Summary

Macroeconomic focus

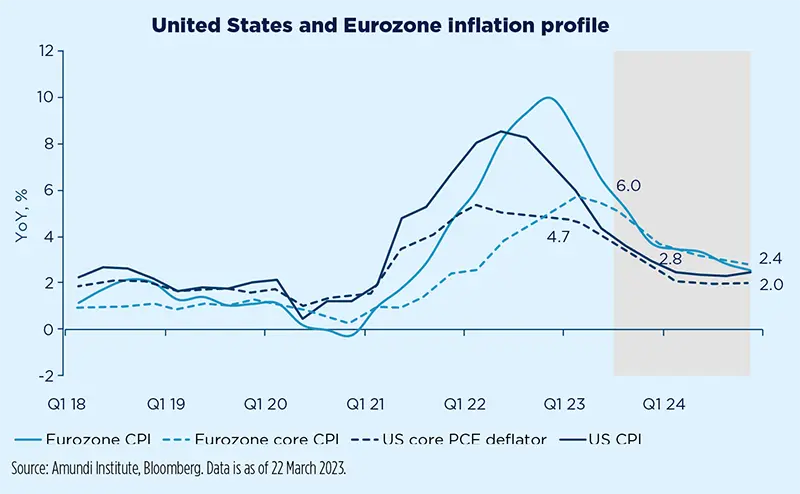

Disinflationary trend to ease pressure on central banks to hike further

The tightening in credit conditions should reduce core inflationary pressures, partly replacing the need for monetary policy action.

Core inflation has been persistent across both the United States and the Eurozone, slightly reversing previous indications of a smoother path and a faster deceleration. With few signs that underlying inflation will decelerate rapidly in the near term and significant weaknesses emerging in parts of the banking sector, market expectations of policy and short-term rates have seen unprecedented volatility. While policy efforts can stabilise financial stability concerns regarding the banking sector, higher lending rates and tighter lending conditions will persist. Central banks appear to be caught between a rock and a hard place and now have a policy trilemma: setting the stance of monetary policy vis-à-vis inflation and growth, while protecting financial stability at the same time.

In our view, inflation is set to decline over the next 12-18 months towards CB targets, although the path may be bumpy and the landing point may be somewhat above CB targets. Lower energy and food prices should represent a significant disinflationary driver for headline inflation, which is expected to decelerate markedly over the year. However, sticky underlying inflation will pose dilemmas for policymakers. Some core inflation components are showing persistence – both in the United States and Europe – pointing to a mix of resilient domestic demand (especially in the United States) and ongoing transmission of past supply-side shocks (notably in the Eurozone). While both should fade as monetary tightening takes its toll on growth and supply shocks are finally absorbed, it may take some time and growth and financial stability concerns are emerging.

Recent events in the banking sector highlight that the aggressive policy tightening, while acting with lags and delays, is producing effects that remain uncertain. Against such a background, we expect CB to be even more data-dependent, with little to no forward guidance, as the recent ECB meeting confirmed. While there is still a high degree of uncertainty on the landing point of inflation over a 12-18 month horizon, the tightening of credit growth on top of tightening financial conditions should produce an additional factor depressing domestic demand and reducing core inflationary pressures. Market-induced tightening of financial conditions – higher borrowing rates and more stringent lending conditions – will, in principle, allow CB to tighten less. How much less will depend both on how sticky inflation is and on how much demand is weighed down by higher borrowing costs.

