Summary

Bonds and EM stand out in the Santa Rally

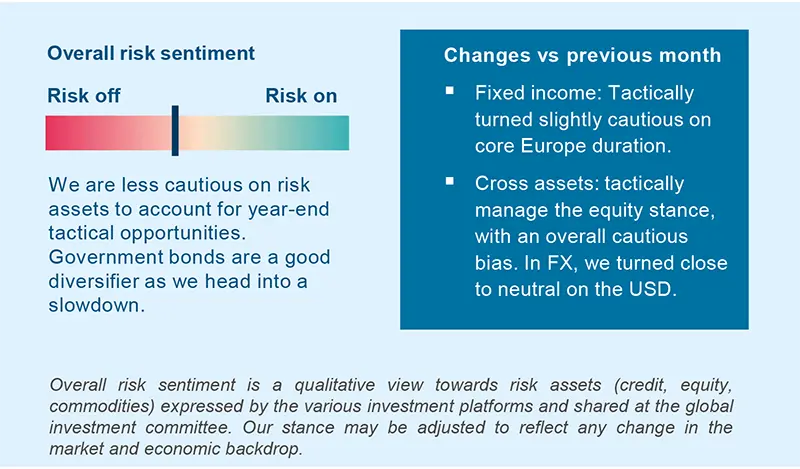

While the year-end rally may offer some tactical opportunities, we keep a sightly cautious view on equities as markets are priced for a Goldilocks scenario.

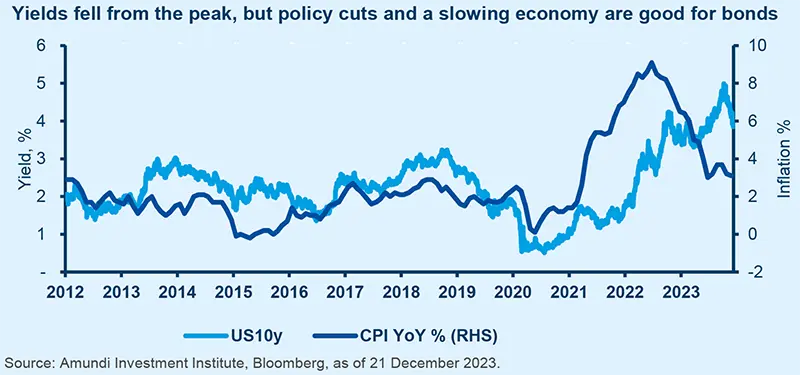

Declining inflation pressures and a relatively dovish Fed caused bonds and risk assets to gain in recent weeks. But risks related to speculation are rising, as markets have already priced in lot of gains expected in 2024. We agree that central banks (CB) will pivot in 2024, but believe rate cuts would start from May/June. The reasons behind this moves are also important. In our view, a slowing economy (not just slowing inflation) will push the Fed towards easing, as the bank will be watchful of any upside surprises on inflation. We see the below themes as the likely main drivers for the global economic environment:

- Inflation is declining, but it’s too soon to declare victory. US core inflation is displaying stickiness, and the ECB is concerned about wage rises as it pushes back against market expectations of cuts in the near future. CBs could wait a few months before easing policy.

- US and Europe weakening. Labour markets are loosening, and consumers’ views of worsening job security adds to our forecasts of a mild US recession in H1. This, coupled with a slowdown in China, would affect Europe, where forward-looking indicators are weak, while the rest of Asia and EM should remain resilient.

- Fiscal constraints in the US and Europe. Currently, markets are ignoring the long-term US debt sustainability issues and are driven by the Fed policy outlook. In Europe, the German budget deal is a compromise that seeks to cut spending, but it could affect growth.

- Geopolitics is in focus as we enter a year of elections, starting with Taiwan in January.

