Summary

Bond yields now more appealing

Geopolitical risks have returned to investors’ radar screens with President Putin’s escalation of the war in Ukraine. At the same time, inflation remains in the spotlight: the latest US reading was concerning, causing yields to rise while equity markets tumbled. Looking ahead, we confirm the outlook of slowing US inflation (headline peak looks to be behind us), but well above the Fed’s targets in the near term and we think central banks, including the Fed and the ECB, will remain hawkish. Politics is also under the spotlight with US mid-term elections, a new government in Italy, and elections in Brazil.

On the other hand, the economic outlook could deteriorate. The US faces an extended period of sub-par growth and the outlook for the Eurozone appears gloomier, compounded by the ongoing energy crisis. While there are discussions around a coordinated EU solution in the form of potential taxes, price caps, etc., markets have yet to see concrete details regarding a full-fledged response. Initiatives at the single country level still prevail, such as Germany’s announced €200bn package to tackle the energy crisis and the fiscal package announced by UK PM Truss. The plunge in UK assets post the announcement of the ‘mini’ budget, on 23 September, triggered a restoration of BOE quantitative easing at a time when the CB is raising rates, indicating the challenging equilibrium in the policy mix and the risk of liquidity strain. Volatility in markets is here to stay. The key themes to watch include the following:

- The narrative driving core yields up at the moment is that hawkish CBs are pushing rates up. Attractive valuations for the UST 10Y, the amount of global pressure (supply and demand side) on economic growth, and geopolitical tensions mean that government bonds should provide a source of protection. Investors should keep an active view which takes into account tactical moves around ‘higher for longer’ rates. In Europe, a hawkish ECB has been forced to deal with supply chain shocks and factors beyond its control. This could put upward pressure on short-term yields for select Euro Area curves.

- On credit, particularly high-quality segments, such as US IG, the picture is positive while in the HY space we keep a cautious stance. In IG credit, debt growth and leverage look to be under control and margins are strong, despite upward pressures on costs. However, cash reserves and liquidity are areas that could emerge as concerns going forward, particularly as the earnings backdrop deteriorates. This is the case more for lower-rated issuers and those in HY, which would most likely consume their reserves when cash flows slow and it becomes more difficult to raise debt.

- In equities, we believe investors should remain cautious, and highly selective, looking for quality. Earnings estimates for the US and Europe do not fully reflect the deteriorating economic backdrop and we believe we are on a downward revision path. Hence, we remain very careful on the earnings front. That is why our focus is on the quality, value sides and names that reward shareholders through dividends, etc. Regionally, the US should perform better than Europe while we are now neutral on China and watchful on the evolution of the zero-Covid policy and regarding the housing sector.

- Emerging markets growth momentum has improved slightly, but there is a need to be selective as inflation is uncomfortably high. The broad decline in inflation has not started yet except in Brazil, where election-related volatility could hurt the real. As a result, CBs (Chile, etc.) have maintained their tightening stances. HC debt offers opportunities in terms of carry and valuations. In particular, we like commodity exporters (Brazil, Mexico) in Latin America, but are cautious on EM FX. Here, investors should watch for the impact of a recessionary scenario with regard to commodity prices and exports. EM equities present a mixed environment, with earnings expectations robust and valuations selectively attractive. Chinese authorities continue to pursue a zero tolerance Covid policy and that is shaping the outlook for near-term weakness but it is one of the few countries where policy is turning accommodative.

