Summary

A historical perspective on the current tariffs

Earlier this year, massive trade uncertainty caused extreme market volatility. Since then, concerns over economic costs, retaliations, and legal challenges have eased tensions. Markets now price limited stress, suggesting peak tensions are behind and current tariffs have become the new norm. However, when considering Trump’s transactional approach: a sense of calm is often followed by renewed pressure. While peak stress may have passed and dealmaking may take priority, we still expect US trade policies and sustained tariffs to pressure supply chains and activity, fueling uncertainty and occasional volatility spikes.

We look to history to put this trade war in perspective. Most media references to today’s episode focuses on the 1930s: we believe this analogy offers an incomplete and reductive picture.

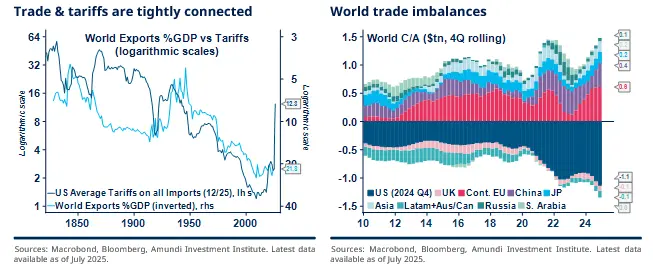

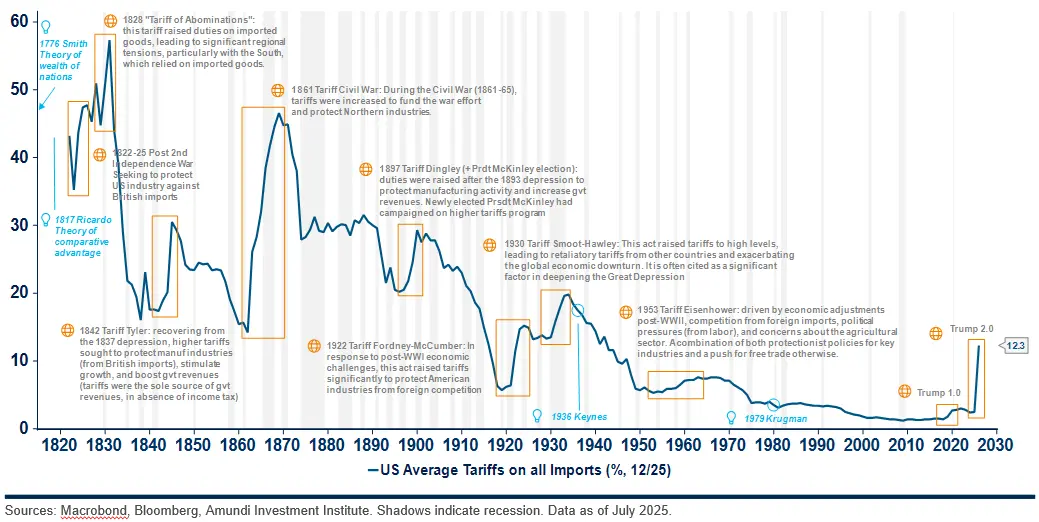

Since the 19th century, there have been roughly ten episodes of US protectionism. We focus on the ones that occurred after the 1861-65 American Civil War.

The context for each of these trade wars has some similarities, but also significant differences compared to today’s backdrop. Some of these tariff policies proved either successful (1897), mixed (1922), targeted (1953), or disastrous (1929). None of these past episodes alone can reliably predict the most likely outcome of the current trade wars:

▪ If most of the current tariffs are intended to be negotiation tactics, the bulk of which ultimately reversed, leading to targeted retaliations, then the closest proxy might be 1921.

▪ If today’s tariffs are a means by design, planned to stay extensively high, provoking significant retaliations, then 1929 appears to be a better reference.