Investors could explore the following asset classes:

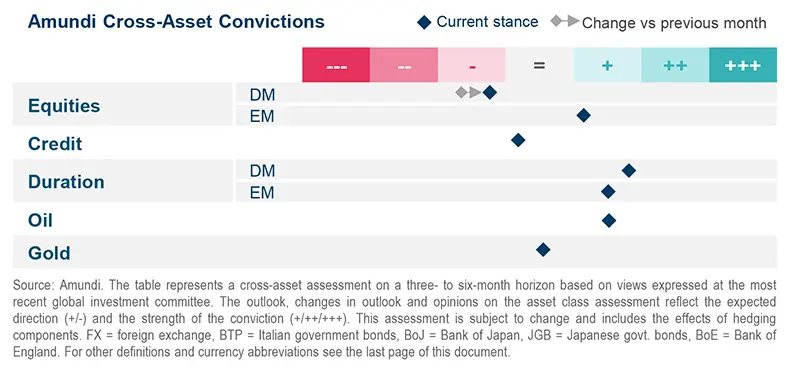

- Cross asset ⎼ Despite the recent move up in yields, USTs and select government bonds may act as a diversifier of portfolios at a time of potential economic stress in H1. At the other end, we stay sightly cautious on developed market (DM) equities, but investors should not rule out a tactical upside that may be played through derivatives. On emerging markets (EM), however, we are positive but see potential for some consolidation following performance of markets such as Brazil. In FX, we shifted closer to neutral on the USD after its recent excessive fall against cyclical FX. But we maintain our cautious USD views against the JPY. Overall, we stay diversified through commodities.

- Fundamentally attractive risk-free yields support a positive stance on US bonds, but after the recent rally, investors should maintain a flexible duration management approach. In Europe, there is long-term value in duration, but we turned marginally cautious tactically amid the recent strong movements. We remain defensive on Japan, with a very active stance. In corporate credit, spreads in US IG and HY have tightened to early 2022 levels, which keeps us very selective and biased towards high grade.

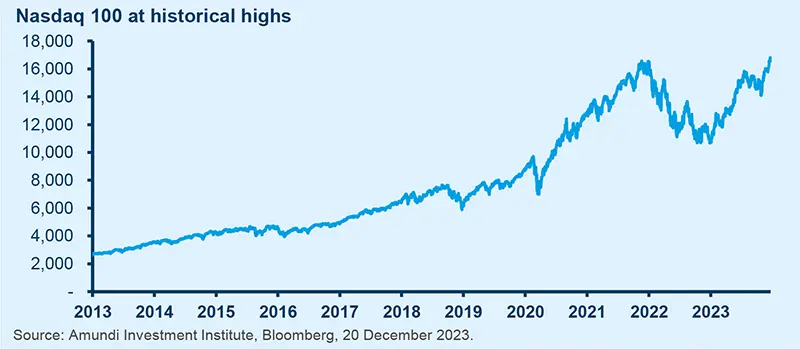

- The operating and earnings environment for equities is challenging and a normalisation of the economy after H1 supports a healthier broadening of sentiment in markets. For now, we stay neutral on Japan and cautious on the US and Europe, particularly large caps, growth and the ‘magnificent seven’ tech stocks. Instead, we prefer to keep a balanced stance, and like defensive, low-beta names, but not just in the traditional sectors. Further, our views are tilted towards quality, value and dividend-oriented names in Europe, US.

- Robust EM economic growth and a potential for earnings recovery underscore our positive views on equities. We like consumer discretionary and financials, and country-wise, we see opportunities in India and Indonesia. In bonds, a potential Fed rate pivot, slowing EM inflation, and strong economic growth are key drivers of our views. At a regional level, we favour Latin America and look for selective ideas in sovereigns and corporates.

Three hot questions

|

Monica DEFEND |

The US Fed seems to be in a ‘dovish pause’ mode after progress on the inflation front, but we think the job is not complete. The central bank is likely to remain in this mode until it starts to cut rates towards the end of Q2.

1| After the latest inflation numbers in the US and Europe, how might the Fed and ECB’s policy evolve?

