Summary

- A second term for President Joe Biden will see the US continue to be deeply involved in geopolitical hotspots, while pressuring allies to share the burden. Foreign policy under Donald Trump may be less predictable, with intensified economic sanctions and a less certain commitment to allies.

- Protectionist trade policies would be pursued by both candidates. Biden may expand the range of targets, while Trump’s desire to protect core US industries could lead to trade conflicts with allies in Europe and Asia.

- Tax policy will be a key issue, with neither candidate proposing a clear path to US debt sustainability. Trump will prioritise extending his 2017 Tax Cuts and Jobs Act, while Biden will seek to cut taxes for low-to-middle-income earners and raise taxes for high-income earners and corporates.

- Immigration remains a politically-charged issue, with both candidates expected to implement stricter policies, although Trump’s threats to deport undocumented immigrants will have a strong adverse effect as it will affect labour supply and wages.

- US energy policy will prioritise self-sufficiency and domestic oil and gas under Trump, while Biden would continue to support clean energy initiatives.

- Equity markets may perform better under a divided government, as contentious tax increases and aggressive trade policies are less likely to be implemented. Both agendas could lead to higher deficits that will push up debt and Treasury yields.

The US election rematch between President Biden and former President Trump will focus market attention on their respective agendas. This paper examines the potential economic and foreign policy changes that could emerge in their second term, as well as the repercussions for financial markets.

A second Biden term would likely maintain the status quo, but could result in higher long-term yields, especially given a deterioration in the US fiscal position that neither party seems eager to address. Trump, on the other hand, would likely announce dramatic policy shifts, including substantially higher tariffs, the increased deportation of undocumented immigrants and attempts to dilute the Inflation Reduction Act (IRA). These changes would constitute a significant supply shock, and potentially drive inflation and yields higher.

The candidates' foreign policy agendas could lead to a range of outcomes. An escalation of protectionism, particularly higher tariffs, may provoke retaliation.

The implications of these policies on government financing needs, borrowing costs, and yields will be crucial for financial markets. While long-term bond yields may become more volatile, a more concerning development would be persistently higher-term premia on a secular basis. This is very likely if the public sector balance sheet continues to deteriorate.

We assess five policy areas based on the candidates’ current comments: foreign policy, trade, taxes, immigration and energy. While rhetoric may not always translate into action, stated policies offer valuable insights into the two candidates’ thinking.

Foreign Policy

Continuation of the status quo: interventionist stance will persist; somewhat higher risk appetite. The main focus will remain on China, containing its technological advancement in critical areas such as semiconductors, AI and biotech, with an emphasis on aligning allies with US policies.

Additional trade tariffs will add another layer of geopolitics: likely less preferential treatment for allies.

In terms of foreign policy, under Biden, the US is likely to continue its deep involvement in geopolitical hotspots. Despite financial and military constraints, Biden's interventionist stance will persist, though he will increase pressure on allies to share more of the burden. The US aims to focus its foreign policy on the South China Sea and China, but recent demands for US military support across various hotspots are stretching US resources.

President Biden will likely approach foreign policy with fewer constraints compared to his current term, given that he does not need to worry as much about re-election. This shift could lead to a more confrontational stance in certain areas.

In the Middle East, support for Israel will persist, even though the stance of Israel’s government could make this increasingly difficult. There are many downside risks that another Biden administration could face. Despite intense diplomatic efforts to keep the crisis geographically contained, an escalation between Israel and Lebanon, as well as between Israel and Iran, still remains likely and both could end up drawing in the US directly.

While the US under Biden will continue to support Ukraine, there is an expected decrease in direct financial support from the US, with increased pressure on Europe to take on more responsibility, such as using windfall profits from frozen Russian assets. There is still significant European opposition to US proposals to raise official and market funding based on the expected long-term interest income on these assets. Any such measure would only become more likely should the heavy lifting of financing Ukraine shift to Europe because the US stops its support – a prospect that would be more likely under a Trump administration.

