Summary

With equity markets at record highs and election uncertainty looming, a balanced approach in equity with a focus on fundamentals is key.

-

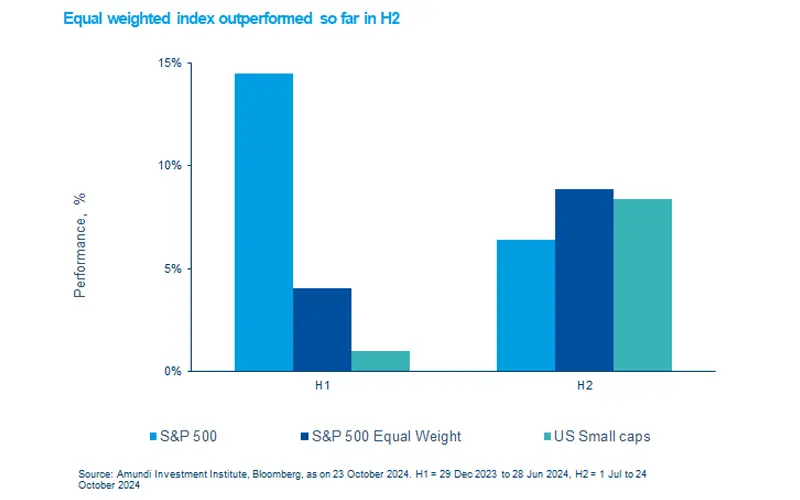

The S&P equal weighted index has outperformed the market-cap weighted S&P 500 since June.

-

Market uncertainty is on the rise approaching US elections.

- Global equities will likely benefit from the broadening of the rally and supportive Central Banks.

The S&P 500 reached multiple record highs this year, fuelled by optimism about a strong US economy, particularly in the first half, led by the tech magnificent 7 (seven large and influential technology stocks in the S&P 500). Since June, the rally has expanded to include small caps and other sectors, aligning with our view of a rotation driven by earnings growth beyond the Mega Caps, alongside supportive monetary policies from the Federal Reserve.

Most recently, this rotation has also been influenced by market expectations surrounding the outcome of the US elections1. This theme is likely to introduce further uncertainty in the coming weeks and lead to additional market rotations.

A combination of both a market-weight and equal-weight approach can help to seek a balance in this phase.

1. See more on US elections in our recent publication

Actionable ideas

- Equal weighted index in US

As the US is currently an expensive market, investors could explore more attractively-priced segments with an equal weighted approach.

- Global equities

A global approach that takes into account valuations and fundamentals would allow investors to explore quality stocks in regions such as Europe, Japan and emerging markets.

