Summary

Crisis memories return in vulnerable markets

We are moving towards a more uncertain economic backdrop, with lower visibility on central bank actions. This calls for a prudent stance on risk assets.

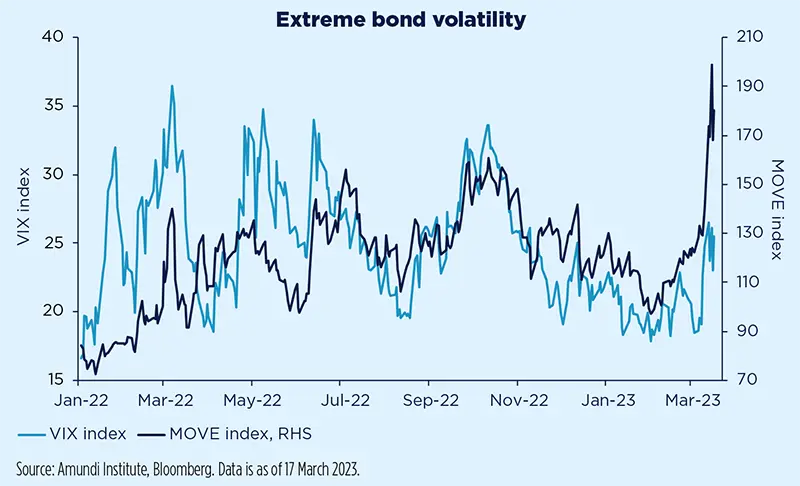

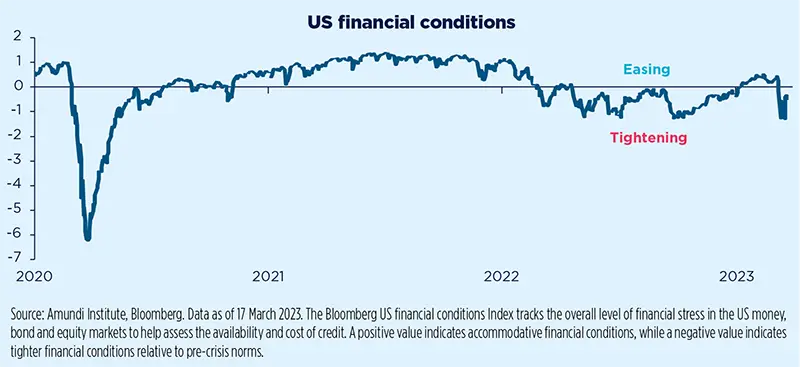

March brought a wake-up call to markets after a complacent start to the year. The trigger was the failure of Silicon Valley Bank and other US regional banks, followed by Credit Suisse in Europe. The repricing of core yields and changes to market expectations regarding central bank actions have been massive in both the US and Europe. Bond volatility reached the highest levels since the Great Financial Crisis, while equity volatility also spiked, but to a lesser extent.

Looking ahead, we think investors should consider the following factors:

- Concerns around systemic risks. We don’t think we face a systemic crisis as banks in the US and Europe are in much better shape compared to 2008, with more stringent regulation. Importantly, European regulators’ affirmation that they do not aim to change the credit hierarchy (the Swiss case is idiosyncratic) should provide support to markets.

- Economic growth in stressful conditions. Recent events mean the economy’s landing could be harder than previously expected. The credit crunch will impact growth, and also determine how pronounced the recession is. While globally the Chinese reopening will help, it will not be sufficient to offset the US recession.

- Central bank actions when inflation is persistent. Swift action from CBs to stabilise markets indicates that they are taking this turmoil seriously, while at the same time continuing to focus on inflation. They will now be even more data dependent, with little or no policy guidance. This, in turn, will keep bond volatility high as inflation is still above targets.

- The impact on EM. The EM world has been affected by the aforementioned volatility, but the EM vs. DM growth advantage should persist. Selectivity will be key in a more vulnerable market environment.