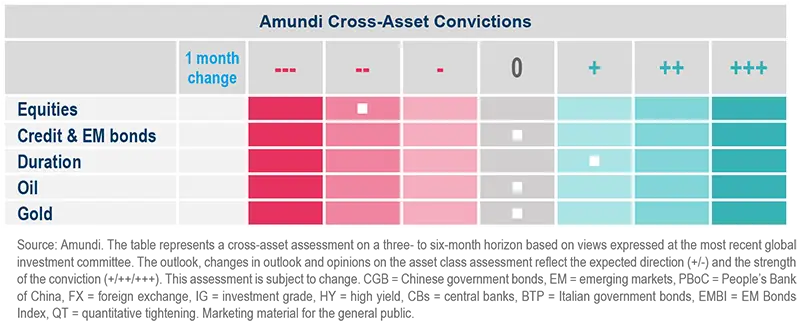

The environment ahead is likely to be characterised by how much pain CBs are willing to inflict on economies to bring inflation under control, particularly at a time when drivers of inflation in the US and Europe are different. However, what is clear is that they will put the brakes on economies, which could affect more vulnerable names in credit and equities. We think this is a time to include bonds and high-quality credit in portfolios, but maintain a diversified approach regarding real assets (commodities, gold). Thus, the overarching theme is to look for returns in areas that can offer protection in an economic downturn and at the same time provide inflation-adjusted returns.

Big picture in short

Inflation evolution: desirable then (before Covid), a headache now

| Annalisa USARDI Senior Macro Strategist Cross Asset Research, Amundi Institute |

Alessia BERARDI Head of EM Macro & Strategy Research, Amundi Institute |

Monica DEFEND Head of Amundi Institute |

The Covid backdrop: Covid-19 inflicted a huge blow on the global economy: output contracted by an unprecedented 3%, but initially inflation declined markedly as the demand contraction outweighed supply constraints and as commodity prices dropped. But after the recovery took hold, improving demand, resurgent commodity prices, unresolved and long-lasting supply-chain disruptions, and labour shortages, all blended together, prompting a dramatic comeback of inflation amid still easy monetary, fiscal and macro-prudential policies. The unprecedented global policy response, which was timely and effective in cutting downside risks to growth and demand, failed to prevent imbalances stemming from constrained supply chains once economies reopened.

From goods to services: First, it was consumer goods inflation that rose, owing to demand-supply imbalances. Demand recovered strongly, supported by generous fiscal and monetary stimulus. Courtesy of mobility and consumption constraints, demand shifted dramatically towards goods, where supply-chain issues were more acute, causing the prices of goods to rise sharply. Supply chain disruptions persisted over time, until the recent easing. However, the surge in inflation was not just driven by goods: after remaining below pre-crisis levels during the unfolding of the pandemic in 2020, oil and commodity prices moved higher when the global recovery gained traction in 2021. As a result, food inflation kicked in, affecting many EM, given the sizeable share of food in their consumption baskets. In the next stage, services inflation materialised as recovery progressed, pushing up core inflation, which was stickier and broad-based, spurring concerns of second-round effects, especially in areas where labour markets were tighter.

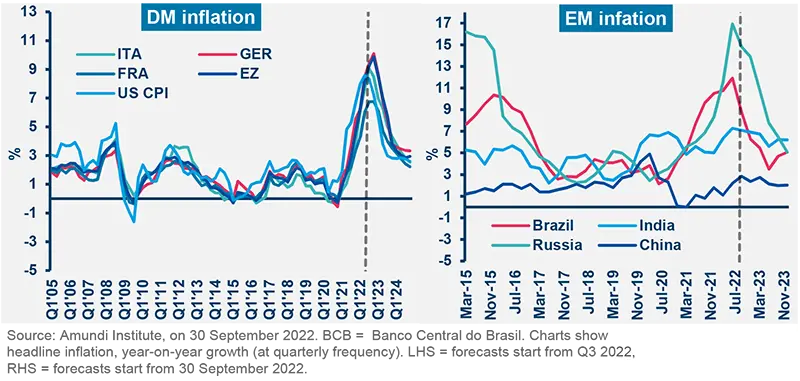

Diverging reasons for US and European inflation: In the US, labour market imbalances remain key to the inflation outlook. A shift to a lower participation rate of the labor force is complicating the calibration of policy withdrawal (from loose to tight monetary policy). The increase in wages, initially concentrated in low-skilled jobs, is now spreading across the economy; inflation remains broad-based in services and in core, and risks are becoming entrenched. Policy priorities are now to rapidly slow wage growth and rebalance labour markets. In the Eurozone, inflation was initially driven by the goods side, owing to supply constraints rather than strong demand, given the region’s slower recovery vs the US. Now, however, the key driver of inflation is energy prices. We think EZ inflation is mostly an imported and supply-related phenomenon, and thus the ECB faces a tough task: reducing demand will not necessarily slow inflation in the short term, whereas tighter financial conditions may weigh on supply even more.

