Summary

Bond yields attractive as inflation stabilises

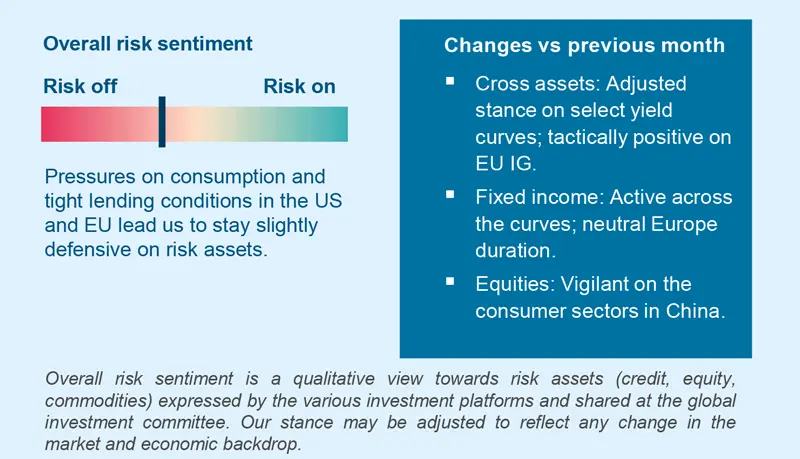

Markets have not priced in the risks related to the credit cycle, volatility in inflation figures (to the upside and downside), and any kind of landing for the US economy. We maintain our quality bias.

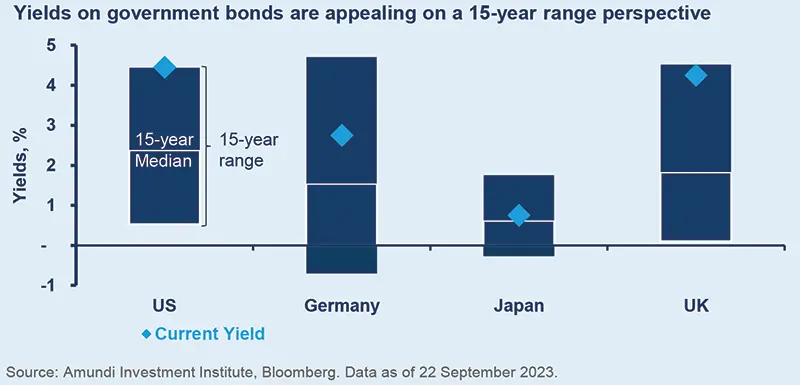

Risk assets have been in wait-and-see mode since summer’s end, but they are still pricing in a soft-landing scenario in which inflation continues to fall without any damage to economic growth. While we believe inflation will decelerate, the job of central banks is not done yet as they try to balance the ‘higher-for-longer’ mantra with economic growth. UST 10Y yields reached new highs for the past 15 years as markets maintained the view of no economic downturn. However, we think pressures on US consumption, Chinese growth and the real estate sector, and on Europe will challenge this Goldilocks scenario:

- Resilience of the US consumer, which represents 70% of GDP, is now giving way to weakness – The effect of tightening financial conditions, receding consumer savings and loosening labour markets will be bigger than the impact of any fiscal boost.

- The inflation trend will decelerate, but higher energy prices recently and costs of production ⎼ for instance, in Europe ⎼ could affect inflation expectations, which must be monitored.

- Policy difficulties – The last leg of inflation is harder to correct without a slowdown. We maintain our call for a mild US recession, starting in 1H24, and sluggish growth in Europe.

- China is key for global growth – China’s supportive policies do not change our view of slowing growth, which would affect other EM. However, countries such as India, Indonesia and Brazil are relatively shielded and should get a boost from domestic consumption.

From an investment perspective, the following areas should be explored:

