Summary

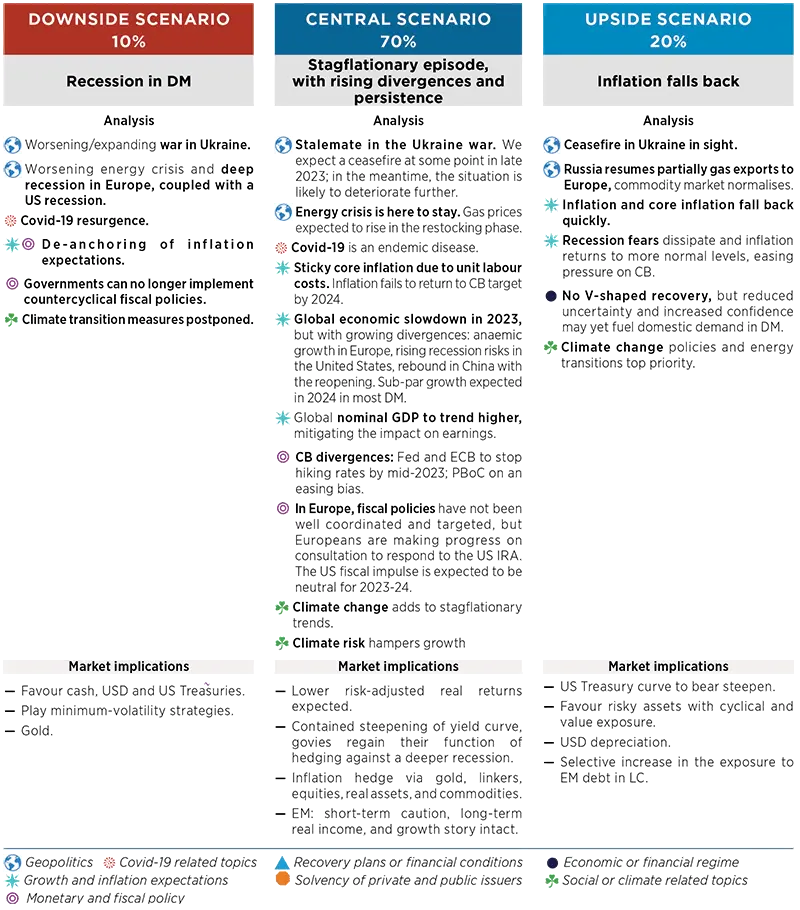

Central & Alternative Scenarios (12 to 18 Months Horizon)

Monthly update

We revise the probabilities of our alternative scenarios. Some of the risk factors we identify may occur in our central scenario, which is probably not yet fully priced in, especially by equity markets. We think risks remain skewed to the downside in the short term, but at the same time, we believe that it would take an unlikely combination of several risk factors to trigger the downside scenario at the 12-18 month horizon. At this horizon, we believe that the upside scenario of rapidly falling inflation is now more likely to materialise. Indeed several factors of different nature can push prices down: easing gas prices, combined tightening of global monetary policies (which has a delayed impact), and normalisation of global value chains thanks to China’s re-opening.