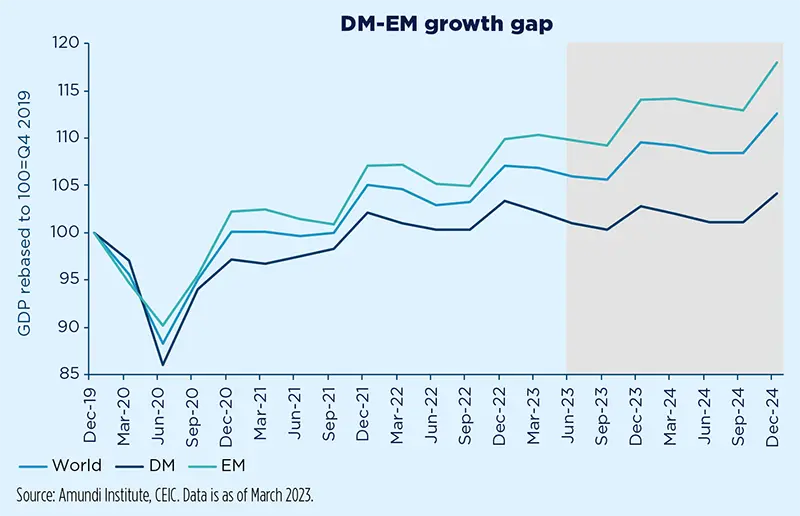

Emerging markets

Scenario reassessment favours EM over DM

The recent banking sector turmoil has triggered a reassessment of growth conditions across key DM, namely the United States, where now we expect an economic recession to be spread over the next three quarters. On the other hand, we have upgraded China’s 2023 growth forecast from 5.1% to 5.6%, based on the stronger-than-expected recovery in real estate and larger credit impulse. On top of the revised macroeconomic backdrop, markets have been repricing significantly core central banks’ monetary policy (MP) trends, in a direction more favourable to EM, notwithstanding the MP conduct so far has not deviated from the primary goal of fighting inflation.

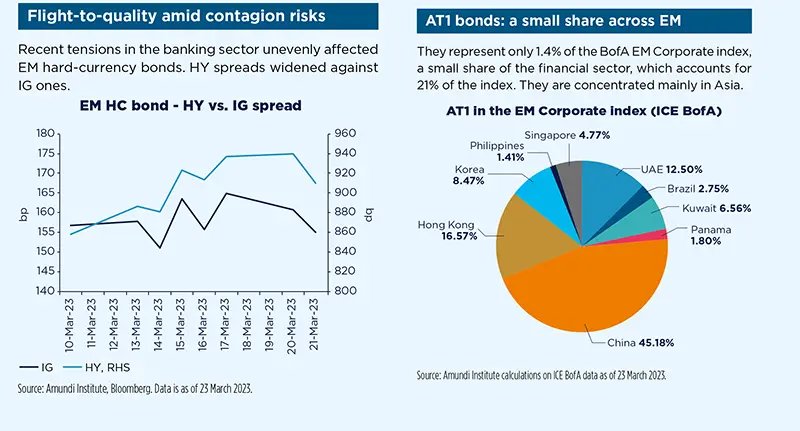

Barring a global liquidity squeeze impairing the banking and financial system, the above signals taken together do not unequivocally add negative momentum to the EM outlook. Indeed, the sell-off across EM asset classes was limited in the aftermath of the banking sector stress. The hard-currency debt spread widened, mainly in the HY segment. Within EM FX, Asian currencies have been outperforming the rest of the universe and the MSCI EM index has underperformed mildly, by around 1.5% – both in local currency and USD terms. On the other hand, over the same period, local-debt duration has definitely outperformed.

In order to assess the macroeconomic and market impact on EM, we should insulate a few key pillars. Firstly, on the back of recent revisions, the still fragile economic environment is envisaging a growth premium between DM and EM that is tilted even more in favour of the latter. Having said that, looking more granularly, weaker external demand from the United States – and partly from the EU – will be offset by Chinese demand according to the geography and the export destination (e.g. Mexico should be on the weaker side). In addition, while still constructive, our oil outlook is catching up with weaker fundamentals, reducing the benefits for exporters. Secondly, the higher cost of funding will widen the divide between fragile and sound sovereigns or corporates. The already high number of frontier countries that struggle to access credit is rising, as highlighted by widening HY spreads, which are not offset by a lower base rate and without more lenient IMF rules. Finally, the underlying repricing of core central banks’ MP path, if not prompting an earlier, faster, and more dovish stance across EM central banks, should at least reduce external pressure to keep hiking and allow a greater focus on domestic disinflationary forces to start easing, with LatAm economies driving this.

Macroeconomic snapshot

The rapid Fed tightening is starting to bite the US economy. In particular, the economic landscape could be harsher than initially thought. We are already witnessing a tangible deterioration in the US economy, which should move into recession in Q2. The credit crunch should weigh on growth and will define how pronounced the recession is, while inflation is set to remain sticky, at least in the near term. The recession and below-par growth will help drive core inflation towards target over the forecasting horizon.

Notwithstanding our upgraded growth forecasts at the start of the year – mainly due to carry-over effects – we expect very weak activity for the Eurozone, especially as financial conditions tighten and weak lending drags investment and weighs on growth. Although China’s reopening represents a tailwind, it won’t be able to completely offset the recession that now we expect in the US. Above-target and persistent inflation, at least in the near term, will hold back consumption and keep the ECB in a tight stance.

