Summary

Markets expect Central Banks to cut rates in early 2024. This is too optimistic, but falling inflation is good news for investors.

- Inflation has fallen faster than expected in both the USA and Euro area, pushing the market to believe Central Banks are at a turning point.

- The Fed was clearly dovish, judging from its statement, revised projections and press conference.

- The ECB committee was more prudent, yet still paving the way for rate cuts in 2024.

The rapid fall in inflation since this summer has largely erased the prospect of further rate hikes in the US and Euro area. During the latest press conference, Fed chairman J. Powell acknowledged that the committee has started discussing the pace of future rate cuts. 75bps of cumulated cuts by the end of 2024, but the market expects more.

ECB chair Chr. Lagarde, for her part, was more prudent. She mentioned that rate cuts had not been discussed. She stressed upwards wage pressure as she tried to push back against market expectations of cuts as soon as Q1 2024. However, overall ECB communication also makes it clear that the next move is likely to be a cut. Cooling inflation and decelerating growth may support bond markets in particular quality corporate credit, where fundamentals remain sound.

Actionable ideas

-

Euro credit

Despite the recent fall in yields, the high quality credit remains interesting and we also see opportunities in high yield short-term maturity bonds. -

Global credit

Corporate fundamentals remain strong despite some deterioration from healthy levels, and quality credit remains favoured.

This week at a glance

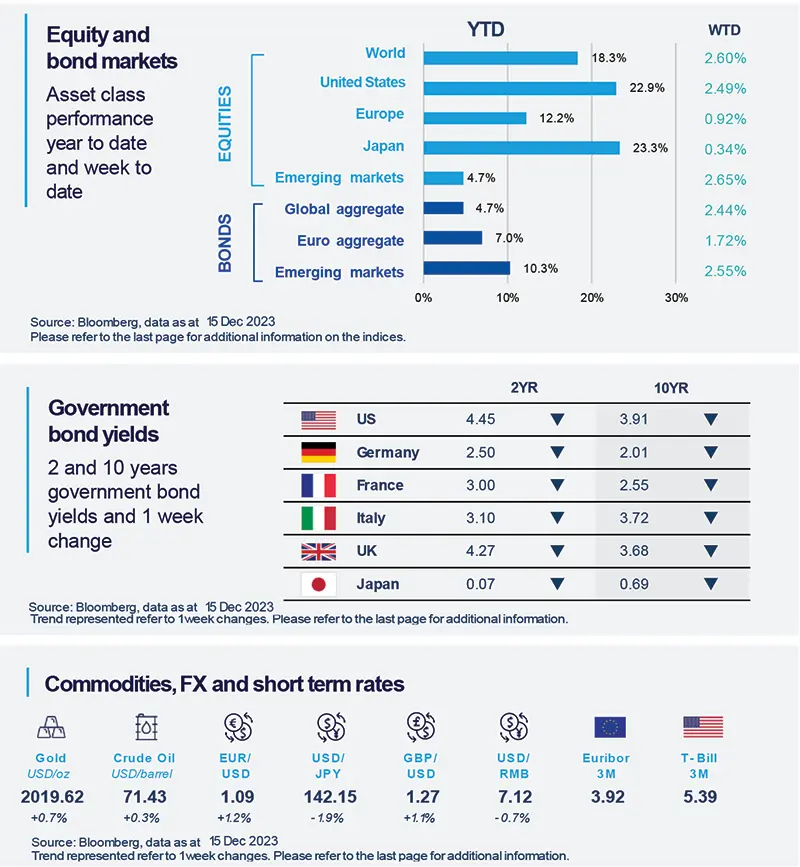

Bonds and equities prices accelerated to the upside this week, on the back of continuing disinflation and dovish communication from the US Fed. US 10 year yields broke below 4.0% while German Bund 10 year yields declined close to 2.0%. Oil prices fell at the beginning of the week before recovering.

Amundi Investment Institute Macro Focus

Americas

Continuing disinflation

The US Consumer Price Index (CPI) rose 3.1% over 12 months in November, a slight deceleration from 3.2% in October. The Core CPI index (ex Food and Energy), for its part, rose 4.0%, unchanged from October. Both figures were in line with forecast. Also on the inflation front, Producer Price Index (PPI) advanced 0.9% over 12 month, a figure below forecast and a deceleration from 1.2% in October.

Europe

The Bank of England keeps rates unchanged with no change in the guidance

As widely expected, the December MPC meeting held Bank Rate stable at 5.25%: the decision was voted by the same majority of 6-3 split recorded in the previous meeting, with three members supporting a 25bps increase. As also broadly expected, guidance remained largely unchanged, and the minutes re-emphasised the need for rates to remain restrictive for an extended period.

Asia

Beijing’s policy pivot continues at a calculated / measured pace.

The Central Economic Work Conference affirms our view that a modest fiscal deficit for 2024 is more likely (3.4% of GDP), which is lower than market expectation of 3.5-4.0%. The final number will be confirmed and announced at China’s National People’s Congress in March. Given the limited upside surprise from policies, we maintain our growth forecast unchanged, to reflect a small and choppy cyclical upcycle in 2024.

Key Dates

|

18 Dec Macro data, Europe |

19 Dec |

22 Dec Macro data, USA |