Summary

2023 KEY CONVICTIONS FROM CIOs

Vincent MORTIER

Group Chief Investment Officer

Matteo GERMANO

Deputy Group Chief Investment Officer

1.

The Russia-Ukraine conflict is acting as an accelerator towards a regime shift, featuring higher inflation, geopolitical uncertainty, and a tug of war between monetary and fiscal policy, in a world already flooded by debt. Expect economic divergences to intensify.

3.

China’s economy could unveil positive surprises in 2023, depending on the outcome of the two main challenges: housing market and Covid-19 policy. On the former, we see a stabilisation thanks to looser policy, on the latter a gradual relaxation of restrictions. Geopolitical pressure and an intensifying US-China confrontation are key risks.

5.

After the great repricing, market valuations are more appealing; this is the glass half full. While economic conditions deteriorate and volatility remains elevated, markets will start pricing a Fed pivot between Q1 and Q2. Follow the sequence: start with a cautious positioning, as the earnings outlook is weak, but prepare for entry points with a gradual approach.

7.

Equities, in our view, will offer entry points during the year. Start cautiously, favour US stocks and the quality/value/high dividend tilt, but be ready to add Europe and China stocks, and also cyclical and deep-value ones to play the rebound.

9.

Long-term ESG themes were reinforced by the Covid-19 crisis and the Ukraine war. Investors should play the energy transition and food security themes, accelerate the Net-zero path, and look for companies that can improve their ESG profile, notably thanks to active engagement.

2.

The energy crisis will be the main economic driver in Europe, which will fall into recession. Fiscal measures may mitigate this, but the moment of truth will be in Q4 2023, when gas inventories need to be restored. Gaining strategic energy independence and signing new commercial ties will be key in a transformative year.

4.

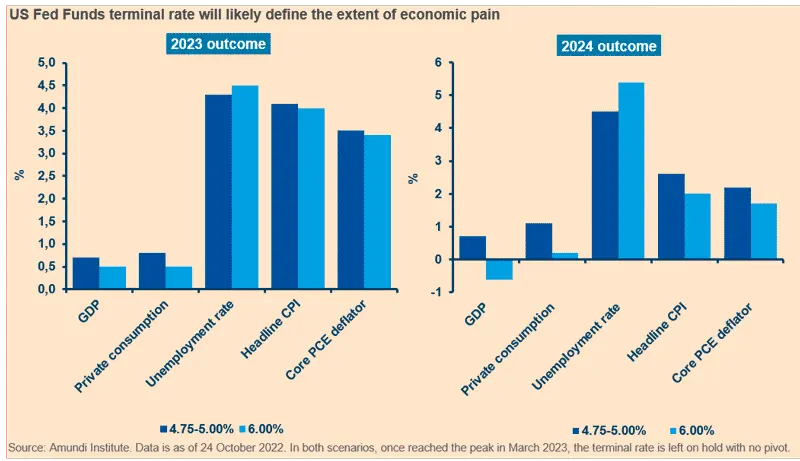

Central banks (CB) will do whatever it takes to fight inflation and avoid a 1970s-style crisis. The tightening cycle has further to go, although at a slower pace than in 2022. Financial markets may have integrated the bulk of the future hikes, but the level of the Federal Reserve’s (Fed) terminal rate will be critical: if close to 6%, a US recession will be in the cards and could be more severe than what is expected today.

6.

‘Bonds are back’ remains an investor theme entering 2023, with a focus on high-quality credit, an active duration stance, and currency management in a world of diverging policies. Pay attention to liquidity risk and corporate leverage.

8.

Emerging markets (EM) divergences will intensify in 2023. Selection will remain crucial. Look at countries where the inflation and monetary outlooks appear more benign and expect the Fed pivot to support EM equities.

10.

The 60-40 allocation revival is in sight, as looming recession risks will mean the government bond diversification engine will work again. Persistent inflation will call for greater allocation towards real assets and to sectors more resilient to the different inflation sources.

2023 will be a two-speed year, with plenty of risks to watch out for. Bonds are back, market valuations are getting more attractive, and a Fed pivot in the first part of the year could trigger interesting entry points.

