Summary

Key takeaways

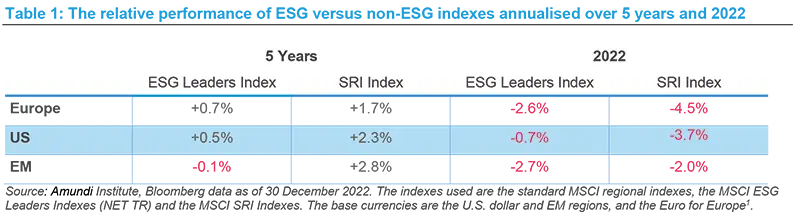

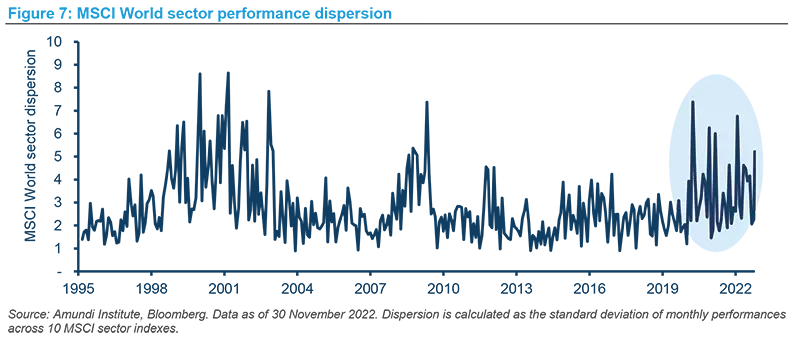

ESG investing has seen some headwinds in 2022. The ESG indexes suffered in 2022 in part due to their low representation in areas of the market that have benefitted from higher energy costs, such as the oil and gas sectors, and high representation in growth sectors that have been challenged by rising rates. However, the energy crisis has intensified the pressure to deliver on the energy transition while higher bills are fuelling the cost of living crisis and drawing attention to social issues. Hence, we expect that ESG investing will continue to gain traction over the medium and long term, but we also believe the main lesson from 2022 is that the traditional exclusion or positive screening only approaches are not sufficient anymore in a world where geopolitical risks, regulation, inflation and economic uncertainty are generating a higher dispersion in returns. This market environment requires a greater focus on stock selection.

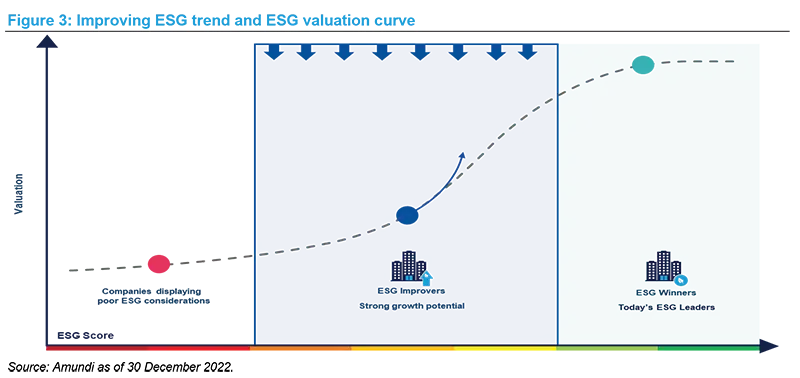

Therefore, investors should embrace an integrated ESG approach that seeks to select opportunities where improving ESG trends are not yet fully priced into companies’ valuations. We believe doing so will add value both in terms of being able to deliver better risk-adjusted return, but also in terms of helping to put focus on -- and ultimately improve -- important ESG parameters for companies and society.

A good way to embrace an integrated ESG approach, in our view, is using a forward-looking approach to select two types of companies, ESG winners and ESG improvers. We define ESG winners as quality businesses that already have strong ESG ratings, while ESG improvers are those companies with a positive ESG path with regards to the most material sector and business drivers. Such an approach offers investors the opportunity to invest today in the ESG winners of tomorrow. In selecting these companies, ESG analysis should go handing-hand with the qualitative fundamental research process in assessing the sustainability and profitability of each company.

