Summary

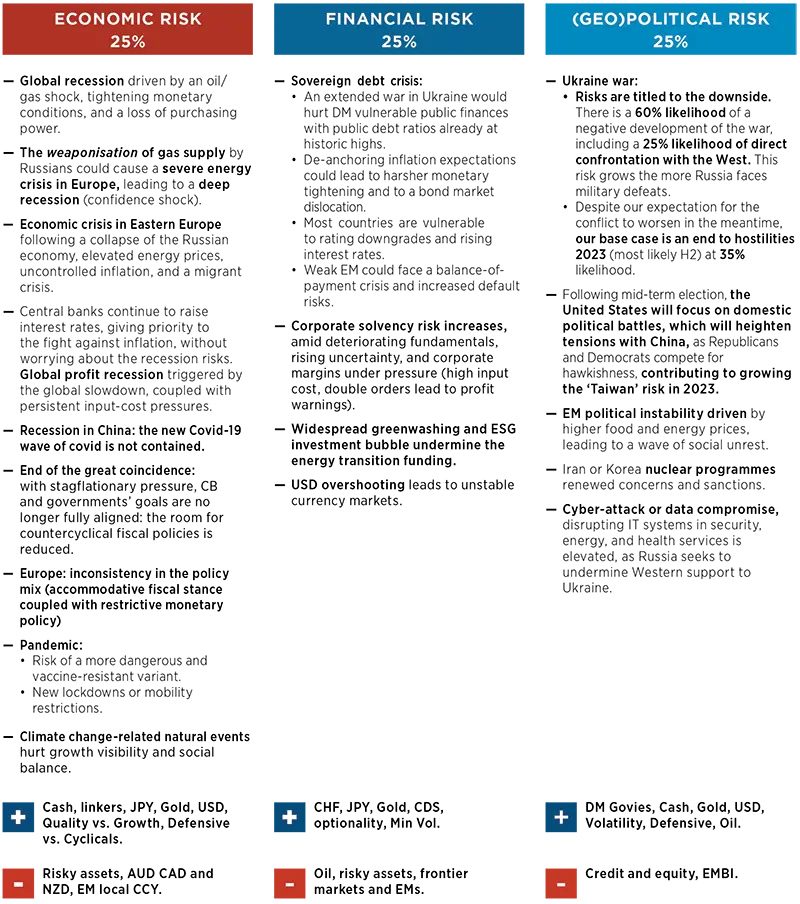

Top Risks

Monthly Update

We see risks on all fronts, but with a little less intensity at the beginning of the year. As such, we lowered the probabilities from 30 to 25%. Economic fundamentals are deteriorating globally, which is reflected in the central scenario, but is not yet fully priced in the equity market. The course of the Ukraine war and its potential implications can tip the scenario in either direction: risks are tilted to the downside in the short term, but the probability of ceasefire by year-end remains significant. We consider Covid-19-related risks as part of the economic risks. Risks are clustered to ease the detection of hedging strategies, but they are related.

