Summary

The late-cycle environment continues to play out

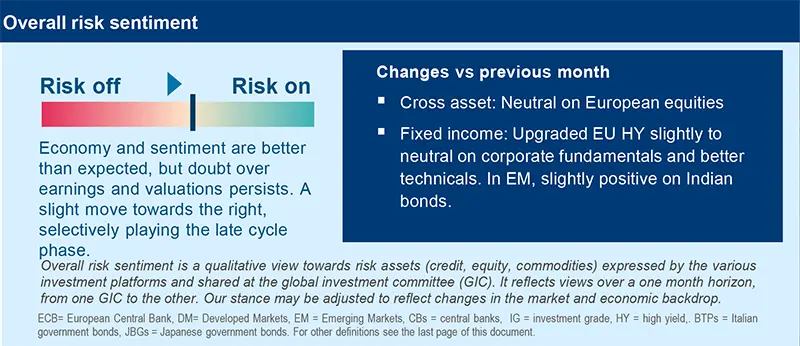

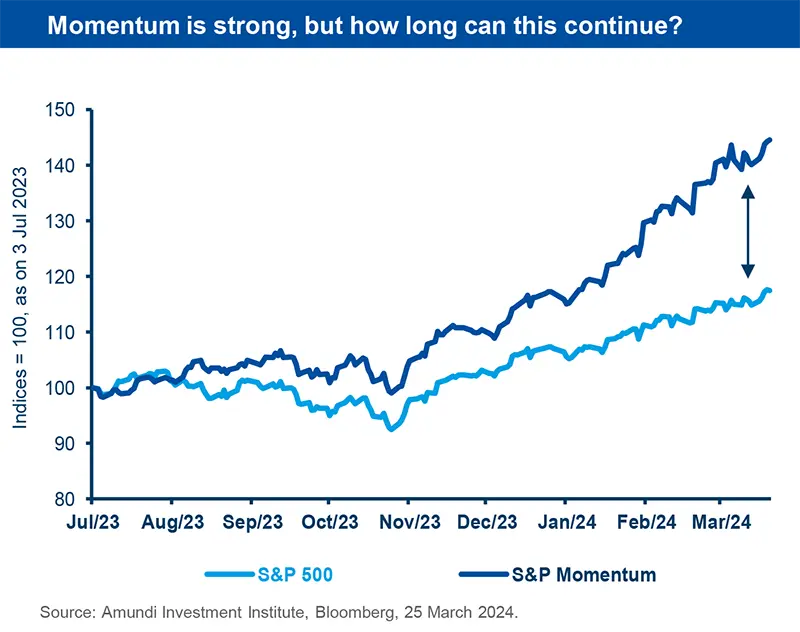

We acknowledge the trend strength in risk assets, but high valuations are preventing us from massively shifting our risk gear upwards from a structural perspective.

A resilient US economy (owing to consumption and wealth effects) and strong earnings expectations for the year are driving the recent upside in equities and increase in yields. Now, the big questions are whether this can continue given the already strong market movements, and whether these earnings expectations are credible?

On the economic front, the past strength led us to forecast a less ugly US slowdown, therefore extending the late-cycle environment. Nonetheless, we do not see this as a beginning of a new cycle, and expect a slowdown around the middle of the year, and continued disinflation. The factors listed below will be crucial to understand the direction of the economy and markets:

- US labour market. A moderation in demand is likely, led by a shift to higher savings, lower consumption and weak labour markets (stress in SMEs* employing a large part of the labour force), along with subdued investment.

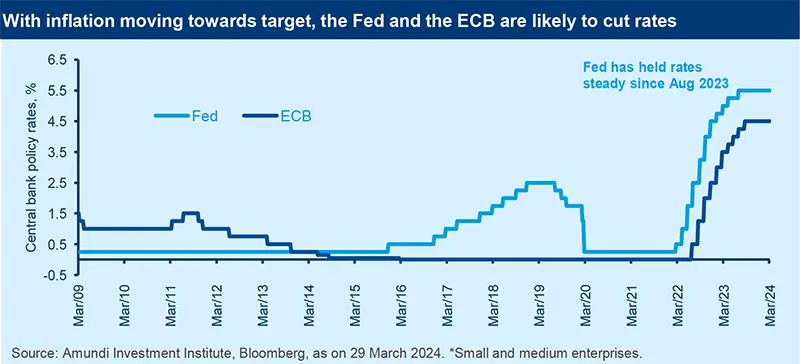

- Monetary policy divergences, with inflation in focus. While the BoJ raised rates after 17 years, the Fed and the ECB are looking to cut rates but would like to be sure on the future direction of inflation first.

