Summary

China in 2025: fate of lower rates

Key takeaways

- China’s leadership explicitly advocates for unconventional policies that include monetary easing and a more expansionary fiscal policy. However, we believe these policies will not offset the existing structural drags and US tariff impacts completely.

- We expect China’s growth to remain on a downward trend, slowing from 5.0% in 2024 to 4.1% in 2025, and 3.6% in 2026.

- In the case of aggressive US trade protectionism and export controls, China should keep its expansionary fiscal stance for longer than currently expected.

- Chinese equity will be influenced by the incoming Trump administration's foreign policy, while additional stimulus could support Chinese markets, particularly domestic stocks. We maintain a neutral stance favouring domestic markets.

Investors learned the hard way that, without belief in fundamentals, one can still make money in China. Over the summer of 2024, the prevailing sentiment was ‘ABC’ (Anything But China) – a full-blown existential crisis framing China as an uninvestable asset class. In late September, China equities rallied an average of 25% on the back of official talk, triggering a widespread ‘buy everything’ sentiment, as the fear of missing out spread across the market.

On 24 September, the PBoC announced equity market support pipelines; then two days later, the Politburo held an emergency meeting and changed economic policies. For those who rely exclusively on fundamentals, it is painful to sit out violent rallies. The takeaway is clear: top-down investing in China has become a tactical game and making short-term judgments most of the time.

Finally, the awakening

Opinions on China are often oversimplified into bullish or bearish camps. It may seem contradictory to pair optimistic titles on policy announcements with bearish views on China's growth and inflation. In essence, we recognise a clear policy pivot intention from the leadership, but we remain sceptical about its effectiveness.

Unlike a year ago, when we described the policy stance as complacently passive, Chinese leadership has now eliminated all ambiguity. It is explicitly advocating for unconventional policies that include monetary easing and a more expansionary fiscal policy. This pivot is probably triggered by an atypical systemic crisis, where local governments were tight on money, struggling to pay corporates, banks and civil servants. Additionally, the election of Donald Trump as US President further seals the deal for such a shift. As a result of this newfound clarity in leadership, we expect a series of measures aimed at stabilising the economy, as follows:

- Monetary policy: we expect a total of 50bp policy rate cuts in H1 2025, bringing the seven-day open market operation (OMO) rate to 1%, starting with a 25bp cut in February.

- Fiscal policy: we expect an expansionary fiscal policy with a 2% additional fiscal deficit, raising the overall deficit to 10% of GDP in 2025 from 8% in 2024. Of this additional spending, 1% will be dedicated to consumption, including a continuous consumer goods trade-in programme and birth subsidies worth 500-800 RMB for families with more than one child. This will be announced on 5 March 2025 at the National People’s Congress. We believe this is the minimum required to stabilise the domestic demand, regardless of what Trump will announce on 20 January.

- In the case of aggressive trade protectionism policies and export controls from the Trump administration, China is likely to maintain this expansionary fiscal stance for longer than currently expected. From 2025-27, we can expect broad easing, reminiscent of the former Japanese Prime Minister Shinzo Abe’s first and second arrows starting in 2012. In that case, a delayed fiscal consolidation is likely, with the deficit being maintained at 10% in 2026-27 as well.

However, we believe that the impact of these policies will not offset the existing structural drags completely. A simple way to frame this is to consider how long it took Japan to recover from its zero-inflation period after Abenomics began in 2012. Markets are likely to position similarly.

We expect China’s growth to remain on the downward trend, slowing from 5.0% in 2024 to 4.1% in 2025, and 3.6% in 2026. The upcoming package could help ease the drag from deleveraging in the past few years but is unlikely to reverse the course of the structural slowdown. As evident in recent data, outside of the segments that benefited directly from the government consumer goods trade-in programme, consumer demand remains soft.

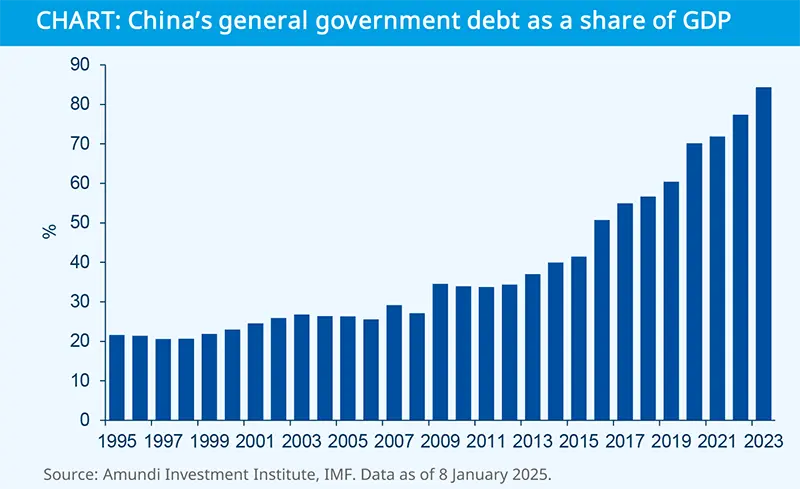

In summary, we believe China’s leadership genuinely intends to stabilise the economy, a notable shift from its passive approach a year ago. However, there is no quick fix to China’s ‘3D’ secular challenges (demographic, debt and decoupling, see here for more details).

