Summary

Don’t ignore the economic weakness ahead

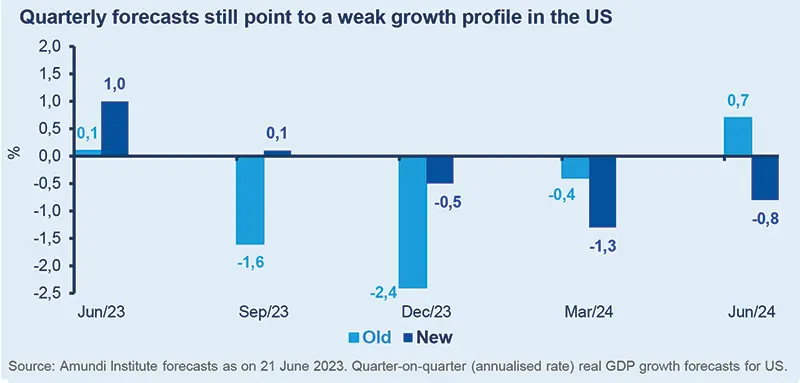

Growth direction remains on the worsening side as US will continue to slow progressively, and a mild recession should begin in H2 2023, leading us to remain cautious.

Equities have been boosted by optimism relating to slowing inflation and stable economic data recently In the US, a large chunk of these gains came from the mega tech stocks, including the ones led by the AI wave.

On the economic front, strong US high frequency data have led us to upgrade our 2023 US growth forecasts, with a milder recession starting a bit later soft data still point to weakness In Europe, we slightly downgraded 2023 growth with divergences across countries. The UK should also remain weak, affected by high inflation and low investments.

However, we see a moderate recovery in China, with some weaknesses, leading us to downgrade our 2023 forecasts Thus, we stay cautious and the factors below further confirm this:

- Policy ambiguity is high and exacerbates downside risks. The Fed is likely to remain data-focused and would prefer to see some additional slowdown before confirming the pause.

-

US consumer and credit conditions. While consumer spending is robust for now, any cracks in the labour market could cause consumers to become conservative.

-

A combination of inflation and weakening consumption patterns could pressurise corporate earnings more from the revenue side.

-

Geopolitical tensions, including US-China relations and the evolution of the Russia-Ukraine war, would increase financial market volatility. Unfortunately, on both, the outcome is highly uncertain.

