Summary

Tariffs U-turn, market U-turn

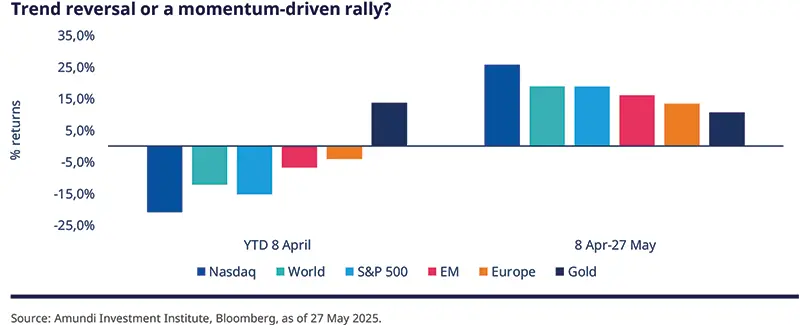

The art of policymaking is a lot about setting expectations against which all future decisions are assessed. When President Trump famously introduced his extreme tariffs on ‘Liberation Day,’ markets were obviously concerned. Since then, resilience in US labour markets, better-than-expected earnings, and trade war de-escalation have boosted sentiment. Risk assets have rebounded, and bond yields risen.

Whether this upside on risk assets is sustained depends on economic performance and clarity on trade policies. For bonds, pressure on the long end of the curve will remain due to fiscal issues/high debt notably in the US (not least because of Trump’s tax bill) and Japan. For the time being, we upgrade our growth projections for the US, EZ, and China, and downgraded US inflation. More specifically:

Growth forecasts upgraded in the US and Eurozone (EZ). The reduction in tariffs has led us to upgrade our US economic growth numbers (real GDP, year-on-year) slightly from 1.3% to 1.6% for both this year and for 2026. This is still a deceleration when compared with last year, and we think growth will remain below potential and consumption will be weak. In the EZ, growth projections have been upgraded to 0.8% for this year with significant divergences at play for Spain, Italy, France and Germany.

The Fed’s and ECB’s response to any weakness in the economy is key for the markets. The Fed, as was evident from its most recent decision, will only be reactive. While markets have lowered their expectations of Fed and ECB rate cuts, our views on the Fed and the ECB are unchanged in terms of the number of rate cuts this year.

The sustainability of this upside in risk assets depends on the resilience of economic activity, consumer sentiment, business confidence, and trade policies.

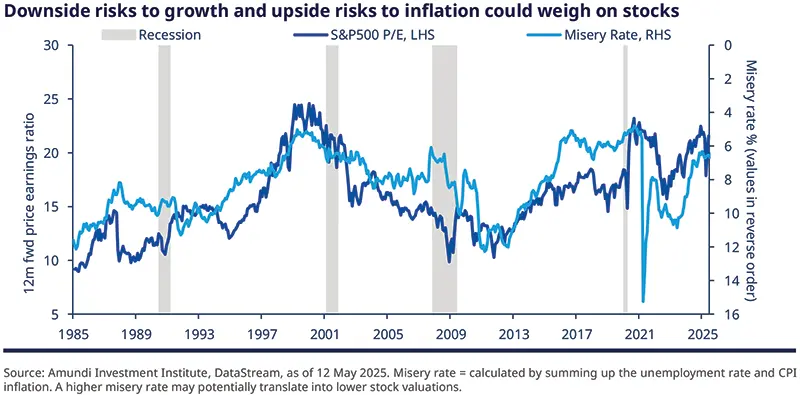

Consumer sentiment and inflation expectations are important for US consumption. We have downgraded our US CPI projection for this year to around 3% owing to a milder-than-expected shock from tariffs. However, consumption could still be affected by the increase in trade tariffs, any potential spending cuts by the US government, and inflation expectations, which could also impact spending patterns.