With inflation remaining above target for several quarters, we keep seeing a cost-of-living-induced recession playing out in the UK. Although the outlook has improved on the back of incoming data and news flow, with lower energy prices removing downside risks, we still see the economy facing headwinds, which will also keep growth subdued in 2024. Energy remains a key risk for both the growth and inflation outlooks.

We have further upgraded Japan’s inflation forecasts. Despite the distortion from the one-off government energy subsidies, the increase in Tokyo’s core inflation broadened in February and was stronger than expected. With improving consumer sentiment and a pick-up in wage growth, core CPI is likely to hold high at around 3% in H1. The banking crisis in the US and Europe challenges our call for faster and earlier BoJ policy normalisation. BoJ’s pressures to intervene have eased since ten-year JGB bond yields fell back below the upper-bound target of 0.5%.

We upgraded China’s 2023 growth from 5.1% to 5.6%. While the moderate rebound in consumption is in line with expectations, investment has exceeded expectations due to upbeat credit growth, and the real estate sector has registered a broad-based recovery in January-February. We now expect housing sales to grow by 5.3% in 2023, compared to the previously projected decline of 2.7%. Policies will remain selectively accommodative throughout the year, as external uncertainties increase. However, we caution against the risk of selective tightening in the housing sector in H2.

Following a surprise spike in January, India’s headline inflation declined moderately in February from 6.5% to 6.4% YoY, with the main contributor being food prices (2.9% out of 6.4%). Similarly, core prices stayed high and above 6.0% (6.1% YoY). According to our expectations, India’s inflation should move within target by March (data released in April) and remain within target for the coming quarters. While we still believe that RBI has reached its terminal policy rate at 6.5%, following the latest hike in February, we do not expect it to ease in 2023.

The State Bank of Vietnam (SBV) unexpectedly cut its key policy rates by 100bp on 14 March. We believe the primary reason behind the move was to ease domestic liquidity stress, particularly for the real estate sector which is facing elevated refinancing needs. The central bank has also taken advantage of more favourable external conditions, as the Fed’s terminal rate expectation was repriced downwards significantly and the Vietnamese dong appreciated again. A more benign growth and inflation outlook also allows room for such a move to ease financial conditions.

Brazil’s economy contracted in Q4 2022 after three robust quarters, highlighting how tight monetary policy has started to bite. We forecast growth below 1% in 2023, as the labour market is also softening, even though the headline rate will benefit from strong agricultural output. The BCB cannot come to the rescue just yet. Despite inflation peaking nearly a year ago, and almost halving, the BCB needs to wait for new fiscal rules and for inflation expectations to stabilise in the context of the – possibly revised – inflation target. Still, we see signs that the SELIC rate will be cut over the summer months rather than in Q4.