Turning to ESG themes, we have highlighted some which have strong tailwinds. For instance, decarbonisation has become more urgent than ever. Among the energy and utility businesses, we focus on those regulatory environments that allow for the recovery of costs associated with energy transition. At the same time, companies’ footprints are being increasingly scrutinised on “Social” (“S”) concerns, particularly those surrounding social inequalities. This has led us to focus on opportunities such as house builders in the affordable housing sector, as we believe these companies are well-positioned relative to their peers. Finally, another material issue is product safety, with companies being increasingly held accountable for their products within their supply chains while labour issues are becoming more and more under the spotlight. In particular, food and clothing companies face very complex labour risks in their global supply chains (e.g. labour issues) and thus we prefer those businesses that are actively collaborating with relevant stakeholders.

A good way to generate alpha is to use a dynamic and forward-looking approach to identify where rising ESG trends are not priced into valuations.

ESG main lesson from 2022

In 2022, ESG investing has been increasingly gaining investors’ attention. Regulation has intensified across the board while, after years of outperformance (particularly in Europe), the main ESG benchmarks have lagged the overall market.

This underperformance might have been in part due to their low representation in areas of the market that have benefitted from higher energy costs, such as the oil and gas sector, and high representation in growth sectors that have been challenged by rising rates.

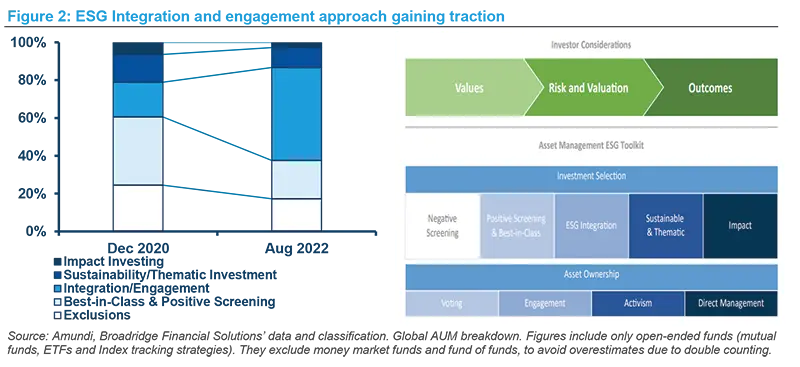

This market environment raises questions about the effectiveness of an exclusion only based approach as well as approaches that concentrate solely on companies with already good ESG credentials. Investors demand is also shifting in this direction, with the Integration and Engagement approach gaining traction (see Figure 2). In fact, the overall ESG market has grown by almost 200% from December 2020 to August 2022 (in terms of global AUM), while the ESG segment of Integration and Engagement has grown much faster at almost 700%2.

With ESG investing becoming mainstream, we believe it is time for investors to move one step further in the search for excess returns. To do so, it is vital to embrace an integrated approach that takes a forward-looking view to identify companies showing improving ESG trends that are not yet fully priced into companies’ valuations.

ESG improvers are the ones that display some potential to become the ESG leaders of tomorrow. In this trajectory, company valuations will adjust, as shown by the MSCI and others3 (see Figure 3). Companies with improving ESG metrics benefit from a falling cost of capital, an improving operational efficiency and more stable profitability. Identifying the companies at the early stage of this ESG rating improvement will be a source of value for investors, in our view.