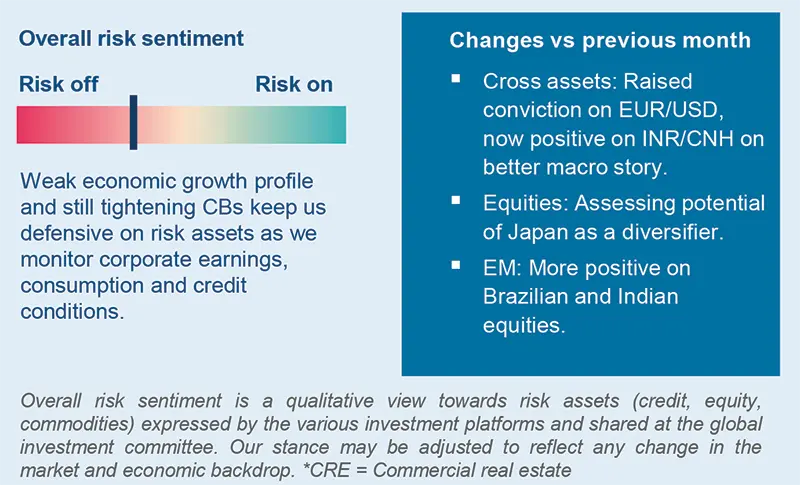

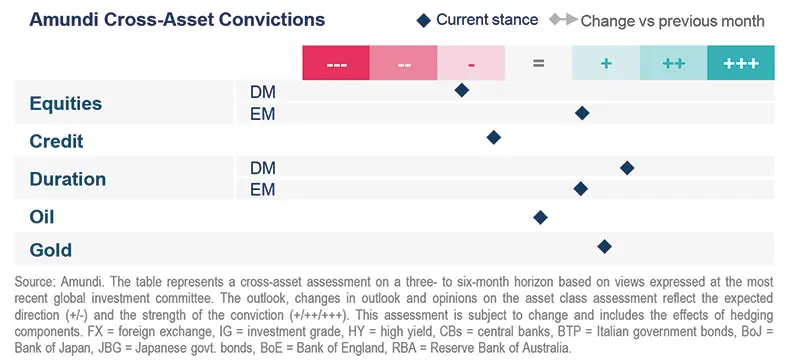

We see the evolution of asset classes as follows:

- Cross asset. Persistent concerns on profits keep us defensive wherein we maintain a positive bias on US duration. We stay cautious on equities and credit valuations, particularly in US large caps and Europe. In credit, we avoid HY, where liquidity could be a problem going forward, and prefer the quality sides of the market. On the other hand, EM offer attractive yields, and we see value in debt as well as in equities (China, Indonesia). In FX, we raised our stance on the EUR/USD and are now positive on the INR/CNH but maintain strong hedges on equities and recommend staying diversified through gold.

- Fixed income. High policy uncertainty is likely to keep volatility high, particularly on the short end of the curve. Based on an overall active approach, we maintain our slightly positive stance on US duration. In core Europe, we are marginally defensive. Importantly, we are evaluating the timing to move back to neutral on Europe as we assess core inflation, ECB policy and the economy, but we are just not there yet. On the other hand, we do not like the leveraged segments in HY, where spread volatility could worsen if earnings slow and credit conditions tighten. We prefer high-quality credit in the US and Europe.

- Equities. While we do not deny a mild rebound, consumption and growth pressures could create a difficult picture. In Europe and the US (growth and tech large caps), caution is key. There is a need to distinguish between businesses that can benefit from adoption of new technologies, such as AI, vs those that are merely benefitting from a sentiment-driven rally. On a positive note, value, quality and dividend-oriented stocks should do well. Value is in a phase of long-term outperformance vs Growth, but this will not be linear and should be combined with quality. At the same time, we are monitoring Japan as a strong diversifier.

- EM. These markets are benefitting from their growth and consumption stories and earnings recovery. Even as we see some signs of slowing growth in China, the relative EM vs DM growth advantage remains. In equities, we like Indonesia and Vietnam, and Brazil where we raised our positive view. EM debt offers attractive yields. In particular, we like Mexico and India, but we stay selective and prefer HY.

Three hot questions

|

Monica DEFEND |

We do not expect the Fed to cut rates this year, as inflation is still above the central bank’s comfort level.

1| What are your views on the Fed, ECB, and BoE hiking path?

We confirm our views on peak fed funds rates at 5.25%, followed by a pause. The first cut is expected in January 2024, with rates being cut to 3.00% by September 2024. Meanwhile, the ECB is not yet in a pausing phase, given its concerns about high and sticky inflation. We expect another 25bps hike in July, with peak rates at 3.75%. Finally, the BoE faces a dilemma, with sluggish growth and the risk of a wage-price spiral. More tightening looks inevitable, and we foresee the BoE raising rates further to 5.50%.

Investment consequences

- Neutral to slightly positive on US duration, slightly cautious on Europe, neutral on peripherals.

- Cautious stance on dollar maintained, stay positive on EUR/GBP.

2| How do you see China’s growth prospects?

We trimmed our 2023 GDP growth expectations from 6.0% to 5.7%. The downgrade is mainly concentrated in Q2. But the picture is of a moderate recovery (and not a recessionary outlook) subject to a mini monetary stimulus, moderate fiscal expansion and incremental easing in the housing sector. A less constructive outlook for the real estate sector has triggered a downward revision for 2024 as well, to 4.3% from 4.7%. The administration is willing to tolerate low and volatile growth for the sake of structural long-term changes.