▪ The objectives of the 1897 tariffs were closest to President Trump’s (President McKinley is not one of his favorite models by coincidence). However, at the time, the US was emerging as a global power – in contrast with today, when it is now being challenged. The preceding recession by then also gave a much stronger economic impulse than we have now. Also, retaliations were then milder.

▪ The 1953 episode is less comparable, as it was more targeted and gradual, aimed at preserving US hegemony rather than reshaping the global economic order.

Highlights • Understanding the historical dynamics of trade and protectionism offers valuable insight into recent trends. • Analogies solely focusing on the 1930s trade wars provide an incomplete picture. • Since the 16th century, global trade experienced four major expansion phases, fueling competition among powers, initially through trade wars, but ultimately leading to WWI. • The fiasco of tariff-wars during the Great Depression and US hegemony contributed to a broad cut in tariffs post-WWII. • Today, worsening trade imbalances and the return of a multipolar world are consistent with the resurgence of tariffs, amid growing geopolitical tensions. |

Key drivers of today’s trade war outcome

Trump 2.0 – main objectives of the trade wars:

▪ Reshore manufacturing and rebuild the middle class to improve societal stability in the long run.

▪ Raise customs revenue in order to lower income tax, amid limited public deficit flexibility.

▪ Use tariffs as leverage to negotiate broader trade deals and other concessions.

▪ Reshape capital and production flows to address the root causes of twin deficits, reduce dependence on China as a creditor, and minimise reliance on strategic goods amid growing multipolar world threats.

| Opportunities: Tariffs aim to protect domestic industries, address trade imbalances, and support emerging sectors, allowing them to develop and become competitive. They can also enhance national security by reducing dependence on foreign suppliers for critical goods and serve as leverage in trade negotiations to encourage trading partners to adopt fairer practices. | |

| Risks: Broader consequences can neutralise initial objectives – by raising consumer prices (particularly in sectors reliant on global supply chains), distorting market efficiency in favour of less competitive firms, misallocating resources, and discouraging innovation. Trade and geopolitical isolation, as well as reduced access to advanced technologies of key resources, can be additional unwanted consequences. |

Ten factors that influence the outcomes of protectionist strategies

|

A brief history of global trade and tariffs

Trade flows were dominated by Asia. Europe imported large quantities of luxury goods from Asia (spices, silk, tea, porcelain, precious stones) in exchange for limited exports of raw materials (metal and wool) and low-value goods. After the fall of Constantinople (1453), the Ottomans and Italian city-states controlled the complex overland trade routes, further restricting direct access to Asia. Payments in gold and silver led to a significant outflow of wealth from Europe. This trade imbalance and the desire to bypass intermediaries, were key factors motivating European explorations and the search for new routes to Asia. In some ways, the US’ trade deficit situation today might not be at odds with that of Europe’s in the 15th century. There have been four major periods of booming global trade in modern times.

The expansion of world trade was driven by European exploration, with figures like Columbus, da Gama, and Magellan leading expeditions that opened new trade routes. Spices, luxury goods, sugar, tobacco and the slave trade spurred this expansion, while new navigation techniques, advancements in shipbuilding, and improved cartography supported it, particularly benefiting the newly created trading companies. Trade then consolidated in the 17th but continued to become more integrated with the expansion of colonial empires, increasingly efficient trading companies, and the establishment of complex trade networks. These developments laid the foundation for the modern global economy.

World trade further expanded with the rise of mercantilism: colonies supplied raw materials that were manufactured in Europe. It fueled Great Britain’s Industrial Revolution in the late 18th century. The rise of capitalism soon followed. Besides, the newly independent US also contributed to global trade dynamics, as it established its own trade relationships.

The third major phase in global trade expansion was driven by technological breakthroughs and production surpluses. Railroad, steamships, and mechanised factories led to a change of scale both trade volume and geography. The broadening of global trade was funded by an expanding banking system and supported by the adoption of the gold standard to mitigate currency fluctuations. Production massively surged, leading to surpluses that needed new markets. Competition for resources and new markets intensified among industrialised nations, leading to economic rivalries: initially through tariff wars and ultimately leading to the outbreak of World War I.