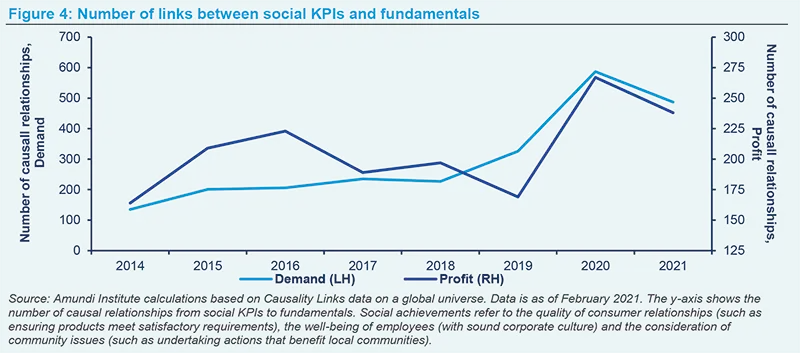

Our internal research has established evidence of a strong link between companies’ social achievements and profitability over many years (see Box 1 below). In addition, we believe that if our approach only focused on ESG winners, there is a risk that it could fall short of encouraging many companies to improve their ESG profiles. By investing in both winners and improvers, we not only enhance the risk / return profile of a portfolio, but also actively push companies towards higher ESG standards.

Box 1: Companies’ social achievements are tied to brand images and profitability

Improvements in a company’s social dimensions and, more generally, in its ESG aspects, have been largely documented as a driver of its financial performance. For instance, the link between companies’ social achievements4 and profitability is well-illustrated in the figure below. This describes the number of causal relationships identified between companies’ performances on social KPIs and their fundamentals (demand and profitability) within a global universe.

The figure also shows that companies’ social achievements have been increasingly linked to demand for their products and services. As companies’ social achievements grow, their brand images improve which, in turn, acts as a positive demand driver for its products and services. Furthermore, our analysis points at the benefits for companies in focusing on all their stakeholders’ welfare. These stakeholders include customers, employees, communities and partners within supply chains. Companies concentrating on improving their social KPIs for all stakeholders can be rewarded by enhanced brand images, which can sustain financial performance by fostering rising demand and market share gains.

This thesis relates to a topical debate on the accounting of intangible assets in companies’ valuations5. Intangible assets include R&D, patents, software development and talent recruitment as well as customer loyalty or brand recognition, both of which can be particularly strong demand enablers. Brand image reflects how customers perceive a company, and can be based on their own interactions when buying a product or on the values they attach to the brand. Also, when mentioning brand image, what often comes to mind are the scandals that some companies have faced in the recent years. Many of these had a negative impact on the companies’ reputations. For example, a disrespect of human rights along a supply chain can have a devastating effect on how a company is perceived, and thereby on its sales and overall financial performance.

However, we argued that there is also room for opportunities, as companies’ efforts on social aspects could strengthen, or even expand their customer bases. More specifically, we found that the quality of consumer relationships, the well-being of employees and the consideration of community issues could trigger stronger demand for socially virtuous companies’ goods and services.

Looking ahead, companies that fail to consider their wider responsibilities will face reputational damage and longer term headwinds. In our view, this will ensure that ESG criteria will continue to be a focus for investors in the future.

A forward-looking approach to ESG investing

To seek ESG improvers, we believe investors cannot rely merely on the ESG standard data, as this data is backward-looking and focused on risks rather than opportunities. Hence, in our view, it is not fit for purpose in seeking the value creation potential attached to an improving trend in a company’s ESG rating. A good way to identify this potential is to use a forward-looking approach based on a quantitative assessment of companies’ ESG dynamics combined with a qualitative fundamental analysis of their businesses. Such an approach would be key in forecasting potential changes ahead.

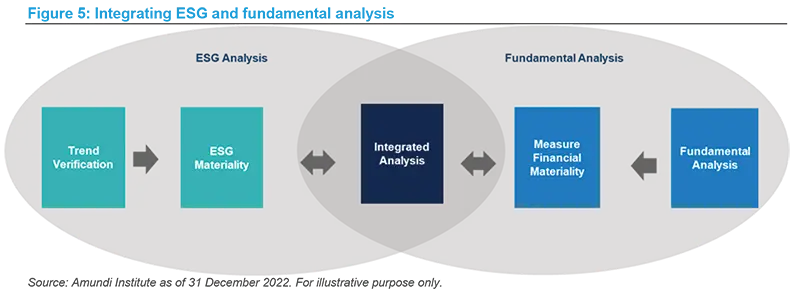

We use three steps to unlocking value using this approach.