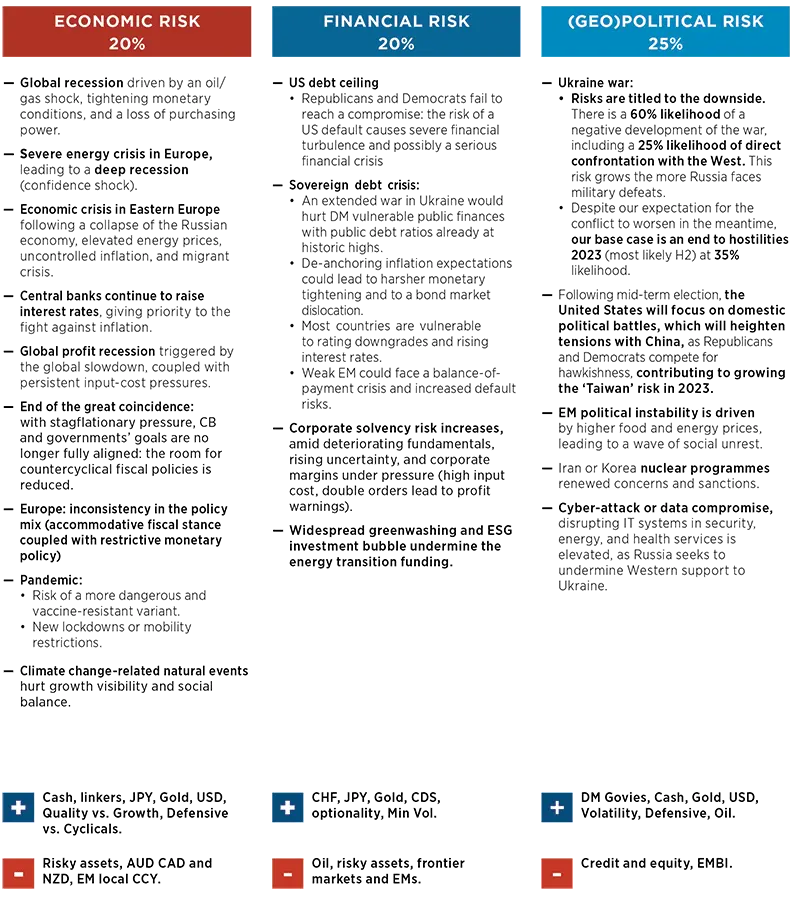

Top Risks

Monthly update

We see risks on all fronts, but with a little less intensity at the beginning of the year. As such, we lowered the probabilities of the economic and financial risks from 25% to 20%. Economic fundamentals have deteriorated globally, which is reflected in the central scenario, but is not yet fully priced in the equity market. The course of the Ukraine war and its potential implications can tip the scenario in either direction: risks are tilted to the downside in the short term, but the probability of ceasefire by year end remains significant. We consider Covid-19-related risks as part of the economic risks. Risks are clustered to ease the detection of hedging strategies, but they are related.