We believe China’s leadership genuinely intends to stabilise the economy, a notable shift from its passive approach a year ago.

Key take-aways on China equities from the desk

- Policy shift and valuations are supportive: There is a notable policy shift towards a pro-growth government stance, with a willingness to underpin the property sector, support private enterprises and encourage consumption. This, combined with the significant excess savings accumulated during the Covid-19 pandemic, could present attractive opportunities for long-term investors. Valuations and positioning are also supportive.

- Rising geopolitical risks lead us to keep a neutral stance in the short term, favouring domestic stocks. High uncertainty about Trump’s policy and the contradictory appointments in his proposed cabinet call for a neutral stance overall. While offshore markets may at some point benefit from positive geopolitical developments, a base case would be a de-escalation, we favour domestic stocks that could be supported by the upcoming stimulus.

- Structural reforms and the size of the fiscal support are key factors to watch. Monitoring the size and composition of fiscal support is critical, particularly in light of the upcoming 'Two Sessions' summit. Observing announcements related to structural reforms that could help rebalance the composition of growth more structurally (such as social security, pension and Hukou reforms) will be essential for a sustained market rebound. However, the political challenges in implementing these reforms may hinder progress absent any recognition that stimulus without reform will only prove to have a temporary effect.

MACROECONOMICS

China: the ‘3D’ challenges

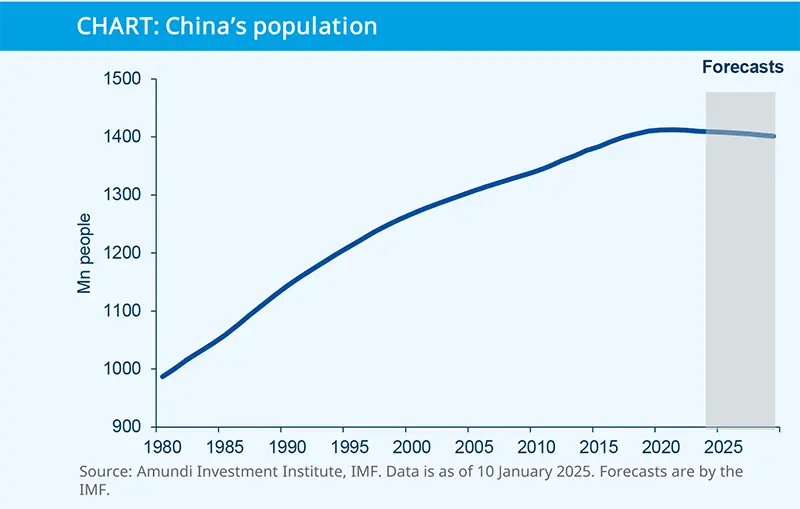

From a long-term perspective, China faces significant and enduring secular headwinds, characterised by demographic shifts, debt issues and decoupling – collectively referred to as the ‘3D’ challenges. We anticipate that these forces will ultimately reduce China's growth to 3% and we expect this convergence to occur sooner rather than later, contrary to consensus and IMF projections.

The demographic profile presents an ultra-long-term challenge

Even if Chinese policymakers successfully raise the total fertility rate from 1.0% in 2023 to 1.5% in 2025 and 1.8% by 2035, the working-age population will decline further over the next decade. As a result, the contribution of an increasing labour force to economic growth is likely to remain negative for the next several decades.

Economic decoupling from the United States should hinder productivity growth

This is particularly the case for US policies aimed at containing China's advancements in critical technologies and redirecting global supply chains away from China. China's response of doubling down on public investments in strategic sectors may not yield the desired results. History has shown that commercialisation and end-user demand are crucial for the successful adoption of new technologies.

Previously, China advanced rapidly along the global innovation curve, largely due to its extensive manufacturing ecosystem, which facilitated process innovation through continuous trial and error. However, companies are now compelled to relocate production overseas either for geopolitical reasons or in search of higher profit margins.

We anticipate that these ‘3D’ forces will ultimately reduce China's growth to 3% and expect this convergence to occur sooner rather than later.

Policymakers are increasingly favouring a flexible stance to address the debt issue.

In late 2021, policymakers enforced a deleveraging process in the property sector and embarked on a multi-year plan to reduce debt in both real estate and informal local government financing vehicles. This has added further strain to an already slowing economy, contributing to a systemic fiscal crisis over the summer of 2024 that resulted in the September policy pivot.

Policymakers are increasingly favouring a flexible stance to address the debt issue. Nevertheless, it seems unlikely that investors believe that deeply rooted problems can be resolved solely through stimulus announcements. While attitudes towards debt are shifting and management strategies are evolving, these changes are expected to create tradable opportunities.