Central Bank Watch

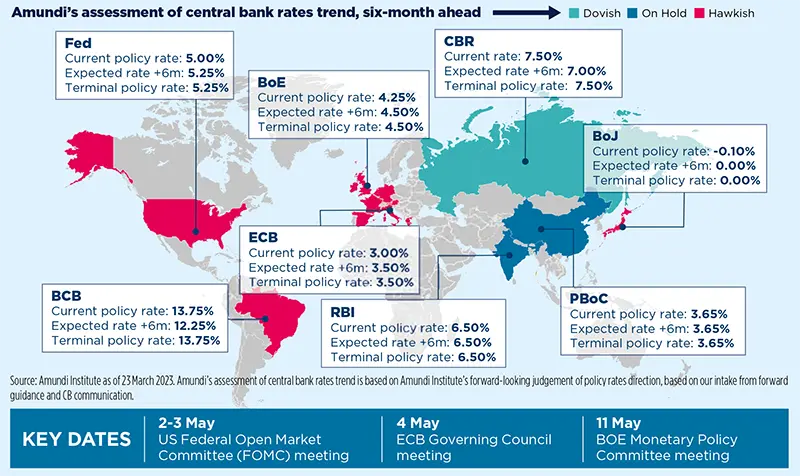

DM CB to turn cautious, EM CB appear less affected by market turmoil

Developed markets

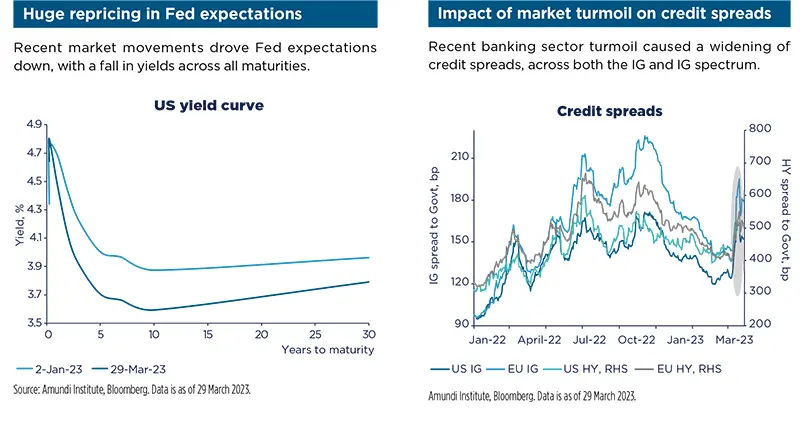

We expect DM CB to adopt a more cautious approach in an environment of still high inflation, but increasingly tight credit conditions. The Fed delivered a dovish 25bp hike in March, taking the Fed Funds target range to 4.75-5.00%. This meeting marked a shift towards a more gradual and cautious approach. The big question today is to what extent the stress in the banking sector will tighten lending conditions and slow the economy. The door is open to a pause. In our baseline scenario, we expect a terminal rate at 5.25% and no rate cuts in 2023 subject to some stabilisation of the banking sector and sticky core inflation.

The ECB stuck to its guidance, with a 50bp hike in March and failed to pre-commit to future rate hikes given the high level of uncertainty. Decisions will be made meeting by meeting and will be data-dependent. We confirm our expectations for the ECB terminal rate at 3.5%.

At its latest meeting, the BoE delivered a 25bp rate hike, taking the Bank Rate to 4.25%. We expect one further 25bp rate hike.

The tightening of global financial conditions has posed a challenge to our earlier prediction for a fast normalisation of BoJ policy. A Yield-curve control tweak remains likely in April or June, as Shunto wage results and inflation exceeded expectations. The BoJ is likely to proceed at a more gradual pace to achieve its 0% terminal rate target.

Emerging markets

The significant market repricing of monetary policy trends for core CB has led to a reassessment of the next steps for EM CB as well. While market expectations have shifted towards a more dovish – or less hawkish – direction, changes in expectations are not significant. Several EM CB (in LatAm and Eastern Europe) were already expected to cut their policy rates over the one-year horizon and these expectations are now even more pronounced. For the few countries where further tightening is expected (such as Thailand, Mexico, and South Africa), market expectations point to these plans being reduced in scope or eliminated altogether.

Since the onset of the banking system turmoil, the few CB that have announced monetary policy changes have confirmed a marginally more accommodative stance. The PBoC has discreetly strengthened credit support by easing lending standards for property developers and mortgage borrowers. Additionally, it cut the RRR by another 25bp to prevent market rates from rising too quickly.

Our reassessment of the macroeconomic backdrop and the ongoing disinflationary path is consistent with a more dovish stance by several EM CB and it does not suggest an urgent need to accelerate the easing trend.

Geopolitics

Bank failures will have political consequences

A worsening economic outlook increases geopolitical risks stemming from the United States, China and Russia

Although the extent of the banking failure saga is not clear yet, there are some specific implications that are – and these will have political and geopolitical implications. The failure of SVB and Credit Suisse is likely to cause lending conditions to tighten, impacting the real economy. A recession in the EU and the United States now seems more likely. Consumers are already struggling with high inflation and rates, they are angry and strikes are occurring in many countries. Deteriorating conditions for banks, which will aggravate the economic realities, will not help. Costly bailouts of financial institutions would only add fuel to the fire. There are various risk areas for geopolitics resulting from this new reality:

- Should the United States enter a recession, the re-election of US president Joe Biden will be more difficult. Historically, hardly any sitting president facing a recession has been re-elected. Biden would turn more hawkish on foreign policy issues (China) and more protectionist. Both would be problematic for the EU.

- For the EU, calls for more banking regulation should increase alongside calls to deepen the banking union, at a time when EU leaders are struggling to find common ground on new fiscal rules and a common European response to the US Inflation Reduction Act.

- For China, a weakening global economy is not good news when it wants to accelerate domestic growth. Should weak global growth weigh on Chinese growth over time, the geopolitical risk emanating from China increases for the need to distract from domestic problems.