Trade turned worldwide, supported by falling tariffs, dropping transportation costs, and the development of more complex supply-chains (moving from exchanging different products between countries pre-WWII to increasingly exchanging parts of the same products), along with a growing share of services. There have been several interesting trends in world trade lately heralding a slowdown: global trade has become increasingly bilateral: 60% of trade is now between pairs, where a country imports goods from another country and exports goods to the same country, vs. 20% in 1950. A growing share of global trade is also between EM countries, while most trade agreements are between EM countries (based on data gathered by Fouquin/Hugot and Klasing/Milionis).

Trade tariffs are not new, but their use as a war tool is recent. Trade tariffs have existed for centuries, but their use took a new turn with the expansion of global trade – culminating in the tariff wars seen during the 19th century until 1930s (earlier tariff frictions were mostly local disputes and are not deemed a ‘trade-war strategy’). The fiasco of tariff wars during the Great Depression, along with US hegemony, both contributed to a general cut in tariffs post-WWII.

Ten episodes of US protectionism since the 19th century

A brief history of protectionism (with key trade-related economic theories)

1822 | Tariffs after the Second War of Independence: Sought to protect industries against British imports. |

1828 | ‘Tariff of Abominations’: Duties were raised on imported goods, leading to significant regional tensions, particularly with the South, which relied on imported goods. |

1842

| ‘Tariff Tyler’: Recovering from the 1837 depression, higher tariffs sought to protect manufacturing industries (from British imports), stimulate growth, and boost government revenues (tariffs were the sole source of government revenues, in absence of income tax). |

1861 | Tariffs during the Civil War: Tariffs were raised to fund the war effort and protect northern industries. |

1897 | ‘Tariff Dingley’: Duties were raised after the 1893 depression to protect manufacturing activity and increase government revenues. Newly elected President McKinley had campaigned on higher tariff programs. |

1922

| ‘Tariff Fordney-McCumber’: In response to WWI economic challenges, tariffs were significantly raised to protect industries from foreign competition. |

1930 | ‘Tariff Smoot-Hawley’: Tariffs were raised to high levels, leading to retaliatory tariffs from other countries and exacerbating the global economic downturn. It is often cited as a significant factor in deepening the Great Depression. |

1953 | ‘Tariff Eisenhower’: Driven by economic adjustments post-WWII, competition from foreign imports, political pressures (from labour), and concerns about the agricultural sector. A combination of both protectionist policies for key industries and a push for free trade otherwise. |

2018 | ‘Trump 1.0 Tariffs’: Tariffs primarily targeted China, and steel and aluminium imports. The goal was to reduce the US trade deficit, protect industries, and pre sure trading partners into renegotiating trade deals. |

2025 | ‘Liberation Day Tariffs’: Tariffs aimed to reshore manufacturing, rebuild the middle class, reduce dependence on China, and minimise reliance on strategic goods in an increasingly multipolar world. |