- US elections and geopolitics. Volatility may rise, as we enter a more active campaign phase. Geopolitics and the risks of high debt globally may provide long-term support to gold.

- Emerging markets’ (EM) resilience. We slightly upgraded our growth forecasts in EM, mainly due to Asia and India, on strong domestic demand and exports. However, our growth expectations for China do not change.

Given this backdrop, we outline our stance on select areas below:

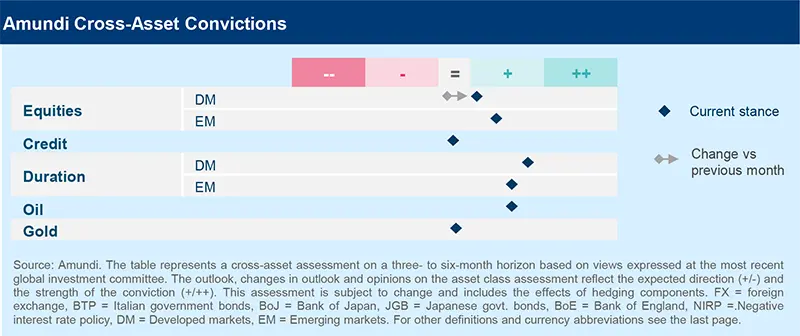

- Cross Asset. Risk assets have priced in the improved outlook for earnings and growth and continue to benefit from positive market sentiment. Without taking additional risks, we maintain our positive duration stance. In bonds, we are also slightly positive on Italian BTPs but are cautious on JGBs. In equities, we are overall positive. We are marginally constructive on Japanese equities, while we are neutral in the US and now on Europe. In Emerging Markets, we are positive on bonds and on equities (India, Indonesia and South Korea). In FX, we see some strength in the USD, BRL and INR, but fine-tuned our views based on recent movements. Overall, we prefer a diversified stance, with sufficient protections on geopolitical tensions (oil) crucial in the current environment.

- In fixed income, the evolution of inflation will be the main driver of policy actions and with that in mind we remain active and positive on US and UK duration. In Europe, we are close to neutral now after the recent move up in yields and dovish messaging from the ECB, but are defensive on JGBs. In corporate credit, fundamentals remain strong for Investment Grade, but default rates in low-rated credit (CCC) are rising, particularly in the US. Therefore, higher dispersion based on quality is likely. Thus, our focus is on quality, and we find lower maturity credit selectively attractive. In Europe, we favour Investment Grade over High Yield, and maintain a preference for higher quality (BB) or short maturities.

- Excessive sentiment in US stocks supports an equal-weight approach. We stay balanced by exploring defensive idiosyncratic opportunities rather than any particular traditional sector. On the other hand, in industrials, high-quality materials is selectively an attractive sub-sector. In Europe, we prefer blending quality cyclicals with a defensive stance. Sluggish growth in the region will continue, which leads us to upgrade staples, while we are cautious on technology. Overall, we like quality, and value in Japan and the US.

- Our structural stance on EM is constructive. We combine factors such as fiscal risks and external vulnerability for countries with our bottom-up views. This allows us to be positive on India, Indonesia, South Korea, and in LatAm (Brazil, Mexico). EM debt should benefit from Fed rate cuts along with continuing EM disinflation. However, geopolitical and idiosyncratic risks keep us vigilant.

Three hot questions

|

Monica DEFEND |

Market sentiment may remain positive if we don’t see an economic slowdown and inflation also doesn’t surprise. However, areas of excess have built up, and underscore the need to remain vigilant.

1| How do you assess the performance of equities over the past few weeks?

Markets seem to be operating under the belief that the disinflation process will continue, and that a Fed pivot is almost a given. While the slowing inflation story is still on track, uncertainty could emerge with respect to the timing and magnitude of cuts, as both the Fed and ECB remain data dependent. In addition to this Fed put, benign fundamentals in the form of economic activity and better-than-expected earnings are providing a boost to risk assets, including equities. As long as disinflation is not seriously questioned, markets could continue to benefit.

Investment consequences:

- From a cross asset view, marginally constructive for equities, cyclical commodities and inflation linkers.

2| What were the main trends in Q4’23 earnings in US, Europe?

As of 8 March, around 99% of S&P 500 companies had reported their results for the quarter ended December 2023. This quarter is proving to be very strong for US markets, led by the communication services, consumer discretionary and technology sectors. Earnings growth in these sectors was much stronger-than-expected at 53%, 37% and 24% (year-on-year), respectively. However, the situation in Europe has been different as Q4 is expected to be the third consecutive quarter of negative earnings growth, by the time all companies have reported

Investment consequences:

- Bias to Quality, Value, Equal-weighed markets in US

- Favour Quality in Europe and Value in Japan

3| How do you view the outcome of China’s recent NPC?