This week at a glance

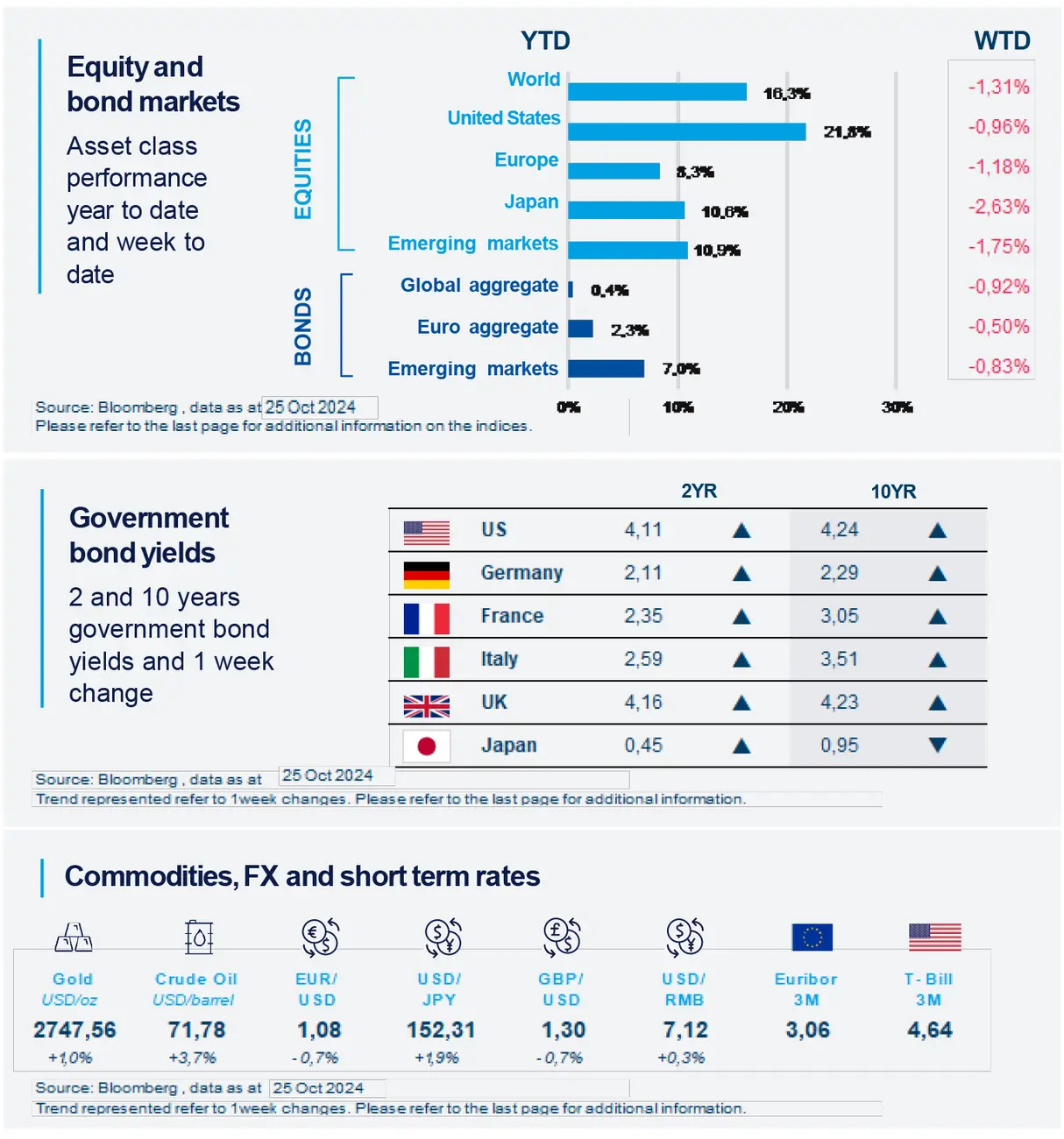

After a long string of weekly gains, equities took a break, assessing the ongoing earnings season and waiting for US payrolls data that will be key to understand the Fed’s next steps. Meanwhile, strong economic data and concerns over the fiscal deficit pushed ten-year US bond yields higher.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as 25 October 2024. The chart shows the S&P 500 index and the S&P equal weighted index.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US beige book depicts a softening economy

Economic activity was little changed according to the latest report: nine districts reported flat/declining activity; only three saw activity growing slightly. Most of them saw declining manufacturing activity. While inflation moderated, consumers’ price sensitivity persisted, with consumption shifting to less expensive alternatives. Employment growth continued at a slower pace, with hiring focused on replacement. Layoffs were limited. Several districts reported compressed profit margins.

Europe

Fourth quarter opens on a mixed note pointing to modest growth

October Eurozone composite PMI was little changed at 49.7, just below 50, the contraction/expansion threshold. The reading sent mixed signals: services PMI disappointed due to a deterioration in France, but the sector is still growing. Manufacturing PMIs beat expectations --surprisingly in Germany --yet they stay in a contractionary area. The employment component eased again, showing a cooling labour market.

Asia

India and China: steps towards normalisation at the BRICS summit

India and China have reached a pact on military patrols along their disputed border, signaling a potential resolution to the military clash started in 2020. During their first formal talks in five years at the BRICS summit, Chinese President Xi Jinping and Indian Prime Minister Narendra Modi agreed to enhance communication and cooperation, with hopes of increasing Chinese investment in India. Both leaders seek to improve bilateral relations.

Key dates

|

30 Oct EZ GDP, US GDP and ADP employment |

31 Oct EZ CPI, BoJ target rate, US personal income |

1 Nov China Caixin manuf. PMI, US employment and ISM manuf. |