CONVICTIONS

At end-September 2022, we gathered in Paris to explore key client themes and to share portfolio allocation ideas for 2023. This year’s Amundi Investment Outlook brings together the hot debates and key investment convictions discussed at the inaugural Amundi Institute and Investment Division seminar.

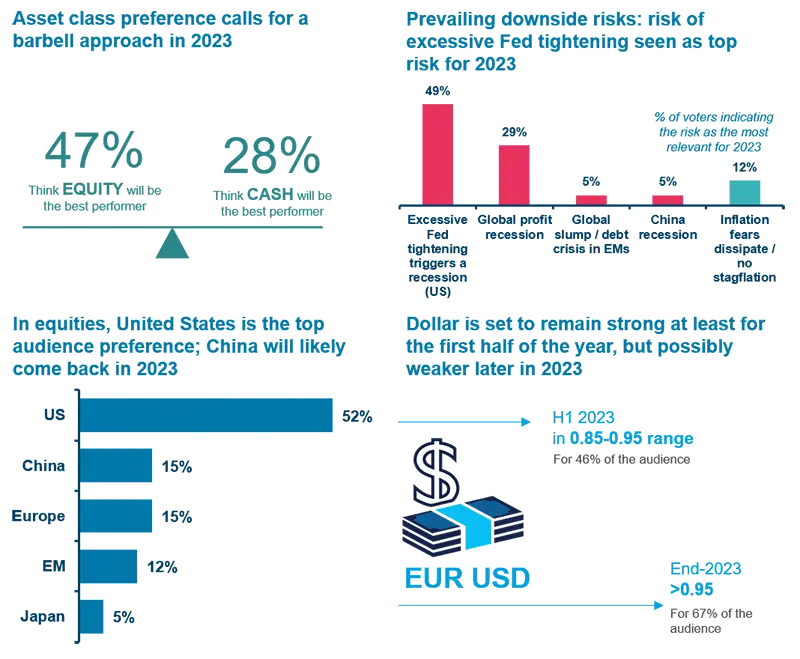

Data refers to polls taken at the Amundi Institute and Investment Seminar on a sample of 50 senior portfolio managers and research specialists. Data is as of 23 September 2022.

