Summary

For international investors the Japanese equity market remains an attractive tactical opportunity supported by the ongoing recovery in profit and corporate reforms.

- The positive trend in the Japanese market is attracting foreign investor flows, amid expectations of further profit recovery.

- Wage negotiations in the spring are expected to lead to wage rises, further helping the country come out of deflation.

- Yen dynamics and Bank of Japan actions are key elements to watch. We expect a gradual normalisation of monetary policy.

Japanese equities continued their strong performance in 2024, reaching their highest levels in 34 years. The recent trend has also benefitted technology shares supported by a solid economic outlook.

This positive trend in Japanese equities is driven by three main factors. Firstly, the Tokyo Stock Exchange has encouraged companies to improve their capital efficiency. Secondly, the profit recovery which equities are undergoing and the fall in the Yen vs the US dollar have supported this trend so far. The third element is the end of deflation. Wage negotiations in the spring are expected to lead to wage rises, further confirming this trend.

All these factors are attracting foreign investors flows into the Japanese markets. Looking forward, a key variable to watch is the Yen (a strengthening could negatively impact on exporters) and the Bank of Japan (BoJ) policy.

Actionable ideas

- Japanese equities

Japanese equities are benefitting from improving domestic activity and the country coming out of deflation. We believe that this asset class may bring value to a global allocation. - Global equities

As some of the US mega caps look expensive, investors should consider broadening their investment universe to global markets to explore opportunities in Japan and Europe.

This week at a glance

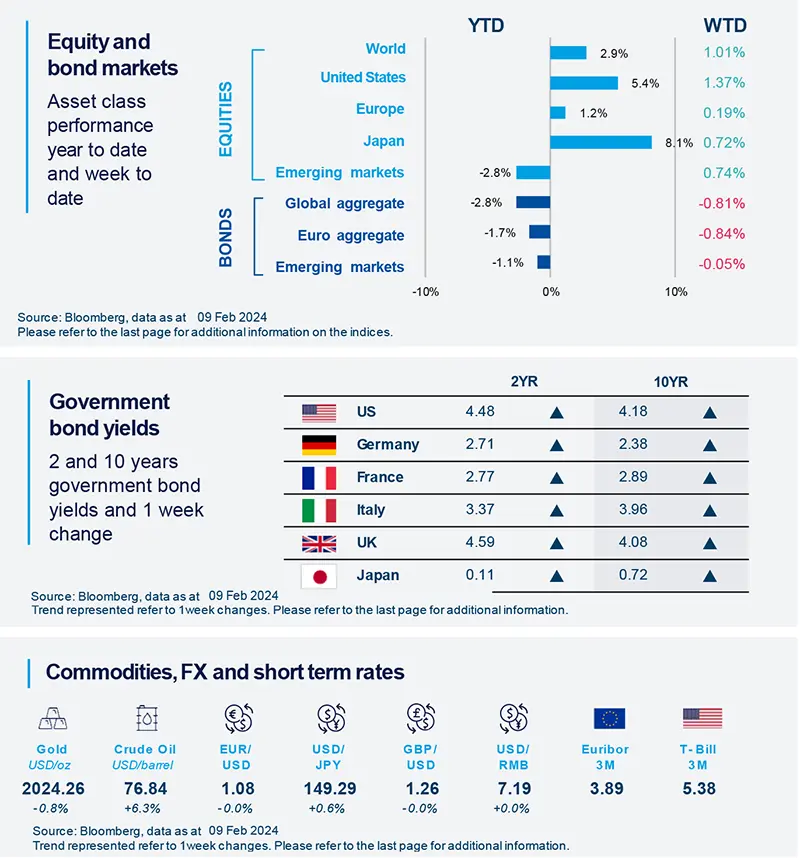

Optimism around a resilient US economy and robust corporate earnings boosted equities, as US stocks touched new highs. Bond yields rose as Fed comments led markets to push back their expectations on rate cuts. In commodities, oil prices were up following the rejection of a ceasefire offer in the Israel-Hamas war.

Amundi Investment Institute Macro Focus

Americas

US non-manufacturing ISM surprised to the upside, increasing to 53.4 in January

The pick-up was supported by increases in new orders and new export orders, some lengthening of supplier delivery times and improvement in employment which returned to mildly expansionary territory after being in contraction. Input prices which rose to 64.0 from 56.7 and reached an 11-month high are key to monitor in order to assess the speed of the disinflationary process in services.

Europe

Eurozone composite PMI rose to 47.9 in January from December's 47.6

Although some weakness in the service sector was confirmed, the optimism about the year ahead was at an eight-month high and headcounts also increased as the employment index rose from 50.8 to 51.2. On the price side, both input and output costs rose faster last month. The output prices index reached an eight-month high of 54.2.

Asia

Reserve Bank of India (RBI) keeps policy rates unchanged at 6.50%

RBI highlighted a strong economy and forecasted GDP growth at 7.0% (Amundi at 6.4%) for the year 2024-2025. This is likely to be driven by capital expenditure, increasing capacity utilization and support of public schemes. Inflation also looks well-anchored, though intermittently it is exceeding targets. All in all, these economic conditions warrant a prudent policy and we expect RBI to hold rates in the near future.

Key Dates

|

12, 13 Feb India, US CPI |

14 Feb |

15 Feb US Retail Sales, Japan GDP |