- For Russia a worsening economic outlook in the West is good news as it reduces Western appetite to support Ukraine. It could encourage a strategy of ‘waiting out’ Western support to renew wider-scale attempts to capture more Ukrainian territory.

Policy

EU: a protectionist industrial policy in the making

Europe’s Net-Zero Industry Act may reinforce protectionist pressures already at work.

The Net-Zero Industry Act (NZIA) – the European response to the US IRA – was presented by the European Commission on 16 March. The aim is to create a favourable regulatory environment for the energy transition and favourable conditions for key sectors (wind energy, heat pumps, solar energy and clean hydrogen) for which demand is also stimulated by the existing NextGenerationEU and REPowerEU plans. The focus is on simplifying and accelerating the permitting of new clean technology production sites. The NZIA sets clear targets for clean technologies by 2030. The aim is to focus investment on strategic projects to ensure Europe’s resilience.

Most funding is supposed to come from the private sector, but this will not be enough. Public funding through state aid is foreseen, under relaxed rules. The Temporary Crisis and Transition Framework adopted on 9 March aims to ensure a level playing field, targeting sectors where there is a risk of relocation. Several funding programmes (e.g. Recovery and Resilience Facility (RRF), InvestEU and Innovation Fund) are available. At the same time, the EU may choose to create a European sovereign fund to maintain cohesion and prevent the risks caused by an unequal availability of state aid, as not all countries have the same fiscal room for manoeuvre. However, there is no question at this stage of providing new European funding through new debt. The priority is to mobilise existing resources (over €250bn of RRF loans have not yet been deployed). The NZIA is not without risk, as it will reinforce protectionist pressures already at work with policies in the United States and China. This is the price to pay for maintaining and developing industry in key sectors and ensuring Europe’s strategic independence in the medium term.

