Summary

In the Trump 2.0 administration, the fiscal outlook and inflation expectations will be the main market themes to watch.

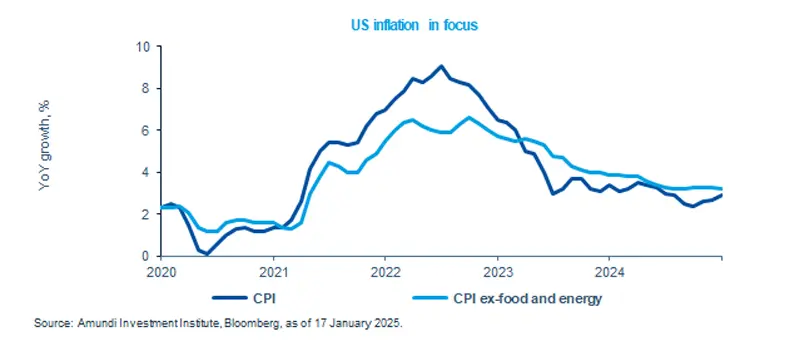

- The lower-than-expected core inflation reading drove bond yields lower, after the previous rise.

- Inflation, Trump’s policy, and Fed expectations are key market drivers.

- We expect uncertainty to remain high entering the Trump 2.0 administration.

Inflation news has been a key market driver over the past week, with core CPI (inflation excluding food and energy prices) increasing by only 0.2% in December, lower than both the previous month and below expectations.

More than indicating continued slow progress on reducing inflation, the main impact has been to reduce recent pressure on bond yields and leading to a strong repricing in market expectations on the Fed, with equities also benefitting.

Latest job market data and retail sales confirmed that the US economy remains in a good shape. All eyes will now be on Trump’s policies implementation, which, together with inflation, remain the main theme on the market.

For investors, this calls for keeping a diversified* and balanced allocation, as market swings are likely to increase.

Actionable ideas

- Multi asset investing to navigate uncertainty

With rising uncertainty on economic policies, a diversified* cross asset allocation may potentially benefit from appealing yield levels and still benign growth dynamics.

- Go global in equities and focus on pricing power

Diversification* is key in this phase, hence investors should potentially look at global opportunities and focus on companies with pricing power.

This week at a glance

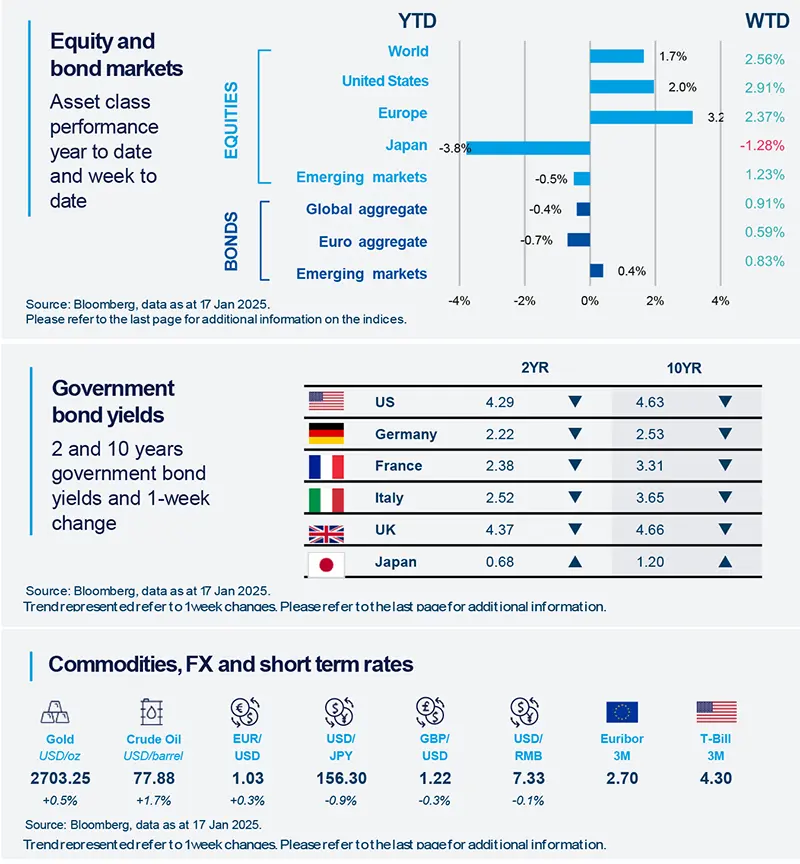

Equity markets gained in particular after the US inflation number release. This helped recover previous losses and bring the YTD performance into positive territory. Bond yields edged lower, while in the commodity space, oil prices rose, driven by wider sanctions on Russia.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 17 January 2025. The chart shows US CPI YoY growth.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US retail sales confirm strong consumption momentum

December US retail sales increased by 0.4% MoM in nominal terms, slowing their pace of growth from November. Gas stations sales rose by 1.5% MoM, mostly price-related. Despite the slowdown, the figures still point to robust consumer spending. In real terms, the trend appears less bright, as real retail sales ticked down in December, led by services consumption. All in all, this data confirms solid consumption at end-2024, bringing strong momentum into the new year.

Europe

UK inflation surprises on the downside

UK service sector inflation declined substantially in December, from 5.0% YoY in November to 4.4%, the largest decline since March 2024. This was more significant than the decline in headline inflation, from 2.6% to 2.5% YoY. The market moved from pricing only one rate cut this year to two cuts and long-end yields declined by over 15bp. We expect three 25bp cuts this year, one more cut than the market.

Asia

China’s growth rebounds thanks to policy support

China’s growth rebounded strongly in Q4, to 5.4% YoY from 4.6% in Q3. Policy supports played a critical role in this recovery, with a notable acceleration of issuance of public bonds, leading to a pick-up in industrial production. The consumer goods trade-in subsidies have also boosted retail sales. We expect the policy supports to continue into Q1 and fiscal policy to stay expansionary for 2025.

Key dates

20 Jan China Loan Prime Rate | 23 Jan US Initial jobless claims | 24 Jan Japan Inflation, BOJ decision |