Summary

In the search for equity opportunities, Emerging Markets may offer appealing valuations and exposure to long-term growth opportunities.

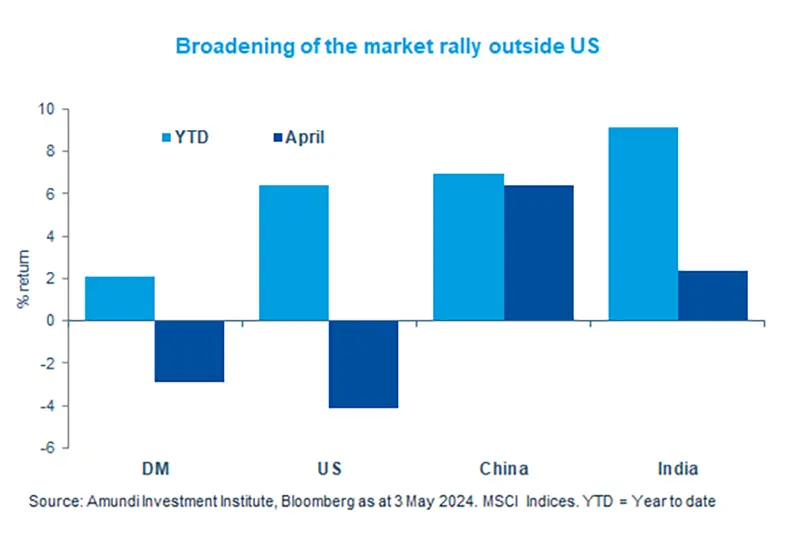

- The latest market movements are indicating a broadening of the rally beyond developed markets.

- Better growth prospects and valuations in emerging markets (EM) are supporting this move.

- The case for long term EM investing is boosted by domestic consumption, rising incomes and exports.

The year to date performance of developed market (DM) equities including US has undoubtedly been strong, owing to resilient growth and positive sentiment around US tech.

However, in April, we saw a broadening of this rally to emerging markets (EM) with China posting positive performances and Indian equities continuing to deliver positive returns.

At a time of extreme valuations in some areas of Developed Market equities, EM equities may offer appealing valuations, positive growth premium compared to the developed world, exposure to domestic demand and long-term growth stories. The region remains divergent and calls for vigilance around country specific factors.

Actionable ideas

- Emerging market equities

EM is home to many divergent regions and offers opportunities across Latin America (Brazil) and Asia (India, Indonesia) with attractive earnings prospects. -

India equities

India is a long-term story supported by structural factors, domestic demand, and stable policymaking that should continue to offer opportunities in 2024 and beyond.

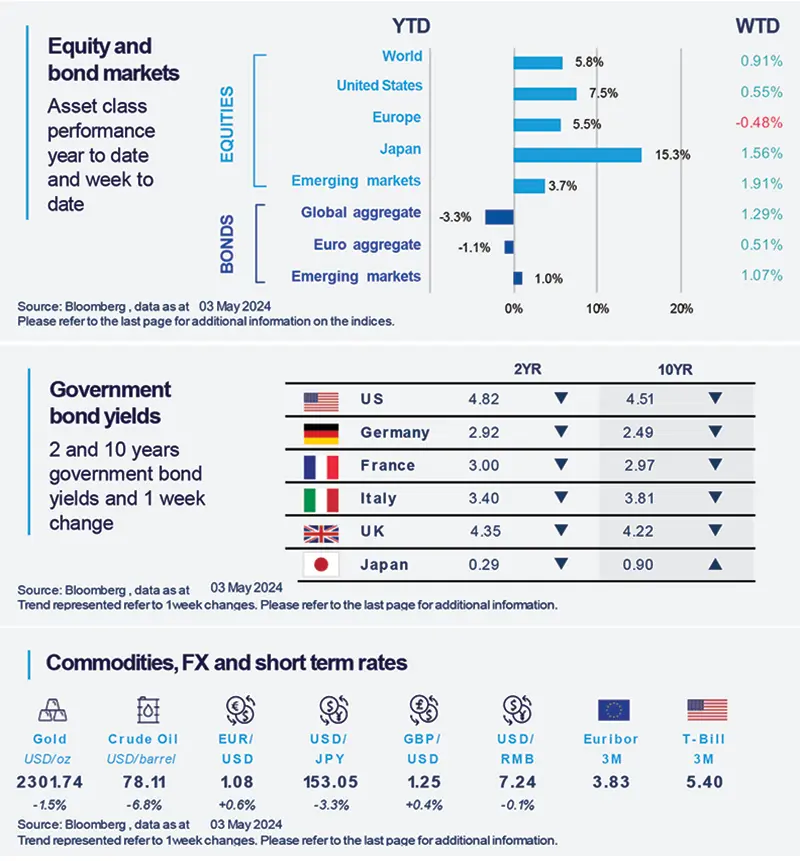

This week at a glance

Stocks were impacted by the earnings season as US and Japanese markets rose. The yen was also up for the week as authorities intervened to support the currency. In contrast, bond yields declined owing to a less-hawkish Fed, while oil prices also fell amid rising US crude inventories.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as 3 May 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Institute Macro Focus

Americas

US consumer confidence falls to lowest level since July 2022.

In April, the Conference Board Consumer Confidence Index fell to 97 (down from 103.1 in March) versus consensus expectations of 104. This was likely due to the elevated inflation and a cooling labour market.

Consumers are also worried about their families’ financial situations over the next 6 months. This may hint at a reduction in discretionary spending in the coming months.

Europe

EZ economy performs above expectations in Q1.

Q1 GDP delivered positive surprises across the Eurozone (EZ). All the big 4 economies expanded at a faster-than-expected pace - Germany (0.2%, QoQ),

France (0.2%), Italy (0.3%) and Spain (0.7%). The composition of growth was varied but domestic consumption may have been the main driver of growth, especially in France and Spain. In addition, external demand was a significant factor across the region.

Asia

The April Politburo meeting doesn’t change our view on China.

The Communist Party of China’s Politburo meeting on 30 April assessed the country’s economic situation and set policy priorities. It also confirmed the month for the long-awaited 3rd Plenum of the Central Committee to July – this plenum traditionally communicates economic reforms for the next five years. The Politburo meeting has shown some positive shifts, but we think there is a lack of a true macro push to support domestic demand.

Key Dates

|

6 May Indonesia GDP, |

9 May Bank of England rate, Mexico CPI |

10 May Japan trade, US consumer sentiment |