EM not far behind: ‘Hi-flation’ took hold pretty much across the board in EM, with the exception of China and ASEAN until recently at least, and, to a lesser degree. In both regions, inflation remained under control. This was partly due to a late and gradual reopening post Covid-19 which slowed any demand pressure and due to somewhat more effective subsidies in place. In contrast, in the CEEMEA areas and LatAm, inflation more or less moved higher earlier, driven by external and global shocks, magnified by pronounced FX depreciation and by very robust domestic demand and tight labour markets (CEE). On top of that, some EM have been impacted by idiosyncratic factors (war in Russia, unorthodox policies in Turkey, Argentina political crisis and run on the peso) overlapping with the aforementioned underlying drivers (demand/supply imbalances, etc). EM CBs responded in a timely manner. In LatAm, core goods inflation is moderating, thanks to aggressive CBs (eg, BCB). Still, in Brazil, services inflation is rising, providing headwinds regarding other inflation dynamics. And thanks to the BCB’s policies (plus tax and fuel price cuts), inflation had already started to shift downwards months ago but at the expense of growth.

To conclude, we believe inflation is the primary concern for policymakers globally now, even as inflation trends and drivers vary across regions. While it appears that inflation peak has passed its peak in select countries, such as the US, it will still remain above CB targets in the near term. Hence, investors should aim for real returns, despite the current growth deceleration.

Inflation drivers in the US and Europe are slightly different, with supply chain disruptions causing more pain in Europe. This makes the task of the ECB more difficult.

Stay cautious in a deteriorating economic scenario

| Francesco SANDRINI Head of Multi-Asset Strategies |

John O’TOOLE Head of Multi-Asset Investment Solutions |

Market volatility has remained above average as growth concerns seeped into valuations, particularly in Europe, the region more affected by recession fears and high inflation, aggravated by the energy crisis. Here, fiscal support measures from national governments and a collective EU response could be game-changers. However, current valuations only partially reflect the deteriorating global scenario. In fact we have yet to see earnings adjustments and thus expect volatility to continue. As a result, we stay slightly constructive on duration, but look for quality credit. In equities, our relative preference is for the US, though the outlook has weakened. On the other hand, there is a need to maintain equity hedges and a diversified stance which includes commodities and FX.

High conviction ideas

We stay cautious on equities amid geopolitical tensions and a tightening trajectory for central banks (rising cost of capital). But we play regional divergences, favouring the US over the EZ, given the downside risks from gas rationing and higher prices in the region. We think this view is supported by the more quality, growth features of the US and the value, cyclical nature of European markets. In China, although we see near-term headwinds, we believe desynchronisation of the country’s economic cycle from global markets could be beneficial. Hence, we keep the relative preference for China over India. We maintain a slightly positive stance on duration through USTs and are neutral on core Europe. The former’s valuations are attractive after recent movements and as curve inversion persists. In the UK, we now take a direct stance on 5Y nominal swaps following the sharp increase in yields. We are monitoring how the BoE’s support for bonds to maintain stability in the markets affects its tightening trajectory and the country’s growth. Secondly, given the ECB’s hawkish stance, we see curve flattening opportunities in Italy. Recession risks could negatively affect the 2Y curve more than the 10Y, further supporting this view. Separately, we maintain our slight constructive stance on BTPs vs Bun, supported by the availability of the ECB’s transmission protection instrument, and our view that the new government should not deviate too much from the fiscal and reform path. However, we are monitoring developments. While we acknowledge pressures in risk assets in general, we believe US credit IG should fare better amid strong corporate fundamentals (high interest coverage ratios, stabilising leverage, strong balance sheets) and robust profit margins despite rising costs. On the other hand, in European credit, we are monitoring the effects of rising borrowing costs and how that could affect the balance sheets of low-rated issuers. In HY, we stay cautious as we believe that this is the area most exposed to risks of excessive tightening. In FX, we are no longer positive on the BRL vs PLN and HUF following the recent appreciation. The Brazilian elections, and the requirement for a second round, might see an increase BRL volatility. In addition, Eastern European currencies seemed to have reached quite stretched valuation levels incorporating a lot of negative news flow so that a rebound now looks plausible. On the other hand, the improving fiscal situation of Indonesia and the hiking cycle of the central bank are positive for the IDR/CNH. Elsewhere, in DM, we think the rates differential between the Fed and other CBs and the approaching global economic slowdown are key supporting factors for the USD (vs CAD, EUR). We remain slightly cautious on the EUR/ JPY as a medium-term strategy and constructive on the CHF/EUR as a safe-haven play.