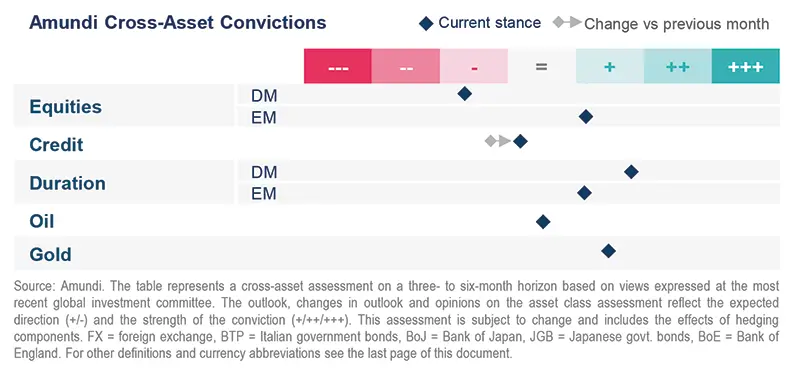

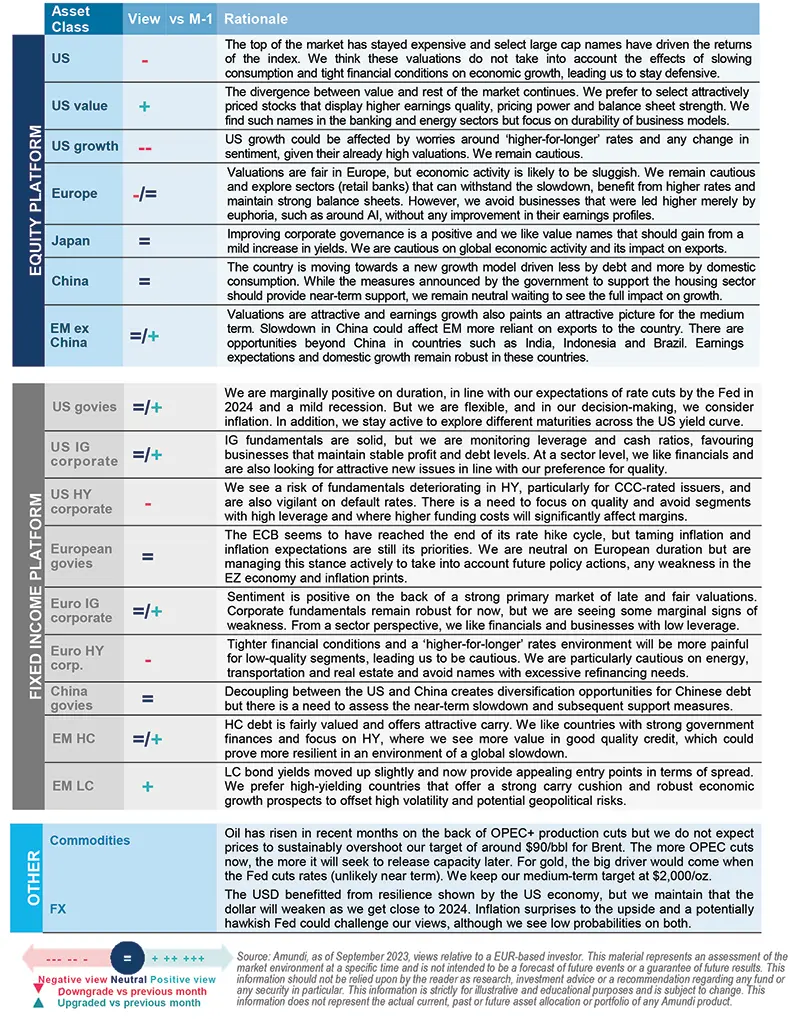

- Economic outlook favours a mildly cautious stance in cross asset. We are constructive on US Treasuries, while we believe risky asset valuations are stretched, although the gap is closing slightly. Being cautious doesn’t mean ignoring tactical ideas that match our long-term convictions. Relatively better fundamentals in EU IG allowed us to tactically raise our stance in line with our preference for high-quality. HY instead could suffer from a tough environment for corporations. On DM equities, our view is still prudent, but we believe EM may offer opportunities, with ample divergences. In addition, hedges on USTs and equities should be maintained, along with a marginally positive view on gold for diversification.

- Select government bonds offer value amid expectations of Fed rate cuts in 2024. We are active and are monitoring government debt, a potential increase in UST supply and disengagement of foreign UST demand ⎼ for instance, from Japan. On core Europe, we are neutral, but we stay cautious on Japan. IG credit is an interesting source of income, while HY markets still incorporate a too benign scenario. Low-rated segments, such as CCC, are witnessing higher defaults in the US and Europe, leading us to stay cautious.

- Limited upside in DM equities; Japan a brighter spot – Earnings were a surprise this season and we noted that communications from top managements are becoming more cautious with respect to top lines and more consistent with our cautious views on the economy. We are defensive on the US and Europe, particularly growth and large caps. However, we like value in the US and Europe and are close to neutral on Japan. Overall, we prefer to stay disciplined and only gradually build positions once the economic direction is confirmed.

- A lot of value to be captured in EM through selection – We are constructive on EM vs DM at similar ratings, both in bonds (LC and HC) and equities. EM are less vulnerable than in the past and their growth prospects are also better. However, slowing momentum in China would affect some countries, and we acknowledge that not all EM have the same fiscal strength. We like Brazil, Mexico, India, Indonesia, and those that present limited risks from China slowdown.