Under Trump, geopolitical risks are likely to increase as trade restrictions for both allies and adversaries will intensify the scale and scope of economic sanctions and export controls, heightening the economic frictions already playing out, and escalating protectionism and retaliation.

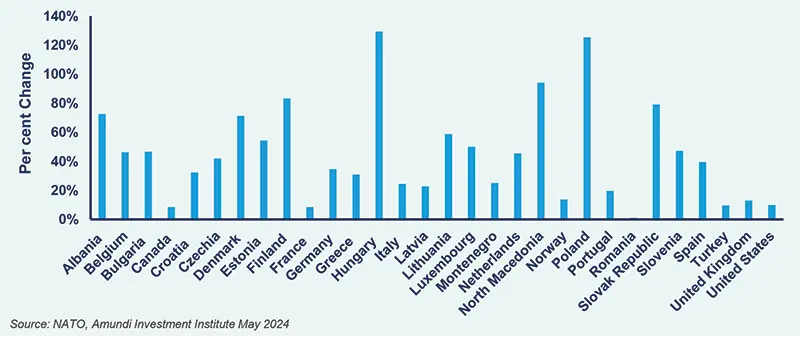

Change in Real Defence Spending by NATO Countries 2023 vs 2018

Overall, US foreign policy would be much less predictable. Trump’s deal-cutting approach could either amplify or mitigate risks. For example, on Ukraine: Trump could push Ukraine and Russia into accepting a ceasefire, which could bring Russia once again closer to the US and weaken China-Russia ties. On the flipside, he could also double down on support for Ukraine.

Beyond trade, allies will feel less secure under Trump: It is legally difficult for the US to actually pull out of NATO as it now requires congressional approval to do so. Nevertheless, if the US president does not want to defend an ally, it is irrelevant whether the US is a NATO member or not – no one can force the US president to protect an ally. However, Donald Trump is not anti-NATO per se. His comments have mainly been about ending the protection of NATO members who don’t pay their ‘fair share’ (of 2% of GDP).

By the time Trump comes into office, the NATO members most at risk will have increased spending to that minimum level in anticipation of a Trump presidency and reflecting the growing security risk. Even though European NATO members are now reaching that minimum spending level, this follows years of underinvestment, leaving an estimated shortfall of EUR 56 billion.

If the US president does not want to defend an ally, it is irrelevant whether the US is a NATO member or not – no one can force the US president to protect an ally.

Taiwan will feel less secure too as Trump could swing from refusing to protect the island altogether towards making any security contingent on Taiwan stepping up the diversification of semiconductor production to the US.

Governments keen to undermine US power in the world will likely test the US’s resolve to protect allies under a Trump presidency. Tensions are likely to increase in the South China Sea as China tests how far it can go before provoking a US response. As the US under Biden has worked hard to improve relations between South Korea and Japan as an alliance that can stand up to China, such an alliance is likely to feel somewhat less stable under a Trump presidency.

Trump’s failure to protect and react to Iran’s attack on Saudi Arabia in 2019 and his rhetoric on various geopolitical hot spots today, will make US allies uncomfortable in solely relying on US security backing. This means more countries are looking for new security buffers. Good examples are Saudi Arabi’s improvement of ties with Iran in 2023, as well as countries in the Indo-Pacific, which are moving fast to step up their joint security cooperation, such as Japan, Australia and the Philippines.