Given this increasingly risky environment, we confirm our cautious stance, with specific points below:

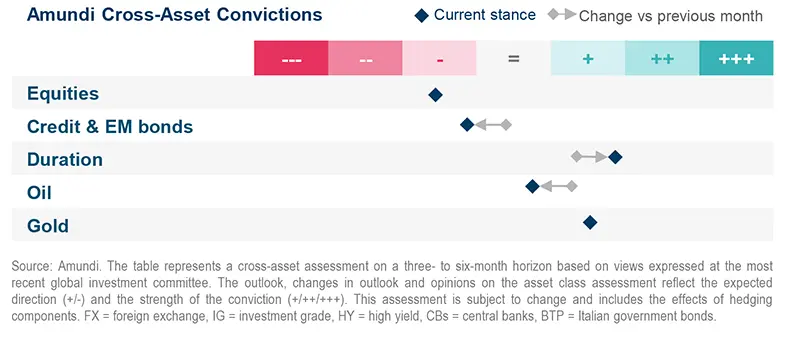

- From a cross-asset perspective, to strengthen safeguards we had raised our already positive stance on US duration before the recent downward repricing in yield. We are increasingly cautious on high yield credit. On risk assets, we remain defensive in equity, where our preference remains for China. We continue to favour high-quality names in both equities and credit. We also think investors should enhance their hedges on US equities and stay well-diversified through gold. On oil, we have become tactically neutral in light of the slowing economic growth.

- In fixed income, movements in rates markets have been very strong, initially driven by sticky inflation readings, and then by the flight to safety move from the banking turmoil. For our part, we remain active and keep a neutral to positive bias on duration in US fixed income, while we have a slightly defensive stance on European duration. In credit we focus on high-quality names and avoid highly leveraged businesses in both the EU and the US, while we remain cautious on HY. Overall, we think the European banking system is robust and that the current repricing could offer opportunities in names with robust capital positions and governance standards.

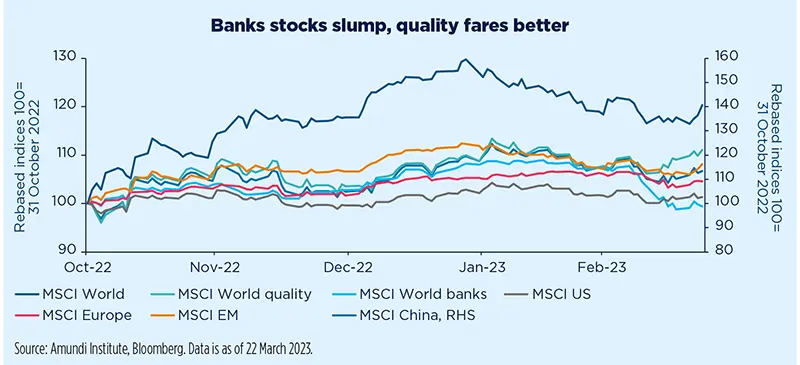

- On equities, we have been cautious for quite some time because we were not comfortable with the excessive valuations. The recent volatility in the US and Europe has been partly a result of markets being complacent. We think investors should aim to benefit from the strong performance so far in segments such as cyclicals, and that they should now consider exploring defensive areas with attractive valuations and strong earnings potential. On the other hand, as inflation remains above central bank targets, we favour dividend-paying stocks that boost investor income. Finally, this turmoil reaffirms our stance on quality, with a value tilt and a preference for non-US banks with a high selection focus.

- The risk-off sentiment mainly affected EM in HC debt, which had performed well recently, but LC looks resilient. With the EM-DM growth differential and the weak dollar acting as positives for EM, we are prioritising selection. In LC we like Mexico, Colombia, South Africa and India. We also like countries such as Thailand, where the hiking cycle has almost reached an end. In equities, we are positive on China, but have lowered our positive stance on Brazil. On the other hand, select Latin American FX, such as MXN, offer attractive carry.

Three hot questions

|

Monica DEFEND |

We confirm our cautious view on equities, and favour value, quality, and high-dividend oriented names.

1| What is your view on the European banking sector?

