Summary

Key takeaways

- Asia has a dual challenge: it is made up of emerging markets in dire need of economic development and needs to transition to a low-carbon economy to meet the global objective of the Paris Agreement to limit global warming to 1.5°C.

- Responsible investment in Asia has long been thought to trail behind that of Europe and North America but our local ESG specialists believe this to be untrue due to two main factors: a regulatory push and an increased demand for responsible investing.

- Regarding regulations, while we acknowledge significant differences across countries and regions, there is an overall trend from voluntary compliance to mandatory disclosure.

- Regarding demand from clients in Asia, we observe a convergence in concerns over global environmental and social issues alongside increased availability of responsible investment solutions.

- Countries in Asia face diverse, yet acute economic development, climate-related risks and transition challenges. Therefore, we expect continued innovation in blended finance and public-private partnerships to accelerate the regional coal phase-out and energy transformation journey.

- A trend to watch in 2023 is transition finance, a new approach to the decarbonisation of high-emitting industries that is spearheaded in Asia. It is defined as finance “intended to decarbonise entities or economic activities that are emissions-intensive, may not currently have a low- or zero-emission substitute that is economically available or credible in all relevant contexts, but are important for future socio-economic development”1.

Introduction

Asia, home to 60 % of the world’s population2 and one of the fastest growing economies, which account for over half of the world’s greenhouse gas emissions3, has its distinct challenges both in terms of economic development and transition towards an inclusive low-carbon economy.

The economic development needs in Asia are daunting, especially for its numerous emerging markets and developing economies. Developing countries in Asia alone need $1.7 trillion per year investments in infrastructure until 20304. GDP growth in East Asia is expected to reach 4.4 % in 2023, 4.8 % in South Asia, and 3.5 % in Western Asia5.

Asia is also facing a very significant energy transition challenge: the region is reliant on coal with a relatively young age of coal power fleets6, about 85 % of the energy consumed in Asia comes from fossil fuels and the demand for energy is protected to rise further due to continue urbanization and population growth7. Renewable energy is key in the region’s transition to green and secure energy, but fossil fuel is also expected to expand for the foreseeable future8. Asia is also significantly exposed to physical risks caused by climate change: examples include heat waves in India, swine fever outbreaks in Thailand, and floods in Pakistan that have killed thousands of lives. Balancing economic development, climate actions and social inclusion is of paramount importance.

At the same time, to reach the objective of the Paris Agreement and limit the rise of global temperatures to 1.5°C (and consequent net zero greenhouse gas emissions by 2050), clean energy investment in emerging markets needs to expand by more than seven times9 to above $1 trillion by 2050. The energy transition will only be successful at the global scale if it is successful in emerging markets. The financial solutions developed must address Asia’s two challenges together: that of economic development and transition to a low-carbon economy. According to the International Renewable Energy Agency (IRENA), Asia can either continue relying on fossil fuels, most of which come from nonindigenous sources, or it can choose to use its ample, affordable and indigenous local renewable energy resources. Asia has a unique opportunity to develop its economy based on renewable energy resources while accomplishing energy security, reliability and affordability goals: it could transition from 19 % of renewable energy in 2018 to 65 % by 2050, and in the process reduce CO2 emissions by 75 %10. This exemplifies why the stakes of decarbonisation in emerging markets is so high, and why making the transition inclusive to the benefit of their populations is fundamental.

Public investments have a significant role to play, both on the development side and on the transition side, but it will not be sufficient on its own: private capital has to be mobilized. Moreover, as emerging countries develop, Asia will progressively benefit less from public aid and will need to rely more on private investments. Blended finance is a strong tool to channel private capital towards projects that contribute to sustainable development. Defined by the OECD as “the strategic use of development finance for the mobilisation of additional finance towards sustainable development in developing countries”11 it allows to mitigate risks while providing financial returns to investors. Those innovative financial mechanisms are especially needed in emerging markets, where risk is multifaceted and difficult to analyse for investors, who often end up overestimating and overpricing it. As Ravi Menon, Managing Director at the Monetary Authority of Singapore explained in his introductory speech on Blended Finance for the Net-Zero Transition in October 2022: “regulatory and political risks heighten the likelihood of default, transaction lead times are long, projects require prohibitively large amounts of start-up capital, and there is limited access to expertise in project development and financing”12. Since 2015, worldwide blended finance initiatives reached an average of $10 billion per year13. While blended finance instruments are fitted to private investors largely, they still tend to mainly attract investors driven by sustainability objectives.

Responsible investment solutions can contribute to tackling the financing of both the economic development to the benefit of populations and the just energy transition, as capital is mobilised while integrating material environmental, social and governance factors. Responsible investment is defined by the Principles for Responsible Investment as “a strategy and practice to incorporate environmental, social and governance (ESG) factors in investment decisions and active ownership”. With such strategies, financial actors can contribute to both economic development and a just energy transition by financing projects and engaging with investee companies. Scaling up responsible investing and deploying it in all geographies represents significant opportunities for Asia: in this paper, responsible investment trends as well as clients' appetite and readiness for responsible investing will therefore be analysed.