Investment consequences

- Positive Hong Kong (HSCEI) and China (CSI 300).

- USD/CNY target of 6.50 in Q1 2024.

3| Do you expect any change to the cautious stance on risk assets?

We confirm our defensive view on risky assets. We think that to change this stance we would need to see at least double-digit returns for the S&P 500 index over the next 12 months to deliver sufficient risk-adjusted returns above bonds. However, for the S&P 500 to hit a target of around 5000, EPS growth should be above 30%, which is overly optimistic.

Investment consequences

- Defensive cross-asset allocation confirmed.

- We keep our cautious stance on equities and credit.

No time to change course

|

Francesco SANDRINI |

John O'TOOLE |

We are navigating the current backdrop with a vigilant, diversified approach that allows us to maintain protections and benefit from any potential opportunities available at a later stage.

Our central scenario is comprised of a mild recession in the US and below-par growth in the Euro Area, with divergences across the region and risks around tightening financial conditions. We remain sceptical on risk asset valuations, which leads us to maintain our defensive view and portfolio hedges. At the same time, we think an active and swift approach that exploits all asset classes is key to benefitting from long-term convictions on the economy. For now, we stay diversified through metals such as gold (modest upside for diversification) and FX, raising our view on the EUR and moving positive on the INR.

High conviction ideas

In equities, we remain cautious on developed markets through the US, Eurozone and Japan, as we believe the environment is challenging, both from growth and inflation perspectives. Valuations and earnings dynamics are also weak, painting an unattractive picture for equities. In EM, we are positive on China and believe there is room for appreciation, although volatility will be high.

Considering the likelihood of Fed rate cuts in 2024, we think valuations favour US duration. We also continue to favour US and Canadian curves in the 2Y-10Y segment. While we are cautious on JGBs, we are monitoring the Bank of Japan’s actions. At the same time, we think investors should look for opportunities across geographies -- for example, in Swedish bonds. A more dovish monetary policy there should be supportive. In addition, our slightly positive view on BTP-Bund spreads is maintained, as Italian bonds would benefit from improving fundamental trends (Q1 GDP, for instance), stable demand and ECB support. But we remain vigilant. We also keep our tactical stance on UK vs Australia 10Y, as the Reserve Bank of Australia is likely to remain in hiking mode. In EM, robust economic growth and under control inflation keep us positive on a select FI basket.

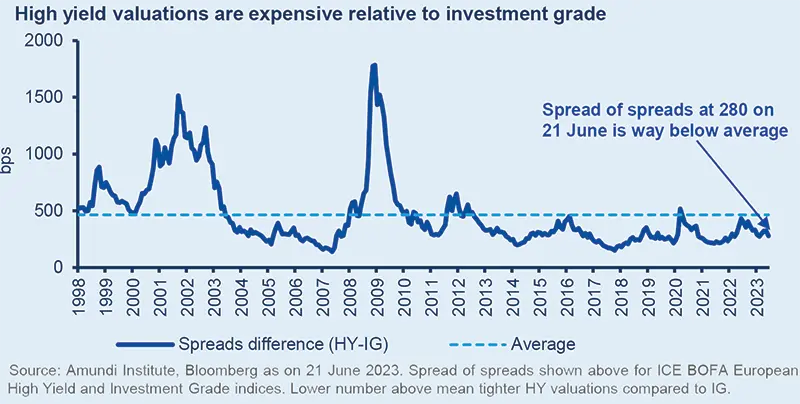

Corporate credit is vulnerable to an unfavourable economic backdrop and we stay cautious on US HY. While at the moment, liquidity ratios are fine, tightening financial conditions and decelerating profits could change that.

In FX, we are now constructive on the INR/CNH due to a positive macro-economic story. Elsewhere, we are optimistic on the MEX/EUR and BRL/USD. In DM, we upgraded our stance on the EUR/USD, given attractive valuations and an environment of a weakening dollar. However, on the GBP, we are cautious vs the EUR and CHF but positive on the JPY vs the EUR and CHF.

