Summary

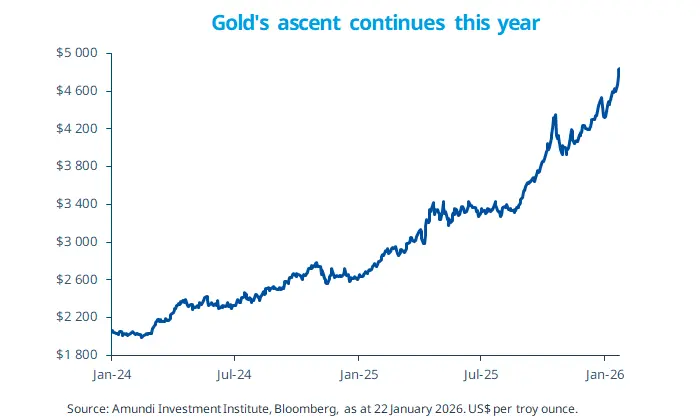

The World Economic Forum in Davos confirmed that the familiar, established global order is over. Instead, a phase of controlled disorder — and persistent market volatility — lies ahead. Investors could mitigate this volatility through diversification and safeguards such as gold.

In Davos, Canadian PM Carney warned that mid‑sized countries must develop a system to replace the US‑centric global order.

- One year after Trump's inauguration, geopolitical risk is back in focus, along with the need to hedge against it.

Diversification away from US assets will be driven by structural trends, such as rising US deficits and global central banks diversifying their reserves into non‑dollar‑denominated assets.

The global equilibrium is evolving, particularly amid significant geopolitical shifts that are causing increased volatility in financial markets. President Trump's threat to impose additional tariffs on eight NATO members — unless the United States were allowed to purchase Greenland from Denmark (a threat that was withdrawn a few days later) — initially caused a short market sell‑off, followed by a relief rally last week. Meanwhile, the European Parliament voted to suspend ratification of the EU‑US trade deal, which would otherwise have come into force on 7 February. This does not mean the deal is dead, but that Europe is adopting a 'wait‑and‑see' approach.

These — and likely future — developments may lead to high and persistent market volatility. Therefore, global investors should maintain a diversified approach with safeguards such as gold, whose price hit a new all‑time high last week.

This week at a glance

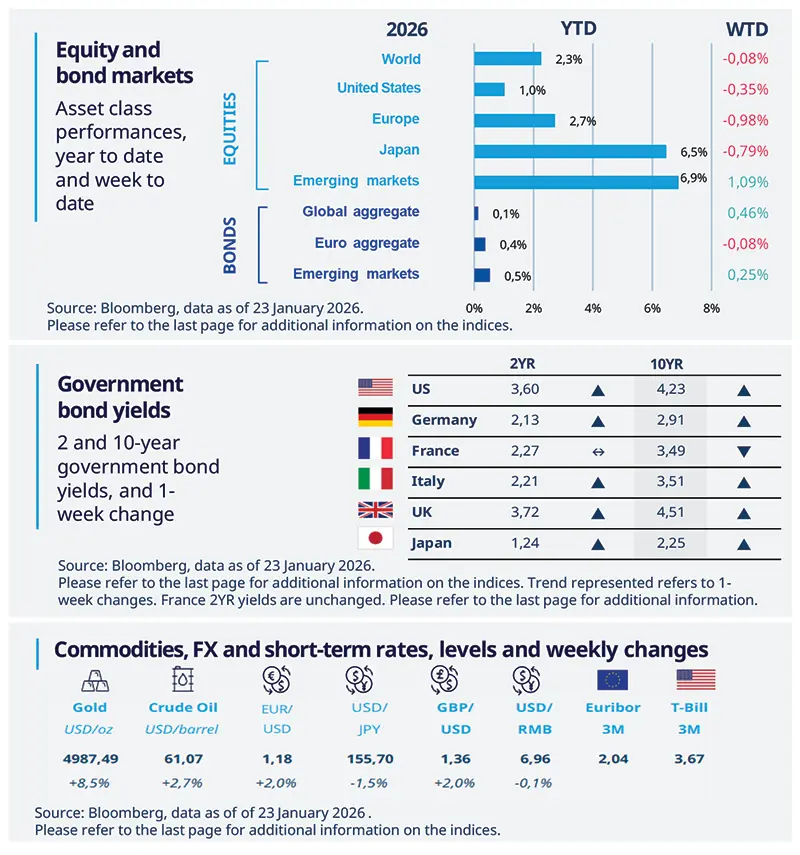

Most global equities fell after heightened geopolitical tensions — notably President Trump’s threats concerning Greenland’s sovereignty and the prospect of additional tariffs — although those threats were later withdrawn. By contrast, EM rose. Bond yields increased in most countries, including Japan, amid growing fiscal concerns. Unsurprisingly, gold prices were pushed higher.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 23 January 2026. The chart shows US headline and core CPI.

Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US labour market to cool down modestly

In the week ending 17 January, initial unemployment claims rose to 200,000, remaining close to an all‑time low. Meanwhile, continuing claims declined gradually, possibly suggesting that, while the labour market is less dynamic than in the recent past, workers are still able to find jobs and avoid long‑term unemployment. Companies appear to have labour costs under control through attrition and reduced hours rather than widespread layoffs, helping to cool the labour market without severe deterioration.

Europe

EZ inflation eases in December

The EZ inflation figure for December was revised down slightly to 1.9% YoY, while core inflation was confirmed at 2.3%. Wage developments remain on track to decelerate gradually, supporting further easing in services inflation. Looking ahead, January EZ inflation should soften further, driven by lower energy inflation; declines in core and food inflation will also contribute to the moderation. We anticipate that core inflation will ease as well, with decreases in most major EZ countries.

Asia

China frontloads stimulus amid slowing demand

China's GDP grew 4.5% YoY in Q4 2025, supported mainly by exports and industrial production, while domestic demand and investment remained weak. Although China achieved its annual growth target of 5.0% in 2025, the uneven recovery and deteriorating domestic demand have prompted policymakers to front‑load targeted fiscal and monetary easing. The MoF pre‑allocated funding for a consumer trade‑in programme and for infrastructure projects, while the PBoC announced a 25 bp relending rate cut as part of a suite of structural monetary policy measures.

Key dates

Germany IFO business climate, US durable goods orders |

Fed interest rates decision, Brazil interest rates decision |

EZ GDP growth and unemployment rate, Germany inflation |