Responsible investment and Asia

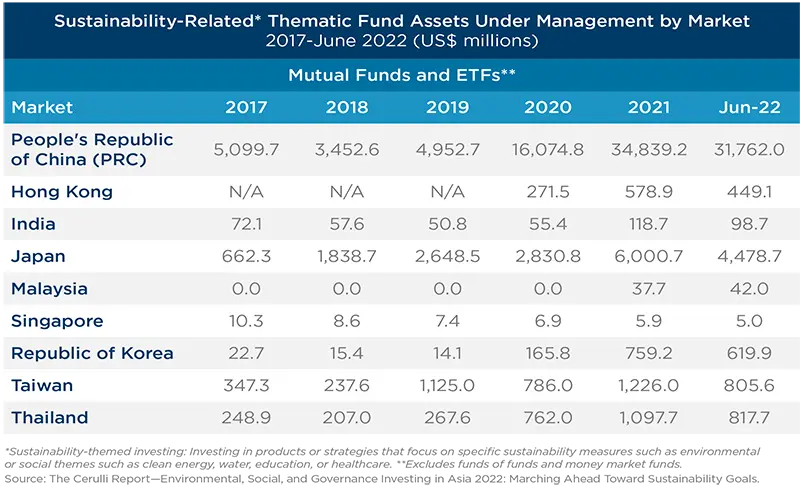

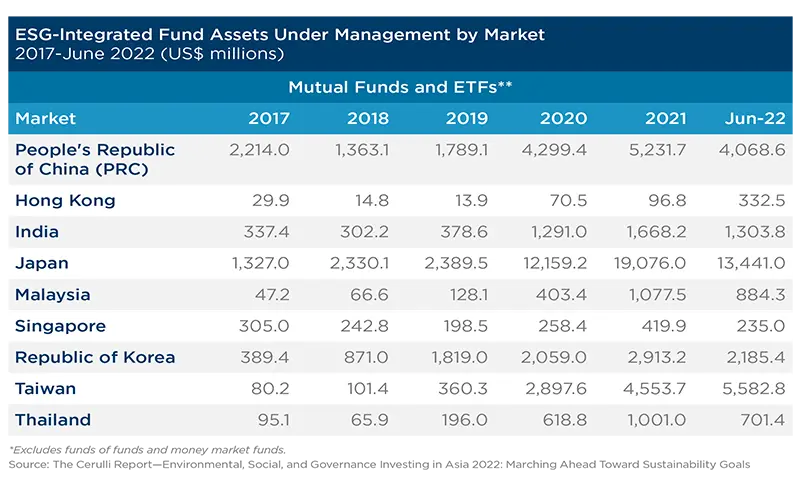

Responsible investment in Asia has long been thought to trail behind that of Europe and North America. However, we believe this has changed, as investors in Asia have been very engaged on ESG issues in the past years.

Investor patterns have changed in Asia: there has been an overall convergence in concerns over global environmental and social issues with the availability of responsible investment solutions. According to a survey done by Amundi Singapore, specially amongst the younger generations (21 to 34 years old), environmental and social concerns drive capital allocation and have become investors’ top priority14: due to natural disasters such as heat waves, droughts, floods, and a pandemic, the interest in companies that address these issues in Asia has heightened. In particular, climate change is viewed as the most important ESG risk factor to be aware of in risk management, asset allocation, and investment opportunities.