We expect net interest margins will be smaller than previously anticipated and volumes will be lower given tighter credit conditions following the recent turmoil. This will have consequences for European earnings growth as a whole as banks were expected to be the number one drivers of European earnings per share (EPS) in the short to medium term. European banks’ earnings growth will still be positive, just less so than previously expected. Concerns about credit crunches appear excessive amid the strong liquidity profiles and capital positions of European banks.

Investment consequences

- Cautious on European equities overall.

- Focus on quality.

2| What is your take on China’s institutional reform and government reshuffle?

President Xi Jinping’s institutional reforms have reinforced the concentration of power, while creating new ‘super ministries’ directly under the party to oversee finance and technology. These reforms are also aimed at increasing defence spending and strengthening domestic security, reflecting growing concerns over regional instability and domestic unrest. On the economic front, growth could still surprise to the upside, especially in the housing sector, while the long-term agenda aims to stabilise the debt-to-GDP ratio.

Investment consequences

- Cautious on equities overall, positive on China and Hong Kong.

- Defensive on high yield, but constructive on investment grade, especially short duration.

3| What is your final take on the Q4 reporting season?

The Q4 reporting season has seen mixed EPS results in the US, while Europe proved stronger than expected. The S&P 500 EPS was in negative territory for the first time since 2020. The Q4 results out so far – with some 96% of companies having reported – point to -3.2% from +4.4% in Q3, mainly driven by margins being revised down. Stoxx 600 earnings fell sharply, but by less than expected, remaining strong at +16.9%, down from +33.1% in Q3.

Investment consequences

- Defensive stance on US equities confirmed.

- Preference for value, quality and high dividend styles.

Enhance safeguards

|

Francesco SANDRINI |

John O'TOOLE |

Market movements reinforce our views on duration and our cautious, diversified stance. Investors should now strengthen hedges in this phase of low growth and stability risks.

Our call to stay defensive and not get carried away by the risk asset rally since the start of the year has been validated by the recent market stress. While excessive valuations were one reason for the stress, economic, earnings and contagion concerns also contributed and these concerns remain. In addition, there is increasing uncertainty around geopolitical tensions. The evolving eco-political environment calls for a defensive stance on risk assets and underscores the need to enhance portfolio protection. At the same time, investors should explore yield curves across geographies, for example, beyond core Europe, and stay well-diversified through assets such as gold.

High conviction ideas

Weak corporate margins, expensive valuations and the potential rebalancing of large pension funds away from stocks make us cautious on developed market (DM) equities. We expect the market to continue to be held hostage to adjustments in terminal rate expectations in the US and Europe. In the US, amid the higher volatility we remove our relative preference for small caps. In contrast, we keep our positive view on China due to the improving economic outlook, cheap relative valuations and scope for increasing inflows.

In fixed income, we raise slightly our constructive view on US Treasuries, which should gain from the flight to safety driven by higher recession risks and financial stability concerns. In this risky environment, the diversification benefit of government bonds has returned. We remain active across geographies, playing opportunities in the Swedish and Canadian curves. We also are mildly positive on the 10Y BTP-Bund spread, but cautious on Japanese government bonds owing to our expectation that the Bank of Japan could give up its control of the yield curve.

We do not think current corporate credit valuations are justified, due to the potential deterioration in financial conditions. We are increasingly cautious on EU HY as we see indications of a worsening environment in the future for HY overall. Even though credit supply has been well received by the market, some profit-taking is materialising. Thus, flows in the credit market will now be less supportive of spreads looking ahead, even more so after recent events.

In FX, the USD forms a key driver of our FX strategies. We think it should gradually weaken and hence we are no longer negative on the GBP against the USD, but this is more due to the dollar and less about any strength in the pound. We upgrade the AUD/USD and stay positive on EUR/USD. In EM, we are now constructive on MEX/EUR given the attractive carry. The currency should benefit from the structural effects of nearshoring (being close to the US) and the robust monetary policy framework. Elsewhere in EM, we are also positive on BRL/USD and ZAR/USD.