Risks and hedging

Hedges would allow investors to prepare for a worse-than-expected US recession. Hence, investors should maintain protection on US equities. On the other hand, gold offers strong diversification and protection if economic and geopolitical environments worsen. But we realise that upside potential for gold looks limited, due to tight valuations.

Policy evolution will impact credit; stay active

| Amaury D'ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

We think the lagged effects of policy tightening will be a drag, particularly on low-rated credit, where valuations are expensive.

Overall assessment

Central banks have not given up their fight against inflation: while the Fed is unlikely to cut rates this year, the ECB remains in hiking mode, along with the BoE as core inflation is high in the UK. This calls for an active stance on government bonds and a focus on IG credit and quality carry in EM.

Global and European fixed income

While headline inflation is slowing in Europe, core inflation is sticky, led by rises in wages, corporate earnings and fiscal support at national levels. Thus, the ECB raised its policy rates, but policy ambiguity remains high. For now, we are slightly cautious on duration mainly through core Europe but are considering moving back to neutral. On US duration and euro peripheral debt, we are neutral. We are cautious on Japan. We also believe in steepening of the US and European curves. In corporate credit, the current environment of mild growth in Europe leads us to prefer EU IG. We are cautiously optimistic on the quality side, and from a sector perspective, we like financials. We think HY credit is expensive vs IG and given the economic growth and default outlook, the former could suffer.

US fixed income

Encouraging signs from hard data (but weak forward-looking surveys) and still-high inflation have pushed core yields up. We remain active and constructive on duration, and also think TIPS are attractive at current levels for long-term investors. In corporate credit, we prefer large national financials over industrials and think select US regional banks and REITS are attractive. We also favour IG over HY not least because default activity in general in the US has increased. This is particularly true for HY bonds and bank loans. But an active primary IG market could present select opportunities. In securitised credit, where spreads have tightened ⎼ eg, in RMBS ⎼ investors may consider locking in some gains without altering their risk profile. There is also a need to be active in agency MBS, as spreads in these markets are tied to broader rate volatility.

EM bonds

The EM-DM growth premium remains favourable for the asset class. While we see some challenges in China, we think fiscal stimulus should be more targeted now: for instance, towards real estate and construction. Elsewhere, we like the LatAm region and see opportunities in Brazil and Mexico. At the same time, we are monitoring idiosyncratic stories such as Turkey (internal politics) and South Africa. In LC, we are constructive on EM FX and LC (India, Romania).

FX

The USD path this year should remain weak. However, we are positive on high carry FX such as MXN, BRL and INR, and are also assessing TRY after the new government. At the other end, we like AUD (hawkish RBA), NOK and yen.

Stay disciplined; avoid over-exuberance

| Fabio DI GIANSANTE Head of Large Cap Equity |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

We remain committed to our investment process by understanding the business models and underlying worth of companies.

Overall assessment

Consumer strength and evolution of labour markets are important for equities and earnings growth. We acknowledge that consumption is strong for now, but the delayed impact of policy tightening (doesn’t appear to be over) could affect investments, labour markets and subsequently consumption. We remain focussed on our disciplined investment process, looking for value, quality names and strong businesses in EM and avoid the excesses in AI-driven rally.

European equities

We expect the recent downward pressure on profit margins to continue in the near term but believe this is already priced into many companies’ valuations. This creates attractive selection opportunities. We keep a barbell approach and like quality cyclical businesses and defensive stocks. In particular, we prefer companies with strong balance sheets which can provide a shield in times of high interest rates and continue to deliver value to shareholders. At a sector level, consumer staples (less positive than before) and healthcare (more positive on medical tech) are preferred. At the other end, we favour financials and industrials that are facilitating the energy transition, such as those involved in factory automation. On tech, we are cautious and believe there are notable question marks related to the continued strength of AI’s underlying growth.