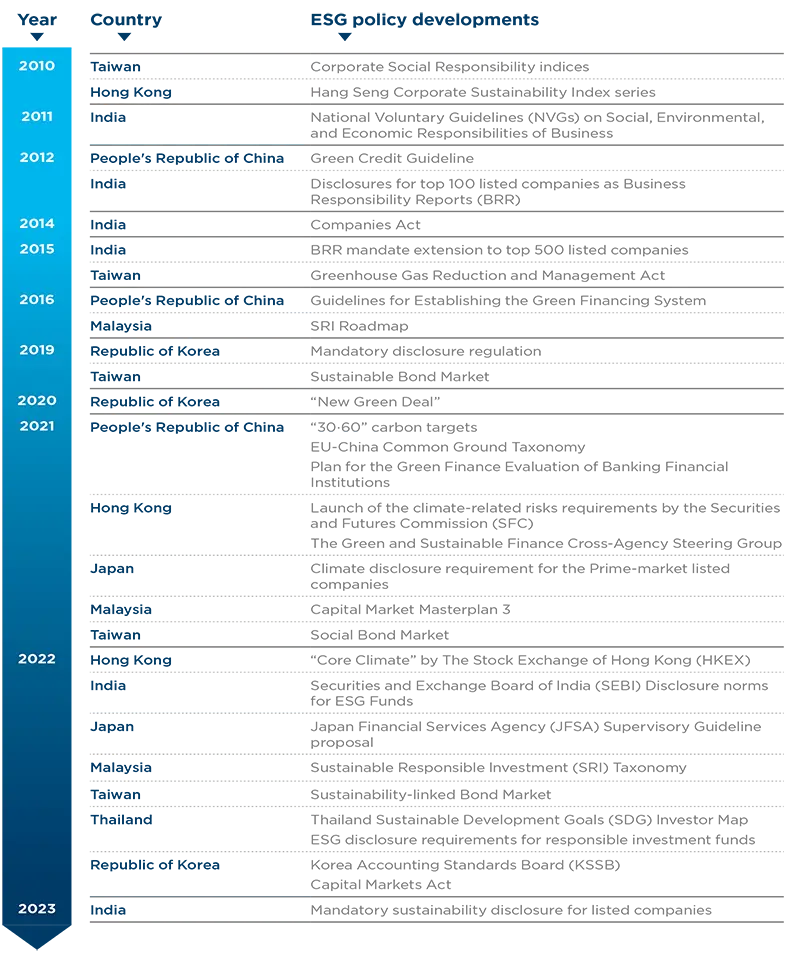

The shift to responsible investing in Asia is due to two main drivers: a regulatory push and an increased demand for responsible investing. Regarding regulations, even though they greatly differ across countries and regions, there is an overall trend from voluntary compliance to mandatory disclosure. For instance, some countries such as Singapore, Hong Kong and Malaysia have released TCFD-aligned regulations, and Taiwan and Japan have issued sustainability reporting and stewardship codes. China has also progressed by setting in place Guidelines on Environmental Information Disclosure for Financial Institutions, the EUChina Common Ground Taxonomy, and there are ongoing consultations in the Securities and Exchange Board of India regarding ESG regulation. The section below in the paper explores responsible investment trends and ESG regulatory developments by country.

At the same time, countries in Asia are diverse in terms of economic development, climate-related risks, transition, and social challenges. Therefore, more innovative mechanisms are expected to be part of the economic development, coal phase-out and energy transformation journey that Asia needs. It is clear that different countries will need to take different development and decarbonisation pathways. While there are numerous opportunities in Asia, these will need to weigh Asia’s continued industrialization, which is accompanied by a growing demand for energy.

There are high financing needs in Asia to support its economic development and the transition needed to achieve the objective of the Paris Agreement while ensuring it is socially acceptable. In the following sections of the paper, we will give an overview of investors’ appetite and readiness for responsible investment in China, Hong Kong, Taiwan, Singapore, Thailand, Malaysia, Japan, India, and South Korea. This outlook for 2023 will also include an overview of transition finance as a trend to watch in the year(s) to come.

Overview of responsible investment trends by country

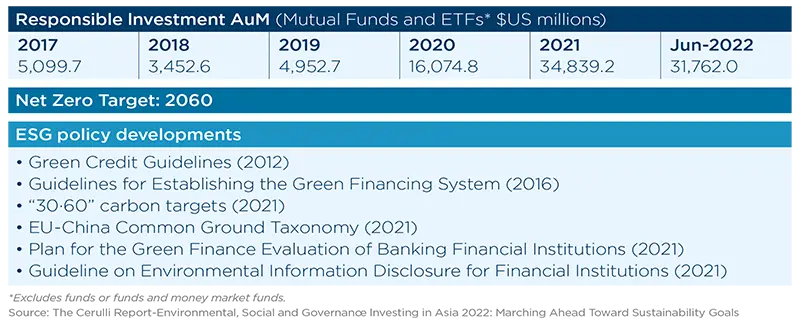

PEOPLE'S REPUBLIC OF CHINA (PRC) - Main Trends

In the People’s Republic of China, responsible investing is mainly driven by environmental concerns. A milestone in the rise of responsible capital flows was the issuance of Green Credit Guidelines in 2012 by the China Banking Regulatory Commission (CBRC). Since the establishment of those guidelines, the majority of capital going to responsible businesses has come from green lending. Another milestone driving responsible inflows to green assets was the “30·60” carbon targets announced in 2020, a policy by which China committed to hit peak emissions by 2030 and carbon neutrality by 2060.

In parallel to its development, responsible finance in China is progressively organizing. In 2016, People’s Bank of China issued Guidelines for Establishing the Green Financing System which covered almost all type of financial products. In November 2021, the central bank rolled out a new lending facility15 that provides low-cost capital to carbon emission reduction loans in its efforts to provide financial support to the country’s “30·60” carbon targets. The People’s Republic of China’s policy framework also includes the Plan for the Green Finance Evaluation of Banking Financial Institutions (May 2021) and the Guideline on Environmental Information Disclosure for Financial Institutions (July 2021).

Going forward, the central bank will still be the major policy force driving the responsible investment, though other financial regulators and non-financial government agencies are also stepping in. The China Banking and Insurance Regulatory Commission (CBIRC) is formulating ESG investing guidelines, and the National Development and Reform Committee (NDRC) is working on the industry policies that are crucial to responsible investors in their research and investment decisions, and has issued a guidance on the green development of the Belt and Road Initiative (BRI) in March 2022. Moreover, according to the NDRC, China will stop building new overseas coal power projects16.