The National People’s Congress didn’t move the needle for us in terms of economic growth. We think the fiscal deficit target for this year of 8.2% is higher than 2023, and while moderately expansionary, it will not be sufficient to revive demand. Thus, despite the government’s 5% growth target, we stick to our 3.9% target, which is below consensus. On the inflation front, weak consumption means CPI inflation should stay low, and excess manufacturing capacity is likely to weigh on corporate profit margins.

Investment consequences:

- Close to Neutral on Chinese equities

- Neutral on Chinese government bonds

MULTI-ASSET

Be disciplined amid market exuberance

|

Francesco SANDRINI |

John O'TOOLE |

We have moved to a neutral stance on developed market equities and more recently on Europe, without adding risks on segments with inflated valuations.

Sentiment is supportive for risk assets tactically and we do not see a US profit recession. But any disappointment on the growth front or in earnings could impact complacent markets. At the same time, an absence of negative news on economic growth would mean this rally may continue. Thus, instead of taking big leaps on risks, we remain prudent and look for opportunities selectively in Asia where earnings growth is more evident. In addition, investors should maintain hedges and a diversified stance.

With a close to neutral stance on DM equities, we acknowledge the minute nuances across the globe. For instance, we are neutral on the US and upgraded Europe to neutral mainly for risk mitigation purposes, but are slightly positive on Japan. In EM, we remain constructive through India, Indonesia, South Korea. In Korea, we marginally raised our positive views owing to improving earnings and potentially better corporate governance.

We are positive on duration in the US and Europe amid attractive yields, potential rate cuts and diversification benefits. However, in light of high government debt and any future inflation surprises, we stay active and vigilant for opportunities if yields rise further. We are also positive on Italian BTPs owing to a potential move lower in core European yields. However, on JGBs our cautious outlook is justified by the recent BoJ move to end NIRP. We are monitoring its future actions, and growth and inflation trends.

Our preference for quality and attractive valuations in corporate credit has not changed as we see increasing differentiation going forward. Thus, we like EU IG. EM bonds offer attractive carry and EM disinflation is progressing. But we acknowledge the difficulties in last mile inflation and believe room for spread compression is getting limited. At the same time, near-term dollar strength may slightly affect returns, hence we stay vigilant.

Tactically, we are slightly optimistic on USD vs the SEK and vs CHF, but cautious vs the yen. In EM, we like the BRL but prefer expressing this view now against the EUR. On INR/CNH, we reduced our stance after strong performance, but believe it still offers good carry and fundamentals.

Even as US inflation is declining, we cannot rule out temporary surprises, underscoring the need to maintain protection on US duration. In addition, oil remains a good hedge against geopolitical risks such as in the Middle East.

FIXED INCOME

Carry is attractive, but balance it with quality in credit

| Amaury D'ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Marco PIRONDINI CIO of US Investment Management |

The messaging from the Fed and the ECB has been focused on how important it is for inflation to come down for them to reduce rates, even if the debate continues on whether the neutral rate has moved higher. Markets, for their part, adjusted expectations of interest rate cuts as core yields moved higher and positive sentiment around economic activity persisted. The latter has even fed into the corporate credit markets, but looking ahead, we cannot ignore the risks of idiosyncratic credit events, particularly in lower-rated segments. Hence, we are cautious and disciplined on highly-indebted companies that face excessive interest costs. However, we are positive on quality sides in DM and EM bonds, where carry is robust.

- After a relatively dovish ECB, we are back to neutral on European duration and remain positive on UK. But we stay cautious on Japan.

- In credit, we like banks over non-banks as industrials will suffer more if the economy decelerates, and favour IG.

- In HY, we are cautious. Lower-rated credit would suffer more from a slowdown. But selectively we like short maturity debt with attractive carry and where fundamentals are relatively better.

- We stay slightly positive but flexible on duration and are monitoring inflation and rates volatility. Yields are still attractive in government bonds.

- In corporate credit, we favour IG over HY, and financials over non-financials. In general, there is better value in short maturity credit.

- Even though spreads in securitised credit have compressed recently, they still offer long-term value.

- In a region characterised by slowing inflation, and an asset class likely boosted by Fed rate cuts, we stay constructive.

- However, it presents numerous idiosyncratic stories, such as India (attractive carry, prudent central bank), Egypt (agreement with multilateral institutions) and Argentina.

- We like HC and corporate debt but have preference for HY given the carry and expectations of limited volatility there.

