Summary

Key Takeaways

- Mario Draghi’s report on Europe’s declining competitiveness poses a significant challenge for policymakers. While it has broad support, implementation will be hindered by fragmentation and a lack of political consensus.

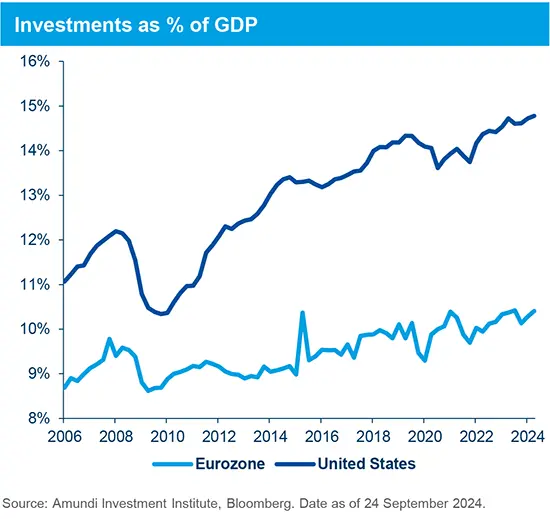

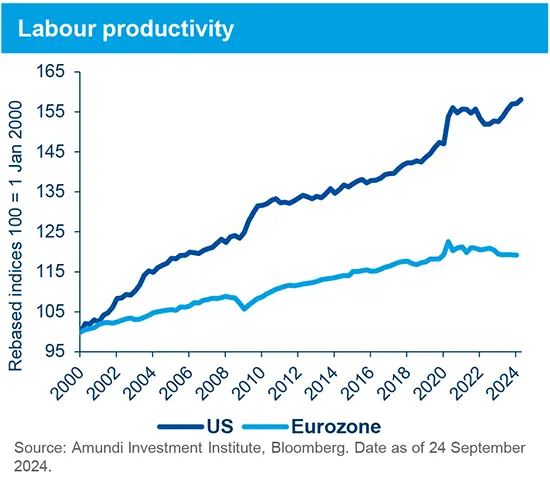

- A combination of low investment and low productivity has undermined Europe’s competitiveness. Companies are hesitant to invest due to weak expected growth, creating a vicious cycle that is stifling further economic progress.

- Draghi advocates significant structural reforms -- including a rethink of regulation and more financial market integration -- and a more flexible governance framework within the EU that will not stifle progress in the adoption of new technologies.

Draghi’s report on Europe’s declining competitiveness offers a comprehensive analysis, but many of its findings are not new. Yet, Draghi’s stature may lend urgency to these recommendations. Those requiring EU funding or treaty changes are likely to encounter substantial political resistance. The report provides a clear direction of travel and some of the reforms that do not require new funding (e.g., regulatory changes) could move the dial sooner.

Key findings

Draghi’s report is more than an economic analysis. It is framed within the broader European objectives of addressing climate change and preserving the continent’s social model. Central to his recommendations are the themes of decarbonisation and inequality, which are not treated as afterthoughts, but as integral components of Europe’s future.

The report highlights a critical dilemma: Europe’s productivity and investment gap with the United States is not only large, but is also widening, and a similar trend is emerging in connection to China. The risk of Europe falling behind has already materialised and the threat of becoming irrelevant is escalating, particularly in light of advancements in the digital economy and artificial intelligence (AI).

Europe’s preparedness to tackle new geopolitical realities - including rising protectionism, changing supply chains and more aggressive industrial policies in other developed markets - is also in question.

Reversing this decline will require higher growth and that, in turn, requires a governance and regulatory system that incentivises innovation and productivity improvements that can raise growth on a sustained basis.

The diagnosis

At the heart of Draghi’s analysis is the observation that Europe’s growth has lagged significantly behind that of the United States since the Global Financial Crisis. This disparity has resulted in lower increases in per-capita incomes and living standards. The primary culprit is identified as the substantially lower levels of investment in Europe compared to the United States, leading to declining productivity. This combination of low investment and low productivity ultimately undermines Europe’s competitiveness.

Draghi’s message is clear: without substantial changes, Europe’s competitiveness will erode further, ringing an existential alarm bell. Companies are hesitant to invest due to a lack of expected growth, creating a vicious cycle that is stifling economic progress.

Challenges to competitiveness

The report highlights key factors undermining competitiveness, notably a lack of innovation, as the EU invests less in R&D than China. This issue is partly due to the incomplete single market, especially in services, limiting Europe’s market scale compared to the United States and China.

Energy dependence on Russia has worsened Europe’s competitiveness, leading to increased costs for manufacturing heavy member states. Electricity prices vary significantly across the EU, with some countries paying up to 35% more, largely due to the absence of a unified electricity grid.

The US Inflation Reduction Act exacerbates the dilemma by attracting investment away from Europe, prompting major companies to delay EU investments in favour of better subsidies in the United States.

Better financial market integration and a larger capital market could reduce the cost of capital

Completing the banking union by facilitating cross-border liquidity and mergers could lower bank financing costs. As larger banks typically have a lower cost of borrowing, they could lend at lower rates and this could help address the disadvantage EU firms face compared to US banks. Europe also needs an integrated capital market to channel savings into investments and reduce reliance on bank financing.

The Draghi report avoids difficult reforms like a uniform insolvency regime and tax system, which are necessary for enabling cross-border securitisation. Relaxing the EU’s sustainable finance and ESG regulations could improve access to finance for SMEs, including in sectors like defence.

The need for structural reforms and substantially increased investment

Draghi identifies a 4% GDP investment gap, requiring an additional €800bn yearly over the next decade. While most of this investment should come from the private sector, that in turn will depend on improved competitiveness and higher returns, hence his call for reforms. The report suggests a €100bn EU contribution for public goods like defence and energy infrastructure, but political feasibility for common EU debt remains uncertain, likely delaying initiatives until the next Multi-Annual Financial Framework in 2027.

Not all reforms require significant funding. Draghi argues that overly cumbersome and fragmented regulations along national lines deter investment and constrain the willingness of firms to spend on innovations, particularly in AI and the digital economy. Moreover, the stringent GDPR regime may be overly restrictive.

The EU’s antitrust-focused competition policy limits mergers, perpetuating a landscape of smaller enterprises. Advancing towards a more integrated services market could yield substantial benefits.

Draghi calls for changes in the EU’s governance framework, which requires unanimity for decisions and stifles reforms. He advocates for allowing subgroups of countries to implement agreements without full consensus

Looking ahead

While Draghi’s report will take time to digest and implement, it will significantly influence the European Commission’s legislative agenda over the next five years. In the near term, sentiment towards Europe could turn around if some of his less onerous recommendations are adopted.