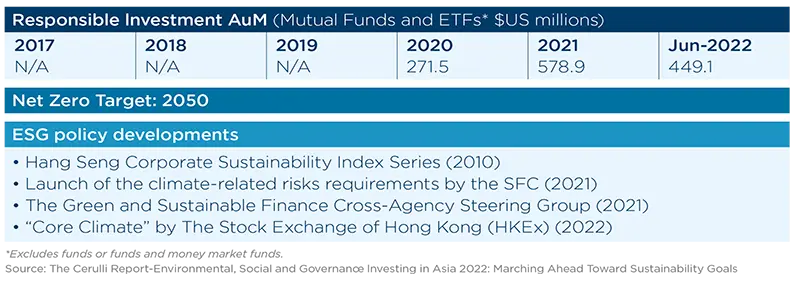

HONG KONG - Main Trends

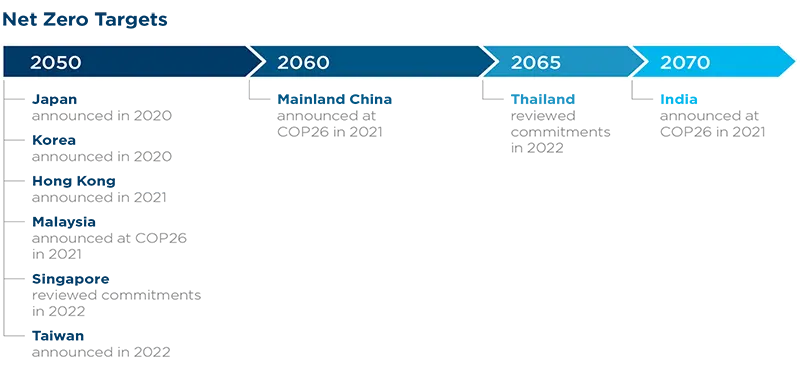

While responsible investments have been gaining significant momentum in the recent years, this trend dates way back in Hong Kong, to when Hong Kong Stock Exchange (HKEx) launched the Hang Seng Corporate Sustainability Index Series in 2010. Since then, the development of responsible investment has progressed and organized through guidelines, requirements and initiatives also from other local authorities such as the Hong Kong Monetary Authority (HKMA), Securities and Futures Commission of Hong Kong (SFC). In November 2020, Hong Kong pledged to reach net zero by 2050, a commitment that was followed the year after by the launch of the climate-related risks requirements by the SFC. It requires fund managers to consider climate-related risks in their governance, investment and risk management processes. Also in 2020, a Green and Sustainable Finance Cross-Agency Steering Group was announced. Co-chaired by the HKMA and SFC, it aims at organizing the management of climate and environmental risks to the financial sector, speed up the growth of responsible investing, and back the government’s climate strategies.

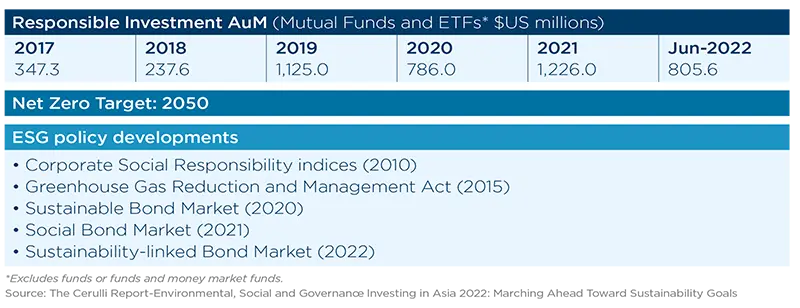

TAIWAN - Main Trends

Responsible investment has been a major topic in recent years in Taiwan, as sustainability and environmental issues have grained traction. For example, the Greenhouse Gas Reduction and Management Act that was passed in 2015 set long-term carbon reduction goals into law. Regarding responsible investing solutions, the Taipei Exchange (TPEx) has been promoting and supporting the green bond market since 2017. Moreover, TPEx established a dedicated sustainable bond market in 2020, a social bond market in 2021, and a sustainability-linked bond market in 2022.

Taiwan further strengthened its commitment in 2021 with a pledge to reach net zero by 2050, and published “Taiwan’s Pathway to Net-Zero Emissions in 2050” in March 2022, outlining four transition strategies to achieve net zero: energy transition, industrial transition, lifestyle transition, and social transition.

As the interest in responsible investment increases, a new dedicated ESG section was added to Taiwan Depository & Clearing Corporation’s Fund Clear in February 2022, to help promote responsible investment by listing ESG funds and their relevant information. To mitigate the greenwashing risk, the Financial Supervisory Commission (FSC) published disclosure requirements for ESG-themed funds in July 2021, requiring ESG-themed funds to allocate at least 60 % of AUM to sustainability-aligned investments. The FSC also increased climate-related requirements to the financial sector, including the mandatory climate-change stress tests that are expected to launch in 2023, targeting banks in Taiwan.

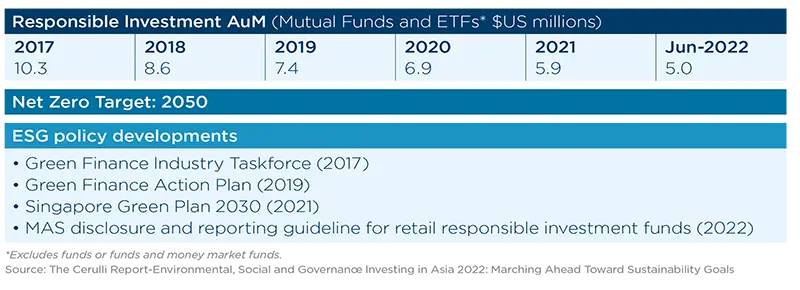

SINGAPORE - Main Trends

Numerous initiatives and tools have been introduced to promote Singapore as a regional responsible investment hub and help to advance Singapore’s national agenda on sustainable development. These range from a general ESG disclosure, taxonomy classification, responsible investment solutions, and technology enablers. As early as 2017, the Monetary Authority of Singapore (MAS) convened an industry-led Green Finance Industry Taskforce (GFIT) and launched the Green Finance Action Plan in 2019 to advance its agenda on responsible finance.

Part of GFIT’s work is to develop the Singapore’s Taxonomy to provide guidelines on classification of economic activities in green, amber and red categories: the first Singapore Taxonomy is expected to be released in 2023. In 2022, MAS published disclosure and reporting guidelines for retail responsible investment funds, which are effective since January 1st 2023. This requires retail responsible funds to provide ESG details such as an investment strategy, criteria and metrics used to select investments, as well as risks associated on an ongoing basis.