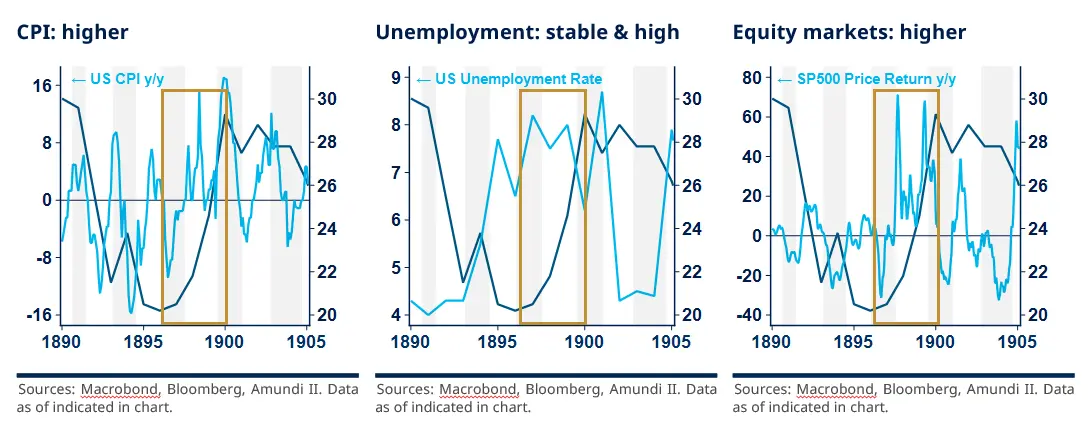

Focus on Tariffs during 1897-1900

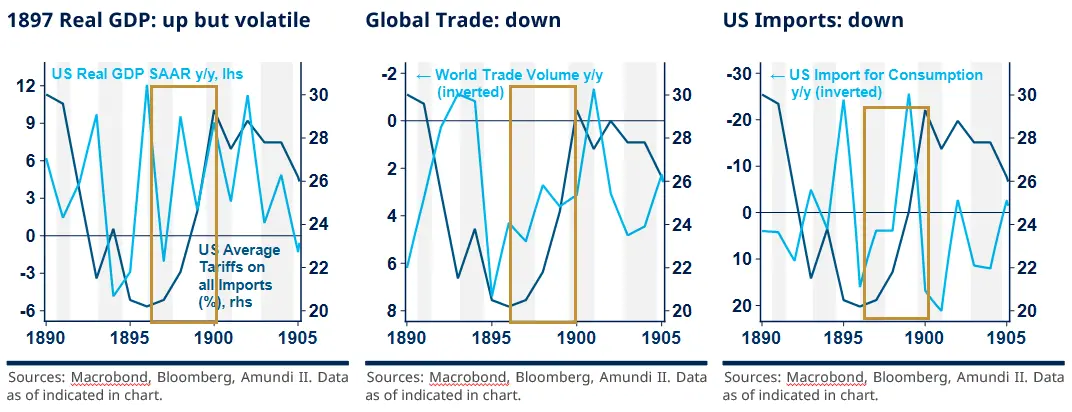

Tariff 1897-1900: Very similar to today on paper, but the US was a rising challenger at the time – not a matured superpower being challenged – and economic support was stronger

US Political & Historical Context: The US had started to recover from the profound 1893-96 depression, giving way to the rise of industrialisation, urbanisation, and economic expansion, which also led to widening disparities and labour unrest. The newly elected President McKinley was a strong advocate of high tariffs to promote growth.

Geopolitical Context Abroad: Imperialism and competition among European powers for colonies and markets characterised the period. The global economy was increasingly interconnected, with trade relationships influencing domestic policies. US frictions were strongest with Germany, whose rapidly expanding influence and military capabilities threatened US interests in Europe and Asia.

Reasons for and Details about Tariffs: The policy sought to i) protect nascent and still-weak industries from foreign competition, ii) stimulate growth and job creation, iii) maximise revenue generation, iv) expand integration in world trade through more reciprocal trade agreements. The 1897 Dingley Tariff Act raised tariffs to high levels – especially on agricultural products (grain and sugar), and manufactured goods (textiles, iron, steel) – mainly targeting Europe and the Caribbean.

How Trade Partners responded: European countries modestly raised their own tariffs (Germany focused on agriculture; France on both agriculture and manufactured goods). In the medium term, these countries sought greater self-sufficiency and increasingly turned to their colonies.

Consequences from the Tariffs: Industries were better protected and growth strengthened, but large disparities emerged as some sectors were favoured over others. Surging inflation affected consumers and ultimately contributed to a mild recession. The trade balance improved, but retaliatory tariffs negatively impacted exports. A modestly worsening budget deficit and rising public debt were later fully overcome. Overall, the strategy proved reasonably successful.

Markets: Strong equity performance was observed, with declining valuation multiples thanks to growing profits coinciding with strong economic growth. Despite rising inflation, yields marginally weakened. The dollar appreciated until the onset of the next recession.

