Summary

Macroeconomic focus

Bank of Japan: back to conventional

The BoJ does not have the right conditions to hike in 2024 or 2025.

In March, the Bank of Japan (BoJ) made a bold move by dropping its negative interest rate policy, Yield Curve Control and complex commitments on monetary base and inflation overshooting in one go. This shift marks a return to a simpler and more conventional monetary policy framework, with the short-term interest rate (TONA) becoming the primary policy tool, accompanied by a general forward guidance of maintaining accommodative financial conditions.

Future interest rate hikes will primarily be driven by inflation, as Governor Ueda clarified during the press conference, emphasising that hikes are conditional on further increases in underlying inflation towards the 2% target. However, with inflation expected to moderate, the BoJ does not have the right conditions to raise rates in 2024 or 2025. We expect the Bank to maintain TONA at 0-1%, conducting quantitative tapering or sporadic tightening if necessary.

Inflationary pressures have been cooling, with all underlying inflation measures, such as the trimmed mean and the weighted median, which have been decreasing towards 2% or less (chart below). In our view, the risk of re-acceleration in the second half of the year is small. We anticipate medium-term inflation to settle at around 1.5%, which is not sufficient to push the BoJ to hike rates further.

As a key input in assessing financial conditions under the BoJ's new framework, the real interest rate is around -3%, significantly lower than the neutral rate* of -0.5% to 0% (IMF estimates). Given our projected core inflation path, the real interest rate will gradually move towards neutral throughout the year. This automatic adjustment process implies that financial conditions will incrementally become less accommodative, reducing room for the BoJ to tighten further.

Mild, not high, inflation in the medium term

Emerging markets

China: Reflation is sight ?

China CPI - housing inflation

Source: Amundi Investment Institute, Wind. Data is as of 27 March 2024.

In Jan-Feb 2024, CPI stayed flat compared to a year ago, recovering from -0.3% YoY in Q4 2023. This was due to a pick-up in services inflation to 1.2% YoY in the first two months, while goods CPI declined in February for the 11th consecutive month. We think it is too early to feel relieved. Looking ahead, the biggest component in services CPI – imputed rent – could start to head lower with falling lease and sales prices. It represents 38% of the services basket and 14% of the entire CPI. Hence, China will most likely be stuck in low inflation and risks are to the downside where deflation could extend to the services segment.

India: Strong Growth Momentum

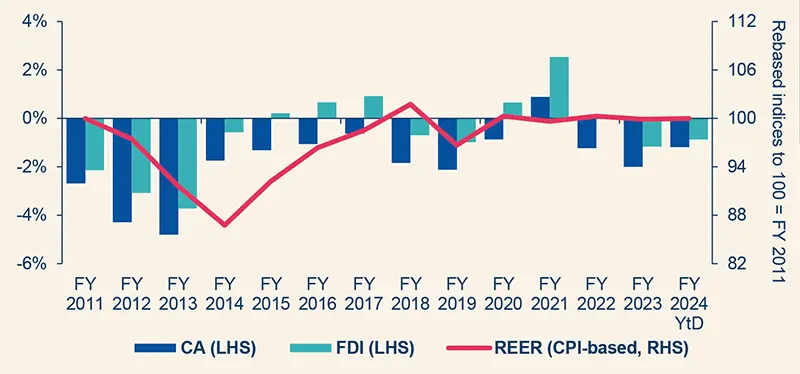

India’s CA Deficit may narrow even further in 2024

Source: Amundi Investment Institute, CEIC. Data is as of March 2024. FY: Fiscal Year; CY: Calendar Year; CA: Current Account; FDI: Foreign Direct Investment; REER: Real Effective Exchange Rate.

In early 2024, India’s growth momentum remained robust. Credit data, electricity generation, freight traffic and PMI manufacturing as well as consumption data (vehicle sales), picked up in February. Exports are improving too, implying that the current account deficit – already on a safer path as per Q4 CY 2023 – could narrow even further in 2024. India’s external vulnerability has diminished over the years. February’s headline inflation printed in the upper half of the Reserve Bank of India (RBI)’s target as expected, while core prices keep declining. If there is any pressure on inflation, it comes from the food component, but the RBI’s outlook of staying on hold in the short term and easing later in the year is unchanged.