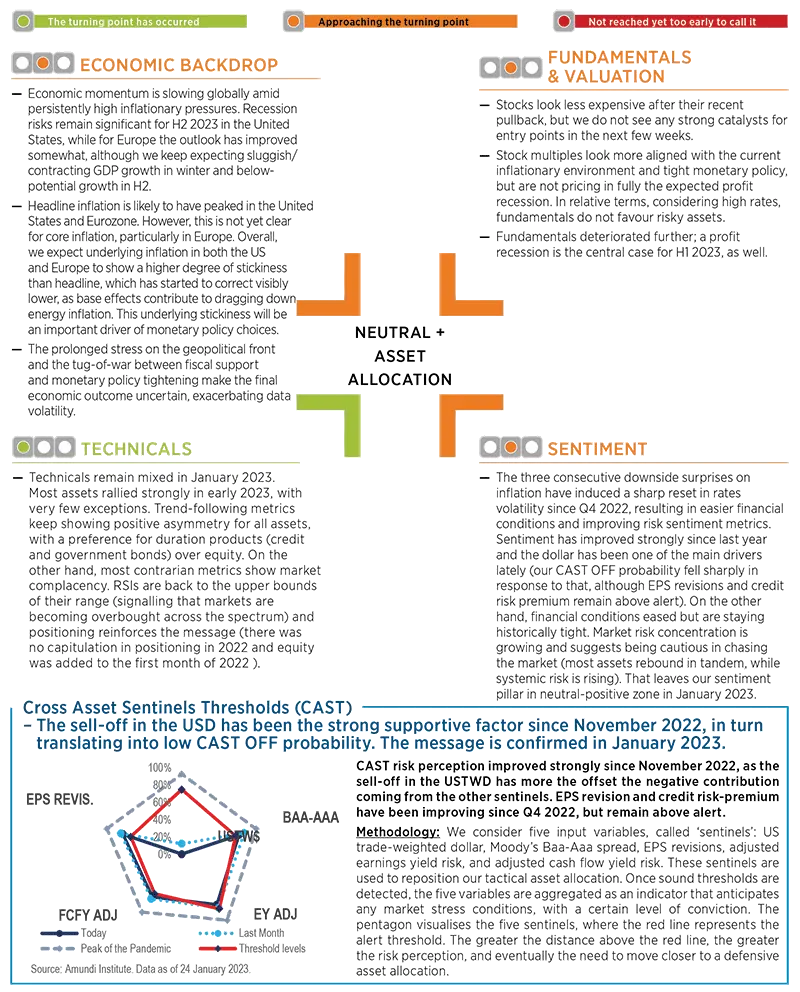

Cross Asset Dispatch: detecting markets turning points

Monthly update

The traffic light on technicals has turned from red to green and from red to orange on sentiment.

Amundi Institute Clips

1| What if inflation drops much faster than expected?

- We foresee different outcomes, depending on the cause of such a drop.

- A drop of 2% faster than our current projection for 2023 – both in the United States and in the Eurozone – could result in a risky-asset-friendlier scenario if core inflation falls at the same pace and if such a positive surprise on price pressures is not the result of lower-than-expected growth.

Investment consequences

- Cross asset positioning remains defensive, with UW on equities and OW on HY.

- We have downgraded government bonds, but they remain in OW territory.

- IG moved to neutral.

2| What if the ECB terminal rate is 4%?

- A higher ECB terminal rate will entail higher costs on the growth front with few benefits on the inflation side.

- If inflation proves stronger than expected in the first half of 2023, the ECB will be more hawkish than currently expected and may push rates up to 4%.

- This should cause a prolonged contraction in the second half of the year and, overall, much weaker growth in 2024, due to monetary tightening and the cost-of-living issue, while core inflation should remain sticky overall.

Investment consequences

- EUR should prove stronger than expected against USD.

3| QT and supply fallout on euro government rates

- This year net euro issuance is set to rise sharply: net EMU-10 issuance should jump to €420bn, EU issuance to €150bn, and core and semi-core issuance to €300bn from €226bn.

- This means that a total of €720bn will have to be absorbed by markets this year, with supply coming from both core and semi-core countries, while peripheral supply is expected to fall from €140bn to €120bn overall.

Investment consequences

- Short positioning on euro duration.

- Cautious stance on peripheral spreads.

4| Budget trends across the Eurozone

- The rise in borrowing rates is not an immediate threat to public debt sustainability.

- Eurozone government debts are staying on a sound path in the near term, thanks to the still favourable interest rate-GDP growth differential.

- However, in the long term, a return to fiscal discipline is needed to ensure debt sustainability. In this respect, 2024-25 budgets will be key.

Investment consequences

- Stay short on euro duration.

- Cautious stance on peripheral spreads.

5| Earnings season early takeaways

- First US results have been positive so far, beating expectations by some 5%.

- S&P 500 EPS for Q4 2022 is forecasted to be the first negative quarter since Q3 2020, with a -1.6% drop, resulting in end-2022 earnings at +4.5%; materials and communications services should be the worst sectors.

- Stoxx 600 Q4 EPS is expected at +14.5%; FY2022 at +19.9%.

- Overall, 2023 is setting the lowest bar ever for S&P 500 EPS growth expectations (+3.2%); in Europe, expectations are close to zero (0.6%).

Investment consequences

- US equities downgraded to UW from neutral against rest of the world, mostly on the growth-value argument.

6| Outlook for primary credit markets

- We foresee limited fallout on primary credit markets from rate hikes, as low refinancing needs and heavy use of cash holdings have mitigated the fallout of monetary tightening thus far.

- However, higher funding costs and slowing growth should start hitting low-rated high-yield issuers the most in 2023.

Investment consequences

- Long credit: we keep our preference for Europe over the United States and for IG over HY.