Risks and hedging

Economic risks may trickle down to earnings and asset prices, leading us to believe that investors should maintain sufficient hedges on the equity side, and on the HY market. We also think there are opportunities in the derivatives market to profit from our negative view on the EUR/USD.

In a still cautious view on risk assets, we prefer high grade credit to equities but keep a close eye on default outlooks and financial conditions.

Agile on bonds, mindful of refinancing risk in credit

| Amaury D’ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

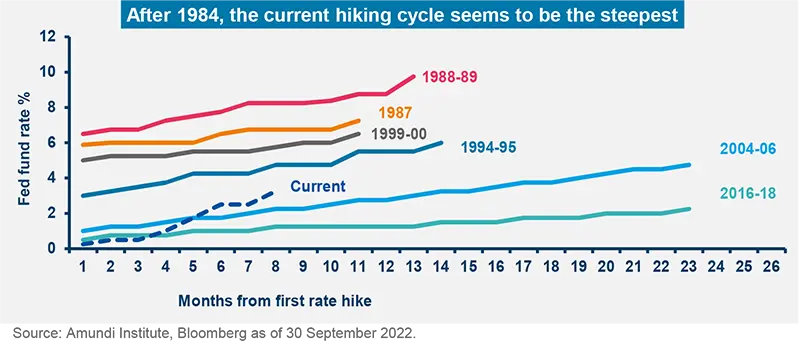

High inflation is creating synchronised hawkish momentum across DM, leading to markets pricing in higher policy rates than previously was the case. We believe the Fed and the ECB will stick to higher policy rates for a longer timeframe, unless inflation falls substantially or there is a fragmentation in the Eurozone (not our central case). As a result, the cost of lending to companies may increase. We may also see a situation where banks do not lend to corporates and primary markets also are shut. This could be particularly the case for low-rated corporates and should be kept in mind. Thus, while staying cautious on risk assets and liquidity risks, we prefer high-rated debt in an overall flexible approach. We also see select opportunities in EM hard currency debt.

Global and European fixed income

We acknowledge the opposite pressures on yields from hawkish CBs and weak economic growth which lead us to maintain an active/ tactical approach. We are slightly cautious on duration, mainly through the US and core Europe. But we are positive on China and neutral on the UK amid the recent sharp movements. Our vigilant approach across curves allowed us to assess that euro peripheral spreads have stabilised and we are monitoring fragmentation and political risks. We are slightly constructive on inflation breakevens in the US and EZ. In credit, companies are emerging from the pandemic with stronger balance sheets and accumulated cash. However, rising costs and slowing consumption, uncertainty related to the Ukraine conflict, and a hawkish ECB could cause volatility. The last factor could affect financing costs for HY and lower-rated debt. Thus, we keep an eye on defaults and potential restructuring, and watch for signs of balance sheet deterioration. Further, we prefer IG and quality debt in banking, autos, energy.