Macroeconomic snapshot

After a strong close to 2023 and a resilient first quarter, we expect the US economy to decelerate as we progress into 2024. The most vulnerable segments of the economy are showing signs of stress, although data on the broader economy remain mixed. We continue to expect inflation to moderate, amid some volatility, particularly on the sticky services side, as domestic demand cools and sequential inflation converges to a more normal pace.

Signs of bottoming out among business surveys support our view that the peak of monetary policy tightening may be almost over; yet, as conditions remain tight, modest global growth and less supportive fiscal policy will compound and keep eurozone growth sub-par in 2024, with a slight improvement in the second half of the year. Core inflation will progressively slow towards target, amid some volatility and heterogenous readings across countries.

We expect weak growth for the UK in 2024, although the contraction in Q1 most likely marked the low point for activity; the headwinds from restrictive fiscal and monetary policy will keep growth subdued especially in H1, while the economy may gradually gather momentum later in the year thanks to the boost to real disposable incomes from falling inflation, which is expected to moderate going forward, moving closer to target before year-end.

The Central Bank of the Republic of Turkey (CBRT) surprised by raising its policy rate by 500bps to 50%, while the consensus was expecting rates to stay on hold. Inflation will continue to rise and the Turkish Lira to depreciate. Further tightening cannot be ruled out but the evolution of FX reserves will be key.

The Hungarian National Bank (NBH) cut its rate by 75bps to 8.25% vs 100bps last month. This caution was justified by elevated market volatility and risks associated with the Hungarian Forint and the path of inflation. Geopolitical tension and uncertainty around the Fed’s easing cycle will not lower this month and a NBH cut will likely be lower in April.

The strong Polish disinflation trend will stop in April and inflation will rise hereafter: i) data for the first two months show a sharp rebound of private consumption driven by strong wage growth and higher social transfers, and ii) anti-inflation shield measures are going to start to be removed. The National Bank of Poland (NBP) has no room to cut and may remain on hold until Q4.

Unusually, but widely expected, the Mexico Central Bank (Banxico) cut interest rates well ahead of the Fed by 25bps, via a split decision (4-1), after keeping them on hold at 11.25% for a whole year during which time monetary policy tightened passively. The easing pace will certainly remain slow and possibly be discontinued (subject to inflation dynamics, Fed actions, and local and US elections).

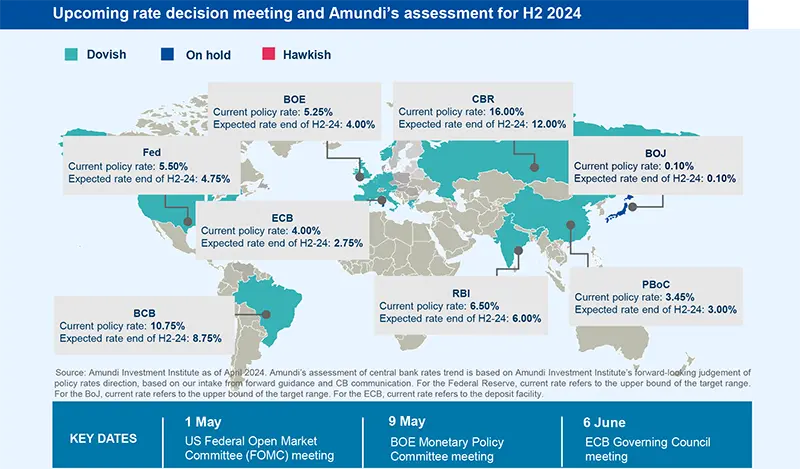

Central Banks Watch

DM Central Banks prudently approaching pivot; EM peers adapting to fickle conditions

Developed Markets

The Fed's rhetoric has not changed despite the recent acceleration in inflation. The story that “inflation moving gradually down on a sometimes-bumpy road towards 2%” is maintained. The median dot continued to show three rate cuts in 2024.

ECB members now look “more confident about hitting inflation goal”. The ECB has revised its inflation forecasts downwards. Momentum is building for a June ECB interestrate cut.