In 2021, the Singapore Green Plan 2030 was launched, detailing the national roadmap to a low-carbon economy “by or around midcentury”. In 2022, Singapore specified its national climate targets to achieve net zero by 2050.

THAILAND - Main Trends

Responsible investment is a growing trend in Thailand. In 2015, The Stock Exchange of Thailand (SET) has developed the Thailand Sustainability Investment (THSI) or Sustainable Stock List. The list promoted responsible investing by disclosing the names of companies meeting specific criteria including ESG considerations for the Stock Exchange of Thailand. Institutional investors, particularly the Government Pension Fund has used the THSI list to help analyse, advise and make informed decisions.

In 2022, Thailand’s Securities and Exchange Commission (SEC) has proposed enhanced ESG disclosure requirements for responsible investment funds to facilitate better transparency. The SET has released its ESG data platform to provide transparency and standardization for ESG data. Also, in 2022 Thailand’s SEC and UNDP Thailand launched the Thailand Sustainable Development Goals Investor Map, which has identified 15 investment opportunities across 8 SDG-related sectors to help advance the national agenda on responsible investment. This map provides guidance to investors to better align their investment opportunities to Thailand’s SDG needs and opportunities and focus on key priorities to enhance sustainable development.

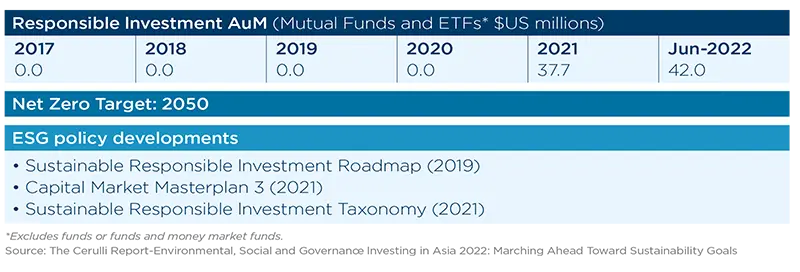

MALAYSIA - Main Trends

Responsible investment in Malaysia is a nascent trend. At COP26 in 2021, Malaysia announced its commitment to reach net zero by 2050. A series of initiatives including the Securities Commission Malaysia’s Sustainable and Responsible Investment (SRI) Taxonomy (2022), SRI Roadmap (2019), and Capital Market Masterplan 3 (2021) were launched to develop responsible investment in the country and create best practices among industry players.

Moreover, there have been a number of ESG index and funds launched in Malaysia in recent times. Bursa Malaysia launched a Shariah index (FTSE4Good Bursa Malaysia Shariah Index) in 2021, a move to improve ESG practices and boost the responsible investing narrative.

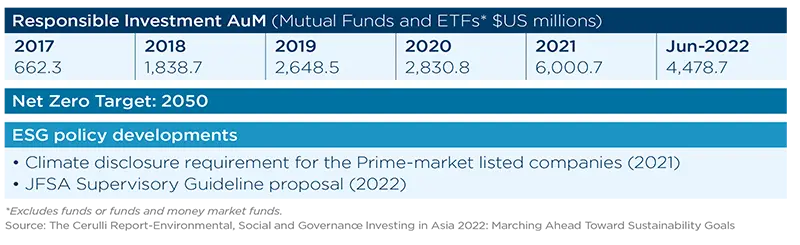

JAPAN - Main Trends

Japan has no regulatory framework that drives capital flows into sustainable businesses as the EU has developed. Public awareness, however, got bolstered after the government's net zero target announcement at the end of October 2020, and the business community followed the lead. The Financial Service Agency (FSA) has become wary of greenwashing risks as the number of funds named with ESG/SDGs increased and sent a message to the asset management industry in its Progress Report in June 2022. But the regulator has maintained a principle based approach, looking to individual asset managers for best practices. The supervisory guidance is being revised with a dedicated section on the “ESG Investment Trust” to ensure the consistency in disclosure between the investment process and stated value proposition in the sales effort. This rule could reshape responsible investment product offerings in the Japanese retail market.

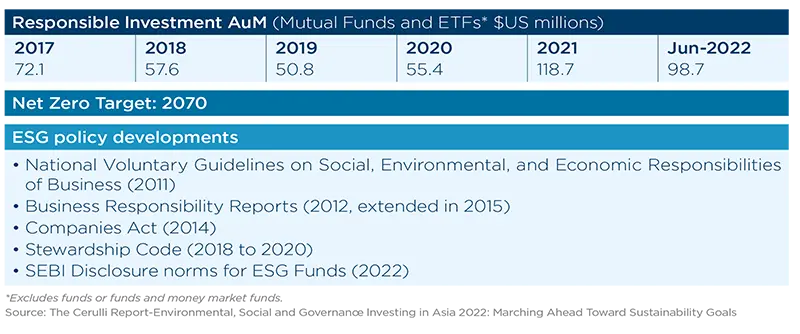

INDIA - Main Trends

The advent of responsible investing in India can be traced back to the early 2010s. Regulatory action gained momentum in 2011, when the Ministry of Corporate Affairs (MCA) published National Voluntary Guidelines (NVGs) on Social, Environmental, and Economic Responsibilities of Business.

