Summary

Macroeconomic focus

China’s policy choices in a divided world

China's shift away from stimulus reliance demands new analytical models.

China's policy landscape is being reshaped by two predominant forces external geopolitical pressures and a distinct internal governance philosophy. Heightened tensions, particularly with the US, have steered China towards a strategy focused on self reliance. Consequently, China is compelled to reinforce its industrial policies, aiming to secure its supply chain independence and bolster manufacturing capabilities.

Internally, a critical reassessment among policymakers, informed by the drawbacks of past stimulus measures, has underscored the necessity of rebalancing the economy. The global context conveniently supports this shift, which provides a persuasive justification for the government’s leaning towards austerity and structural reforms over stimulus measures.

Investors must therefore adjust to recalibrations in China’s future policies which aim to:

1. Prevent excessive financialisation, potentially reversing some past liberalisation efforts that resulted in unconstrained expansion of capital;

2. Strengthen industrial production capacities, particularly at critical points in the global supply chain;

3. Selectively open up the economy to strike a balance between national security and economic development.

Given these strategic choices, the outlook for traditional stimulus measures, commonly favoured by the markets, appears limited. Instead, China is likely to maintain modest fiscal deficits with a strong emphasis on fiscal discipline, complemented by gradual monetary easing. Policies are likely to act as a force that depresses inflation, warranting cautious assessment.

Macroeconomic snapshot

The US economy started to show signs of growth moderation in H1 and we expect this to continue in H2, driven by slowing domestic demand, particularly consumption. With the labour market slowing and wage growth softening, we also expect inflation to continue along a moderating path, although at a slower pace than seen during 2023.

Economic activity in the Eurozone will progressively firm during the year converging towards potential, supported by real income improvement as delayed wage growth catches up with inflation and restores purchasing power, while investments will likely catch up later in the year Inflation will progress in its descent towards target, with stickiness in services.

Ongoing restrictive monetary policy and the constrained fiscal space will mean the UK faces a subdued medium-term growth outlook. The recovery towards potential will be supported by a continuing decline in inflation and improving real income, putting a floor on consumption and gradually increasing investments.

All eyes are on the BoJ for clues of further monetary policy normalisation. While markets priced in additional rate hikes this year, we believe it is premature to tighten given it is still in the early stage of an economic regime change. While wages have shown signs of improvement, underlying inflation measures have either plateaued or cooled further.

Following the Q2 China GDP miss, PBoC resumed its easing cycle and cut its policy rates by 10 bp in July. We expect fiscal expenditure to accelerate, facilitated by the increased issuance of government bonds. Incremental easing efforts are expected to revive China’s growth temporarily, but in light of structural headwinds, the economic slowdown will resume afterwards.

India’s inflation remains within the RBI's target, albeit staying in the upper half throughout the forecast period. A favourable base effect will bring it down to the central target or below during the summer. RBI's updated neutral rate estimate of 1.4-1.9%, supported by a potential growth rate of around 7%, reinforces a gradual approach to monetary policy easing.

The Mexican economy is no longer expanding as strongly as in 2023 in line with the historical pre- and post-election dynamics - robust fiscal spending will need to come off further. Alongside more benign core inflation as of late, Banxico’s easing door has opened a bit wider and we expect it to deliver a cut in August. But AMLO’s busy last month in office (September) and the approaching US elections (5 November) will make further rate cuts a policy- and politics-dependent event.

The macro environment is doing well with Brazil’s economic activity accelerating, inflation gradually moderating (sequentially as the annual comparison is dealing with unfavourable base effects) and the BoP (Current Account Balance) is in a solid position. However, the BCB had to 'interrupt' its easing cycle due to deteriorating inflation expectations reflecting the highly uncertain fiscal situation. The recent announcement to freeze spending is very welcome but markets will await delivery first.

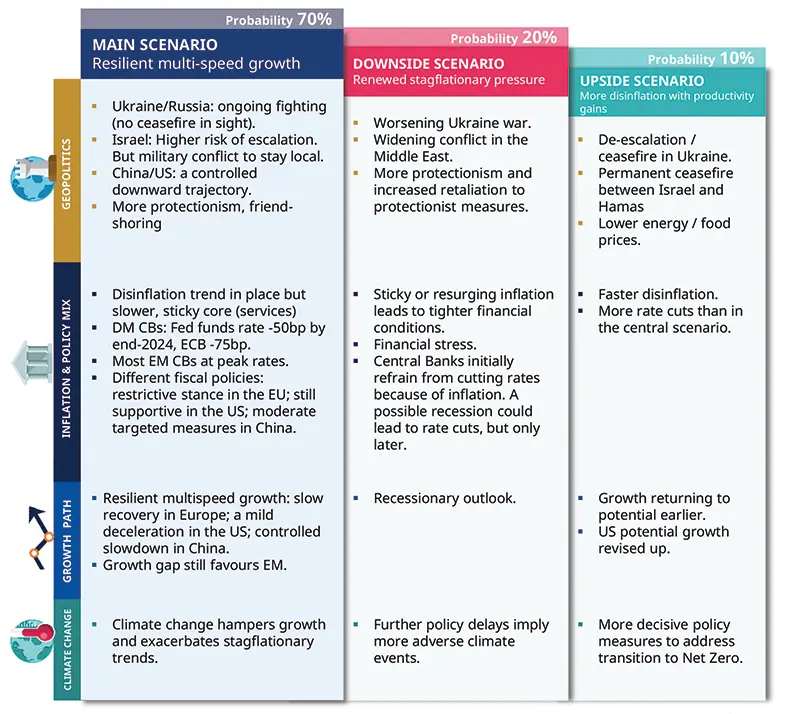

Main and alternative scenarios

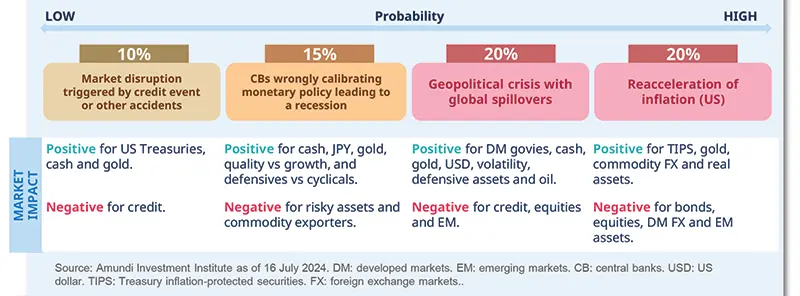

Risks to central scenario