The Bank of England made a further dovish step towards a turn in the cycle. Its members need to see more progress in the current disinflationary trend, but the overall outcome of the meeting looks consistent with a turn in the cycle getting closer.

The BoJ has ended its unconventional policy regime, raising interest rates for the first time since 2007 and removing the target and reference rate for 10-year JGB yields. Governor Ueda underlined that a rapid rate hiking cycle could create risks in the economy after years of low interest rates.

Emerging Markets

Following very benign reports in December 2023 and January 2024, EM February inflation marginally and broadly surprised to the upside across EM, with the exception of CEE, which surprised on the downside. In our view, February figures do not represent a change in the trend; however, it’s worth noticing that our inflation expectations for 2024 maintain a fairly stable path ahead. On the global stage, US data seemed to support the idea of a more prudent Fed until Powell confirmed the previous dots.

Thus, either due to poor inflation figures or excessive currency volatility, EM Central Banks again promptly adapted to the fickle conditions and somehow cooled down expectations for their easing stance. Indeed, BCRP (Peru) discontinued its easing cycle, BCB (Brazil) tweaked its forward guidance in a relatively less dovish sense, CBC (Taiwan) unexpectedly hiked its policy rates aiming to reduce currency weakness and CBRT (Turkey) boldly hiked its policy rates by 500bps (to 50%) against the consensus for staying on hold and continuing a more orthodox policy mix.

Geopolitics

What a Trump presidency means for NATO

Most-at-risk countries will have reached the minimum NATO spending level by the time the next US president would come into office.

Concerns are growing over the possibility that the next US administration may refuse to defend NATO allies. It is legally difficult for the US to actually pull out of NATO as it now requires congressional approval to do so. Nevertheless, if the US president does not want to defend an ally, it is irrelevant if the US is a NATO member or not, indeed no one can force the US president to do it. However, Donald Trump is not anti-NATO per se. His comments have mainly been about stopping protecting NATO members who do not pay their ‘fair share’ (2% of GDP). By the time the next US president comes into office, NATO members who are most at risk will have time to increase spending to the minimum level in anticipation of a second Trump administration but also reflecting the growing risk of war. NATO countries in direct geographic proximity to Russia and Ukraine already exceed the 2% threshold; Germany allegedly reached 2% in January and is expected to spend more in coming years. France is also planning to reach 2% this year. Even though European NATO members are now reaching that minimum spending level, this follows years of underinvestment, leaving a shortfall of EUR 56 billion. The question, therefore, is whether a possible Trump administration will be happy about countries catching up over time or will require NATO members to make up for the historic shortfall to guarantee security.

Policy

The EU defence has the wind in its sails

The search for new sources of financing is increasingly the sinews of war.

At the EU summit on 21-22 March, EU leaders expressed their determination to strengthen the technological and industrial base by rapidly implementing the European Defence Industrial Strategy (EDIS) presented by the Commission (EC) at the beginning of March. On the menu is a substantial increase in defence spending, joint investment and better access to public and private funding. The Council and the EC are due to examine all possibilities for mobilising funds and submit their conclusions in June.

The aim is to reverse recent trends and produce more in Europe. Between the beginning of 2022 and June 2023, 78% of defence purchases by EU Member States were made outside the EU, with the US alone accounting for 63% of this share. It is now planned that 50% of defence equipment will be purchased within the EU by 2030 and 60% by 2035.

The use of windfall profits from frozen Russian assets should make it possible, in the short term, to jointly purchase military equipment for Ukraine. But in the medium term, other sources of funding will need to be mobilised, and budgets will also be called upon to contribute. In the next multi-annual financial framework (from 2028), an ambitious financial envelope will have to be allocated to defence.

Last, but not least, Europeans reiterate that defence investments aimed at maintaining peace do not contravene environmental, social and governance (ESG) factors. There are no EU rules hindering private investment in the defence industry.