2023 GLOBAL OUTLOOK FACES STEEP CHALLENGES

Shallow recession in sight amid sticky inflation and global divergences

Monica DEFEND

Head of Amundi Institute

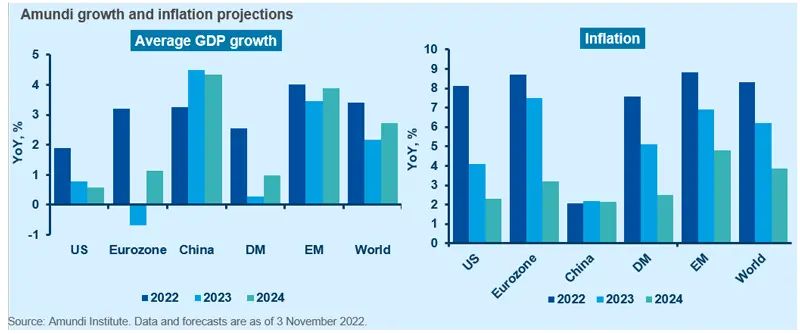

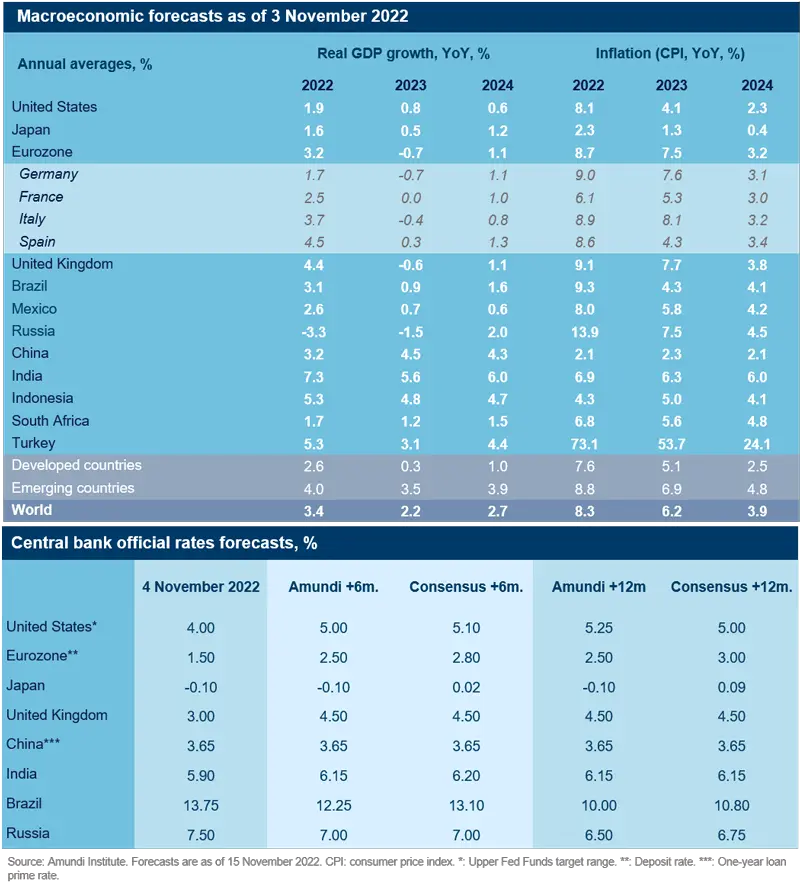

We expect global growth to slow significantly, with several countries across both developed markets (DM) and EM suffering stagnation, while others may face a slowdown at best. Global growth should land at around 2.2% in 2023, down from 3.4% in 2022, with DM expected to slow to 0.3% from 2.6%, while EM growth should slow to 3.5% from 4.0%. While both aggregates should decelerate, the EM-DM growth gap should favour the former. While the slowdown partly results from the increasingly coordinated withdrawal of policy accommodation, regional or country-specific factors are driving mixed trends. The depth and persistence of the stagflationary environment will depend on how the ideological, political, economic and technological transitions are addressed.

The main driver of European growth dynamics remains the energy shock, compounded by unresolved post-Covid-19 supply-side inflationary pressures and resulting in double-digit inflation. This is generating a cost-of-living crisis, which we expect to drag Europe into recession this winter, followed by a slow recovery. Notwithstanding the recession, inflation should remain significantly above target up to end-2023. Exogenously, the outlook depends on energy prices, gas supply and storage issues, which may return in mid-2023, while the key endogenous risk is for policy mistakes, both on the monetary and fiscal front. On the other side of the Atlantic, the Fed embarked on an aggressive tightening cycle, which should push growth severely below potential in H2 2023, in order to rein in domestic inflationary pressures stemming from a tight labour market and strong domestic demand. US recession risks for H2 2023 have increased due to the accelerating tightening path which should not slow in the near term. We expect consumption and residential investment to slow, but be partly offset by lower imports. Inflation should remain significantly above target at end-2023, despite rents cooling down and high inventory levels. The avoidance of a credit event and preservation of financial stability are key to these projections.

The low growth-high inflation backdrop should spread evenly across the EM universe with a few exceptions, the most relevant being China. While we cut China’s 2023 growth from 5.2% to 4.5%, it remains on an upward trend when compared to 2022’s anaemic growth at 3.2%. Housing market stabilisation and China’s gradual reopening are key assumptions. Indeed, the global slowdown and the impact of early and bold monetary tightening would be a drag on EM growth. Favourable 2022 nominal growth conditions should revert in 2023, making fiscal support less affordable for many countries due to the debt trajectory becoming less sustainable. While moderating inflation should allow a shift in monetary policy stance, global financial conditions would warrant caution in EM CB easing. On this new monetary policy path, there are countries with persistent and convincing deflationary trends (e.g., Brazil) or countries where recession is close and deep, such as CEE or relatively small Latam countries.

Regime shifts underpin a new global disorder.