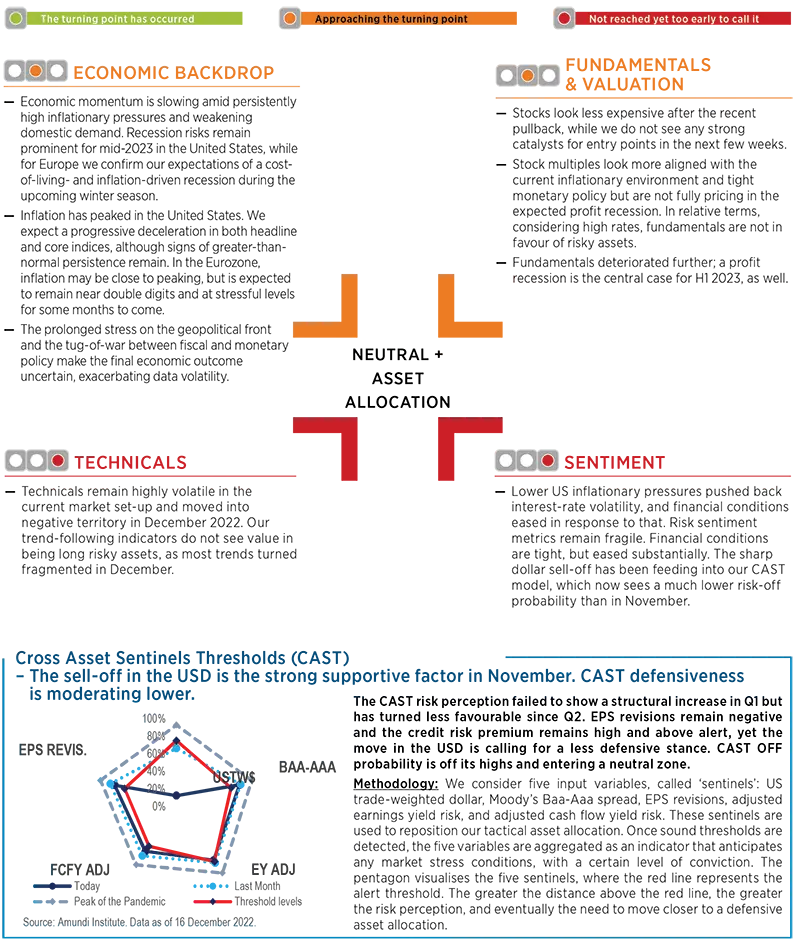

Cross Asset Dispatch: detecting markets turning points

Monthly update: The traffic light on technicals has turned from orange to red

Amundi Institute Clips

1| Global growth outlook

- The 2023 global GDP forecast was cut to 2.2% from 2.5% YoY. Core inflation should prove sticky across DMs, while EMs have gradually been winning their fight against inflation.

- G3 CBs may be done with jumbo rate hikes, while about 40% of EM CBs have wrapped up their tightening cycle.

- The US soft landing has been confirmed, with very weak growth foreseen in H2 2023 and non-negligible risks of recession. US headline inflation will decelerate markedly in H1. Among core inflation components, core goods will be deflationary, while core services will be the main driver of sticky above-target inflation.

- The Eurozone economy should contract mildly in Q4 2022-Q1 2023. It is too early to call a peak in inflation. Over the next few months, we foresee significant moderation in headline inflation and more gradual moderation in core inflation.

- EM growth has been slowing, despite a possible early reopening in China. As of October, inflation had peaked in some 60% of the emerging universe.

Investment consequences

- The economic backdrop and profit cycle will remain fragile into 2023.

- Amid the correction, cross-asset positioning will remain defensive: UW global equity, OW government bonds, inflation-linked bonds, IG, and gold.

2| Fed outlook

- The Fed is likely to reduce the size of rate hikes, but this does not mean a dovish pivot is likely in the short term.

- The Fed will stay committed to fighting inflation, while past tightening takes a toll on labour market.

- We have cut our 12-month target on 10-year US Treasury yields to 3.5-3.7% from 3.9-4.1%; we expect the US yield curve to bull-steepen in H2 2023.

Investment consequences

- Tactical UW on US duration before moving to neutral stance.

- The Treasury-Bund spread should narrow.

3| Prospects for quantitative tightening in 2023

- The Fed is likely to continue its QT programme in its current form, with monthly caps at $60bn and $35bn on Treasury and MBS run-offs, respectively; the Fed’s balance sheet should shrink by some $1tn in 2023.

- Regarding the ECB, QT is likely to be limited to APP securities and to begin in mid-2023. We expect a jump in net supply net of ECB flows.

Investment consequences

- Duration UW on euro rates.

- Peripheral spreads could be under pressure.

4| Recent easing in financial conditions is not justified

- We disagree with the dovish market interpretation of Chair Powell’s speech.

- Lending conditions have already been tightening in multiple segments of the US economy; US banks have been tightening lending standards on industrial loans at a pace consistent with a recessive environment.

Investment consequences

- DM bond valuations have become stretched after the rally.

- Markets may have misplaced their hope of a forthcoming Fed dovish pivot.

5| The dollar bull cycle is getting stretched

- The current environment is shifting and a few dollar supports have been fading, as US inflation has been decelerating and the Fed has opened the door to a less aggressive pace of rate hikes.

- The focus could shift sharply from the risk premium over the Fed – which was a strong dollar driver in 2022 – to a dollar premium over fundamentals, as a downside risk.

Investment consequences

- Deeper dollar depreciation in 2023: Six-month EUR/USD target raised to 1.00 from 0.92; 12-month target raised to 1.10 from 1.04.

- We are currently keeping limited dollar exposure (favoured shorts: EUR, GBP and CAD).

- Short USD against JPY and CHF.