- Identify the most material ESG drivers for each business

Materiality is measured as being the potential impact of a driver on a business’ fundamental internal rating and future value. For each investment case, we monitor between 3 and 5 material KPIs. - Understand the financial impacts of the drivers

The material ESG drivers can affect revenue, profitability, cash flow, debt and leverage. - Detect how the drivers will evolve in the future

We have built a database of ESG KPI scores that allows us to monitor their evolution. The portfolio managers and analysts speak with company management about the financial and ESG aspects of all investment cases.

-

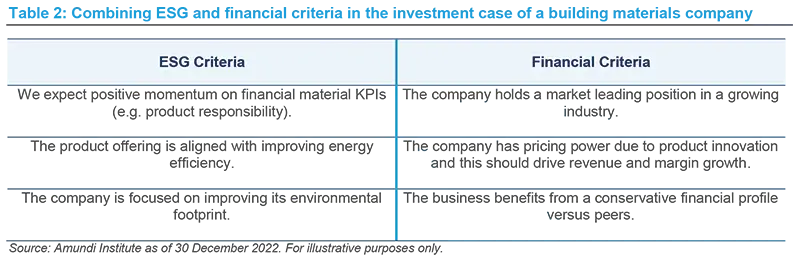

We believe the integration of a forward-looking ESG approach with active bottom-up analysis, enhances our understanding of a company’s ESG dynamics and their interaction with its financial parameters. In particular, engagement with management on ESG issues enables the team to avoid the risk of carrying out ESG box ticking exercises. The result is a deeper understanding of a business’ fundamental drivers and their potential to drive returns. An example of the integration of ESG criteria into fundamental analysis is showed below (Table 2) in the case of a building materials company.

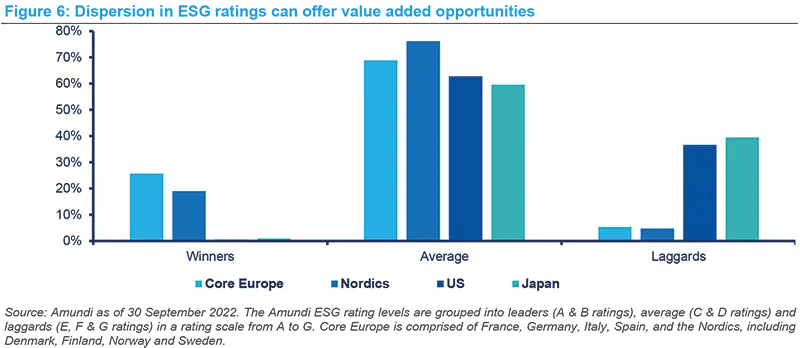

Finally, the growth of ESG investing has fuelled concerns about the creation of a speculative bubble in ESG assets. However, in our view, some of the risks of a bubble may be mitigated by using a bottom-up stock selection approach with forward-looking ESG data, rather than just historical data. In addition, the distribution of ESG ratings is uneven across countries, providing plenty of attractive opportunities for stock pickers. In Europe, the Nordics are the ESG leaders with a large number of highly rated companies, while elsewhere there is a more diverse ESG profile (see Figure 6).

The U.S. market lags behind the European market, offering room for improvements. Here, however, it is important to have a solid bottom-up understanding of a company and the potential future direction of its regulatory environment to assess the opportunity for that business to improve its ESG rating. As regards Japan’s ESG scorecard, research6 has revealed that while Japanese companies are taking steps in the right direction, there is also significant potential for them to do more. Similar to the U.S. companies, their overall performance lags behind that of companies in Europe, with large players generally outperforming smaller players.

In addition to the notable dispersion in ESG ratings, the current environment of higher inflation, rising interest rates and economic uncertainty has also led to an increased dispersion in returns across and within sectors. This offers a fertile ground for active managers able to detect the dynamic evolution of ratings in global equity markets.

The dispersion in ESG ratings within and across sectors, amid an uncertain economic backdrop with sticky inflation and high geopolitical risks, offers opportunities to use a global forward-looking ESG approach.

