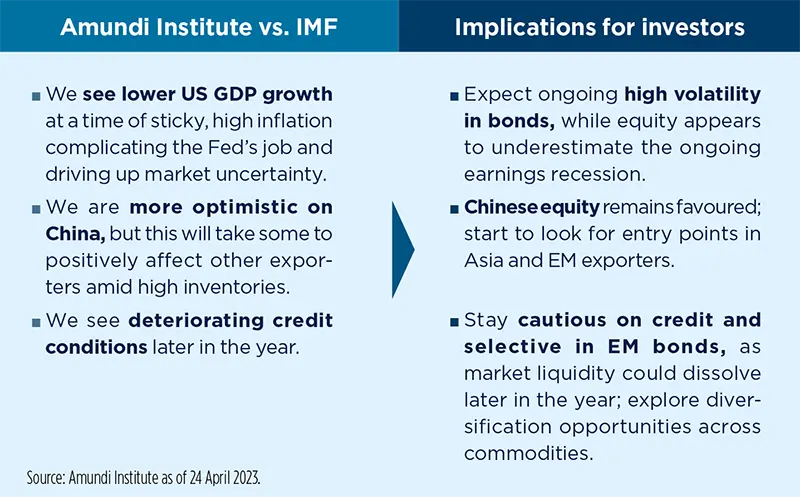

Investor sentiment is downbeat, but not overly bearish. With tightening credit conditions, our US growth outlook is lower compared to the IMF’s, while we are more optimistic on China. This supports a cautious stance and a search for opportunities across the emerging world, starting with China. There are some signs of complacency on Europe, while debates were mostly focused on geo-economic fragmentation and the urgency of policy action regarding crisis management and to secure artificial intelligence development.

The global economy has proven resilient and remains on track despite the unfortunate sequence of crises that have occurred over the past four years. An intensification of the slowdown should materialise progressively this year and the next, despite the rebound expected in China following its economic reopening that at present has not spilt over to streaming partners. Inflation should prove stickier and stay above central bank targets for longer. Our base scenario is largely aligned with the ‘plausible’ scenario showcased by the IMF. A key difference is that about half of the expected 2024 global growth, according to the IMF, should come from China and India combined, while some 90% of DM economies are expected to slow. We foresee the divergence between developed and emerging economies widening, as we anticipate a US recession and accelerating growth for China. Furthermore, no wage spiral is expected. As such, global central banks will need to stay the course and use rate hikes to fight inflation and keep inflation expectations anchored, while financial stability risks should be addressed using macro-prudential tools. Only a systemic risk would require them to start cutting rates: this is tough talk, but not enough to make the market change its mind.

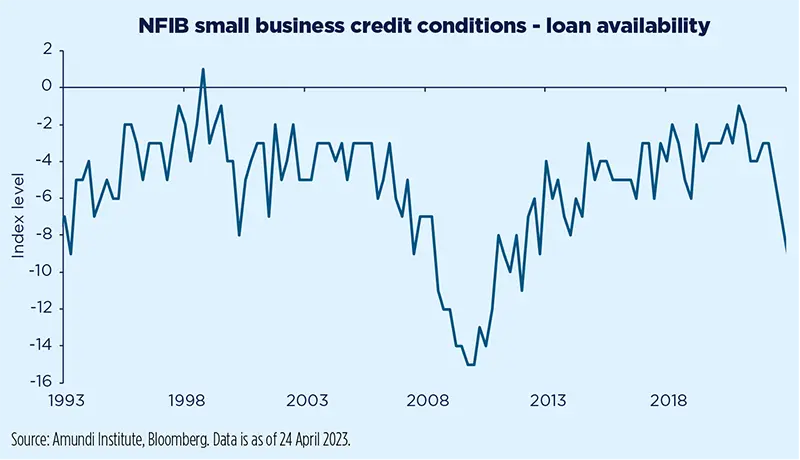

This outlook should weigh on credit markets, especially in the second part of the year. We are already seeing signs of deteriorating credit conditions in the United States, with lending conditions for small businesses quickly deteriorating to their worst level in a decade. So far, weak primary market activity has masked this challenging environment, but things may change in the second part of the year, when an increasing number of low-rated corporates will test the market to refinance the upcoming maturity 2024-25 wall. Fiscal and monetary policy should go hand in hand, with the social support needed from the former to protect the most vulnerable from rate rises. As a result, debt sustainability may be at risk because of high leverage, rising interest rates and slower GDP growth. This will be key, especially across low- and middle-income economies of which some 15% are classified as debt-distressed, while another 45% are high-risk and some of them are not even eligible for the common framework, as was the case for Sri Lanka. Moreover, China has ambitions to be a global creditor, as it is becoming more and more involved in bilateral agreements to give credit to many of these countries. It has the ability to conclude bilateral agreements very quickly and also, apparently, without any conditionality. As such, EM economies will be under increasing scrutiny. To sum up, it looks like an impossible trinity, where we cannot have healthy GDP growth, inflation at target levels and financial stability all at the same time.

Regarding international relations, the peace dividend looks to be over and globalisation is being replaced with near- or friend-shoring, which represents a real opportunity for areas such as Latin America. However, not all countries are proceeding at the same speed, as some are more concerned with internal political issues. Deteriorating – while still evolving – US-China relations are also a key takeaway, with the latter being more tepid on trade relations with countries known as being US-friendly and the United States targeting a progressive weakening of the Chinese economy.

Finally, new technologies such as artificial intelligence (AI) will be a game- changer and will identify the new power. Governments will need to supervise and monitor developments, since they are fast and possibly shadowed, as some aspects of the Ukraine-Russia war are showing on the communication front.

Investment implications

It looks like an impossible trinity, where we cannot have healthy GDP growth, inflation at target levels and financial stability all at the same time.

Overall, market sentiment was not as negative as it was in October, despite uncertainty remaining high. There was a wide consensus about markets currently pricing in too many Fed rate cuts that confirms our positive view on US duration. While the deteriorating lending environment and a still too-optimistic market view on earnings call for a cautious approach to risky assets.

On commodities, the Brent oil price is forecast at $90/barrel on average this year following the OPEC+ production cut, but could go higher later as there is no comprehensive plan to replace oil and gas supply in Europe and the energy transition needs time. Russia is unlikely to go back to its pre-war production level. More generally, commodity prices should rise over the medium term due to large underinvestment across many economies.