Summary

While the Fed refrained from cutting rates in July, we believe, falling inflation will give it sufficient confidence to reduce rates later in the year. This is likely to be positive for government bonds.

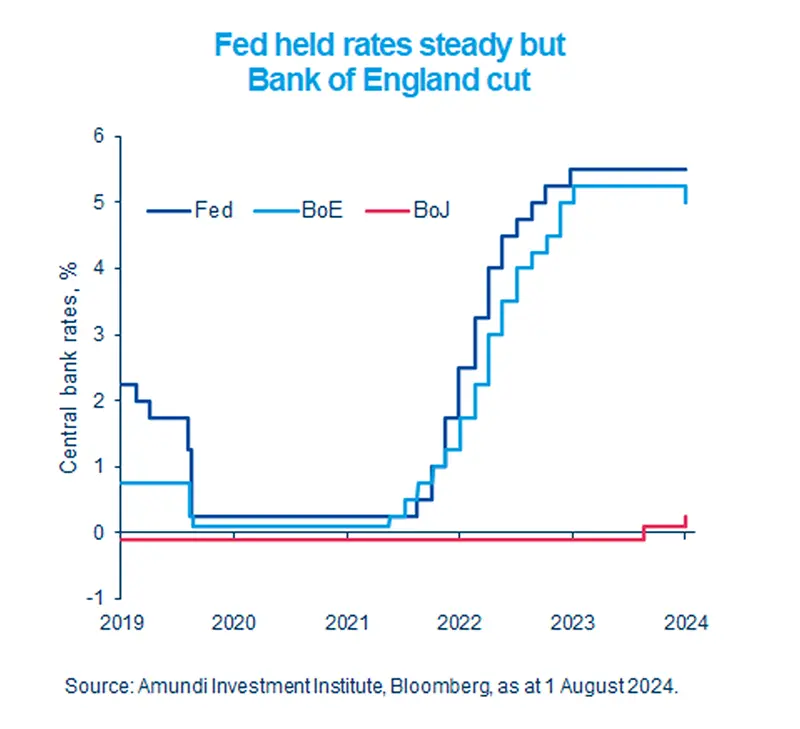

- The Fed kept policy rates unchanged, but the BoE reduced rates in a sign of some divergences in monetary policies.

- We think inflation is progressing towards the Fed’s goal, leaving the door open for easing at its future meetings this year.

- Bonds may benefit from central bank rate cuts and falling inflation.

The Fed left interest rates unchanged in its latest policy meeting in July but acknowledged that price pressures are subsiding. This could encourage the Fed to reduce interest rates later this year. Across the Atlantic, the Bank of England (BoE) implemented its first rate cut since early 2020 on abating inflation in the UK. In contrast, the Bank of Japan (BoJ) raised policy rates for the second time this year to control upward pressures on inflation.

We think these temporary divergences in central bank actions are primarily a result of the different economic environments prevailing in these countries. Hence, incoming data on inflation and growth are important and would drive central banks’ policies.

Actionable ideas

- US bonds

A mild deceleration in US economic activity in the second half of this year and declining inflation paint a constructive picture for government bonds. Quality corporate credit is also attractive.

- Global bonds

Robust economic growth in emerging markets and policy easing by DM central banks such as the BoE underscore the need to explore global bonds, and high quality credit.

This week at a glance

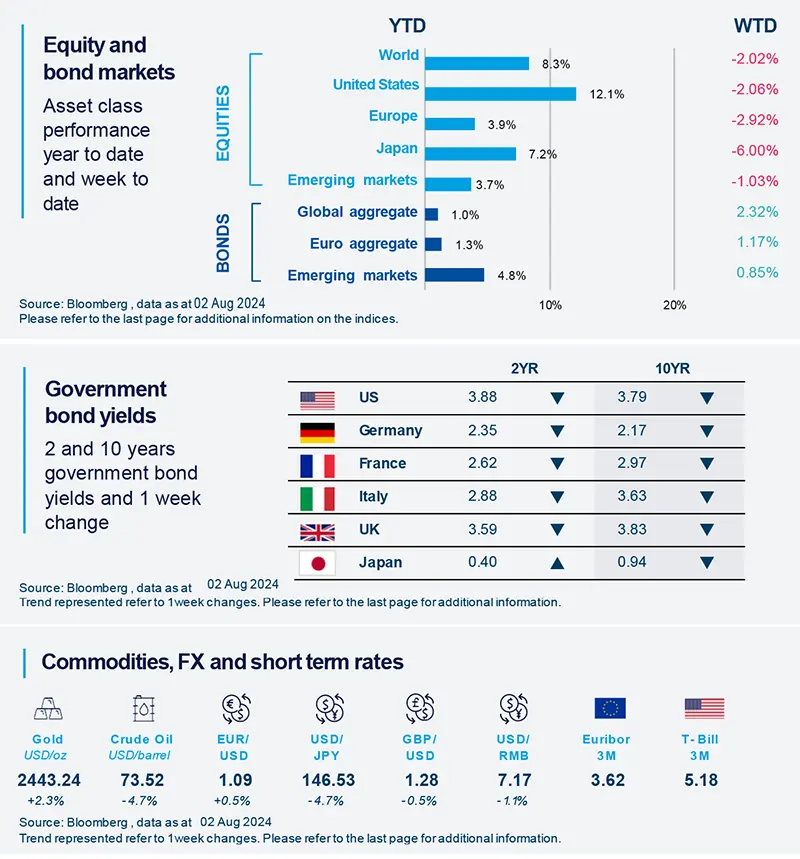

Global markets were affected by concerns over the US economy and corporate results in the tech sector. Equity markets fell around the world, in particular in Japan. Meanwhile, expectations of rate cuts by the Fed pushed bond yields lower and gold prices got a boost from safe-haven demand.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as 2 August 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US labour markets show signs of cooling

Labour markets continue to signal a slowdown. The latest weekly data on jobless claims maintained its upward trend. On the other hand, productivity (output of goods and services for every hour worked) in the second quarter improved. This may put downward pressure on overall labour costs and eventually contribute towards slowing inflation.

Europe

Euro area (EA) growth stronger than expected

The EA GDP growth came in at 0.3% (quarter on quarter) for the second quarter, according to preliminary data released. The German economy contracted marginally but Spain and France expanded at a robust pace. Notably in Spain, activity in both the manufacturing and services sectors was strong. The data broadly reflects our views that the region is on a path of an economic recovery, with some divergences among countries.

Asia

Bank of Japan (BoJ) raised rates

The BoJ hiked policy rates unexpectedly and decided to reduce its purchase of Japanese government bonds, a hawkish move that prompted a strong appreciation in yen. Despite this, real interest rates (interests rates after considering inflation) are still negative in the country. We are closely monitoring BoJ communication and believe the bank will take into account future inflation data before hiking rates further.

Key Dates

|

5 Aug Indonesia GDP, EZ PMI, |

7 Aug Trade balance: |

8 Aug Reserve Bank of India, |