Risks and hedging

Looming risks around economic growth and still-high inflation underline the importance of gold as a safe asset. On the other hand, we see some risks around weakening demand in the US and Europe amid tightening lending standards that could affect overall consumption, potentially impacting oil. Thus, we are tactically neutral on oil for now, but will keep monitoring this stance. Finally, we see scope for strengthening financial hedges, particularly on US equities, and maintaining protections in credit.

Government bonds back as portfolio diversifiers

| Amaury D'ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

Tightening conditions and slowing consumption may pressurise corporate cash flows, potentially worsening the default outlook.

Overall assessment

Sharp yield movements in the US and Europe, and the repricing in the market’s terminal rate expectations, have been a result of heightened volatility and tightening financial conditions. While CBs and regulators were swift to provide liquidity support to markets, their task is not yet done as high inflation and stability concerns remain. Thus, they must maintain that delicate balance to maintain their credibility. This means investors should actively explore bonds, particularly US government bonds, to provide some stability to their portfolios at a time of tightening financial conditions in the markets and lending standards in the economy. They should also include inflation protection assets and explore selective opportunities in credit and EM debt, with a focus on quality.

Global and European fixed income

High inflation leads us to be slightly cautious on duration overall through Europe and Japan, but we are now neutral on the US after the recent concerns over financial stability and growth. However, we remain flexible here. On breakevens, we are now positive on Europe through BTPs, but believe 2Y US breakevens are now expensive. For risk assets, markets are not fully recognising issues such as wage growth pressures, which could affect earnings and eventually cause a deterioration in credit metrics. While we are marginally positive on credit, we stay cautious on HY but favour EU IG. Corporate balance sheets in IG are strong, leverage is low and we largely see fixed rate loans. At a sector level, we acknowledge the volatility in banks but believe the repricing may present opportunities in financials with strong capital positions. In addition, we like green bond issuers with whom we can engage and improve their ESG performance.

US fixed income

The Fed faces a question of credibility at a time when it is grappling with the difficult task of taming inflation. In this environment, we keep a slightly constructive outlook on duration but stay active. Risks to credit spreads have increased, particularly for the weaker, highly leveraged segments. While spreads have widened across the board, markets are still not fully accounting for the slowdown. Hence, investors should consider using the rallies to lock in performance. Overall, we favour financials over non-financials such as industrials, and IG over HY, and we like names with robust capital buffers. In securitised markets, we think the US consumer is likely to retrench somewhat as the job market weakens and unemployment climbs. This will be compounded by banks tightening their lending standards and increasing pricing across loan books. Thus, we are very vigilant.

EM bonds

Recent movements in LC could open up opportunities and we focus on LatAm, South Africa and India. We also favour countries where the hiking cycle is almost at its end (Thailand, Colombia). Overall, EM growth and a stable policy backdrop are positive for EM assets, including HC. We are monitoring the political environment in Turkey, but do not see insolvency risks. Selection is essential amid the geopolitical tensions over China and the US.

FX

We are close to neutral on USD amid the fading rates advantage of the US, but positive on safe haven FX (CHF, JPY). We favour MXN and BRL in LatAm and IDR and INR in Asia.

Explore quality resilience

| Kasper ELMGREEN Head of Equities |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

Investors should avoid expensive names and consider moving towards quality businesses with strong balance sheets.

Overall assessment

The failure of some regional US banks and the stress in Europe, and the resultant volatility, has led to questions about the sustainability of market’s exuberance. Although our stance has been cautious all along, recent events lead us to reassess our views based on fundamentals. Though supported by falling energy prices, the consumption backdrop is still weak as inflation continues to tax corporates/individuals. Hence, investors should focus on companies with strong balance sheets in the quality and value spaces. In these areas, we look at earnings potential of businesses with operational efficiencies. There are opportunities in less-cyclical parts, and investors should explore countries such as China with limited correlation with DM, with a vigilant stance.