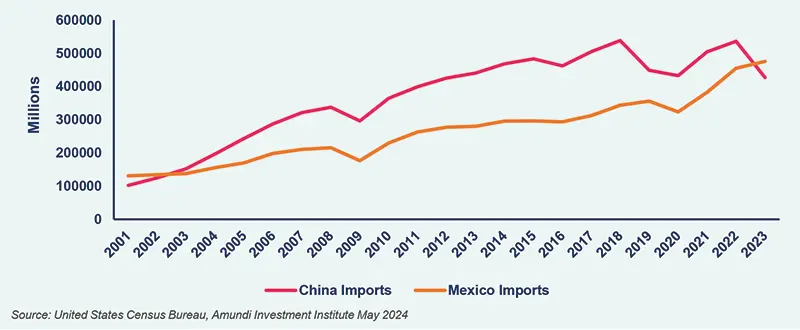

China vs Mexico Imports to US

Trade

Continuation of the status quo: Targeted expansion of protectionist industrial policy, renegotiation of United States-Mexico Canada Agreement in 2026 and more curbs on Chinese access to the US market and restrictions on tech exports to China

Trade protection: Ideas floated include a universal 10% tariff on imported goods and reciprocal tariffs on countries imposing tariffs on the US. End permanent normal trade relations status for China and/or 60% higher tariffs. Incrementally increase tariffs on countries that are considered to manipulate exchange rates or engage in unfair trade practices.

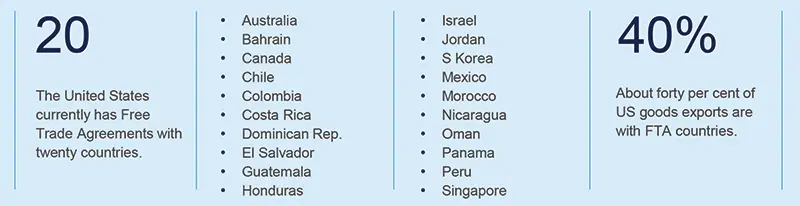

During Trump’s first term, the US adopted an activist protectionist policy, exiting the Trans-Pacific Partnership (TPP) and transforming the North American Free Trade Agreement (NAFTA) into the United States-Mexico-Canada Agreement (USMCA); Trump targeted China and allies alike with these measures. However, during Biden’s first term, the US maintained Trump's tariffs on China and expanded selective protectionism with additional measures that prevent China from accessing high technology from the West. Both candidates will likely continue with protectionist policies to varying degrees.

Biden’s re-election would likely maintain the status quo with a targeted expansion of protectionist industrial policies. We anticipate no major changes to the existing tariff system and Biden might renegotiate the USMCA to include protections on labour and environmental issues. With no material change in direction (with the exception of more protectionism against China) we would not expect any significant economic impacts.

Trump’s comments and the book ‘No Trade is Free’ by his former trade advisor Robert Lighthizer, serve as guidance for his likely trade policy. Trade policy is likely to range from ideological to pragmatic choices.

On the more ideological spectrum are policy ideas such as repealing China’s Most Favored Nation trade status, trying to completely eliminate the US’s dependence on China by phasing out all Chinese imports of essential goods or implementing 60% tariffs on all Chinese imports. On the more pragmatic spectrum are tariff structures that would be revised annually for certain goods and Trump could use unilateral authority to exempt whatever countries he chooses from import tariffs.

Trade conflicts will arise with allies in Europe and Asia as the US under Trump would seek to reduce its trade deficit. Any industry considered a core US interest could be threatened, as witnessed with steel tariffs on Japan and Europe in the past administration. Tariffs on aluminium and car imports are also possible.

Nevertheless, it is important to keep in mind that policy does not occur in limbo and any measure that Trump implements will have a reaction and a consequence. Countries are now more experienced in reacting to punitive trade measures. Additionally, countermeasures will have an impact on the US economy and can also affect the stock market performance – a measure Trump cares about deeply.

Taxes

- Extension of middle-class tax cuts: Raise taxes on high-income earners – those making more than $400k. Enact income tax of 25% individual minimum tax on households with wealthof $100 million or greater. Restore Child Tax Credit and introduce a first time home buyers tax credit of $10,000 over two years.

- Raise corporate taxes from 21% to 28% and implement the international agreement to set a worldwide 21% corporate minimum tax. Raise the excise tax on corporate stock buybacks from 1% to 4%.

- Extension of Trump Tax cuts: Fully extend the 2017 Tax Cuts and Jobs Act and cut corporate tax rate from 21% to 15%.

