Summary

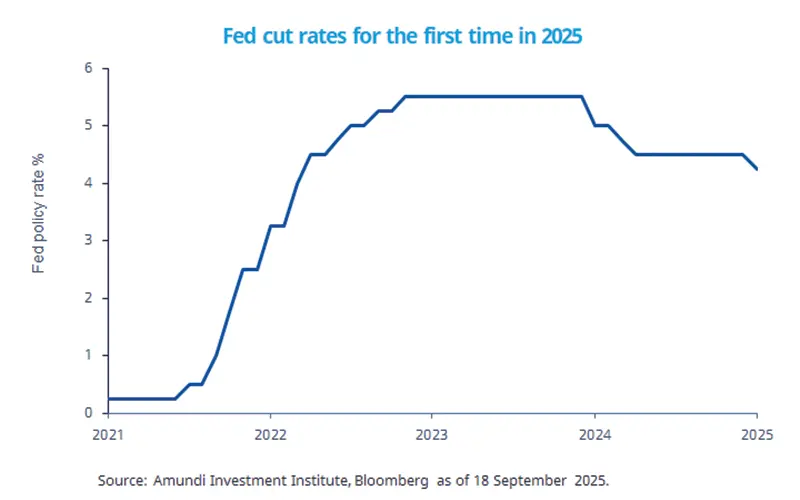

The weakening US labour market, alongside the likely erosion of disposable income due to tariffs, should lead the Fed to cut rates further this year, even if inflation may accelerate somewhat.

The Committee was relatively unanimous in its decision, with only governor Miran preferring a 50bp cut.

Chair Powell suggested that the latest cut was driven by risks on employment and that it was a “risk-management cut”.

Leading indicators of wage growth and employment point to potential further softening ahead for private consumption.

At its September meeting, the Fed cut the Fed Funds target range by 25bp to 4.00-4.25%, as expected. The Fed’s economic projections showed the median Fed Funds forecast shifting to a total of 75bp of cuts this year, implying a 25bp cut at each of the remaining two meetings. This is happening at a time when both the ECB and BoE left rates unchanged, thus providing opportunities for global fixed income investors to play central banks’ policy asynchrony.

We expect the US economy to slow in late 2025 and early 2026, due to the cooling labour market combined with the impact of tariffs on disposable income. On the price front, US importers have been absorbing most of the higher costs implied by tariffs, containing the impact on consumer inflation for now. However, inflation might accelerate over the next few months, eroding the consumers’ spending power. This scenario – combined with political pressure on the Fed - supports our view of two further rate cuts this year.

This week at a glance

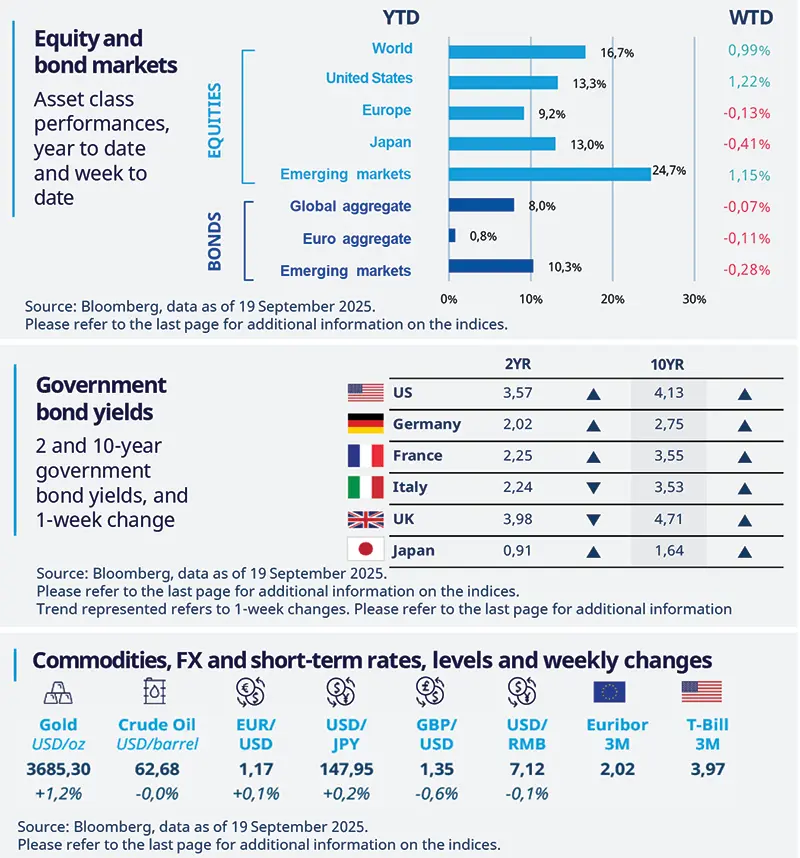

US stocks rose as the Fed reduced its policy rates and indicated more rate cuts are likely this year. Optimism around trade talks also boosted sentiment. Yields on long maturity bonds rose. In commodities, oil prices gave away initial gains on concerns over additional sanctions on Russia, ending the week almost flat. Gold was boosted by Fed rate cuts as prices touched new record levels.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 19 September 2025. The chart shows the upper bound of the Fed Funds target.

1Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US jobless claims ease but remain elevated

Initial unemployment claims fell for the week ended 13 September, reversing last week’s spike. The four-week moving average declined slightly but is still above recent lows. Continuing claims, people already receiving unemployment benefits, also decreased for the week ended 6 September but remain elevated, indicating slower hiring and potential further increases in coming months, in line with a cooling labour market.

Europe

Eurozone wages set to stabilise at lower levels

Forward-looking data shows continued easing of negotiated wage growth. ECB wage tracker for H1 2026 indicates lower, but more stable wage growth: the headline number came in at 1.7%, down from 2.1% in H2 2025. Additionally, employee coverage (percentage of employees across the participating countries that are directly covered by the tracker) narrowed to around 30%, reflecting a smaller sample but confirming the overall slowdown in wage growth.

Asia

Bank Indonesia cuts rates by 25 basis points

Despite the surprise cut, we continue to believe that Indonesia’s economic environment is consistent with further monetary easing: growth is decelerating, credit struggles to pick up. That said, any political uncertainty may increase volatility in the rupiah and could put upward pressure on inflation (with respect to imports getting expensive). In general, rate cuts by the Fed and a potentially weak USD are supportive of the EM asset class in general, including for Indonesia.

Key dates

23 Sep Australia, Eurozone, India, UK, and US flash PMIs |

25 Sep US durable goods orders and existing home sales | 26 Sep US personal income and spending and core PCE deflator |