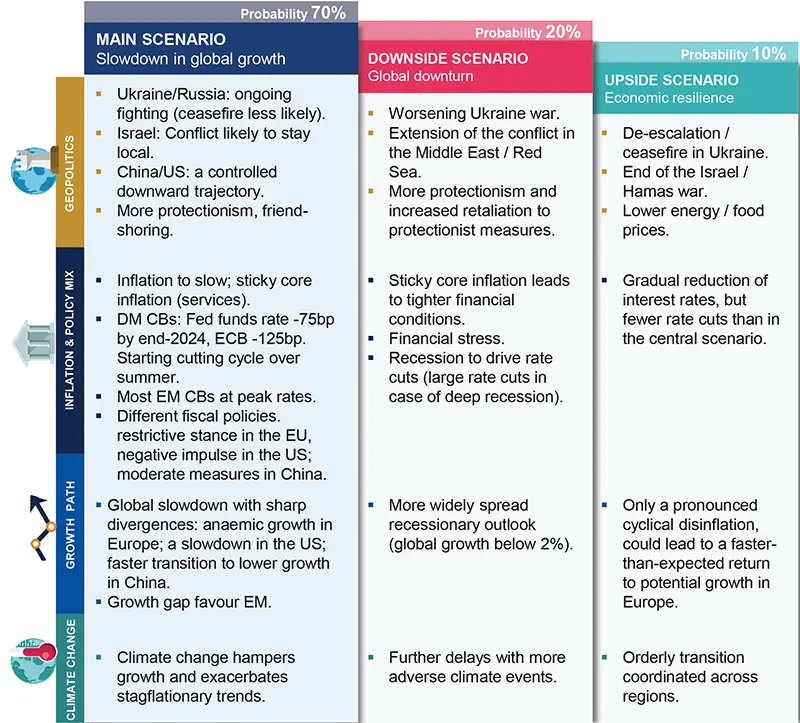

Scenarios and Risks

Main and alternative scenarios

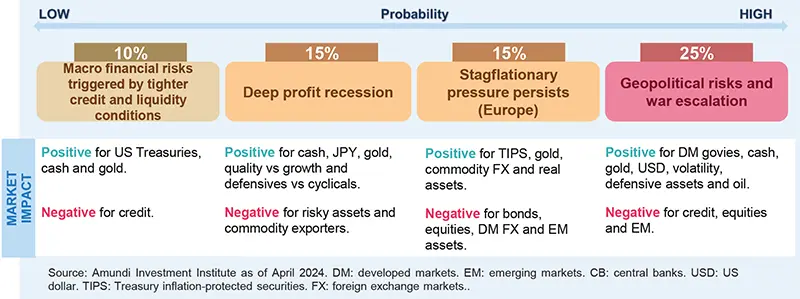

Risks to central scenario

Amundi Investment Institute Models

Advanced Investment Phazer: Amundi Investment Institute quarterly update

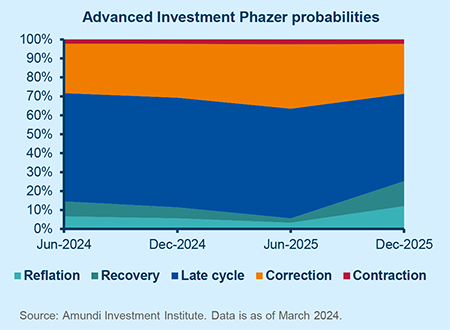

Macro-financial regimes are key to fine-tuning risk exposure and rotation within each macro asset class when it comes to portfolio allocation.

- The rationale: economic cycles have been a crucial driver for financial markets, making regime-based dynamic asset allocation (DAA) a common practice in supporting optimal portfolio construction. Changes in key economic indicators, monetary policy trends and the evolution of financial leverage have proven a reliable guide in identifying business cycle phases. Assessing the evolution of the probability for alternative regimes is often the best indicator for capturing a change in expectations.

- Model setup: We have developed a disciplined approach where regimes are identified by a clustering algorithm applied to a comprehensive set of macro-financial variables split over four dimensions: growth, inflation, monetary policy and financial leverage. We use this dataset (from 1875) to identify the most relevant recurring five regimes – correction, contraction, recovery, late cycle and asset reflation – and screen the overall cross-asset universe to detect which allocation models would have worked best during the various regimes.