- Repeal certain tax aspects of Biden's Inflation Reduction Act, such as the 15% minimum book tax and 1% share repurchase tax. Repeal green credits such as the electric vehicle credit, which are seen to benefit China.

One of the key pillars of Trump’s first term was the passage of the Tax Cuts and Jobs Act (TCJA) in 2017. During Biden’s first term, significant achievements included the Child Tax Credit and various investment incentives in the Inflation Reduction Act (IRA).

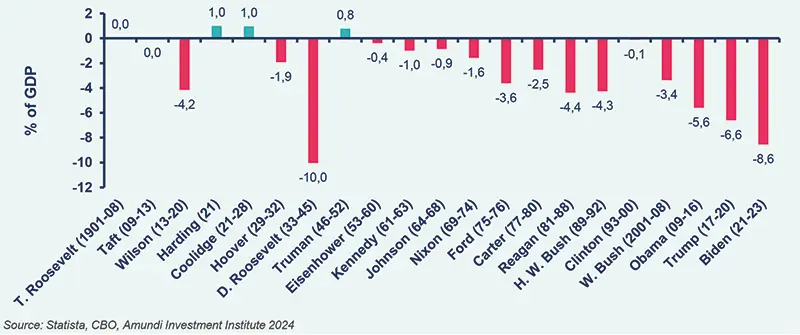

Looking ahead to their potential second terms, neither candidate has proposed a plan to put the US on a path of debt sustainability. Budget deficits are expected to remain structurally high, likely exceeding 6% and continuing an upward trajectory over the next decade, with the debt-to-GDP ratio forecast to rise above 100%. Two major fiscal challenges loom in 2025: reaching the debt limit in the first quarter and the expiration of the TJCA in December. Extending the TCJA could add approximately $3.5 trillion to the US deficit over 10 years.

Tax policy is poised to be a central fiscal issue for both candidates. Trump is likely to prioritise extending the TCJA, reducing the corporate tax rate, and repealing the IRA’s green credits. Biden has released a more detailed budget proposal that aims to extend the tax cuts for the low-to-middle-income earners while raising taxes for those making more than $400,000 and increasing the corporate tax rate from 21% to 28%.

According to the Committee for a Responsible Federal Budget, Biden’s plan would reduce the net deficit by $3.3 trillion through 2034, with debt-to-GDP projected to rise from 97% at the end of FY 2023 to nearly 106% by 2034. Without a comparable budget proposal from Trump, it’s difficult to assess his plans, but a similar rise in debt-to-GDP can be anticipated.

Average Budget Deficits Relative to GDP Under US Administration Since 1990

Immigration

- Increase Enforcement: Work with Latin American governments to try and stem flow of immigration.

- Increase Enforcement: End ‘catch and release,’ restore ‘Transit Ban Rule’ and make asylum more difficult. Use the National Guard and local law enforcement to enforce immigration laws. Restrict work permits and social services for unauthorised immigrants. Revoke temporary protected status for immigrants from select countries. Reinstate Title 42, which expels people from countries with communicable diseases, on the southern border.

- Implement a merit-based immigration system.

Both candidates have committed to tightening immigration controls. A key difference is Trump’s pledge to deport undocumented immigrants, which could significantly impact labour supply and increase wage pressures. We believe the recent surge in immigration has driven faster population growth, adding to the labour supply, increasing consumption, and impacting state and local government spending, thereby contributing to stronger economic growth. We expect this trend to continue as long as immigration remains above historical averages.

During Trump's first term immigration policies were tightened with enhanced security measures along the US-Mexico border, including increased border security personnel and barriers. In contrast, Biden's first term saw relaxed immigration rules through an executive order that reinstated an Obama-era policy granting asylum to migrants fleeing domestic or gang violence, resulting in a surge in both illegal and legal immigration.