European equities

Even though fundamentals are deteriorating, we think the Q4 earnings season has been slightly better than expected, but it is too early to start discounting a better scenario. Instead of getting overwhelmed by movements, investors should prioritise valuations and stay balanced, favouring the quality and value areas of the markets. This may also be a time to rotate within the key convictions. For instance, we prefer well capitalised core European retail banks. In a barbell style approach, we explore quality cyclical businesses and defensive stocks, such as those in staples and healthcare. But in some cyclicals areas where valuations are now excessive (consumer, industrials), investors should be cautious. Having said that, we continue to maintain a preference for quality retail banks, given the beneficial effect of high interest rates on their net interest margins.

US equities

We believe current valuations are not justified given the inflation backdrop, higher interest rates expectations and weak soft data. In the latest Q4 results, we noted that earnings growth was lower than the previous quarter and forward guidance from companies was weak. As a result, we assess companies’ quality of earnings to understand whether the increase in profits has been a result of the strength of business models and is therefore repeatable. Here, we favour companies with high operational efficiencies and those with the potential to reward shareholders. In particular, we like quality, value names in sectors such as banks and energy, but avoid unprofitable growth and mega-cap names. In addition, there are select names in capital goods and energy that should be able to outgrow their sectors. However, valuations in discretionary are expensive and the sector will be affected by persistent wage pressures. Relatively defensive names in healthcare equipment and services and life science tools sectors are also attractive.

EM equities

EMs are displaying geopolitical/domestic political risks but we see select opportunities led by the recovery in China, attractive valuations and improving earnings. For instance, we are positive on China and Brazil. On the latter, while we are less positive than before, we expect a more market-friendly stance from the government in the future. We are constructive on consumer discretionary but keep a negative view on healthcare. On a relative basis, energy is preferred to materials and value to growth.

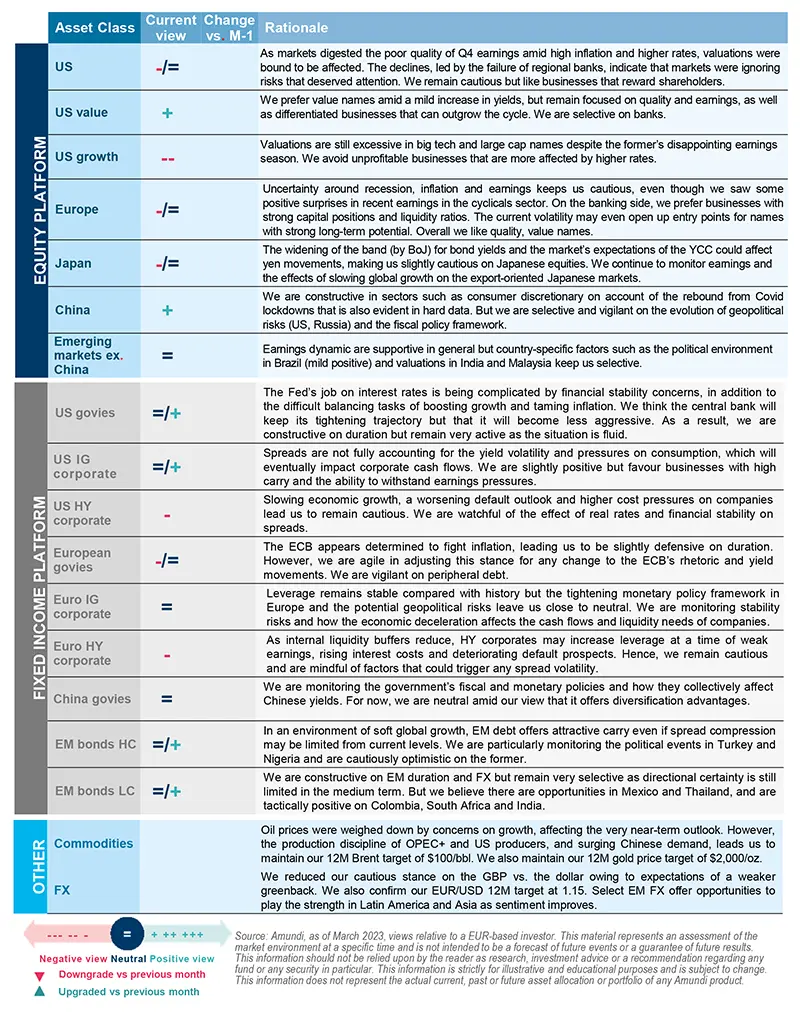

Amundi asset class views

Definitions & Abbreviations

- ADR: A security that represents shares of non-US companies that are held by a US depositary bank outside the US. They allow US investors to invest in non-US companies and give non-US companies access to US financial markets.