The long-term decoupling between US and China will continue, in our view, even as both would try to ‘manage’ this downward trend in relations and economic linkages. In terms of growth, we have revised our GDP views upwards for 2025, from 3.9% to 4.3%. Although it may appear that the outlook has almost been completely restored, we emphasise that some damage is irreversible. The uncertainty around trade policy is still high, and this will weigh on private-sector confidence.

These points on consumption, growth, and inflation suggest a more complex picture than markets are indicating. For instance, while US inflation pressure may seem to subside, the details around more long-term trade policy decisions would direct the overall inflation trend. Furthermore, the recent corporate earnings season was above expectations in the US and Europe, and may indicate better prospects for risk assets in the near term. That said, we do not call for a structural re-rating of risk.

| Amundi Investment Institute: a more nuanced policy stance in sight |

Expectations of three rate cuts from the Fed and ECB* this year, with the Fed’s benchmark rate reaching 3.75% by year end. While we have raised our growth forecasts, we have not changed our views on Fed rate cuts because growth will be below potential in 2025 and 2026, encouraging the Fed to reduce rates even next year. The ECB is also likely to reduce rates thrice (25 bps each), with rates reaching 1.5% by September*. The Bank of Japan, however, seems to be the only major central bank on a hiking trajectory. We expect rates to increase to 0.75% by Q3. Chinese policymakers would like to reserve some ammunition that may be used in later stages. The result of US-China negotiations diminishes the possibility of a huge fiscal stimulus in Q3, but authorities will still be prone to support growth. On monetary policy, the PBoC’s response of cutting rates by 10 bps is milder than we had expected. This is a change from the bank’s intention of providing full support to growth that was on display at the beginning of the year. We continue to see two rate cuts of 10 bps, one each in July and September this year. |

Global policymaking is becoming increasingly nuanced. While the Fed will need to consider inflation expectations before cutting rates, the ECB is in a slightly better position, whereas the BOJ is likely to hike rates.

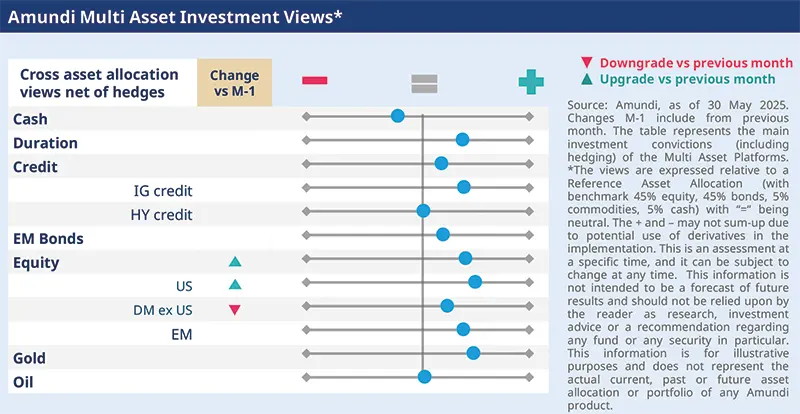

Against this backdrop, our main investment convictions are:

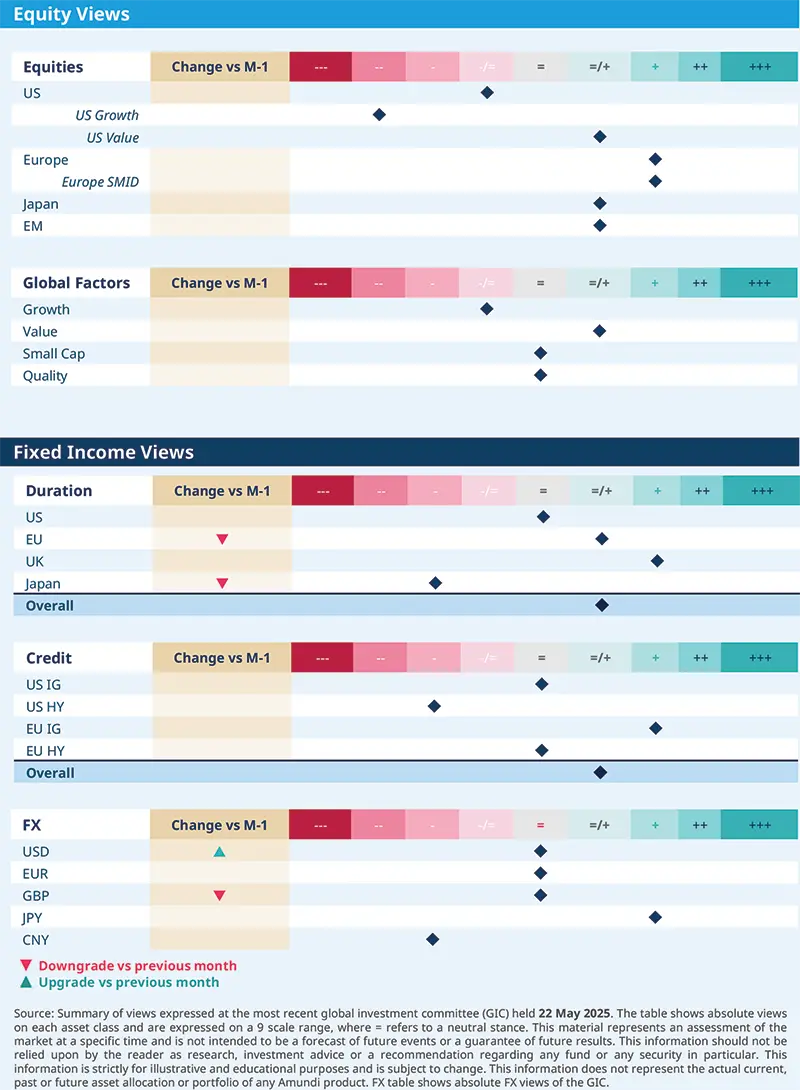

Resurfacing fiscal concerns and government debt issues will affect fixed income markets globally, including Japan. We are close to neutral on US duration, and are vigilant on any volatility in yields arising out of high inflation expectations, tariffs uncertainty, and debt supply. We stay positive on EU and UK, but are more cautious than before on Japan. In credit, we like high quality, short-dated credit, and prefer the EU to the US.

Balanced stance in equities, tilted towards global markets. US equity losses have recovered, with valuations now above long-term averages following recent gains. Regionally, we prefer Europe and the UK, while in the US, growth names appear highly sentiment-driven.

The easing of trade tensions is beneficial for emerging markets, but we do not yet know the status of tariffs after the 90-day pause. Overall, disinflation trends in the US, Federal Reserve easing, and a weakening dollar paint a positive picture for emerging market assets.

Tactical rebalancing and strengthening of hedges in multi asset. Economic growth prospects are not very exciting, but they are still decent, and earnings growth, while weaker than before, is still in positive territory. This allows us to maintain a constructive stance on risk assets through equities where we are slightly more positive on US in the short term.

The ongoing US-China competition will create volatility and opportunities. Hence, we seek value in dislocated segments for enhanced returns while maintaining protections.

FIXED INCOME

Deficit concerns driving the long end

Amaury D’ORSAY |

US CPI inflation and wage growth seem to be under control, but bond vigilantes are up and taking note of the high fiscal deficit and debt (huge amount of US debt maturing this year), and inflation expectations. The boost to economic growth from lower tariffs is also driving yields upwards. In an environment of a sharp increase in yields across the DM, we maintain our global and selective approach.

At the same time, we are monitoring the hard data coming out of Europe, particularly in Germany and UK, and how will the ECB and the BoE will respond. For the time being, we think ECB’s job is easier than the Fed’s, which is facing relatively high inflation risks. Overall, we remain mildly positive on duration, and keep our curve steepening stance in the US.