US fixed income

The inflation story continues to gain momentum as markets become more concerned that the Fed may maintain rates higher for longer. Unsurprisingly, yields have risen since the beginning of August as the inflation and hawkish Fed narrative gained momentum. As a result, even though we maintain a tactical and close to neutral view on duration, we now have a positive bias regarding these higher yields. The upward move in nominal yields is also reflected in real yields, leading us to monitor TIPS for attractive entry points. We notice IG spreads are marginally wide vs their long-term averages. This means we could see some repricing of liquidity risks, particularly in lower quality. So, we are cautious overall but not pessimistic, and prefer high quality. In addition, companies that depend on private credit markets for liquidity/reserves could face pressures as borrowing costs rise. In securitised credit, we are actively managing our positions in agency MBS because of valuations.

EM bonds

We are modestly defensive on duration, but believe sentiment is turning positive for EM bonds. The backdrop is more favourable for HC vs LC, but selectivity remains important amid idiosyncratic stories. We are mindful of distressed levels across regions. Our preference is for countries where the tightening cycle is close to the peak, coupled with compelling carry (Brazil). We stay cautious on EM FX.

FX

We are constructive on the USD and cautious on the GBP (new fiscal policies), EUR and CNH. However, discussions about an EU-wide response to the energy crisis could provide some support to the EUR and we remain flexible. In EM, we are positive on the MXN, CLP but cautious on the TWD.

GFI = global fixed income, GEMs/EM FX = global emerging markets foreign exchange, HY = high yield, IG = investment grade, EUR = euro, UST = US Treasuries, RMBS = residential mortgage-backed securities, ABS = asset-backed securities, HC = hard currency, LC = local currency, MBS = mortgage-backed securities, CRE = commercial real estate, QT = quantitative tightening

A steep hiking cycle is leading the markets to price in a higher Fed terminal funds rate, which could affect cost of capital, particularly for low-rated companies.

Follow earnings resilience

| Kasper ELMGREEN Head of Equities |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

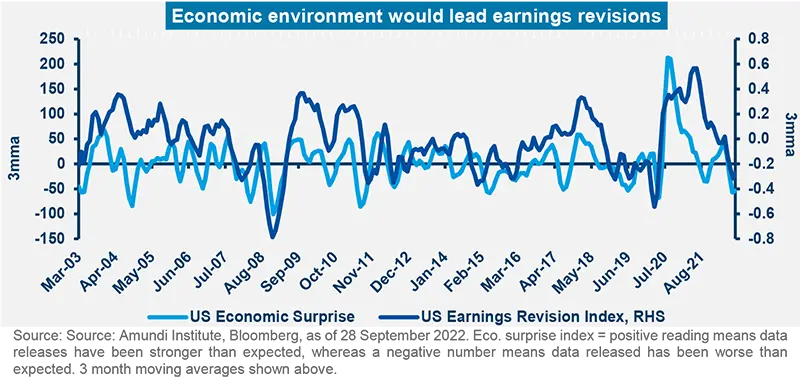

Overall assessment

While we are witnessing a weakening of economic data, forward earnings indicators seem too high. Until now, we have seen disruptions in supply chains, shortages, and energy supply affecting the operations of companies, but going forward, we are likely to witness consumer demand-induced surprises which could pull down markets’ earnings expectations. However, not all companies will be affected equally. The ones with strong pricing power and stable balance sheets should be better able to withstand the slowdown. As a result, we stay selective and avoid businesses with excessive debt on their balance sheets in light of the increasing cost of capital and a slowing economy. Overall, we keep our preference for the US, but stay vigilant regarding the evolving economic backdrop.

European equities

Amid expectations of earnings downgrades, we maintain balanced and barbell-type approaches, with positive views on defensive consumer staples and quality cyclicals. The key is to understand ‘what is currently implied’ given where valuations are. Selectivity is key. For instance, even against a backdrop of deteriorating macro fundamentals, we like select retail banks, as implied valuation expectations are extremely low. Across sectors, we have a preference for strong balance sheets, resilience of business models, and pricing power. Importantly, the current crisis is a time to renew the emphasis on ESG. Conversely, we are cautious on technology.