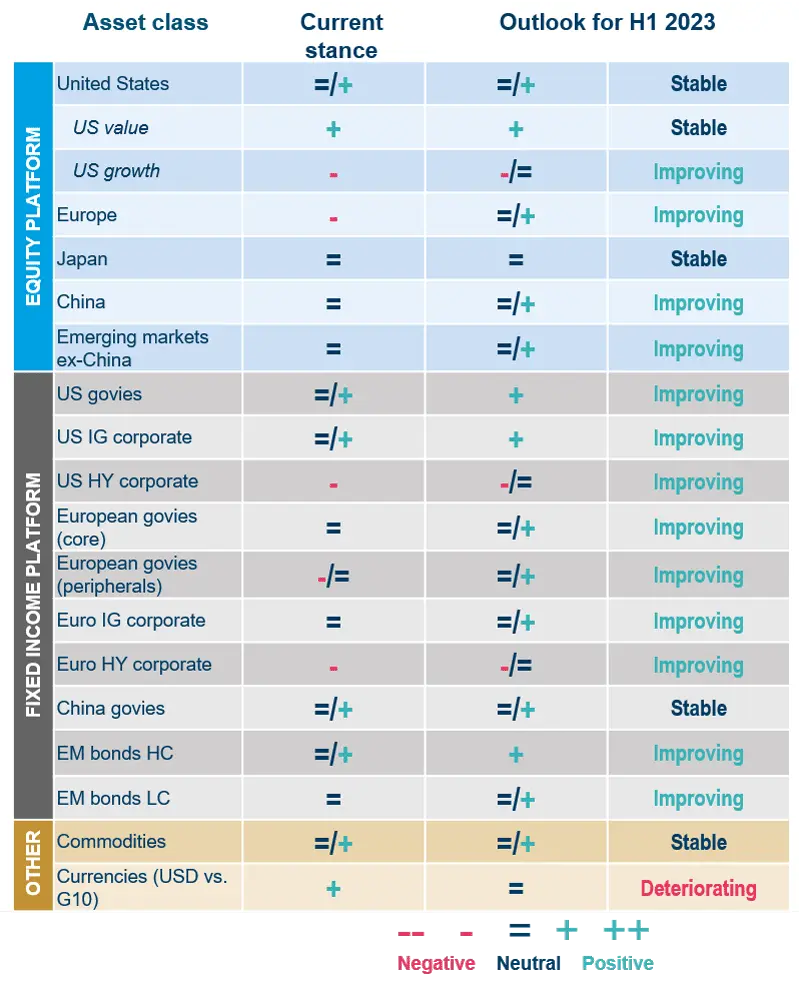

Start defensive in asset allocation, but stand ready to adjust throughout the year.

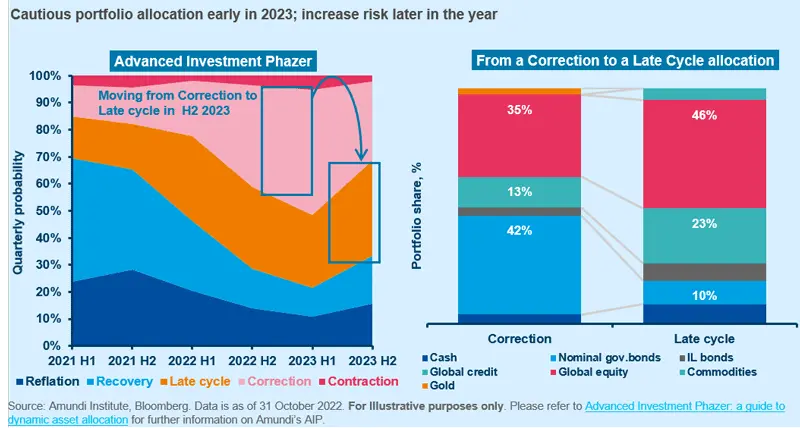

The economic backdrop should translate into a continuation of the current Correction phase in financial markets during the first half of 2023, featuring a profit recession and high inflation. This is the most likely scenario according to the Amundi Institute’s Advanced Investment Phazer (AIP).

The first factor contributing to this outcome is the macroeconomic outlook. Growth should decelerate across DM, spanning from sub-par levels in the United States up to recessions in the Eurozone and the United Kingdom. The exceptional spike in global inflation experienced over the past 18 months should persist into 2023 – albeit at a slowing pace – should take a toll on consumer spending and sentiment. At the same time, it should keep central banks in tightening mode in their effort to ease price pressures via cooler demand and prevent any unwanted loosening of financial conditions.