Three hot questions

|

Monica DEFEND |

We see inflation trending lower but remaining above central bank targets in 2024. The process will not be linear and the recent surge in oil prices is adding further uncertainty, supporting an argument for keeping rates higher for longer.

1| How is the China slowdown affecting India? What is your view on the Indian economy?

Compared to other EM countries, India is more insulated from a slowdown in China. Moreover, its economic momentum remains quite robust, supported by domestic demand (household consumptions as well as investments). Indeed, we have revised up GDP growth for CY 2023-24 to 6.4% and 5.8% YoY, respectively, from 6.0% and 5.5% YoY. Strong growth momentum reflected in positive earnings expectations is in line with the GEM aggregate (9% vs 12%).

Investment consequences:

- We hold a positive stance on India equity, benefitting from a positive outlook on earnings (with better revisions compared to Asia), which helps counterbalance the less supportive valuations backdrop.

2| What is your assessment of the recent oil price spike? And how do you think this will affect US inflation?

We believe that oil prices are overshooting and we do not expect them to keep doing this for much longer. Therefore, our target for Brent remains $85-90/bbl. Although they should decline soon, the current levels add unwanted uncertainty. By incorporating the last developments on energy, 2023 average CPI moves from 4% to 4.2-4.3%. We also expect higher 1Q24 CPI. Even if the impact on YoY CPI is quite mild, a continuous rise in energy prices gives CBs another argument to keep rates higher for longer.

Investment consequences:

- Oil: Brent prices anchored around an $85-90/bbl target.

- Copper price target: $8,500/t (3M), $8,700/t (12M).

3| What is your assessment of valuations from a cross asset perspective?

From our perspective, current levels are discounting a very supportive scenario, which is more optimistic than ours is. Valuations are not supportive for risky assets, due to the recent rally and deteriorating economic fundamentals. This is the case particularly in equity and HY credit, while IG credit valuations appear less stretched. Government bonds appear undervalued, assuming our central scenario of the Fed cutting rates in 2024 more than markets expect.

Investment consequences:

- Cautious on equity and HY credit.

- Favour government bonds, IG credit and cash.

Seek opportunities in credit and bond curves

|

Francesco SANDRINI |

John O'TOOLE |

We stay cautious on risk assets, but aim to benefit from tactical opportunities emerging, for example, in EU IG, where corporate fundamentals are better.

Markets have remained range-bound on the back of news flow around a resilient US, DM monetary policy and China’s housing sector. Even though US growth found support in resilient consumption and fiscal spending not expected at the beginning of the year, these factors seem to be fading which allows us to stay cautious. Nonetheless, investors should consider exploring ideas on the quality side of credit and be vigilant on yield curves across geographies. This should be done via a balanced approach, using the EM lever, and keeping a diversified stance.

High conviction ideas

The backdrop for DM equities such as the US is characterised by a weakening labour market, higher oil prices working as a tax on the consumer, and rising consumer delinquencies. Even in Europe, growth is expected to stay subdued, owing to the weak industrial cycle, while Japan continues to be exposed to the global slowdown. But we continue to be positive on EM amid improving prospects for select countries in Asia and Latin America.

UST valuations are now more attractive in light of a weaker macro backdrop. In addition, we keep our Canadian swap curve steepening views. Across the Atlantic, we maintain a slightly optimistic view on Europe duration, Swedish bonds and on Italian BTPs, which have been supported by domestic retail demand and expectations of negative net issuance in the near future. Overall, our active approach allowed us to adjust our relative views on UK gilts vs Australian 10Ys. In the process, we reduced our positive outlook on gilts and are no longer negative on Australia. The RBA should refrain from hiking rates substantially because of domestic economic weakness. But we remain defensive on JGBs. Meanwhile, close to peak inflation in most EM and CBs approaching the end of tightening cycles allow us to stay optimistic on select EM bonds (South Africa, Indonesia, Mexico, etc).

While we maintain a cautious stance on US HY, we prefer to balance this with a constructive view on EU IG, to have a neutral stance on credit overall. The demand for IG credit remains highly supportive, which makes timing the spread widening difficult to assess, despite increasing default rates and migration of ratings. FX offers multiple relative value ideas in EM as well as DM. In the former, we stay constructive on MEX/EUR to capture the attractive carry, on the BRL/USD and on the INR/CNH owing to positive macro story for India. In DM, we are negative on the EUR vs the JPY. But compared with the GBP, we are positive on the EUR and the CHF.