ESG themes with strong tailwinds

Please see below some examples of ESG themes that offer attractive opportunities for selecting ESG winners and improvers:

1.

Decarbonisation has become more urgent than ever. Within the energy and utilities sectors, we see companies moving towards more eco-friendly power production. Energy transition has been the focus, but since the Ukraine invasion, attention has also been directed towards energy security and affordability. Within energy, the integrated oil companies are increasingly concentrating on natural gas with some of them making significant investments in renewable energy, while the utilities are gradually moving towards green electric power generation (see Case Study 3 below). Among these companies, we select those with regulatory environments that allow for the recovery of costs associated with the retirement of coal plants and the introduction of clean energy renewables, or gas. Also under the decarbonisation umbrella are the industrial companies that are facilitating the energy transition. In particular, these businesses are involved in improving factory efficiency, building automated processes and providing equipment used to hook up alternative energy sources to grids. We believe the importance of sustainable transport is growing and, as a result, we favour some ESG improvers focused on rail transport and electric vehicles (see Case Study 1 below).

2.

Along with environmental concerns, companies’ footprints are being scrutinised more and more on “S” issues, particularly those focused on social inequalities. For example, there is a growing political and regulatory focus in Europe on the issue of affordable housing. We prefer companies in this area that are well-positioned, in our view, in relation to any potential political or regulatory risks. For instance, we are positive on a German residential property company, a long term owner and operator of Europe’s largest multi-family housing portfolio for lower income groups.

3.

Investors are also paying more attention to product safety. Companies are now being held accountable for the safety of their products, not just for their customers but also within their supply chains. An example of how material this issue has become was provided recently by the uncertified use of a building materials company’s products. This sadly contributed to a loss of life, highlighting the necessity for companies to take full responsibility for how their products are being used. In our engagement with management, we discussed this necessity and were reassured by their response to investors’ concerns. Notable changes were made to their compliance process and a complete audit of their supply chain was undertaken. As a result, the company is now rated as an ESG improver by the equity team (see Table 2).

4.

Turning to labour issues, we believe these will experience a growing tailwind in years to come. In particular, food and clothing manufacturers and retailers face complex risks among their global suppliers (e.g. labour issues). We favour companies that are working towards ESG certification on the specific risks within their sectors while actively working with local bodies to mitigate them. A good example of such a company is a global food manufacturer, whose management are taking measures to incentivise parents to keep children in school for longer within its raw material supply chain.

5.

Another key area within “S” issues is cybersecurity and companies’ ability to protect their data. Any data breach can have a significant impact on companies, investors, supply chains and communities as well as individuals’ well-being, both mentally and financially. The non-inclusion of a business data protection policy is considered an obvious omission by a company (see Case Study 3 below).

To finish, the “S” in ESG is just evolving. Although investor scrutiny is increasing, there is not the same level of transparency into what best practices looks like, as there is on the environmental side. We believe this will change with best practices increasingly seen as those focused on collaborating with local centers of excellence and reducing industry risk for all stakeholders. Hence, we look at companies which are proactive in addressing “S” risks in their industries, and are not just looking after their own narrow footprints.

Bringing the investment approach to life

Case Study 1: A leading maker of lenses, frames and sunglasses

- Company overview: The company is a market leader in the design, manufacture and marketing of a range of lenses, frames and sunglasses to improve and protect eyesight. Its strong market position is the result of a merger, which is generating substantial cost and revenue synergies. The company is currently viewed as an ESG improver.

- ESG improver: As the integration progresses, we are seeing improving momentum across a range of governance related KPIs. In particular, there was a marked improvement in governance post 1H 2021, especially in relation to the board structure. This structure removed the previous dual representation of the two pre-merger companies, resulting in a more streamlined solution with one new CEO across the combined group.

- Outcome: We expect further upside on a range of KPIs across all three ESG components in the coming months, as sustainability best practices are rolled out across the group. Specifically, we anticipate these to focus on product innovation and labour concerns within the supply chain.

Case Study 2: A German auto-manufacturer

- Company overview: The company is among the top 10 auto-manufacturers in the world. It has a first mover advantage in the Chinese market, which we expect to be margin accretive in the near term.