Scenarios and Risks

Central and alternative scenarios

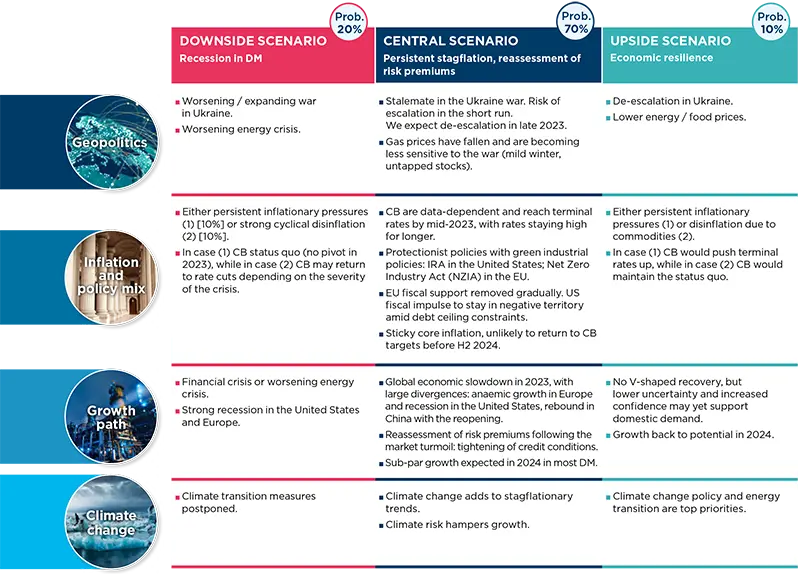

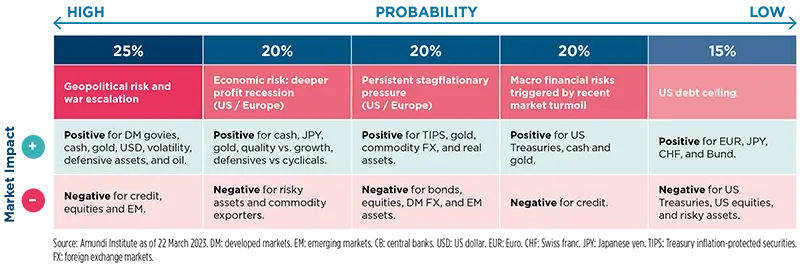

Risks to central scenario

Amundi Institute Models

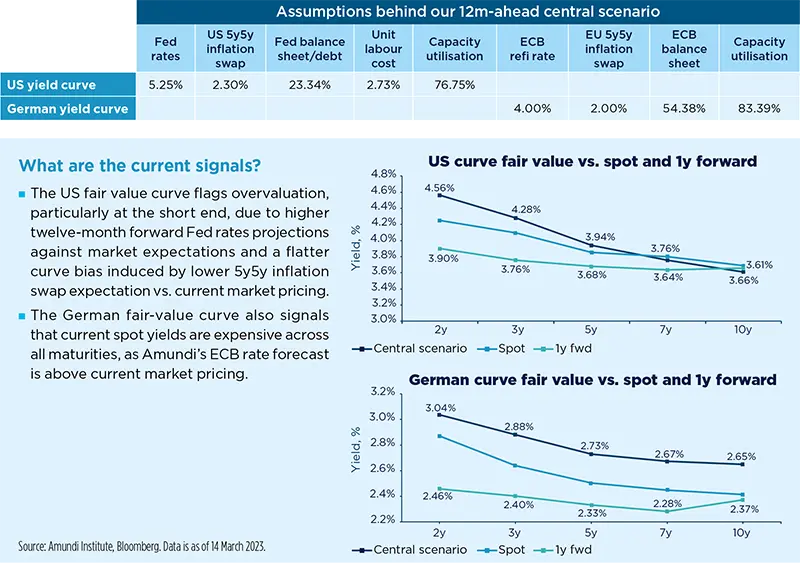

Yield curve fair value - Nelson-Siegel model

Robust and consistent valuations across every maturity allow us to detect signals not only on yield levels, but also on the shape of the curve.

What is the model about?

- The rationale: Bond yields are among the key factors on which investment choices are based. The level and shape of the yields’ term structure reflect an investor’s expectations of future interest rates, economic growth, and inflation. In addition, they are key determinants of the profitability of banks and of monetary policy transmission. The correct assessment of the main determinants of the yield curve and their underlying drivers is of crucial relevance in the set-up of a rigorous dynamic asset allocation process.

- Model setup: At Amundi Institute, our approach to the valuation analysis for bonds follows two steps: firstly, we leverage the Nelson-Siegel (NS) model to extrapolate different yield-curve factors. Then, we model each component using sound and consistent macro-financial variables. Such a framework results in robust and consistent valuations across every maturity, allowing us to detect signals not only for yield levels, but also for the shape of the curve.

- Goal: By generating a valuation framework based on macroeconomic and monetary policy dynamics, Amundi Institute’s yield-curve assessment aims to maximise the chance of allocating assets optimally and allows us to build reliable alternative scenarios for efficient and solid risk management.

- Model output: According to Amundi Institute’s twelve-month outlook, a forward-looking central scenario is defined for each variable that has historically proven statistical significance in explaining the evolution of the yield curve’s components, resulting in the fair-value curve.

Infographic - Markets in charts

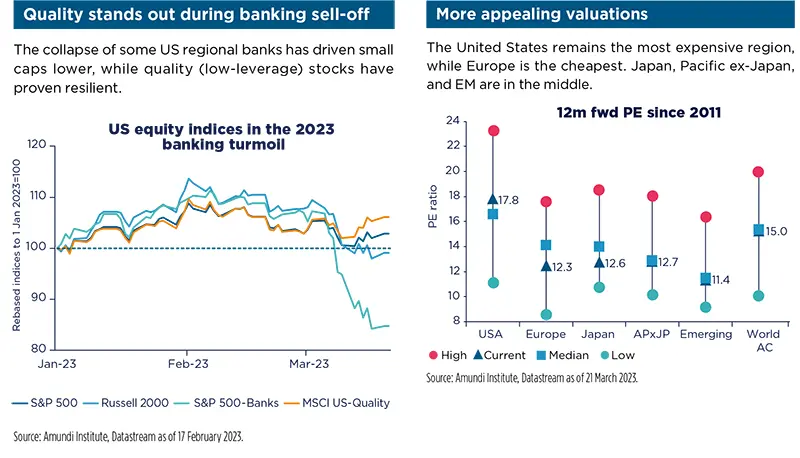

Equities in charts

Developed markets

Equities are under the influence of banking stress.