With rapid progress on inflation and an imminent economic slowdown, we’ve witnessed a sharp fall in core yields. Markets are anticipating a much less restrictive monetary policy stance for 2024. We broadly agree with the magnitude of rate cuts currently priced in by the markets: 130bp of easing is priced in by December 2024 for the Fed and ECB vs our internal forecasts of 150bps for the Fed and 125bps for the ECB. However, we are sceptical on the timing. While markets expect the Fed and ECB to start rate cuts in March, we think cuts are likely to start in May/June.

Investment consequences:

- US duration: slightly positive

- Core Europe: neutral to slightly defensive

2| What is your view on the dollar amid concerns on US growth and a potential Fed pivot?

The recent fall in the dollar indicates that US exceptionalism took a hit in response to weaker-than-expected data and markets significantly repricing lower Fed fund rates. In the near term, we do not see additional room for a significant leg lower in the USD. However, renewed weakness is possible once the central bank cuts its policy rates. At the same time, massive upside is also unlikely, given the economic weakness and falling inflation.

Investment consequences:

- Close to neutral USD and EUR

3| How might the elections in Taiwan affect China, and the US-China relationship?

Elections in Taiwan are likely to result in a China-hawkish outcome. The ruling DPP, a hawkish party, is favoured to win the January presidential election but may lose its parliamentary majority. In this context, geopolitical risks around US-China rivalry may increase in the medium term, and could act as a fillip to themes such as near-shoring and supply chain reallocation in the new global realignment.

Investment consequences:

- Equities: neutral China, cautious Taiwan

- FX: slightly constructive on TWD as election risks largely priced in

Flexibility is key after the recent rally

|

Francesco SANDRINI |

John O'TOOLE |

Duration is a conviction for us, but flexibility is important after the recent fall in yields, and in DM equities, a tactical upside may be exploited through optionality without changing the cautious stance.

Dovish CB communications and declining inflation have been driving the positive backdrop in risk assets and bonds recently. While we welcome this rally, we are sceptical about how long it can be sustained and think that a reality check may come in early 2024 amid deteriorating fundamentals. A diversified stance that balances long-term convictions with short-term trends is key to enhancing potential returns. We are doing this by staying slightly positive on duration, cautious on DM equities (slightly less than before), becoming neutral on the USD, and exploiting market opportunities across DM and EM.

High conviction ideas

We are cautious on US and European equities, but acknowledge the tactical boost that may come from buybacks and sentiment improvement which may be explored via derivatives. On Japan, we maintain our neutral stance amid an improving domestic story. In EM, we are positive on a select group of countries, but also think investors should aim to benefit from this rally selectively: for instance, in Brazil. Overall, the picture regarding EM is optimistic.

On duration, we are positive on the US, and see curve steepening in the US & Canada. In Europe, despite the sharp fall in yields, we think weak economic growth still supports a small positive stance on European duration. In addition, with no immediate risks around Italian rating downgrades, we keep a small positive stance on BTPs.

On Japan, a positive economic outlook and expectations for the BoJ to end its NIRP in early 2024 allow us to maintain our cautious stance on JGBs.

Moving to EM bonds, we like both HC and LC, owing to strong fundamentals and disinflation in the US and slowing EM inflation. More accommodative DM and EM CBs should reduce some risks associated with a hard-landing of the global economy.

On the other hand, we see potential in high quality European credit, but are cautious on US HY.

In FX, after the recent decline, we turned neutral on the dollar, and are no longer positive on the AUD. The dollar movement has been excessive against cyclical FX such as the SEK, on which we moved cautious. This is supported by a weak Swedish economy in a recession. But against the JPY, we are defensive the USD. In EM, we are positive on the BRL/USD and INR/CNH. In light of the persisting Israel/Hamas war in the Middle East, we maintain our positive views on oil.

Risks & hedging

The economic backdrop and earnings concerns lead us to stay defensive on DM equities, but we think optionality and derivatives can help investors capture any near-term upside without altering the cautious stance. We also maintain safeguards in fixed income.