US equities

Large mega caps continue to drive gains but historically instances where market breadth is narrow have been followed by a catch-up from a broader valuation re-rating. However, we cannot say that with certainty this time round. As a result, we stay defensive on expensive mega caps and unprofitable growth. There is a need to identify businesses that would benefit in the long term from new technologies such as AI and avoid names that are simply riding the wave. On the other hand, select areas such as Value present opportunities and we balance this with the quality and strength of individual businesses. In addition, we are exploring cyclicals and defensives. In the former, the weaker names appear to be very cheap, but the others that show potential are very expensive. In defensives, one of our strongest convictions is healthcare equipment (medical technology). At the other end, we like energy, materials, banks and non-spread financials.

EM equities

Earnings recovery potential is supporting the positive environment. We believe this upward trend should continue in H2 and will be concentrated in EMEA and Asia. We also like LatAm, especially Brazil (more positive), where the government’s market-friendly stance may continue. In Asia, we raised our stance on India and are monitoring the near-term headwinds to Chinese consumption but stay positive. At a sector level, we favour real estate and consumer discretionary, but maintain a cautious stance on healthcare and materials.

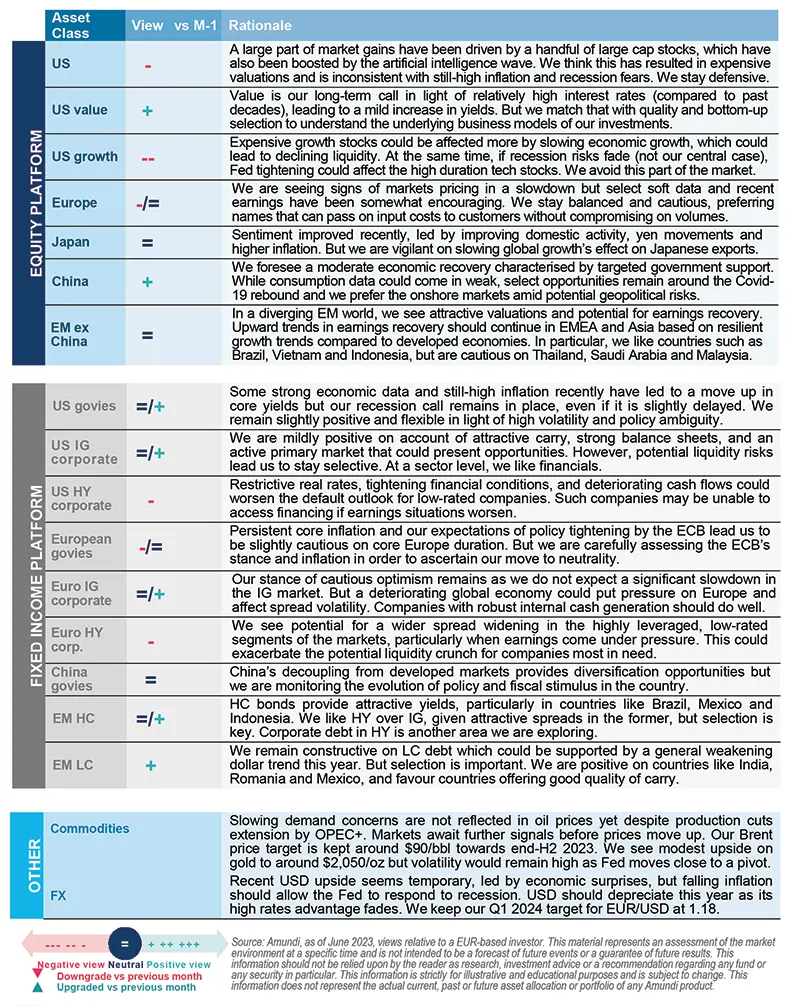

Amundi asset class views

Definitions & Abbreviations

- ADR: A security that represents shares of non-US companies that are held by a US depositary bank outside the US. They allow US investors to invest in non-US companies and give non-US companies access to US financial markets.