Similarities & Differences vs Trump 2.0: While President Trump pursues objectives broadly aligned with those of President McKinley, the macroeconomic context of the US today differs significantly from that of McKinley’s era. The US was then emerging as a new global power – now it is the one being challenged. The recession at the time also gave a much stronger economic impulse than today. Retaliations were mild.

Tariff Dingley Mandate: President McKinley

|

“Surging inflation affected consumers and ultimately contributed to a mild recession. The trade balance improved, but retaliatory tariffs negatively impacted exports.”

From tariffs to taxes: the fiscal rebalancing of 1913 Important fiscal shift in 1909 and especially in 1913: Tariffs are no longer the main source of

|

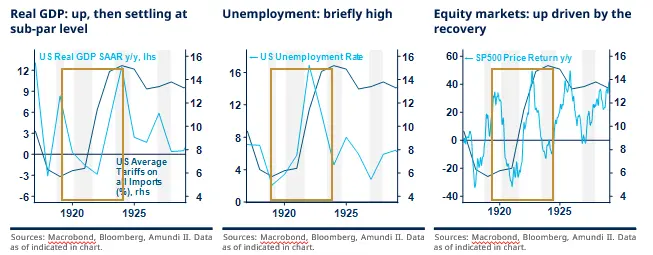

Focus on Tariffs during 1919-1923

Tariff 1919-1923: An intense but short-lived trade war, initially benefitting the US but ultimately leading to sub-par US growth, as tariffs were kept elevated for years.

US Political & Historical Context: Post-WWI optimism faded amid economic challenges, labour unrest, and fear of communism. Call to support farmers intensified amid agricultural over-production and declining prices. President Harding backed high tariffs to stabilise growth, which started to recover in 1922, driven by industrial growth and consumer demand.

Geopolitical Context Abroad: Post-WWI Europe faced economic instability, due to debt, inflation, and social unrest. The US emerged as a global economic power during this period.

Reasons for & Details for Raising Tariffs: Tariffs aimed to protect US industries from foreign competition and to support agriculture. The Fordney-McCumber Tariff Act of 1922 raised tariffs significantly, targeting a wide range of products (grain, textiles, manufactured goods, steel, machinery), particularly from Europe.

How Trade Partners Responded: European countries raised tariffs more sharply, causing US exports to Europe to fall significantly (exports to Germany dropped 30%). Europe shifted focus to colonies and intra-European trade. The impact was severe but relatively short-lived.

Consequences of the Tariffs: The US economy briefly experienced strong growth, higher profits, and modest fiscal improvement, but consumers faced high unemployment (albeit short-lived). The trade war severely but briefly disrupted supply chains and global trade. With tariffs remaining high, US growth settled at a weak 0-2%.

Markets: Equity performance was strong until the mid-1920s, with prices reflecting anticipated profit growth (multiple valuations initially rose, then normalised later). Credit spreads tightened and housing prices rose. As the US gradually exited the previous deflation period, yields continued to decline. The dollar was slightly up.

Similarities & Differences vs Trump 2.0: Exiting from a major war, the context then was different from today. Valuations were also much lower. However, the stage in the economic cycle shows some parallels (both periods saw a recovery following a growth slowdown), and geopolitical instability is a shared factor.

Tariff Fordney-McCumber Mandate: President Harding

|

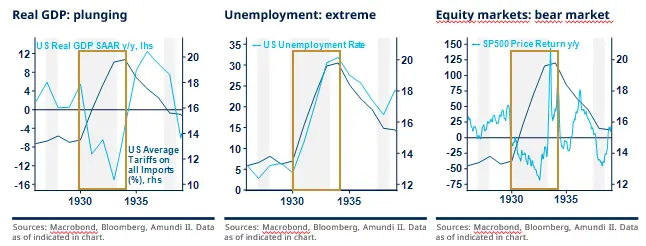

Focus on Tariffs during 1930-1933

Tariff 1930-1933: Designed to protect industries and jobs in a recessionary environment, tariffs greatly amplified the economic depression, met with retaliations of the same magnitude.