EQUITIES

Fundamentals are the compass in inconsistent markets

| Barry GLAVIN Head of Equity Platform |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Marco PIRONDINI CIO of US Investment Management |

Stocks are pricing in a rosy scenario in terms of economic growth and that has led to very strong upside already this year, with some broadening of the rally evident recently. These movements are further aided by ample liquidity and robust earnings, particularly in the US. However, if we dig deeper, we are seeing divergences among segments – earnings for megacaps have been better than rest of the market, and this has resulted in extreme valuations in some cases, despite an increase in yields. Thus, amid high dispersion, we see opportunities from a more fundamental perspective, with a balanced stance overall. In terms of sectors, our preference is for US value, Japan, and more broadly quality (high margins, differentiated products, etc.) and dividends, including in Europe and EM.

- We believe blending quality cyclicals and defensive is important in this market. In particular, we upgraded our views on defensives through consumer staples.

- At the other end, we like banks owing to their high dividends and earnings growth. However, we are cautious on discretionary and tech (albeit slightly less than before).

- Overall, earnings are critical, given that valuations leave little room for disappointment.

- The rally is broadening, but we do not see this as a time to increase risks. We remain cautious on mega-caps, and favour value.

- With a balanced approach, we explore segments with attractive valuations, and like an equal-weighted approach. On one end, we like defensives, but rather than framing our views through traditional sectors, we favour idiosyncratic businesses.

- We also like quality financials and materials.

- Structural opportunities across EM, for instance in Asia (Indonesia, India) but high need for selection.

- Country-wise, we are positive on South Korea owing to dividends and improving corporate governance. In China, there are trends around share buybacks but we do not change our views yet.

- In Brazil, we are vigilant on any government meddling in the corporate sector.

- However, we are cautious on Taiwan and Malaysia.

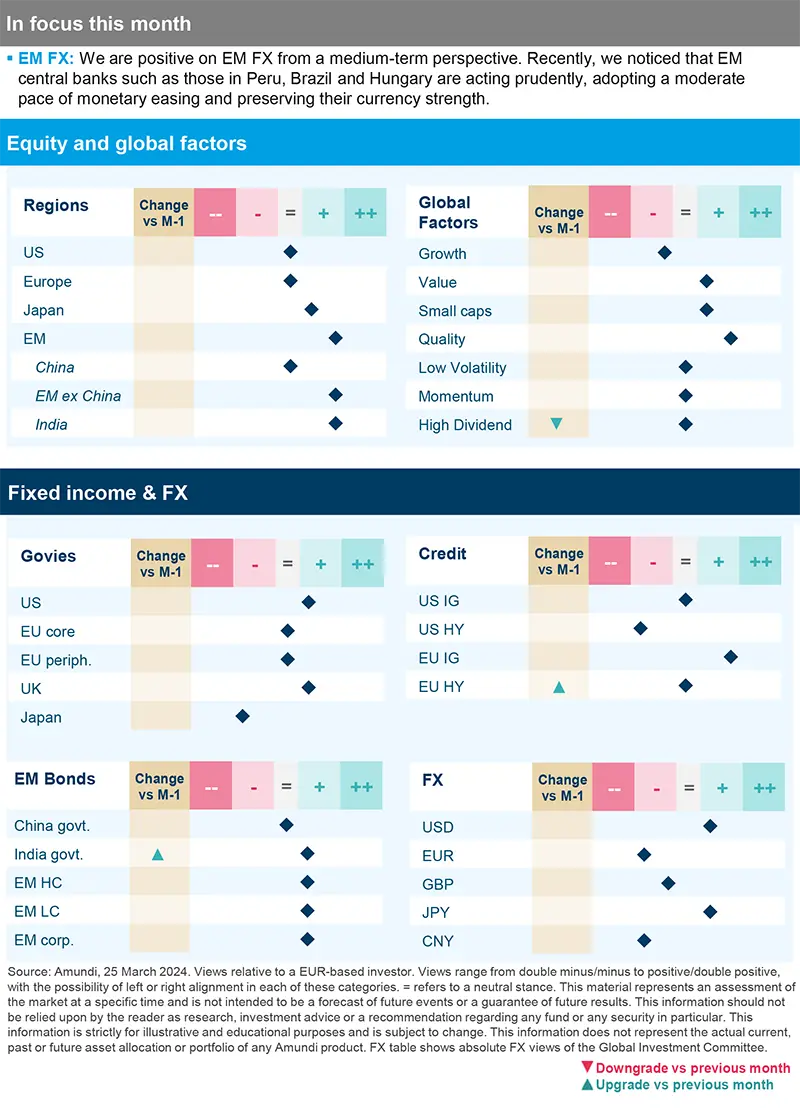

Amundi asset class views

Definitions & Abbreviations

- Currency abbreviations:

USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.