- Goal: The Amundi Investment Institute Advanced Investment Phazer’s (AIP) goal is to assess a financial regime’s likelihood of persisting over a certain time horizon and assess the asset allocation model that should be favoured in relation to the forecast financial regime probabilities. In fact, we have found that asset classes and sectors display different behaviours during each regime which investors should consider within their portfolio allocations.

- Model output: We can identify different asset allocations depending on the probability distribution, favouring the combination of assets that is expected to perform best in the central scenario deemed most likely to materialise.

Late Cycle is the most likely phase for 2024

What are the current signals?

- The AIP signals Late Cycle as the most likely phase for 2024 due to strong resilience in the US economy and single-digit positive EPS growth in GEM economies should support global growth as well.

- The Late Cycle favours a marginally pro-risk asset allocation with a special focus on high-quality assets. The non-negligible probability of negative tail risks suggests a significant exposure to govies as well.

Equities in charts

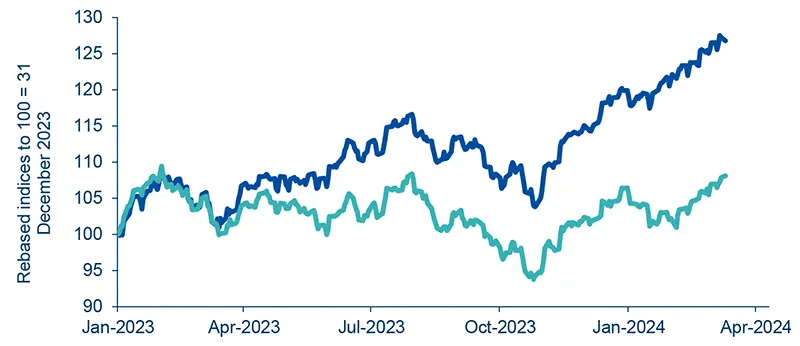

A broadening of participants in the rally has started

MSCI ACWI & MSCI ACWI Equal Weighted

Source: Amundi Investment Institute, LSEG Datastream. Data is as of 29 March 2024.

The equity rally has now started to become more spread out. While the market-cap-weighted MSCI ACWI is well above its 2023 highs, the equal-weighted MSCI ACWI has only just reached them. There is room for this broadening to continue.

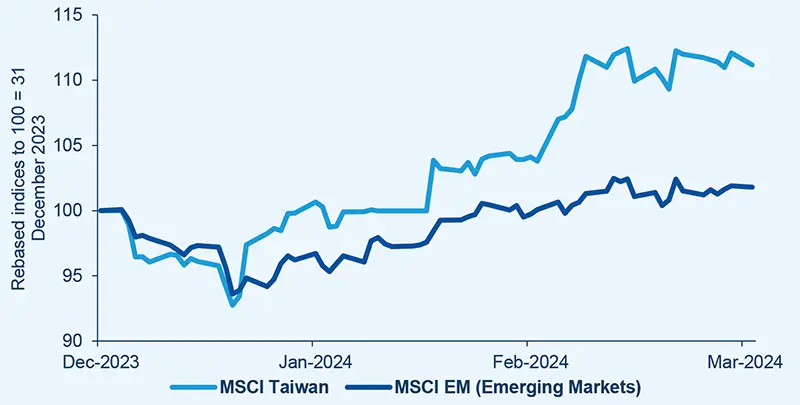

EM: The semiconductor industry has been carrying Taiwan vs EM

Taiwan vs EM performance YTD

Source: Amundi Investment Institute, Factset. Data is as of 1 April 2024.

Taiwan has been one of the best-performing markets in EM year-to-date, showing that the semiconductor industry recovery, which has been anticipated for some time, is happening and can be further sustained by advancements in artificial intelligence technology.