The second factor shaping the 2023 business cycle stems directly from the first one: a profit recession is on the cards for Q1 and Q2, with US EPS forecast to contract by -10% and -15%, respectively, on a twelve-month trailing basis. Earnings will be challenged by top-line deceleration caused by dollar strength and weaker nominal GDP growth. Margins will also be under pressure due to increased costs across the entire spectrum: production, capital and labour.

The resulting asset allocation for a Correction phase favours a defensive approach, with gold and IG credit among the preferred asset classes. The hawkish Fed narrative feeding through 2023 – and likely to persist up to Q1 – will add upside risk to government bond yields in H1, as a result of no clear Fed pivot yet and sticky inflation pressure. This will call for an active duration stance in government bonds which are the favoured component in a ‘typical’ correction phase.

The aforementioned headwinds should abate somewhat in the second half of 2023, favouring an improvement in the business cycle and a switch from Correction to Late Cycle according to AIP. Another of Amundi Institute’s proprietary models (Inflation Phazer) indeed signals a transition from the Hyperinflationary regime which prevailed in 2022 – and possibly also in Q1 2023 – to a more benign Inflationary regime, which has historically featured price pressures in the 3-6% range. Although still above target, moderating price pressures should mitigate the burden of the rising cost of living on consumers, allowing an economic recovery from the first-half lows and prompting the Fed to halt interest rates hikes.

One of the most crucial implications of the above scenario is the dollar, which we expect to depreciate by 4.7% on a trade-weighted basis in 2023. This should have positive spillover on EPS revisions amid a less challenging macroeconomic environment for profits, which should recover from H1 lows. From an asset allocation standpoint, with the next move for on-hold monetary policy expected to be a cut yield curves should bull steepen and conditions be supportive for risky assets, with a tilt towards DM equity and high-quality credit.

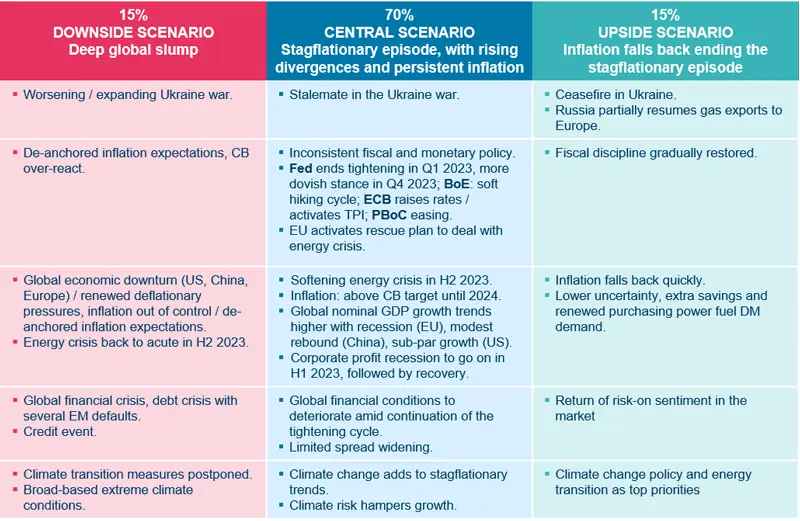

When turning to the most relevant risks threatening the business cycle in 2023, the realised inflation pattern will be at the forefront. If inflation fails to normalise to sustainable levels, the macroeconomic scenario will turn into a more severe stagflation, with the Fed forced to keep hiking despite the recession. Under such a scenario, risky assets would face losses, amid severe market turmoil and liquidity stress. Monetary and fiscal policies will have to be mutually consistent, as recent the UK episode highlighted.

Alongside inflation, geopolitics will also remain crucial in shaping macroeconomic and financial trends over the next few quarters. As such, investors should focus on the evolution of the Russia-Ukraine war and the United States-China relationship.

