Summary

The sequencing of tariffs, tax cuts and deregulation complicates the Fed’s mission and raises concerns about near-term inflation pressures. Nevertheless, we anticipate substantial rate cuts in the second half of the year as weaker growth emerges.

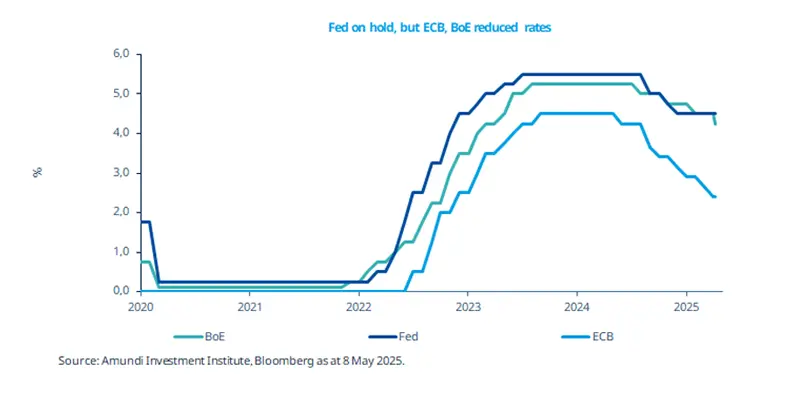

The Fed remained in a ‘wait and see’ mode, whereas the BoE and ECB (last month) cut interest rates in their latest meetings. Trump’s approval rating -- currently at 41% -- is the lowest for any president at 100 days since Eisenhower.

This policy divergence is a result of higher consumer inflation expectations, which the Fed likely considered in its latest decision.

- In contrast, the ECB faces limited risks on inflation, for now. This calls for a global approach to asset allocation.

The Fed refrained from cutting rates in its latest policy meeting, as it awaits more clarity on the impact of tariffs on inflation and consumer confidence. In contrast, the ECB and the BoE recently reduced their policy rates. The US economy contracted slightly in the three months ended March, marking the first contraction since Q2 2022. We believe the Fed’s repeated assertion that the economy is robust contrasts with weak soft data (such as surveys) and elevated uncertainty about both growth and inflation. We expect substantial rate cuts by the Fed later this year, as weaker growth outweighs transitory inflation pressures. A tariff-induced recession is not our base case, but uncertainty will remain high.

Actionable ideas

Multi asset

Ambiguities over tariffs, growth, and inflation may underscore the need for a flexible approach that explores a diverse* set of assets which could maximise returns while managing risks.

Global bonds

We believe a continued rate-cut path in Europe and limited risks around inflation could make European bonds and credit attractive. Additionally, in our view, there are potential opportunities in quality EM bonds, which should be supported by a weak dollar.

This week at a glance

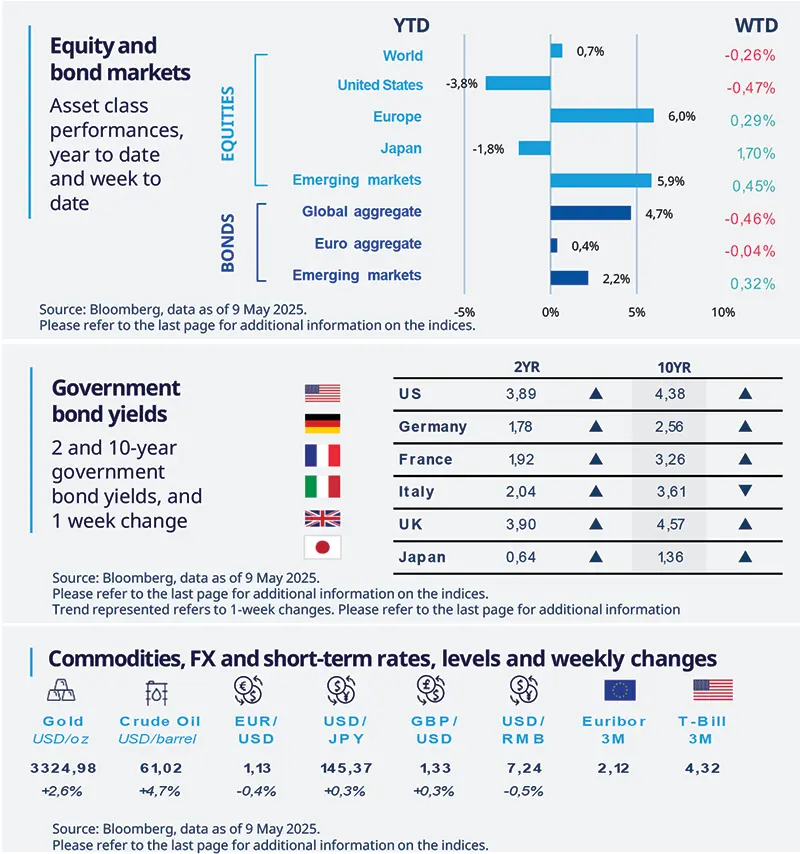

Global stocks were generally mixed last week ahead of the China-US trade talks, following a framework agreement with the UK that generated optimism. Most government bond yields rose. Gold was up overall, but very volatile throughout the week as the market digested the news of the announced trade deal.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 9 May 2025. The chart shows official rates of main global central banks.

Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US services sector healthy for now amid high uncertainty

The April ISM services index unexpectedly jumped to 51.6 from a nine-month low of 50.8, pointing to further expansion of the US non-manufacturing sector. The new orders component increased to a four-month high of 52.3, underpinning the US economic resilience. Price pressures remain strong, with the prices paid index hitting its highest level in over two years. Respondents cited tariffs’ pricing impact as a concern.

Europe

EZ PMI slightly up, but trade uncertainty is high

The April EZ services PMI was revised up to 50.1 from 49.7, pointing to almost stagnation in the sector. Input costs increased sharply, while business confidence deteriorated for the fourth month in a row. The composite index was also slightly revised up to 50.4. Concerns on tariffs and slower growth drove activity expectations to their lowest level in 18 months. All in all, this data points to limited growth ahead amid trade tensions and an uncertain outlook.

Asia

China resumed monetary easing amid trade uncertainty

After holding for over half a year, the PBoC finally cut its policy rate by 10bp and the required reserves ratio by 50bp on 7 May. Although China’s overall export growth held up in April, the breakdown shows significant rerouting likely through ASEAN and Latam to the US market, putting sustainability of the strength into question. We expect easing to keep shoring up domestic demand.

*Diversification does not guarantee a profit or protect against a los

Key dates

13 May US CPI, Germany ZEW survey, UK unemployment rate | 15 May US retail sales, PPI, industrial production, EZ industrial production, UK GDP | 16 May US housing starts and building permits, US University of Michigan Sentiment |