Summary

- Fed action: The Federal Reserve kept its benchmark federal funds rate unchanged at 5.25-5.50% for the third consecutive meeting. Chair Jerome Powell struck a more dovish than expected tone, noting that interest rates are at or near their peak. Updated forecasts of future federal funds rates included an additional 25 basis point rate cut next year. The Summary of Economic Projections (SEP) also saw a notable downgrade to the core personal consumption expenditures (PCE) inflation forecast.

- FOMC statement: The Federal Open Market Committee (FOMC) acknowledged that economic activity slowed in Q3, and while progress has been made in tackling price rises, inflation remains elevated. However, the Fed’s forward guidance was also tweaked to align with the SEP, which reflects the possibility of three more 25bp rate cuts in 2024.

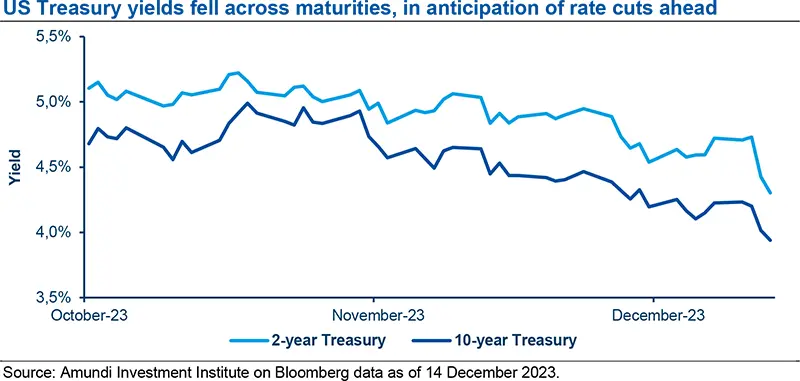

- Market reaction: Markets reacted positively to the Fed’s monetary policy decision, with government bonds and equities rallying sharply. The US yield curve steepened on the prospect of easier monetary policy, as yields declined more on shorter than longer-dated maturities, and major US equity indices closed approximately 1.4% higher. By contrast, the US dollar depreciated by nearly 1%, and remains vulnerable to the start of the Fed’s easing cycle.

- Investment implications: The Fed may be preparing to cut rates, but remains data dependent. Despite its desire for a ‘soft landing’, there are still risks to US growth. We remain cautious, and favour themes of longer interest rate duration, higher credit quality, and exposure to sectors where spreads compensate for potential macroeconomic uncertainty and tighter market liquidity.

Overview of the Federal Reserve’s monetary policy decision

The FOMC statement and press conference were more dovish than we – and the market – expected.

The Fed kept its benchmark overnight borrowing federal funds rate unchanged at 5.25-5.50% for the third consecutive meeting, that is, a period now spanning almost five months. The FOMC statement and press conference were more dovish than we – and the market – expected. This was exemplified in Chair Jerome Powell’s comment that the Fed believes interest rates are at or near their peak in this cycle.

Further adding to the meeting’s dovish tone, the updated forecasts of future federal funds rates, or the ‘dots’, included an additional 25 basis point rate cut in the upcoming year removing a rate hike instead. This brought the median expectation to three 25bp rate cuts by the end of 2024. Additionally, the refreshed SEP saw a notable downgrade to the core PCE forecast, with little impact on growth and unemployment.

Given a more dovish than expected reading from the Fed, government bonds and equities rallied sharply while the US dollar (USD) weakened. Specifically, the US Treasury curve steepened as yields declined in the 2-, 10- and 30-year segments by 22bp, 13bp and 9bp respectively. The major US equity indices all closed the day approximately 1.4% higher.

Key monetary policy decision takeaways:

- The Fed kept the federal funds rate unchanged at 5.25-5.50%;

- The federal funds rates dots’ median forecast now considers three 25bp rate cuts in 2024;

- SEP: Upward revision to 2023 gross domestic product (GDP) and downward revision to core PCE in 2023, 2024 and 2025, with no meaningful change in the unemployment rate forecasts;

- Press conference: Powell’s overall tone was dovish as he acknowledged that rates are at or near their peak, and cuts may be warranted as inflation continues to moderate.