Also, in 2012 the Securities and Exchange Board of India (SEBI) mandated sustainability disclosures for top 100 listed companies as Business Responsibility Reports (BRR) based on the National Voluntary Guidelines. In 2014, the Companies Act mandated 2 % of a firm’s 3-year profit to be spent on Corporate Social Responsibility activities, thus adding a social angle to investments. In 2015, the BRR mandate was extended to top 500 listed companies and SEBI instituted the detailed corporate governance disclosure guidelines for all listed companies. An improved version of BRR, the Business Responsibility and Sustainability Report (BRSR) will be mandatory for 1000 listed entities from 2023.

Between 2018 and 2020, different regulators mandated adoption of the Stewardship Code for Insurance, Pension and Mutual Funds and in 2022, SEBI introduced disclosure norms for ESG Funds with details to avoid greenwashing. In 2022, SEBI constituted an ESG advisory committee to enhance the evolving ESG ecosystem in the country in 2022. That same year, the Reserve Bank of India (RBI) issued a consultation paper to propose mandatory climate disclosures by all banks and the Ministry of Finance launched the first tranche of sovereign green bond issuances in 2023.

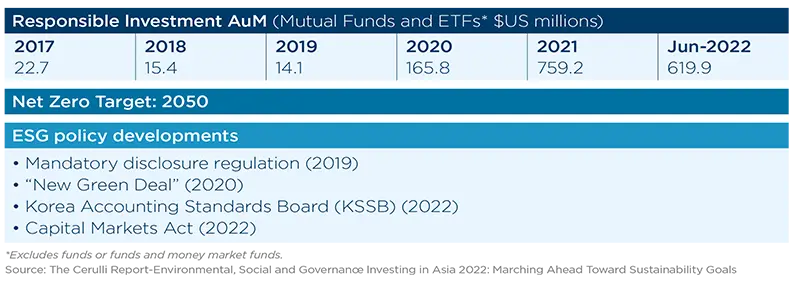

REPUBLIC OF KOREA - Main Trends

Responsible Investment has been driven by one major player and prescriber in the Republic of Korea. The National Pension Service, a Korean public pension fund and one of the largest in the world, has accounted for the largest portion of the Republic of Korea's responsible investment market for the past 17 years. In addition to quantitative expansion, the National Pension Service also worked hard to build a responsible investment infrastructure, including the revision of six investment principles including sustainability, internal guidelines, dedicated departments, ESG evaluation model, and stewardship codes. This has a positive impact on the Korean investment market as a whole.

Having said this, national policy has played the biggest role in the increasing responsible investment trend. In the second half of 2020, the Korean government announced the “New Green Deal” and “2050 Carbon Neutral” policies to cope with the economic recession triggered by COVID-19 and the climate crisis. The private sector is also increasingly interested in responsible investment, following international policy trends and those of the Republic of Korea.

Regarding social consideration, progress were made regarding gender equality: in August 2022, with the revision of the Capital Markets Act, a system requiring at least one woman to be included in the composition of the board of directors was implemented. At the end of the year, the percentage of women other than directors in the top 100 companies exceeded 20 %. Regarding governance issues, related acts have been actively revised to protect minority shareholders' rights, such as enhancing transparency through the appointment of independent auditors, improving dividend procedures, and reinforcing IPO rules since 2020.

The Republic of Korea has implemented a mandatory disclosure regulation related to governance structure for listed companies with assets of more than 2 trillion won from 2019, and plans to implement a mandatory disclosure regulation for comprehensive ESG information from 2025. In addition, at the end of 2022, the Korea Accounting Standards Board (KSSB) was established and is preparing to introduce the International Sustainability Standards Board (ISSB). Since the Republic of Korea has an economic structure that is highly dependent on exports, the EU’s Sustainable Finance Action Plan and the US Securities and Exchange Commission (SEC) disclosure regulations in terms of ESG issues are also being closely watched.

Clients’ appetite and market readiness for responsible investment

Even through responsible investment in Asia is globally a nascent phenomenon, clients’ appetite and readiness for it is increasing.

The growing appetite for responsible investment in Asia is driven by a regulatory push, especially strong in the People’s Republic of China and India. International institutional investors are also increasingly present in the region. Finally, there is a strong need to integrate ESG risks as Asia is a region disproportionately affected by the adverse effects of climate change, and has a dire need for the transition to be socially acceptable, among other themes. Overall, responsible investment solutions incorporating climate risks such as transition and physical risks are the most popular and will continue to gain popularity due to the above reasons.

Certain countries are working hard to align with international standards and enhance the information disclosure to promote capital flows to responsible activities. China, for instance, has launched green bond principles for which issuers must allocate 100 % of the proceeds to green projects, either based on Green Bond Endorsed Projects Catalogue, Common Ground Taxonomy, or EU Taxonomy. Another example is in Hong Kong, where the Guangdong-Hong Kong- Macau Greater Bay Area Green Finance Alliance (GBA-GFA) was established in 2020. The alliance’s aim is to exchange and synergy, promote and mobilise resources to further advance green finance innovation in the Greater Bay Area. In the coming years, we expect there will be more collaborations with cities in the Greater Bay Area, and Hong Kong will continue to be the financial gateway between the People’s Republic of China and the rest of the world, promoting responsible investment standards and certification in the area, as well as facilitating green capital and investment opportunities across the border.