- Agency mortgage-backed security: Agency MBS are created by one of three agencies: Government National Mortgage Association, Federal National Mortgage and Federal Home Loan Mortgage Corp. Securities issued by any of these three agencies are referred to as agency MBS. Beta: Beta is a risk measure related to market volatility, with 1 being equal to market volatility and less than 1 being less volatile than the market.

- Breakeven inflation: The difference between the nominal yield on a fixed-rate investment and the real yield on an inflation-linked investment of similar maturity and credit quality.

- Carry: Carry is the return of holding a bond to maturity by earning yield versus holding cash. Core + is synonymous with ‘growth and income’ in the stock market and is associated with a low-to-moderate risk profile. Core strategy is synonymous with ‘income’ in the stock market.

- Correlation: The degree of association between two or more variables; in finance, it is the degree to which assets or asset class prices have moved in relation to each other. Correlation is expressed by a correlation coefficient that ranges from -1 (always move in opposite direction) through 0 (absolutely independent) to 1 (always move in the same direction). Credit spread: The differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration the possible embedded options. Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.

- Curve flattening: A flattening yield curve may be a result of long-term interest rates falling more than short-term interest rates or short-term rates increasing more than long-term rates.

- Curve steepening: A steepening yield curve may be a result of long-term interest rates rising more than short-term interest rates or short-term rates dropping more than long-term rates.

- Curve inversion: When long-term interest rates drop below short-term rates, indicating that investors are moving money away from short-term bonds.

- Cyclical vs. defensive sectors: Cyclical companies are companies whose profit and stock prices are highly correlated with economic fluctuations. Defensive stocks, on the contrary, are less correlated to economic cycles. MSCI GICS cyclical sectors are: consumer discretionary, financial, real estate, industrials, information technology and materials. Defensive sectors are: consumer staples, energy, healthcare, telecommunications services and utilities.

- Duration: A measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates, expressed as a number of years. High growth stocks: A high growth stock is anticipated to grow at a rate significantly above the average growth for the market. Liquidity: The capacity to buy or sell assets quickly enough to prevent or minimise a loss. P/E ratio: The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS).

- NBFI: A non banking financial institution provides select financial services but doesn’t have a full fledged banking license.

- Net interest margin: It is a measure that compares a bank’s interest income from lending with its interest expense on its liabilities (such as bank deposits), expressed as a percentage of its assets.

- QE: Quantitative easing (QE) is a type of monetary policy used by central banks to stimulate the economy by buying financial assets from commercial banks and other financial institutions.

- Quality investing: This means to capture the performance of quality growth stocks by identifying stocks with: 1) A high return on equity (ROE); 2) Stable year-over-year earnings growth; and 3) Low financial leverage.

- Quantitative tightening (QT): The opposite of QE, QT is a contractionary monetary policy aimed to decrease the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.

- Non-SIFI: A systemically important financial institution (SIFI) is an institution that the US Fed and regulators believe would pose a serious risk to the financial system and the economy if it collapses. A non-SIFI is an institution that doesn’t fall in this category.

- TIPS: A Treasury Inflation-Protected Security is a Treasury bond that is indexed to an inflationary gauge to protect investors from a decline in the purchasing power of their money.

- Value style: This refers to purchasing stocks at relatively low prices, as indicated by low price-to-earnings, price-to-book and price-to-sales ratios, and high dividend yields. Sectors with a dominance of value style: energy, financials, telecom, utilities, real estate.

- Volatility: A statistical measure of the dispersion of returns for a given security or market index. Usually, the higher the volatility, the riskier the security/market.

- Yield curve control: YCC involves targeting a longer-term interest rate by a central bank, then buying or selling as many bonds as necessary to hit that rate target.