We are constructive on duration overall, but have slightly reduced our view on the EU-core as the region’s economy should start to benefit from the ECB’s cuts.

On peripherals and UK duration, our positive stance is unchanged.

In US, we see steepening opportunities on the 5Y-30Y curve.

On Japan, we have further raised our cautious stance.

Credit continues to offer attractive yield, and will likely benefit from decent economic growth and continued monetary easing.

We retain our preference for high quality (IG over HY), short term maturities, but are generally cautious on long-dated credit.

Regionally, we favour the EU over the US, and are neutral on UK credit.

At a sector level, we like banks and BBB-rated securities.

On the USD, we have moved to a neutral stance in a highly volatile environment. The correlation between the dollar and US rates has turned positive. Hence, the currency may no longer be as effective a diversifier as before. But international interest in USD is still high, and we could see some near-term consolidation.

We have moved neutral on GBP, but given the fluid situation, we stay active.

EQUITIES

Ambiguity on tariffs will affect valuations

Barry GLAVIN |

The temporary understanding between the US and China has provided relief to the markets, thus allowing for a rebound. However, corporate guidance from the earnings season confirms our view that more clarity is needed for businesses to make investment decisions and assess the impact on their future earnings. Any deterioration in labour markets and inflation expectations that stay high for long periods will likely affect spending patterns and stock valuations.

As a result, volatility is likely to continue, and we aim to address this through our fundamentals driven bottom-up approach that compares current valuations with a company’s future earnings prospects. We find such quality businesses across Europe, the UK and in Asia. At the same time, we tend to minimise this volatility through exploring strong business models that will be less affected by the ongoing uncertainty around international trade.

The corporate earnings season has played out better than expected in the US and Europe. But on the US, we stay cautious overall because of concentration and valuations risks. That said, we keep our bottom-up approach and are exploring quality industrial segments and defensive businesses that are priced well.

In Europe we stay constructive as they offer better valuation protection. The UK seems to have positioned itself well amid the ongoing tariff uncertainty with the US.

In Japan, we maintain our positive stance due to the continuing corporate reforms and drive to improve profitability and capital returns.

We maintain our barbell stance, with defensive and cyclical sectors. In Europe, consumer staples and health care stocks are favoured. At the other end, we like select quality cyclical sectors that show better valuation now. In addition, we see opportunities in banks with strong balance sheets and attractive dividend yields.

In the US, we prefer value and quality names that are relatively insulated from President Trump’s uncertain policies. We also like large cap banks that may benefit from a steepening yield curve, and potentially benign regulatory changes and lower taxes under the Trump administration.

EMERGING MARKETS

De-escalation is supportive of EM

| Yerlan SYZDYKOV Global Head of Emerging Markets |

Fed easing and dollar weakening paint a positive picture for EM. We are also seeing growing optimism following the better-than-expected initial outcome of the US-China trade negotiations, but elements of worry remain. Issues such as the status of tariffs after the 90-day period, the unpredictability around President Trump’s negotiation, and the recent downgrade of US ratings may create volatility.

In China, the sentiment has improved, and we are assessing how sustainable that is, as we progress along the negotiation period. At the same time, the absence of a fiscal bazooka prevents us from taking a strong position on the country yet. We maintain our bottom-up approach of selecting value across the EM world in equities as well as debt.