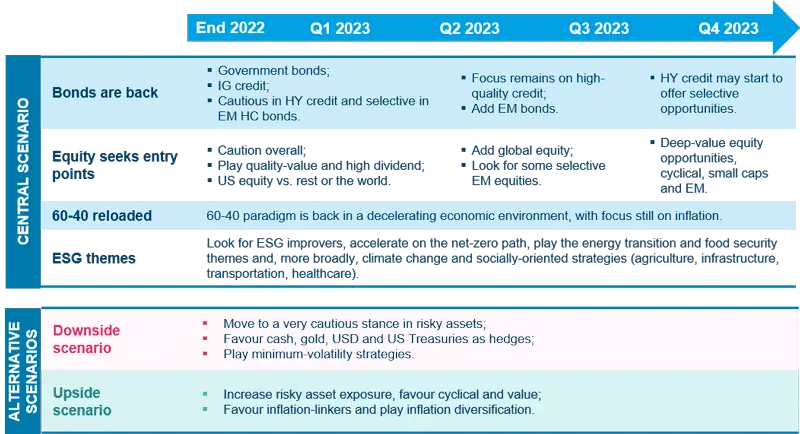

INFOGRAPHIC: THEMES TO SHAPE THE 2023 MAIN SCENARIO; INVESTING IN 2023

THEMES TO SHAPE THE 2023 MAIN SCENARIO

CENTRAL AND ALTERNATIVE SCENARIOS

Source: Amundi Institute as of 28 October 2022. DM: developed markets. EM: emerging markets. CB: central banks. Fed: Federal Reserve. BoE: Bank of England. ECB: European Central Bank. PBoC: People’s Bank of China. QT: quantitative tightening. TPI: Transmission Protection Instrument by the ECB.

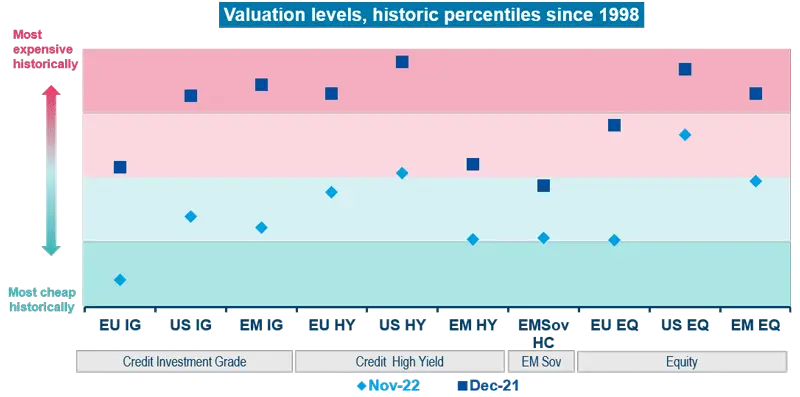

INVESTING IN 2023: MORE APPEALING VALUATIONS

INVESTING IN 2023: FOLLOW THE SEQUENCE

Source: Amundi Institute, Bloomberg, DataStream. Latest monthly data is as of 14 November 2022. EU IG, US IG, EM IG, EU HY, US HY, EM HY are ICE BofA corporate bond indices. IG: investment grade. HY: high yield. EM Sov HC: is JP Morgan EMBI Global Diversified. EU EQ, US EQ, EM EQ are MSCI indices for equity markets. All indices refer to a specific region (EU: Europe, US: United States, EM: emerging markets. Analysis is based on spreads for bond indices and on twelve-month forward PE ratio for equity indices. Valuation are in historic percentile since 1998. Cheapest means is in the first quartile, Most expensive is in the fourth quartile.

HOT DEBATES

GEOPOLITICS IN FOCUS

A difficult year ahead, with bright spots along the way

Anna Rosenberg

Head of Geopolitics, Amundi Institute

2023 will be a difficult year for Europe, but it will also be transformative. How the war in Ukraine progresses will determine the depth of Europe’s recession, fiscal and energy policy, the direction of domestic politics, as well as Europe’s international relations. Conversely, the mood in the West will also shape the next phases of the war.