Fed declares victory on inflation maybe too early

| Amaury D'ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

Inflation is not a done deal yet and we could see some upside and volatility in yields that underscores the need to be agile in duration.

Overall assessment

The rapid retreat in yields caused by falling inflation and dovish CBs has affected valuations, but bonds are still a good diversifier as we enter a slowdown. However, we may see some uptick in yields (owing to inflation). And thus, staying active on DM duration and tilting to quality in credit and EM are crucial.

Global & European fixed income

The sharp movements in core yields reduced some appeal for duration, but the environment is still evolving as the European economy is weakening. Our conviction is that the ECB could cut rates (positive for bonds) when it sees a slowdown in growth, but until then, inflation is a key variable which could drive yields back up. For now, while we turned slightly cautious on European duration from a tactical point of view, we stay flexible and believe there is long-term value to be explored. In credit, we are marginally positive and prefer IG over HY, and our view on quality is maintained through consumer and automobile sectors. We remain very cautious on the lower-rated parts of HY but believe there is scope to explore Euro high-rated segments such as BB, as divergences are high. Overall, we like to exploit a good balance of quality and returns.

US fixed income

We expect the Fed will want to make sure that inflation is under control and after that, a recession may push the CB towards rate cuts, which are more likely to start by end-Q2. Yields are still attractive in bonds but slightly less so now. Looking ahead, rates volatility will be high as markets try to balance Fed policy with the economic growth outlook. Thus, we stay positive on duration and also see value in TIPS, as breakeven inflation is now around the Fed’s long-term target. In credit, IG spreads are attractive selectively, but investors should consider taking advantage of this rally. We continue to favour financials (banks) over non-financials and are seeing huge divergences in these two sectors. Another area that is fundamentally attractive is agency mortgage-backed securities. The housing market is seeing support from a supply/demand mismatch, but we are selective.

EM bonds

EM growth prospects and a Fed indicating rate cuts in 2024 support EM debt. But there are idiosyncratic issues that we are vigilant about. For instance, we are monitoring oil exporting businesses as support from OPEC+ has not been enough to boost prices. We are constructive on HC bonds, and prefer HY over IG in the sovereign and corporate spaces. Regionally, we maintain a bias for LatAm. On local rates, we are selective, favouring countries with attractive real yields.

FX

We are neutral on the USD as the advantages that it enjoyed earlier, such as higher US rates, economic growth are fading. In EM, we stay positive on select high-yielding LatAm FX vs the dollar, and we like the MXN, BRL and INR.

Stay balanced amid some excessive euphoria

| Fabio DI GIANSANTE Head of Large Cap Equity |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

Markets are expecting a ‘perfect everything’ scenario, but we see derating risks and prefer earnings resilience.

Overall assessment

The recent rally is largely based on easing financial conditions and expectations of a soft or no landing next year. There is a disconnect between valuations in some segments and their earnings potential, which raises risks of deratings. However, select markets such as Europe may benefit from peaking rates and bottoming-out of economic activity. We remain selective and explore value, quality names in DM (US, Europe, Japan) and EM.

European equities

Real wage growth is keeping consumption robust in Europe and disinflation is continuing. We prefer companies that can support margins and reward shareholders. Secondly, we stay balanced through our views on quality cyclical and defensive stocks, but in both we prefer cheap valuations. In cyclicals, industrials are among our main convictions, but there are opportunities to benefit from a sharp rebound. At the defensive end, we like staples and healthcare. The latter presents select businesses that were excessively punished by the exuberance around efficacy of obesity medicines (such as GLP-1). In financials, we think some banks may be affected by potential windfall taxes on profits. Conversely, we are cautious on technology, but overall favour good quality business models that, in our view, offer upside potential.