Risks & hedging

Uncertainty around global growth and inflation is presenting risks in equities and fixed income. We think investors should keep protection on USTs and on equities. Outside of financial assets, gold presents a valid hedge in case of a deep recession/geopolitical crisis. We see limited upside, given its fair valuations and the Fed’s ‘higher-for-longer’ narrative.

Bonds are attractive on a long-term perspective

| Amaury D'ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

High core yields, slowing inflation and a potentially weak economic activity create a positive backdrop for bonds such as US Treasuries.

Overall assessment

With yields at historically high levels and inflation expected to slow, with still present recession risks, government bond markets offer good opportunities. But hawkish CBs and concerns on debt supply keep us agile on duration. We also explore carry in EM and DM, with a quality bias.

Global & European fixed income

The ECB’s rapid rate hike cycle has resulted in a consistent decline in demand for loans to businesses and households, among other things. But near-term fragilities in the bond market and upside risks to inflation keep us very active on duration, on which we are marginally cautious – neutral on core Europe and significantly defensive on Japan. We are also monitoring yield movements to incorporate future policy actions into our decision making. In credit, we are slightly constructive, mainly through financials, subordinated debt and IG. From a regional perspective, we prefer Europe but are neutral on the UK and US. In Europe, spreads are fair in IG and leverage seems to be under control. However, we are cautious on HY, especially on sectors such as energy, transportation and real estate.

US fixed income

Markets have accepted the Fed’s message of ‘higher-for-longer’ rates, and subsequently bond yields have drifted higher. These yield levels, coupled with a slowing economy, allow us to be positive on duration. We are constructive on the intermediate part of the UST curve, but remain active, taking into account concerns on the fiscal deficit. In addition, TIPS are attractive for long-term investors. We note that the housing market is being supported by a robust consumer so far and an acute housing supply/demand mismatch. We prefer securitised credit but are becoming vigilant after the recent rally. In corporate credit, primary market activity has been strong and we see potential to benefit from new issue premia by favouring higher quality parts. Even in HY we look for quality in general. From a sector perspective, we like financials over industrials and other non-financials.

EM bonds

We are constructive on EM debt and believe lower Chinese growth is being offset by higher forecasts for LatAm and other Asian countries. But we are monitoring concerns on DM rates and dollar strength which could affect returns. On HC, we stay positive, particularly HY, where carry is attractive. LC also offers value and we like Mexico, Brazil, India and Indonesia. However, we are turning cautious on Sub-Saharan Africa, owing to the recent coups in West and Central Africa.

FX

We maintain our slightly cautious USD view but are vigilant on rates. We like the NOK, AUD and the JPY that should catch up on the back of the recent change in the BoJ’s narrative. In EM, we like high-carry FX (MXN, BRL), the IDR and INR.

Favour EM equities, with a focus on India

| Fabio DI GIANSANTE Head of Large Cap Equity |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

While we are cautious on DM equities, we see pockets of value in select EM, owing to their strong domestic consumption.

Overall assessment

As markets assess the economic path ahead, we are noticing declines in consumer confidence in the US and Europe and pressures on corporate earnings. Equity valuations for the broader markets (Europe slightly better than the US) are not consistent with our outlook and a select number of stocks are driving returns. Despite that, pockets of value persist in the US, Europe and EM. We remain focused on identifying such names through our fundamental and ESG analysis.

European equities

High interest rates are affecting not just consumers but also businesses and their internal returns. This environment keeps us cautious on consumer discretionary (autos, etc) and cyclical technology businesses. However, we think the value vs growth gap is wide: we like energy and financials (retail banks) that display strong balance sheets, dividend yields and are benefitting from high interest rates. At the same time, a combination of quality cyclical and defensive businesses is key in this phase. In the former, we look for industrial names that are trading at attractive prices with respect to their earnings potential and are facilitating the energy transition. Conversely, we are cautious on tech and are concerned about the valuations of some AI-driven stocks, given the cyclicality in many of their end-markets.

US equities

Hard data and some leading indicators on the economy are starting to show weakness. This, coupled with higher rates and higher energy prices, is putting pressure on the consumer. We think cyclical and consumer parts of the market will start to reflect these issues and we are becoming cautious on them. But there is a wide dispersion in valuations, which increases the importance of selection. In addition, some segments are overly inflated vs others that haven’t yet fully realised their potential. We stay cautious on such mega caps and tech names. But we like value and quality, and dividend stocks, and prefer the cheapest stocks within each style with respect to their earnings potential. Sector-wise, we are constructive on life science tools, energy and materials, which should benefit from the electrification-related developments in infrastructure. We also like large banks with stable deposit bases and those that used technology to improve their value propositions.