US Political & Historical Context: The Great Depression. President Hoover then faced the public’s desperation and growing calls for intervention.

Geopolitical Context Abroad: Economic instability and rising protectionism dominated, with no coordination in a global economy that was becoming increasingly interconnected.

Reasons for & details for Raising Tariffs: Tariffs were intended to stabilise the economy by encouraging consumers to buy American-made products. The Smoot-Hawley Tariff Act of 1930 was introduced in response to pressure from agricultural and industrial interests struggling to emerge the recession. The average tariff rate reached 60% on many imported goods.

How Trade Partners responded: Most countries retaliated with very high tariffs of similar magnitude. US exports fell dramatically (from 1929 to 1933: -67%).

Consequences of the Tariffs: Tariffs did not lead to the intended recovery; they exacerbated the downturn, with the US increasingly isolated trade-wise. Reduced external demand added to domestic issues, leading to extreme unemployment, a much higher public deficit, and rising debt. The dollar weakened, reflecting lower confidence in the US. Overall, this trade war was a fiasco.

Markets: With tariffs raised shortly after the start of the recession, equity performance was strongly negative, with valuation multiples contracting and massive credit spreads widening. Yields dropped amid deflation. The dollar eventually declined after the US abandoned the gold standard.

Similarities and Differences vs Trump 2.0:

Similarities: Manufacturing and job recovery were shared goals; both trade wars were met with fierce retaliation; and equity markets were highly valued in both periods.

Differences: The economic backdrop today is far more stable. Liquidity stress was far higher in 1930.

Tariff Smoot-Hawley Mandate: President Hoover

|

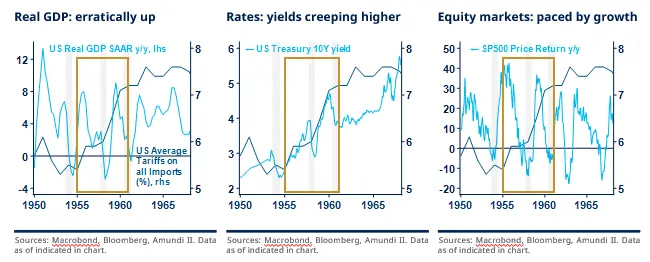

Focus on Tariffs during 1953-1962

Tariff 1953-1962: Calibrated tariffs to protect select industries without undermining the principle of free-trade.

US Political & Historical Context: The Cold War. Newly elected President Eisenhower focused on the containment of communism, economic growth, consumerism, and the expansion of the middle class. He generally favoured free-trade but also felt that protection in certain industries was needed to shield jobs.

Geopolitical Context Abroad: Recovery in Europe and Japan, supported by the Marshall Plan, led to increased competition amid the Cold War (especially in manufacturing and technology). The US was also transitioning out of the Korean War (1951-53).

Reasons for & Details for Raising Tariffs: Tariffs aimed to protect specific industries from foreign competition, including textiles, steel, agricultural products, and certain manufactured goods. The Tariff Classification Act of 1959 and subsequent measures reflected these protectionist sentiments, primarily targeting Japan.

How Trade Partners responded: Other countries, including Japan, modestly raised tariffs, mainly on grain.

Consequences of the Tariffs: The tariffs had a modest and temporary impact on trade (US exports to Japan fell by 10%). Growth and corporate profits continued to be positive, though somewhat erratic. The tariffs had little effect on inflation, public deficits, and debt.

Markets: Equity performance and credit spreads were influenced more by shifts in economic growth than by tariffs. Yields and the dollar crept higher.

Similarities and Differences vs Trump 2.0: Both periods were marked by significant geopolitical tensions and growing foreign competition. However, tariffs in the 50s sought more modest geoeconomic ambitions, were more targeted, leading to milder retaliations.

1953-1962 Tariffs Mandate: President Eisenhower

|