Immigration has become a pivotal and controversial issue in the 2024 election. Both candidates are expected to implement stricter policies. Trump's proposed measures include ending asylum and reinstating the "Remain in Mexico" policy from his first term. Under Biden, policies are also expected to become stricter, likely ending asylum and continuing outreach to Latin American countries to control the flow of immigrants, reflecting the heightened political focus on this issue.

Net Immigration

The Congressional Budget Office (CBO) estimates that net immigration rose by 2.6 million in 2022 and 3.3 million in 2023, conservatively totalling 5.9 million during Biden's tenure, with other estimates reaching as high as 7 million.

The CBO states that “The decline in net immigration between 2024 and 2026 may stem from changes in decisions by other foreign nationals to enter or leave the United States, changes in actions by the Administration or immigration judges, or a combination of those changes.”

A key difference is Trump’s pledge to deport undocumented immigrants, which could significantly impact labour supply and increase wage pressures.

Energy

- Supporting Alternative Energy: Leverage Department of Education loan programmes for battery material supply chain, advanced nuclear energy and industrial decarbonisation. Augment electric vehicle battery chain.

- Energy Exports & Distribution: Refill the Strategic Petroleum Reserve and rescind energy regulations such as car fuel and emissions standards. Streamline energy exploration on government land.

- Exit Paris Climate Accords. Ban ESG investments through executive order and work with Congress for a permanent ban.

Under either candidate, US energy policy is expected to emphasise self-sufficiency and encourage domestic oil and gas production. A second Trump term would likely focus on expanding energy exploration, exports and distribution, while the re-election of Biden would continue to prioritise clean energy initiatives.

During Trump's first term, the administration focused on increasing US production to reduce dependency on imported energy through an 'America First' policy. This included supporting energy development on public lands and approving major projects like the Dakota Access and Keystone pipelines.

Conversely, Biden's presidency has centred on the clean energy aspects of the Inflation Reduction Act (IRA), which has become a cornerstone of his administration. The IRA aims to lower renewable energy costs for consumers and businesses and includes rebates for home energy efficiency and electrification projects. However, less publicised, Biden has also supported an increase in traditional energy production, such as oil and gas.

Congress will determine what either President can implement

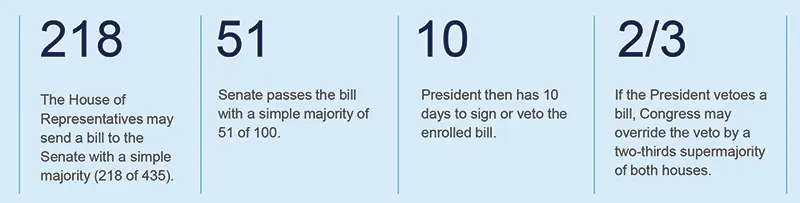

Both presidential candidates can implement policies through Congressional approval or executive orders. When the same party controls the executive branch and both chambers of Congress, policies can be enacted via budget reconciliation – a method allowing legislation related to budget issues, like government spending or revenues, to pass with only 50 Senate votes and without being subject to a filibuster. This approach enabled the passage of key legislation such as Trump's TCJA in 2017 and Biden’s IRA in 2022.

Under a divided government, the president may resort to issuing executive orders, which are directives managing government operations without needing Congressional approval. However, these orders are limited to the president's constitutional powers and can be overturned by the courts, a veto-proof congressional vote or a subsequent president. A congressional sweep by either party would likely enable the implementation of either President’s full agenda. A divided government would mean Trump might use budget reconciliation to enact his policies, while Biden would likely rely on executive orders for a more restricted set of non-budgetary policies.

Financial Market Implications

Equities

If a Republican sweep occurs, we anticipate a short-term rally in equities driven by the prospect of another tax reform, particularly if it includes a cut in the corporate tax rate. Trump's proposed tax deductions for small businesses could particularly benefit smallcap stocks, while an increase in defence and energy spending might boost related sectors. However, repealing the IRA’s green energy credits could negatively impact green energy firms. The wild card for equity markets would be that Trump’s implementation of a more aggressive trade policy would likely be negative.