- ESG improver: We consider this car manufacturer as being an ESG improver given its credible plan to shift its product mix towards electric vehicles over the short, medium and long term. Furthermore, this German business has ambitious CO2 reduction goals across its entire supply chain.

- Outcome: We expect these CO2 reduction goals to meet the EU regulatory fleet emissions targets. The company uses targets to 2030, established by the Science Based Targets initiative (SBTi). In doing so, management are showing their commitment to achieving climate neutrality across its value chain no later than 2050.

Case Study 3: A Nordic renewable utility

- Company overview: Established in 2018, this company develops, constructs and operates offshore and onshore wind and solar farms, bioenergy plants and energy storage facilities. Over the last ten years, the business has transformed from being one of the most fossil fuel intensive utility in Europe to one of the world's largest producer of offshore wind energy.

- ESG winner: The company is considered a winner due to its sustainable competitive advantage and market leading position in the renewable sector. In particular, our analysis of the company’s ESG historical data shows an ongoing improving trend in the Environmental KPIs which we consider to be financially material. Finally, the company benefits from strong regulatory and political support.

- Outcome: We anticipate the direction of the group’s environmental KPIs will continue to be positive. The company will carry on building its leading position in the fast growing renewables sector.

Case Study 4: A global payment system provider

- Company overview: This company is a global payments provider that operates one of the largest payment processing networks, connecting billions of consumers, millions of merchants and thousands of financial institutions in more than 210 countries. The company’s investment case rests on its strong secular tailwind (the shift to cashless transactions), premier business model and excellent free cash flow generation as well as the large investments made to protect customers’ data and privacy.

- ESG improver: Cybercrime is a high financial risk for a global payment company and this risk is forecasted to increase notably going forward. While cybersecurity has mainly been viewed as a technology issue, it is now also regarded as a key ESG concern, falling under the “Social” pillar. This payment provider is investing enormous amounts into social capital (i.e. data security and privacy), making it extremely difficult to replicate the company’s business model.

- Outcome: The analysis of historical data on employment conditions, product responsibility and data security shows an ongoing improving trend. Specifically, this positive trend relates to the Social KPIs that we consider are financially material to the investment case and we will continue to monitor them in the future.

Case Study 5: A Japanese diversified financial services company

- Company overview: The business has evolved from being purely a leasing company into a well-diversified financial business, offering services in areas such as lending, rentals, life insurance and real estate financing. This evolution has been supported by a culture that encourages new business ideas from employees. An openess to new ideas has enabled the company to cultivate a multi-skilled staff force which is a key driver of this company’s value creation.

- ESG improver: The setting up of the company’s sustainability committee is one of its ESG milestones. This sits as an execution body, providing a forum to discuss business opportunities and risks. In addition, as part of its Corporate Sustainability Policy (2021), material ESG issues and key sustainability goals were decided in terms of CO2 emissions reductions, including the possibility to divest some businesses, if necessary, to meet targets. Also, management has adjusted its Sustainable Investing and Lending checklist to incorporate risks in relation to human rights in business assessments.

- Outcome: This company’s ESG governance KPIs are on a positive trend. We believe the business is well-positioned to continue its evolution on sustainability through its diversified business model.

Conclusions

- ESG investing has been under pressure in 2022, amid challenging performances. For investors, the main lesson is that ESG investing has to continue to transform, moving beyond the top ESG performers (companies that score the highest in terms of ESG standards and ratings) to seek additional value;

- By integrating ESG criteria and sustainability into the investment decision, we expect to add value both in terms of being able to deliver better risk-adjusted return, but also in terms of helping to improve important ESG parameters for companies and society;

- Improvements in ESG standards are key drivers of companies’ financial performances, hence we believe that combining ESG winners and improvers is a good way to build more resilient ESG portfolios able to deliver excess return (alpha);

- We favour a forward-looking approach that integrates ESG analysis within a strong bottom-up stock selection process. Issues such as decarbonisation and social inequalities are gaining traction and offer room for selection.