In India, on the other hand, responsible investment seems to be rather pushed voluntarily by asset managers rather than by asset owners. Asset managers have voluntarily set up ESG funds. However, the Securities and Exchange Board of India (SEBI) is already discussing ways to improve responsible investment integration, adoption of different types of responsible investing funds (thematic funds, exclusion, bestin-class) and may come up with detailed policy guidelines in this direction in the next two years. While Responsible Investment is currently nascent in India, there is a clear learning curve that should accelerate action and could converge with global standards eventually (such as the IOSCO and UNPRI).

Another example is South Korea. The country’s Financial Supervisory Service is preparing specific implementation measures for mandatory disclosure of ESG information, analysis of climate risk scenarios, and practical application of Korean taxonomy. As responsible investment expands, concerns about greenwashing allegations are also increasing, financial institutions will be asked to strengthen the process of measuring and disclosing ESG performance.

In terms of themes, environmental topics such as the fight against climate change and the net zero ambition are at the forefront of the agenda in Asia, and we expect them to continue being so in the foreseeable future. All countries analysed above have committed to achieving net zero targets by 2050, 2060, 2065 and 2070. Therefore, we can expect that the interest in such themed responsible investment opportunities will heighten. We also expect blended finance on this topic to increase: we anticipate public sector initiatives to crowd in private capital as was exemplified in the Just Energy Transition Partnerships with Indonesia at COP27.

While the majority of the countries analysed above are mainly focused on the environment, Malaysia is more interested in faith-based investing, a specific type of responsible investing that aligns investment with religious beliefs and values. A distinctive element of the Malaysian market is that Malaysia is a leading Islamic Finance centre in the region. Islamic finance refers to the provisions of financial services in compliant with Islamic laws and principles. Islamic finance is expected to gain momentum in 2023, underpinned by banking asset growth and resilient economic recovery from many of the core markets. S&P forecasts that the Islamic banking market in Southeast Asia will join an annual compounded growth rate of around 8 % in the next 3 years17.

In terms of retail investment sentiment in Asia, there is growing awareness and attention given to ESG issues. Amundi Singapore released its first sustainability profiler investor report in 202218 and identified a clear generational shift in attitudes towards responsible investing for Singapore retail investor base. Not only do younger generations such as Gen Z (21-24 yearold) and Young Millennials (25-34 year-old) show stronger interest and commitment to environmental and social causes on a daily basis, these causes also have an influence their investment decisions. An interesting finding is that younger generation places greater emphasis on social aspects such as poverty, inequalities and discrimination.

Trend to watch in 2023: transition finance

In the Asian context, transition finance can take the centre stage within the responsible investment market.

According to the OECD, transition finance is defined as finance “intended to decarbonise entities or economic activities that are emissions-intensive, may not currently have a low- or zero-emission substitute that is economically available or credible in all relevant contexts, but are important for future socioeconomic development”19. Transition finance is a new approach to the decarbonisation of high-emitting industries that is spearheaded in Asia: particular attention is given to those sectors that might be negatively impacted by transition to sustainability (such as aviation, oil & gas, and coal). For instance, the Asia Transition Finance Study Group20 was created by Japan to provide a comprehensive support measure to ASEAN countries to promote transition finance: the aim is to create practical recommendations to supplement existing frameworks (such as the ICMA guidelines).

Responsible finance’s objective is to finance the transition of our economy towards a more sustainable model while aiming at delivering financial returns. To reach that goal, it needs to be deployed at scale to reach all geographies, all sectors, and all types of clients. To achieve the objective of the Paris Agreement and limit global warming to well below 2°C, all sectors of the global economy, and in particular high emitting industries, must rapidly decarbonise. Transition finance is predicted to grow in popularity in the field of responsible investment in specific geographies and sectors, as it is needed for a whole-of-economy decarbonisation to achieve the objectives of the Paris Agreement.

At the same time, inclusive transition is about decarbonising without compromising social and economic development: the energy supply must be reliable and affordable. In this context, transition finance can ensure that the energy transition is just, as it can help to avoid sizeable economic inefficiencies in emerging markets, where there are countries in which greenhouse gas emitting sectors represent a large share of economic activity. The energy mix needs to shift progressively, first to relatively less emissions-intensive fuels like natural gas, and then to renewables. For example, should the energy transition not be successful in these sectors, the loss in economic value for Asia would be around 15-20 % of GDP21 by mid-century. While investments in ESG activities will contribute to the decarbonisation of Asian economies, investments in transition activities are also necessary. Only a combination of both will enable a just transition, one that reduces greenhouse gas emissions but also ensures the reliability and affordability of energy supply.

Having said this, for transition finance to be successful in achieving the transformation of the real economy and gain credibility, certain challenges need to be overcome. There is still little consensus on how to support the transition to an inclusive low-carbon economy, as there are no set of technical criteria or qualifying sectors or technologies that are commonly used. Transition finance is still a nascent approach and needs to gain credibility by setting tangible KPIs and by taking a dynamic view. Better transparency, consistency, and real success stories need to be developed.

If transition finance addresses its challenge to gain credibility, we believe its ambition will increase. In order to do so, financial market participants have to identify high-emitting companies and analyse their climate strategies (which is a prerequisite for transition finance), support the implementation of companies’ climate strategies, thoroughly assess companies’ transition plans when deciding to provide financing to a company, and only finance companies with credible plans. Also, financial market participants should make use of existing frameworks: set interim net zero targets, use metrics and KPIs, use carbon credits (once plans have been made to “avoid” and “reduce” carbon emissions), be coherent internally with a company’s business plan, etc.