Conversely, a Democratic sweep might pressure equities due to potential increases in corporate taxes, a higher excise tax on corporate share buybacks, increased taxes on high-income earners and the introduction of a wealth tax. Biden’s continuation of the Build Back Better agenda could lead to outperformance in infrastructure, construction and green energy sectors, while technology and traditional energy sectors might lag.

Currently, market expectations favour a divided government, which typically benefits equities. Historically, equity markets have responded positively to divided governments, as contentious measures like tax increases and significant tariff hikes are less likely to be implemented.

Fixed Income

US yields will be determined primarily by the trajectory of US debt, which many currently view as unsustainable. Whichever party is in office will at some stage have to come up with a credible adjustment plan to assure markets that government funding requirements will be manageable. Any procrastination on a belief that higher productivity and higher growth will reduce the debt burden on a sustained basis will only delay the inevitable. One important market implication is higher term premia as investors increasingly demand a premium for holding longer-maturity debt.

At the margin, based on announced policy pledges, the Trump agenda would lead to a faster deterioration of the public sector balance sheet and higher deficits because of what appears to be unfunded tax cuts. The Biden agenda seems a little more balanced – with intentions to increase some taxes, but that will also not be sufficient to stem the rise in the debt burden absent any significant expenditure cuts.

Beyond the very near-term outlook for lower rates across the yield curve as inflation continues to decline, yields will be determined by the longer-term debt outlook and especially next year as a new administration embarks on its policy agenda. Any set of policies which do not show a longer-term consolidation plan will be vulnerable to ratings downgrades and market pressures that will, at some stage, force a reckoning. Again, on balance, the Trump agenda, if enacted as currently indicated, appears more vulnerable to this risk.

The US Dollar’s longer-term status

The long-term status of the US Dollar will continue to hinge on relative interest rate differentials and growth prospects compared to other major currencies. Despite potential narrowing interest differentials as the Federal Reserve reduces policy rates, the stronger growth outlook for the US is likely to support the Dollar. In theory, significantly higher tariffs under a Trump administration could shrink the trade deficit and bolster the Dollar.

However, increased tariffs and the potential for trade wars could heighten trade uncertainty and dampen investor sentiment towards the US, making investors wary of exposure to US markets and likely increase volatility. If Trump's main policies – including stringent immigration controls, tax cuts and a rollback of the IRA – are implemented early, this could lead to higher inflation and longer-term yields, introducing greater uncertainty about the Dollar's trajectory.

Conclusion

Although 5th November is only six months away, the rematch between President Biden and former President Trump is still too uncertain to predict. The election may see momentum swing either way, as the race is influenced by several factors: Trump’s legal issues, third-party candidates, the domestic economic climate, inflation and geopolitical tensions. The analysis presented in this paper is predicated on the announced agendas of each presumptive nominee, which are subject to change depending on the election results – even with a unified Congress, a president may struggle to fulfil their entire agenda.

For example, during Trump’s first term, despite promising to revive coal and steel jobs, the US saw a 10% reduction in coal jobs due to his tariffs (according to the Federal Reserve Bank of St. Louis). This time, Trump could face difficulties in completely repealing the IRA, making minor adjustments more likely. And pursuing higher trade tariffs could risk retaliation, as seen during his first presidency when tariffs led to a trade war with China, ultimately financially impacting US businesses and households.

Neither candidate has proposed a path to steer the US towards debt sustainability, as budget deficits are expected to remain high with debt-to-GDP poised to exceed the post-WWII peak of 106%. Yet these are the realities that the next administration will have to deal with, as social security is projected to become insolvent in ten years and interest payments are now the third largest budget item, surpassing defence spending. These unresolved structural issues could increase pressure on short- and long-term interest rates, eventually affecting equity markets.

These unresolved structural issues could increase pressure on short- and long-term interest rates, eventually affecting equity markets...