EM equities

We expect robust economic activity in some LatAm countries and selectively in Asia. While valuations remain attractive, selection is key. We are monitoring the stimulus measures in China but for the moment prefer to play the EM story through Brazil, supported by the already-started easing cycle and still-appealing valuations, and India. In terms of sector allocation, we continue to prefer real estate and consumer discretionary, but observe important divergences among countries. Overall, we maintain our preference for value over growth.

Amundi asset class views

Definitions & Abbreviations

- ABS: Asset-backed securities. These are financial securities such as bonds, which are collateralised by a pool of assets, possibly including loans, leases, credit card debt, royalties or receivables.

- Agency mortgage-backed security: Agency MBS are created by one of three agencies: Government National Mortgage Association, Federal National Mortgage and Federal Home Loan Mortgage Corp. Securities issued by any of these three agencies are referred to as agency MBS. Beta: Beta is a risk measure related to market volatility, with 1 being equal to market volatility and less than 1 being less volatile than the market.

- Breakeven inflation: The difference between the nominal yield on a fixed-rate investment and the real yield on an inflation-linked investment of similar maturity and credit quality.

- Carry: Carry is the return of holding a bond to maturity by earning yield versus holding cash. Core + is synonymous with ‘growth and income’ in the stock market and is associated with a low-to-moderate risk profile. Core strategy is synonymous with ‘income’ in the stock market.

- Correlation: The degree of association between two or more variables; in finance, it is the degree to which assets or asset class prices have moved in relation to each other. Correlation is expressed by a correlation coefficient that ranges from -1 (always move in opposite direction) through 0 (absolutely independent) to 1 (always move in the same direction). Credit spread: The differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration the possible embedded options.

- Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.

- Curve steepening: A steepening yield curve may be a result of long-term interest rates rising more than shortterm interest rates or short-term rates dropping more than long-term rates.

- Bull steepening: a change in the curve due to short-term rates falling faster than the long-term rates. This leads to a higher spread between the short and long term rates.

- Curve inversion: When long-term interest rates drop below short-term rates, indicating that investors are moving money away from short-term bonds.

- Cyclical vs. defensive sectors: Cyclical companies are companies whose profit and stock prices are highly correlated with economic fluctuations. Defensive stocks, on the contrary, are less correlated to economic cycles. MSCI GICS cyclical sectors are: consumer discretionary, financial, real estate, industrials, information technology and materials. Defensive sectors are: consumer staples, energy, healthcare, telecommunications services and utilities.

- Duration: A measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates, expressed as a number of years. High growth stocks: A high growth stock is anticipated to grow at a rate significantly above the average growth for the market. Liquidity: The capacity to buy or sell assets quickly enough to prevent or minimise a loss. P/E ratio: The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS).

- Net interest margin: It is a measure that compares a bank’s interest income from lending with its interest expense on its liabilities (such as bank deposits), expressed as a percentage of its assets.

- QE: Quantitative easing (QE) is a type of monetary policy used by central banks to stimulate the economy by buying financial assets from commercial banks and other financial institutions.

- Quality investing: This means to capture the performance of quality growth stocks by identifying stocks with: 1) A high return on equity (ROE); 2) Stable year-over-year earnings growth; and 3) Low financial leverage.

- Quantitative tightening (QT): The opposite of QE, QT is a contractionary monetary policy aimed to decrease the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.

- Non-SIFI: A systemically important financial institution (SIFI) is an institution that the US Fed and regulators believe would pose a serious risk to the financial system and the economy if it collapses. A non-SIFI is an institution that doesn’t fall in this category.

- RMBS: Residential mortgage-backed securities (RMBS) are a debt-based security backed by the interest paid on loans for residences. The risk is mitigated by pooling many such loans to minimise the risk of an individual default.

- TIPS: A Treasury Inflation-Protected Security is a Treasury bond that is indexed to an inflationary gauge to protect investors from a decline in the purchasing power of their money.

- Value style: This refers to purchasing stocks at relatively low prices, as indicated by low price-to-earnings, price-to-book and price-to-sales ratios, and high dividend yields. Sectors with a dominance of value style: energy, financials, telecom, utilities, real estate.

- Volatility: A statistical measure of the dispersion of returns for a given security or market index. Usually, the higher the volatility, the riskier the security/market.

- Yield curve control: YCC involves targeting a longer-term interest rate by a central bank, then buying or selling as many bonds as necessary to hit that rate target.