Summary

India is a long-term story supported by structural factors, domestic demand, and stable policymaking that should offer opportunities in 2024 and beyond.

- The Indian story is gaining momentum as the country’s equity market is heading towards a strong performance in H2 2023.

- We expect a robust economic growth outlook for India, led in particular by investments.

- In general, the EM world is expected to grow at a higher pace compared to DM, but divergences in the former would remain.

Indian stocks seem on track to outperform the US, EM and world equity indexes in H2. In the first week of December, the country’s market capitalisation crossed $4tr for the first time ever, making it the 5th largest country by market capitalisation after US, China, Japan and Hong Kong. Optimism has been boosted by political stability, with markets giving thumbs up to growth focused policies of the government, after the ruling BJP party won key state elections. The recent upward revision to Q3 GDP growth to 7.6% (YoY) contributed also to the positive momentum, making India one of the fastest growing economy in the EM universe. India is just one example of EM opportunity arising from a more fragmented world with ongoing supply chain relocation.

Actionable ideas

- Indian Equities

From a long-term perspective, Indian equities should benefit from a large domestic market, favourable demographics and a thriving and a stable democratic environment.

- Emerging markets ex-China

The EM ex-China universe offer exposure to a wider set of opportunities, of which India is the most relevant in terms of weight (being around 22% of the MSCI Emerging Markets ex-China index).

This week at a glance

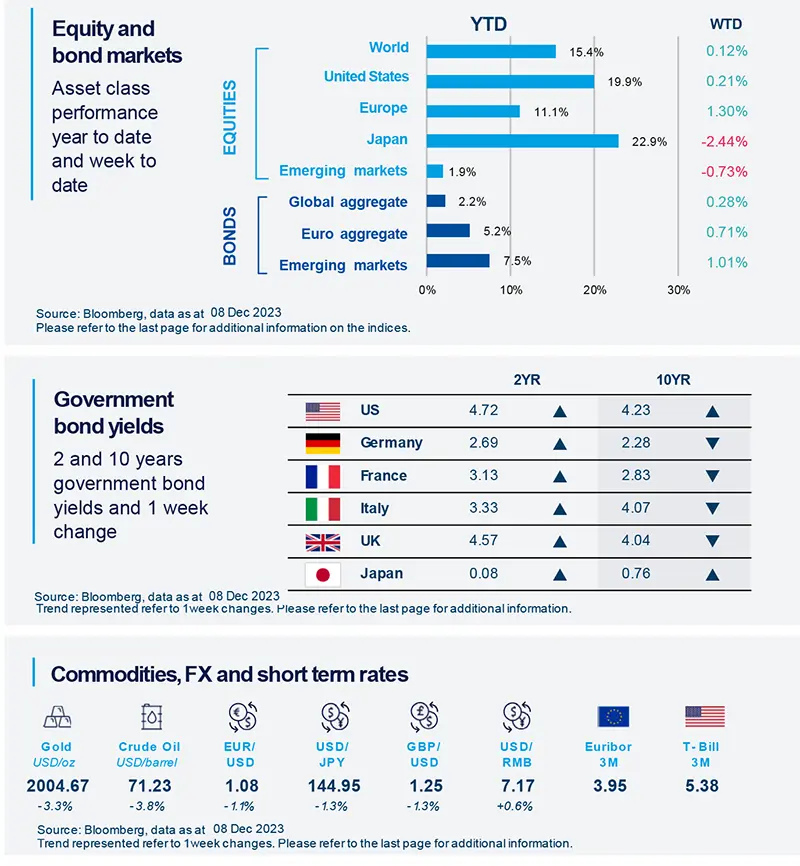

Bonds continued to rise this week as yields declined on dovish monetary policy expectations, fueled by a combination of lower inflation figures at the end of the preceding week (in the US and Euro area) and falling oil prices. Stocks also rose, with several major indices reaching new historic highs.

Amundi Investment Institute Macro Focus

Americas

Composite PMIs in the United States stay in mild expansion territory, supporting view of slowing activity

S&P's composite PMI remained at 50.7 in November, with no change compared to October. On the manufacturing side, the indicator moved lower from 50 to 49.4, thus back to mild contraction territory, whilst the services gauged inched up from 50.6 to 50.8. These readings remain compatible with an economy slowing

from the strength of Q3.

Europe

Weak PMIs point to lackluster growth in the current quarter, if not to a mild contraction

HCOB/S&P's composite PMI rose to 47.6 from October's near three-year low of 46.5, posting the best reading since July but still in contractionary territory; this helped by an improvement in services PMI, which increased to 48.7 from October's 47.8. Manufacturing remains in contractionary territory at 44.2, after 43.1 in October.

Asia

India confirms strong economic momentum

Q3 GDP data came in stronger than expected at 7.6% YoY vs 6.8% YoY. Investments continued to be one of the most relevant growth contributors (3.8% out of 7.6%) and Public Expenditure has maintained buoyant; on the contrary, Households Consumptions have been on the softer side. As a result, we have revised up our GDP growth for 2023 to 6.9% YoY from 6.5% and mildly revised down 2024 GDP to 5.8% YoY from 6.0%.

Key Dates

|

12 Dec Macro data, USA |

13 Dec |

14 Dec Central Banks, Europe |