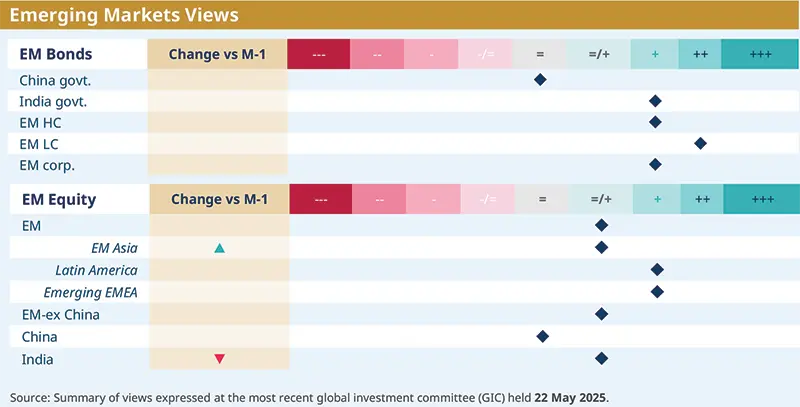

We stay positive on HC and LC debt. The latter should benefit from continued global disinflation and rate cuts by EM central banks. In addition, EM should now have lower inflation impulse from lower tariffs, and this gives further impetus to LC debt. Specifically, we like Latin American countries such as Brazil, Mexico, Peru.

Country-wise, we are close to neutral on Chinese bonds, and are positive on India amid continued disinflation.

In FX, volatility (such as that seen in the Taiwan dollar) will continue if Trump uses revaluation of currencies as a negotiation tool.

We are slightly more positive on EM Asia after the temporary easing of trade tensions that also improve prospects for Taiwan’s tech sector. While we are positive on India on a long-term basis, we see some weakness around private capex and high market valuations in the near term.

In emerging EMEA, we stay constructive overall, and like emerging Europe due to robust growth in broader Europe.

In LatAm, we are positive on Brazil and Mexico. We realise that a rebound in the region is in an advanced stage, but LatAm is relatively less affected by the volatility from US trade tariffs.

| Main convictions from Asia |

Short-term relief. Asian markets reacted positively to the US-China tariff agreement to lower tariffs from ultra-prohibitive levels. However, that hasn’t stopped the changing market narrative on US exceptionalism. We think this may trigger higher demand for protection against USD weakness from Asian institutions. In addition, elevated macro uncertainty may hamper corporate investment decisions in the near term. But it is unlikely to alter Asian companies’ medium-term desire to redeploy supply chains in adapting to changing order of the global economy.

|

Multi-asset

Rebalance in momentum-led markets

Francesco | John O’TOOLE Head of Multi-Asset Investment Solutions |

We believe the recent rebound in risk assets is an opportunity to reinforce protections and tactically adjust the stance towards more resilient segments of the market.

While the worst-case scenario in terms of tariffs on US and Chinese exports has been avoided, we think there is still huge uncertainty with respect to trade policies, growth/inflation, and earnings in H2. There are renewed concerns over fiscal deficit and government debt. For the time being, the US economy and labour markets are showing strength. Hence, we have tactically rebalanced our risk stance in markets, which are being driven by momentum currently. We also think investors should consider this as an opportunity to strengthen their hedges.

In DM equities, on the one hand we have marginally upgraded US equities on positive sentiment following the trade truce and support from recent large-cap earnings. We also have a slight positive stance on US mid-caps due to their valuations. On the other hand, we believe volatility is high and offers a chance to selectively reinforce protections, for instance in the EZ, where we stay positive. Finally, the UK allows for a good diversification within the European space. In EM, our positive tilt is maintained through China. We have slightly adjusted our stance towards Chinese tech and segments that may benefit from potentially additional liquidity and fiscal support.

Our constructive view on duration is maintained, but increasingly we prefer segments that are less affected by rising deficits. In the US, we have a small positive stance on the 5Y, and are also positive on core-EU, peripherals and the UK. Disinflation in Europe should continue amid lower energy costs, allowing the ECB to cut rates. On Japan, we are cautious and believe yen appreciation is complicating matters for the BoJ. In addition, we see value in EM spreads amid decent carry.

Fading USD exceptionalism continues to play out, but it may not be linear. We are positive on EUR/USD and on JPY/USD. Overall, we like gold, and have enhanced our views on equity safeguards in Europe.

VIEWS

Amundi views by asset classes

Definitions & Abbreviations

Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.