US equities

Excessive valuations are indicating market expectations of a soft/no landing and a strong earnings growth scenario. But as the economy evolves, and we get more clarity, markets will start paying more attention to valuations. Thus, we believe quality, value is a natural call and investors should consider adding defensiveness. However, this should be done not just through traditional defensive sectors but also through idiosyncratic opportunities across sectors. In particular, our highest convictions are in financials, banks and materials, but energy is incrementally becoming less attractive. In banks, we favour names with stable deposits and are monitoring loan growth. The sharp fall in yields is reducing the stress in their unrealised losses on bonds. But, we are cautious on tech and select consumer sectors due to the impact of higher rates and weaker labour markets on consumption. Overall, we avoid names where we see a lack of capital discipline.

EM equities

EM earnings and the economic backdrop are positive, but divergences prevail. We are optimistic on value over growth, and on consumer discretionary, real estate and financials (especially in India, Indonesia). However, we are less constructive on healthcare, materials and energy. Regionally, we prefer LatAm countries such as Mexico and Brazil that are more advanced in their policy easing. We also like Indonesia and India, due to their endogenous growth dynamics, and UAE, whereas we are more cautious on Taiwan, Saudi Arabia and Malaysia.

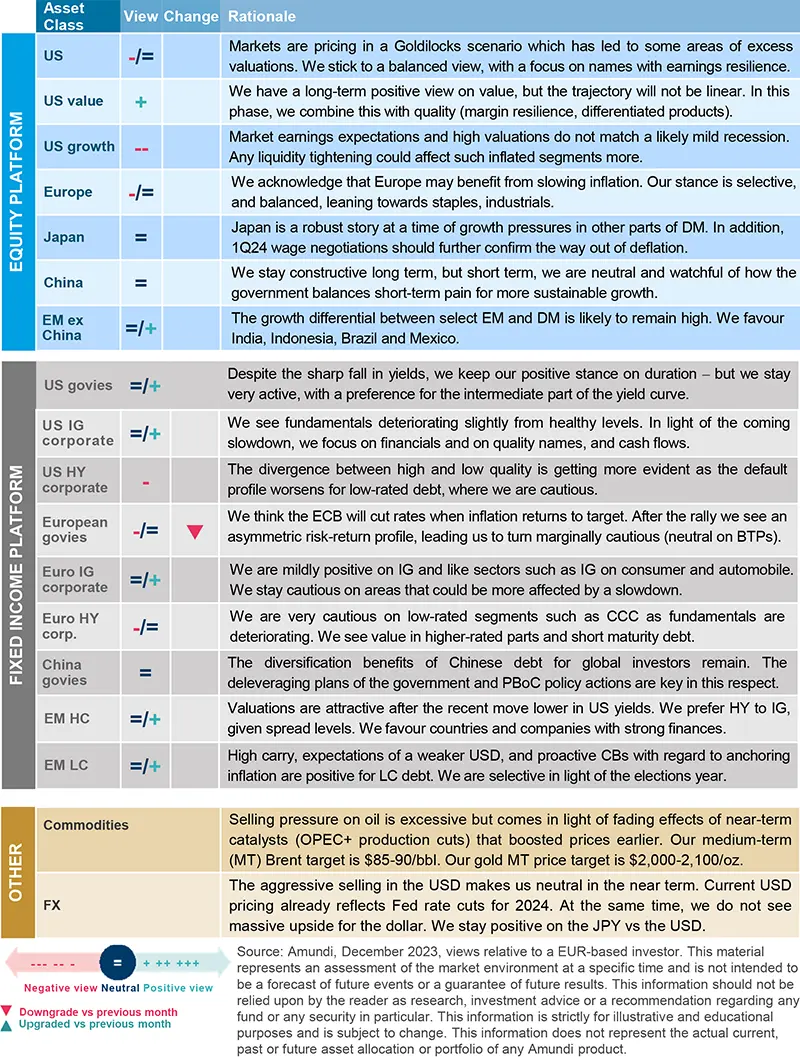

Amundi asset class views

Definitions & Abbreviations

- ECB= European Central Bank, DM= Developed Markets, EM = Emerging Markets, CBs = central banks, IG = investment grade, HY = high yield, HC = Hard Currency, LC = Local Currency. For other definitions see the last page of this document.

- Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.