Bonds in charts

DM: yields reacted strongly to upside surprises on inflation

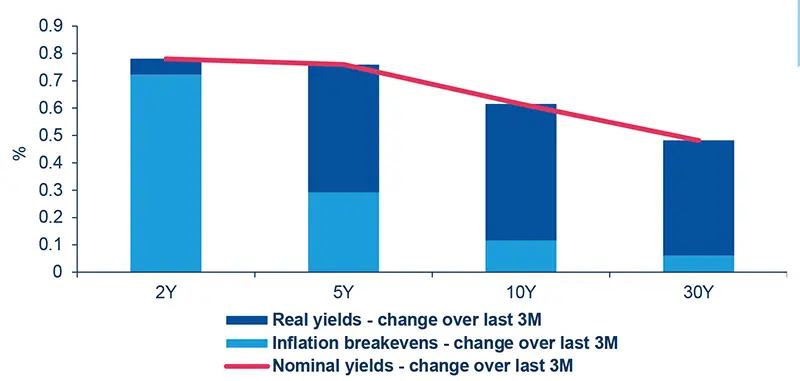

Changes in US Treasury yields over the last 3 months

Source: Amundi Investment Institute, Bloomberg. Data is as of 15 April 2024.

Strong rise in 2y and 5y inflation breakevens since the start of the year: front-end inflation compensation was too optimistic about how quickly inflation would moderate.

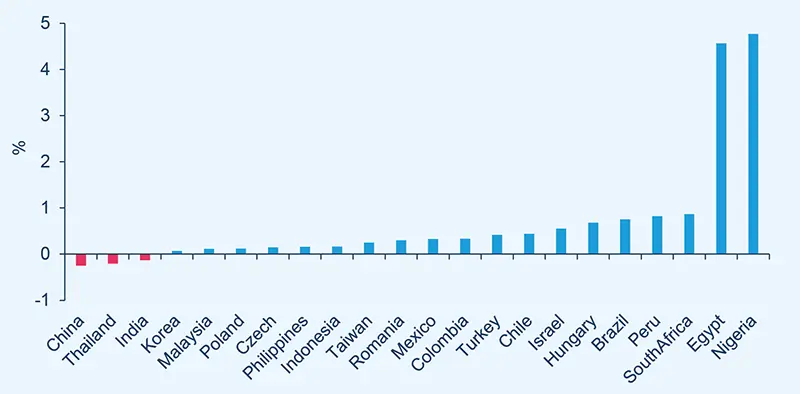

EM: EM yields on the rise YTD

EM bond local - YTD change in yields

Source: Amundi Investment Institute, Bloomberg. Data is as of April 2024.

With the notable exception of China (that is discounting massive monetary easing, which is not our base case) and some other Asian countries, EM yields moved higher year-to-date, re-opening the valuation gap and creating a good entry point for investors.

Commodities

Both gold and cyclical commodities are trending up, reflecting markets’ optimism and doubts.

Confidence in a monetary pivot by the summer is building, boosting gold. Longer-term catalysts – fiscal premium, FX reserves diversification, geopolitics and the uncertain next phase of the cycle – are also aligning favorably for more upside. We see an initial milestone at $2,300/oz.

Geopolitics, tightening oil markets and resilient demand are providing support for oil prices. Downside risks are limited, but ample spare capacity, non-OPEC output creeping up and stretched technicals would prevent a sustainable spike. We maintain our $85/b target for Brent.

Moderating China consumption and milder investments in construction continue to cap metal prices. Yet, evidence of a mining output outage and dry prospects of medium-term excess supply are providing support for copper prices. We maintain our $9,000/t medium-term forecast.

Currencies

US exceptionalism requires a hawkish Fed to persist.

The disinflationary process backs the ECB’s soft commitment to a June cut and points to an actual policy divergence relative to the Fed. A shortterm headwind for the EUR, which requires a dovish shift from the Fed to realign with the improving fair valuation.

Surging commodity prices and robust US economic activity make the magnitude and timing of the Fed cutting cycle unclear and is a support for the USD. With no substantial pass-through to US inflation though, such support should fade the closer we get to the first cut.

Given the shift in tone from the BoE in March, we expect further downside surprises in UK growth and inflation as headwinds for the current UK rates advantage. We expect a modest unwinding of cross- GBP trades within the G10 in the short term.

The BoJ’s historic hike did not sustain the currency and forced officials in Japan to step up the verbal intervention level. We expect little real support from this angle and see the JPY as anchored to the US growth and rates dynamic.