FOMC statement: Some minor revisions, but pointing to a pivot

Release of the quarterly SEP kicked off the first leg of the afternoon’s bond market rally.

There were only a few minor changes to the FOMC statement. First, the Fed’s economic assessment recognised that economic activity has slowed from its strong pace in the third quarter, representing a downgrade from the November statement. Second, it acknowledged that inflation has eased over the past year, but remains elevated. Finally, there was a minor but potentially significant change to the forward guidance with the insertion of ‘any’ to ‘additional policy firming that may be appropriate’, nodding to the fact that the SEP now reflects no further hikes. While the statement was incrementally more dovish than before and compared to expectations, the subsequent release of the quarterly SEP kicked off the first leg of the afternoon’s bond market rally.

The SEP and accompanying ‘dots’ are no longer signalling the possibility of one more 25 basis point rate hike, but the possibility of three 25bp rate cuts in 2024. This was a dovish surprise to investors.

Specific to the federal funds rate ‘dot plot’:

- 2024 year-end: The median dot fell from 5.1% to 4.6%, implying three 25bp cuts;

- 2025 year-end: The median dot declined from 3.875% to 3.625%;

- 2026 year-end: The median dot was unchanged at 2.9%;

- Long-term: The median dot was unchanged at 2.50%. This is commonly referred to as the ‘neutral rate’, and should be compared to the Fed’s 2% long-term inflation target.

Powell strikes a dovish tone in the press conference

Inflation does not need to hit the Fed’s 2% long-term target to start easing.

There was a bit of a triumphant tone to Chair Powell’s press conference. He noted positive developments on the dual mandate, with greater balance in the labour market, and progress on tackling inflation. Powell spent some time outlining the Fed’s framework. Since the start of its tightening cycle, the Fed needed to assess how fast and how far to hike interest rates, and when it would become appropriate to ease policy. Having moved past the first question, they are assessing the current level of rates, and several Fed participants believe we are at the peak of the cycle. Powell made it clear that the move to an easing stance is next on the Fed’s agenda. In fact, the FOMC discussed the timing of rate cuts, noting that inflation does not need to hit the Fed’s 2% long-term target to start easing. While signalled in previous SEP releases, this was Powell’s first press mention that the committee has been thinking about the timing of future interest rate cuts. Overall, an extra 25bp rate cut in 2024 and 2025, removing a rate hike from the 2023 dot plot median, aligns the Fed more closely to the market’s expectations.

A dovish Fed sparks a strong rally in financial markets

We interpreted the December FOMC meeting as unequivocally dovish, relative to market expectations. The US yield curve steepened on the prospect of an eventual start to the Fed’s easing cycle in 2024, as the 2-, 10- and 30-year yields declined 22bp, 13bp, and 9bp respectively. The USD depreciated by nearly 1.0%. The Dow Jones, S&P 500 and Nasdaq each rallied by approximately 1.4%.

Implications for investors

Despite the Fed’s desire for a ‘soft landing’, we believe the risk of weaker growth is not as low as the market currently perceives.

The FOMC’s statement, the updated SEP and Chair Jerome Powell’s press conference make it clear the Fed believes monetary policy is sufficiently restrictive, and is preparing to exit its tightening cycle. However, the Fed remains data-dependent, and could pause from cutting rates if inflation proves more stubborn than expected. At the same time, if more progress is made in tackling inflation, it could cut rates sooner. Despite the Fed’s desire for a ‘soft landing’, we believe the risk of weaker growth is not as low as the market currently perceives. Therefore, we remain cautious, and continue to favour longer interest rate duration, higher credit quality, and exposure to sectors where spreads compensate for potential macroeconomic uncertainty and tighter market liquidity. The US dollar remains vulnerable to the start of the Fed’s easing cycle, to large twin deficits, relatively expensive valuation, and the possibility of weaker future growth.