US equities

Markets expect earnings to grow in 2022 and 2023, and inflation may actually protect nominal profits to some extent. But we think markets are generally late in discounting recession-related earnings downgrades. As a result, companies could use the upcoming reporting season to lower market earnings expectations for next year. This, in turn, could impact prices, particularly for the more vulnerable, un-profitable and expensive businesses. Thus, we are prioritising valuations and earnings resilience, and favour companies that can deliver dividends, despite the upcoming economic slowdown. On the other hand, we stay clear of names with excessive leverage and very high cyclicality combined with high valuations. Having said that, we are also observing that valuations in select quality cyclicals and quality growth segments have corrected substantially, making them attractive from a long-term perspective. At a sector level, we like financials such as banks and insurers. US banks are demonstrating high returns on equity and credit concerns are still limited, but we remain selective. Finally, we think investors should consider a quality and value bias in their portfolios.

EM equities

Geopolitical risks and uncertainty remain elevated, leading us to keep a cautious stance short term. However, the DM-EM growth differential and selectively attractive EM valuations are positive. We like Brazil and UAE while we are tactically neutral on China and are cautious on Turkish banks. At a sector level, we search for value names in discretionary segments (especially in China, given the expected rebound in domestic demand), and favour energy over materials.

We are not yet at the point where markets start getting attractive again, and hence, our focus remains on selection and earnings resilience beyond the near term.

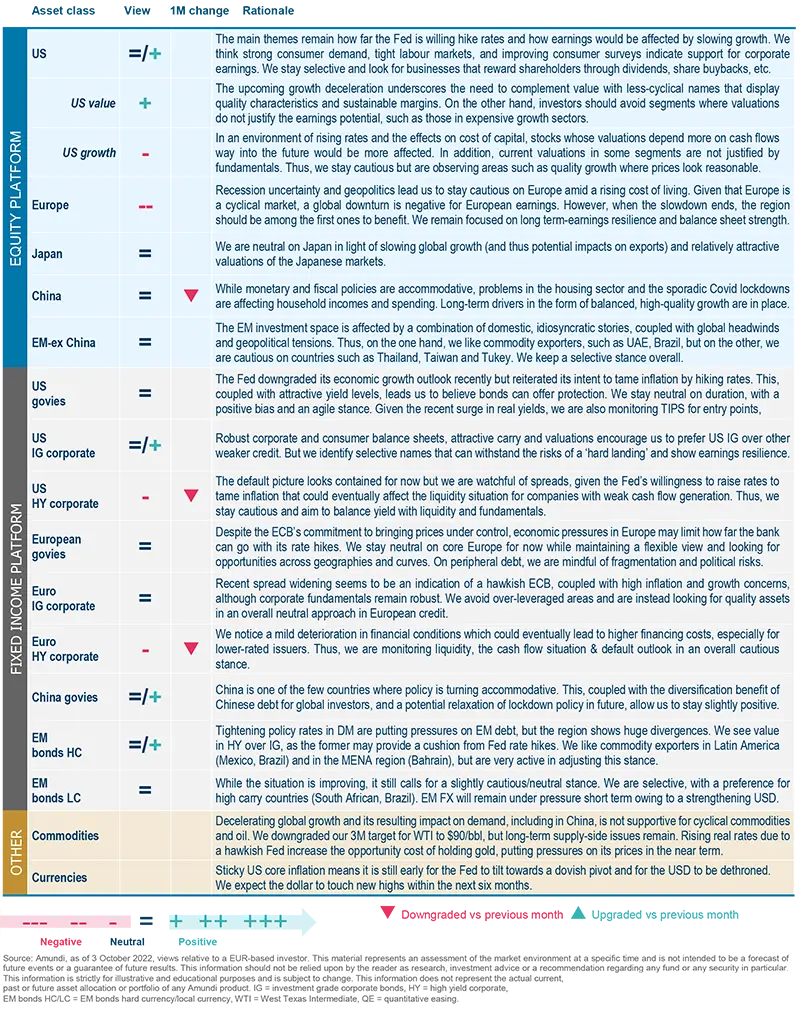

Amundi asset class views

Definitions & Abbreviations

- ADR: A security that represents shares of non-US companies that are held by a US depositary bank outside the US. They allow US investors to invest in non-US companies and give non-US companies access to US financial markets.