- Agency mortgage-backed security: Agency MBS are created by one of three agencies: Government National Mortgage Association, Federal National Mortgage and Federal Home Loan Mortgage Corp. Securities issued by any of these three agencies are referred to as agency MBS.

- Beta: Beta is a risk measure related to market volatility, with 1 being equal to market volatility and less than 1 being less volatile than the market.

- Breakeven inflation: The difference between the nominal yield on a fixed-rate investment and the real yield on an inflation-linked investment of similar maturity and credit quality.

- Carry: Carry is the return of holding a bond to maturity by earning yield versus holding cash. Core + is synonymous with ‘growth and income’ in the stock market and is associated with a low-to-moderate risk profile. Core strategy is synonymous with ‘income’ in the stock market.

- Correlation: The degree of association between two or more variables; in finance, it is the degree to which assets or asset class prices have moved in relation to each other. Correlation is expressed by a correlation coefficient that ranges from -1 (always move in opposite direction) through 0 (absolutely independent) to 1 (always move in the same direction).

- Credit spread: The differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration the possible embedded options.

- Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.

- Curve steepening: A steepening yield curve may be a result of long-term interest rates rising more than short-term interest rates or short-term rates dropping more than long-term rates. Bull steepening a change in the curve due to short-term rates falling faster than the long-term rates. This leads to a higher spread between the short and long term rates.

- Bull steepening: A change in the curve due to short-term rates falling faster than the long-term rates. This leads to a higher spread between the short and long term rates.

- Curve inversion: When long-term interest rates drop below short-term rates, indicating that investors are moving money away from short-term bonds.

- Cyclical vs. defensive sectors: Cyclical companies are companies whose profit and stock prices are highly correlated with economic fluctuations. Defensive stocks, on the contrary, are less correlated to economic cycles. MSCI GICS cyclical sectors are: consumer discretionary, financial, real estate, industrials, information technology and materials. Defensive sectors are: consumer staples, energy, healthcare, telecommunications services and utilities.

- Duration: A measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates, expressed as a number of years.

- High growth stocks: A high growth stock is anticipated to grow at a rate significantly above the average growth for the market.

- Liquidity: The capacity to buy or sell assets quickly enough to prevent or minimise a loss.

- P/E ratio: The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS).

- NBFI: A non banking financial institution provides select financial services but doesn’t have a full fledged banking license.

- Net interest margin: It is a measure that compares a bank’s interest income from lending with its interest expense on its liabilities (such as bank deposits), expressed as a percentage of its assets.

- QE: Quantitative easing (QE) is a type of monetary policy used by central banks to stimulate the economy by buying financial assets from commercial banks and other financial institutions.

- Quality investing: This means to capture the performance of quality growth stocks by identifying stocks with: 1) A high return on equity (ROE); 2) Stable year-over-year earnings growth; and 3) Low financial leverage.

- Quantitative tightening (QT): The opposite of QE, QT is a contractionary monetary policy aimed to decrease the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.

- Non-SIFI: A systemically important financial institution (SIFI) is an institution that the US Fed and regulators believe would pose a serious risk to the financial system and the economy if it collapses. A non-SIFI is an institution that doesn’t fall in this category.

- TIPS: A Treasury Inflation-Protected Security is a Treasury bond that is indexed to an inflationary gauge to protect investors from a decline in the purchasing power of their money.

- Value style: This refers to purchasing stocks at relatively low prices, as indicated by low price-to-earnings, price-to-book and price-to-sales ratios, and high dividend yields. Sectors with a dominance of value style: energy, financials, telecom, utilities, real estate.

- Volatility: A statistical measure of the dispersion of returns for a given security or market index. Usually, the higher the volatility, the riskier the security/market.

- Yield curve control: YCC involves targeting a longer-term interest rate by a central bank, then buying or selling as many bonds as necessary to hit that rate target.