Emerging markets

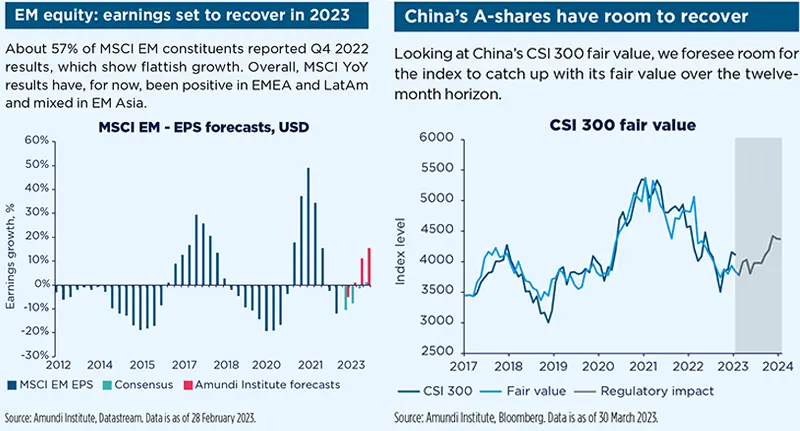

Earnings momentum stalled in Q4 2022 across EM, with room to recover this year.

Bonds in charts

Developed markets

Increase selectivity in credit amid tighter financial conditions.

Emerging markets

EM bonds have been hit unevenly by the recent flight-to-quality move.

Commodities

Limited downside on oil, but confidence should recover

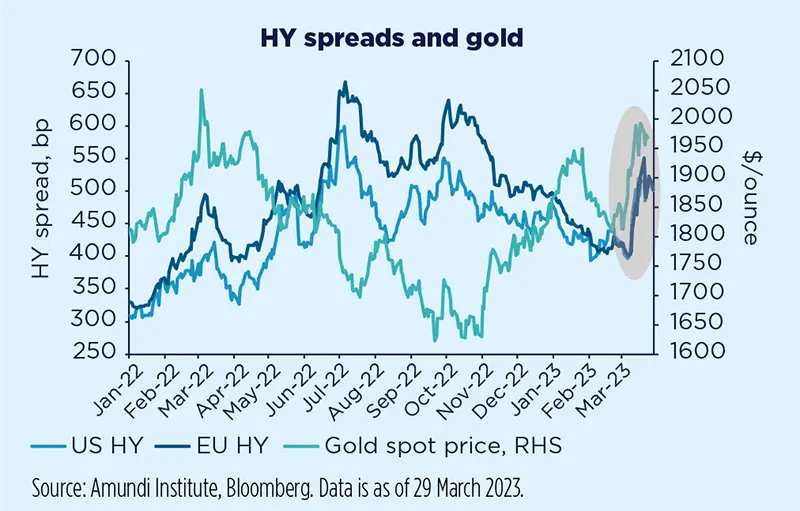

Limited downside risk on oil, but a lack of any upside near-term catalysts; on gold, the risk-reward balance might be becoming asymmetric, starting a lock-in of profits.

Oil was hit by the stress in the banking sector, amid weakening fundamentals and was amplified by technical factors. The psychological damage to investors will need time to repair, but positioning and valuations suggest limited downside risk from here. The supply-demand balance is set to tighten, but at a slower pace and to a lower extent than previously anticipated. We see Brent’s medium-term equilibrium price within a $85-90/barrel range, down from $100/barrel.

Gold was boosted powerfully by the plunge in real rates, widening credit spreads, and the dollar remaining in check. Gold could get further support from retail flows but will need the Fed on its side, as well as persisting banking concerns. Investors’ fast and broad reshuffling of the Fed’s hiking cycle and quantitative easing expectations leaves limited room for surprise. Amid less attractive valuations, gold looks vulnerable. As such, we would start to lock-in profits.

Currencies

The strict link between the Fed and the dollar

The USD has been driven more by rate repricing rather than by fly to quality.

Monetary tightening is spilling over to financial conditions and lending standards, challenging the resiliency of the global economy. Rates volatility surged to historically high levels, banks plunged and spreads widened, yet the USD struggled to react, thwarting its usual diversification properties. Yet, the break in correlation comes with little surprise once we look under the surface. In a difference to February, this time monetary authorities’ intervention and the subsequent fall in US rates triggered a surge in rates volatility in March. The US yield curve bull steepened as the Fed path was repriced and the USD showed its Achilles’ heel. The response to the shock matters more than the shock itself. In this context, and without a global liquidity crisis, the USD status loses its appeal (JPY and CHF are better hedges in a low-growth environment), reinforcing our expectation for a weaker USD in 2023. A reacceleration of US inflation remains the key to short-term risk, yet a cyclical downturn should fend off a too-hawkish Fed response.