- Agency mortgage-backed security: Agency MBS are created by one of three agencies: Government National Mortgage Association, Federal National Mortgage and Federal Home Loan Mortgage Corp. Securities issued by any of these three agencies are referred to as agency MBS.

- Curve flattening: A flattening yield curve may be a result of long-term interest rates falling more than short-term interest rates or short-term rates increasing more than long-term rates.

- Curve steepening: A steepening yield curve may be a result of long-term interest rates rising more than short-term interest rates or short-term rates dropping more than long-term rates.

- Beta: Beta is a risk measure related to market volatility, with 1 being equal to market volatility and less than 1 being less volatile than the market.

- Breakeven inflation: The difference between the nominal yield on a fixed-rate investment and the real yield on an inflation-linked investment of similar maturity and credit quality.

- Carry: Carry is the return of holding a bond to maturity by earning yield versus holding cash.

- Core + is synonymous with ‘growth and income’ in the stock market and is associated with a low-to-moderate risk profile. Core + property owners typically have the ability to increase cash flows through light property improvements, management efficiencies or by increasing the quality of the tenants. Similar to core properties, these properties tend to be of high quality and well occupied.

- Core strategy is synonymous with ‘income’ in the stock market. Core property investors are conservative investors looking to generate stable income with very low risk. Core properties require very little hand-holding by their owners and are typically acquired and held as an alternative to bonds.

- Correlation: The degree of association between two or more variables; in finance, it is the degree to which assets or asset class prices have moved in relation to each other. Correlation is expressed by a correlation coefficient that ranges from -1 (always move in opposite direction) through 0 (absolutely independent) to 1 (always move in the same direction).

- Credit spread: The differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration the possible embedded options.

- Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.

- Cyclical vs. defensive sectors: Cyclical companies are companies whose profit and stock prices are highly correlated with economic fluctuations. Defensive stocks, on the contrary, are less correlated to economic cycles. MSCI GICS cyclical sectors are: consumer discretionary, financial, real estate, industrials, information technology and materials. Defensive sectors are: consumer staples, energy, healthcare, telecommunications services and utilities.

- Duration: A measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates, expressed as a number of years. High growth stocks: A high growth stock is anticipated to grow at a rate significantly above the average growth for the market.

- Liquidity: The capacity to buy or sell assets quickly enough to prevent or minimise a loss.

- P/E ratio: The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS).

- QE: Quantitative easing (QE) is a type of monetary policy used by central banks to stimulate the economy by buying financial assets from commercial banks and other financial institutions.

- QT: The opposite of QE, quantitative tightening (QT) is a contractionary monetary policy aimed to decrease the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.

- Quality investing: This means to capture the performance of quality growth stocks by identifying stocks with: 1) A high return on equity (ROE); 2) Stable year-over-year earnings growth; and 3) Low financial leverage.

- Quantitative tightening (QT): The opposite of QE, QT is a contractionary monetary policy aimed to decrease the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.

- Rising star: A company that has a low credit rating, but only because it is new to the bond market and is therefore still establishing a track record. It does not yet have the track record and/or the size to earn an investment grade rating from a credit rating agency.

- TIPS: A Treasury Inflation-Protected Security is a Treasury bond that is indexed to an inflationary gauge to protect investors from a decline in the purchasing power of their money.

- Value style: This refers to purchasing stocks at relatively low prices, as indicated by low price-to-earnings, price-to-book and price-to-sales ratios, and high dividend yields. Sectors with a dominance of value style: energy, financials, telecom, utilities, real estate.

- Volatility: A statistical measure of the dispersion of returns for a given security or market index. Usually, the higher the volatility, the riskier the security/market.