We anticipate several factors that can support a credible transition finance trend in Asia. As the real change need to happen at the company level, we do not believe that specific financial instruments will be needed, and that existing ones should suffice. Issuers can typically finance decarbonisation projects by issuing Sustainability-Linked Bonds, whose proceeds are used to fund projects with environmental and/or social benefits projects. Another driver of success and credibility will be increased data transparency and consistency, dissemination of real success stories. Lastly, active ownership and shareholder continued engagement on climate strategies will greatly influence companies.

Conclusion

As ESG regulations and investors’ demand increases across Asia, asset owners and asset managers should pay attention to fast growth of responsible investing in the region.

ESG integration has boomed in the three years between 2019 and 2021, and will continue to do so in the long term despite the challenging year due to the Russia-Ukraine war in 2022 and consequent energy and food crisis. We expect that climate-related funds will continue to dominate product development in the medium to long-term as governments contribute to the achievement of the global net zero goal.

At the same time, Asia has to face the specific double challenge of economic development and decarbonisation, to which a broad and accelerated deployment of responsible investments could be an answer. Because transition finance addresses these challenges specifically, in the sense that it focuses on enabling a socially acceptable energy transition, and provided it demonstrates its credibility and ambition, it is set to become the centre stage in the field of responsible investment in Asia. A good step in the direction of an ambitious transition finance is the establishment of Just Energy Transition Partnerships such as the one launched with Indonesia at COP 27. If successful, such a visible initiative that leverages public money, will have two main benefits: creating the environment of a decarbonised development in Indonesia (including the development of an adequate economic ecosystem), and establishing an example that will be replicated by other countries.

If transition finance addresses its challenge to gain credibility, we also believe that it will increase in ambition. If transition finance frameworks are not ambitious enough, it will be a fancy concept with mainstream “grey finance” in the back drop, its ability to mobilize capital at scale with the additionality that the world needs will be limited. On the contrary, high-ambition transition finance, supported by successful case studies such as the JETP approach and ambitious frameworks, will become part of the solutions favoured by sustainable investors in emerging markets and developing economies. Given the depth of sustainable development financing gap, the potential for a recognized transition finance is as high as its social and environmental benefits could be.

Appendix

Sources

1 OECD 2022 Guidance on Transition Finance https://www.oecd-ilibrary.org/environment/oecd-guidance-on-transition-finance_7c68a1ee-en

2 UNFPA Asia and the Pacific 2022 Population trends https://asiapacific.unfpa.org/en/populationtrends

3 Our World In Data 2021 Annual CO2 emissions by world region https://ourworldindata.org/grapher/annual-co-emissions-by-region

4 Asian Development Bank 2017 Meeting Asia's Infrastructure Needs https://www.adb.org/publications/asia-infrastructure-needs

5 United Nations 2023 World Economic Situation and Prospects https://desapublications.un.org/sites/default/files/publications/2023-01/WESP2023ExecutiveSummaryE.pdf

6 Amundi Research Center 2021 ESG Thema #8: Financing the energy transition in Asia https://research-center.amundi.com/article/esg-thema-8-financing-energy-transition-asia

7 IRENA https://www.irena.org/How-we-work/Asia-and-Pacific

8 ADB https://www.adb.org/sites/default/files/publication/611911/asia-pacific-renewable-energy-status.pdf

9 Amundi Research Center 2021 ESG Thema #8: Financing the energy transition in Asia https://research-center.amundi.com/article/esg-thema-8-financing-energy-transition-asia

10 IRENA 2022 Renewable Energy Outlook for ASEAN: Towards a Regional Energy Transition https://www.irena.org/publications/2022/Sep/Renewable-Energy-Outlook-for-ASEAN-2nd-edition

11 OECD https://www.oecd.org/dac/financing-sustainable-development/blended-finance-principles/

12 Ravi Menon (MAS) October 2022 opening remarks https://www.mas.gov.sg/news/speeches/2022/blended-finance-for-the-net-zero-transition

13 Ravi Menon (MAS) October 2022 opening remarks https://www.mas.gov.sg/news/speeches/2022/blended-finance-for-the-net-zero-transition

14 Amundi Singapore 2022 Purpose Beyond Profit https://www.amundi.com.sg/retail/ESG/A-Tidal-Shift-Purpose-Beyond-Profit-An-ESGReport

15 The interest rate for carbon emission reduction loans may be as low as 1.75 %.

16 NRDC September 2021 https://www.nrdc.org/experts/alvin-lin/china-announces-it-will-not-build-new-coal-plants-abroad-0

17 S&P Islamic Finance Outlook 2022 https://www.spglobal.com/ratings/en/research/pdf-articles/islamic-finance-outlook-2022-28102022v1.pdf

18 Amundi Singapore. An ESG Report 2022 https://www.amundi.com.sg/retail/ESG/A-Tidal-Shift-Purpose-Beyond-Profit-An-ESG-Report

19 OECD 2022 Guidance on Transition Finance https://www.oecd-ilibrary.org/environment/oecd-guidance-on-transition-finance_7c68a1ee-en

20 The Asia Transition Finance (ATF) Study Group published the ATF Activity Report and the ATF Guidelines in September 2022.

21 Amundi Research Center 2021 ESG Thema #8: Financing the energy transition in Asia https://research-center.amundi.com/article/esg-thema-8-financing-energy-transition-asia