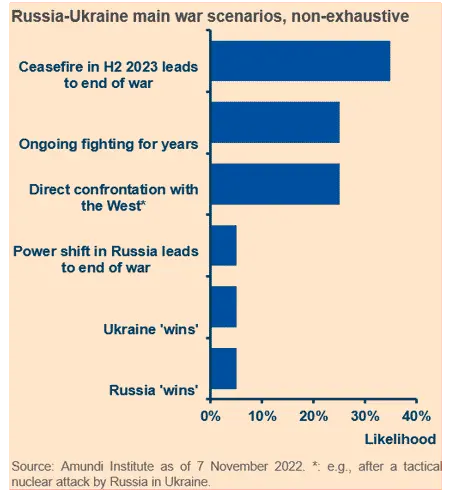

We identify six scenarios for how the war might evolve. A ceasefire – most likely in H2 – leading to an end of hostilities is our base case at 35% likelihood. Nevertheless, risk is tilted to the downside, including a 25% likelihood for the war escalating into a direct military confrontation between Russia and the West in Ukraine. This risk grows as Russia suffers more military defeats.

The trajectory of our base case (ceasefire in H2 2023) depends on various conditions: both Russia and Ukraine would need to see their military capabilities weaken. For Ukraine, it would be because Western support wanes, while for Russia it would be because it has exhausted its military toolbox and taken enough territory to claim ‘victory’. Ukraine would lay down arms if offered sufficient security guarantees by the West, which the latter would be compelled to provide. These guarantees, coupled with Russia’s military losses, could see an end to the war, not just a temporary ceasefire waiting to be broken once Russia rearms.

The energy crisis will pose severe challenges. Prices may remain high as supply is tight, but severe energy shortages are not our base-case scenario, as demand will be reduced to offset the lack of Russian gas flows and additional sources are likely to come online. A more ‘benign’ energy outlook reduces policymakers’ appetite for making difficult choices. Without an acute crisis, Germany is unlikely to revisit its decision to shut the remaining nuclear reactors in April. The Netherlands, despite sitting on ample reserves in the Groningen gas field, will stick to its commitment to halt production there. Differing attitudes to ‘saving’ energy will reduce appetite for energy sharing between countries. As a result, Europe is likely to face a deeper recession.

We expect a new EU-wide fiscal support package to alleviate the economic fallout. However, rising interest rates and the recent UK market turmoil will make fiscal support smaller and more targeted, as governments return to fiscal conservativism. The consequence will be more people suffering the economic impacts of the war. This supports our base-case scenario of a ceasefire, as a shift in public opinion against the war will push politicians towards persuading Ukraine to negotiate.

The war will also shape the EU’s foreign policy. The Democrats’ uphill battle leading up to the 2024 election will remind EU leaders about the perils of relying too much on the United States. Through 2023, the Biden administration will be busy with domestic political battles, as the Republicans will be a more disruptive force.

Coupled with a difficult economic environment, these pressures will undermine the United States’ commitment to Ukraine, again feeding into our war base-case scenario.

The EU will resist being dragged into the United States’ decoupling from China, as long as the Taiwan tensions do not lead to direct military confrontation. The economic impact of the Russia-Ukraine war reduces appetite to weaken ties with China. The need to expand renewables will be acute in 2023 and China is a major producer of solar panels.

However, concerns about over reliance on China (e.g., rare earth minerals) will see the bloc forge new trade ties. Trade deals with Mexico and Chile are likely and Mercosur is back on the agenda. An agreement with Australia and New Zealand is in the making. EU-United Kingdom relations may improve, while a likely trade deal between India and the United Kingdom will alleviate some Brexit pains. Intra-EU relations will benefit from elections in Poland, which are likely to usher in a pro-EU government, which would unfreeze billions of EU funds.

It is in times of crises that the EU grows more powerful. The pandemic and the war have seen the bloc take unprecedented decisions on joint debt, sanctions, defence and energy. There has also been progress towards achieving the EU’s green goals despite, and because, of the war: 2023 should see more of the same.

MONETARY AND FISCAL POLICY MIX

Too early for a European energy crisis plan; there will be pain before action

Didier Borowski

Head of Macro Policy Research, Deputy Head of Global Macroeconomics, Amundi Institute

With low or negative growth and high inflation, the Eurozone is experiencing a stagflationary episode that is challenging economic policy. Rising prices are no longer limited to energy and wages are expected to offset the loss of purchasing power, at least partially. The ECB intends to further normalise its monetary policy as its credibility is at stake. It is up to the ECB to anchor inflation expectations, as the recession may not be sufficient to bring inflation back to target.

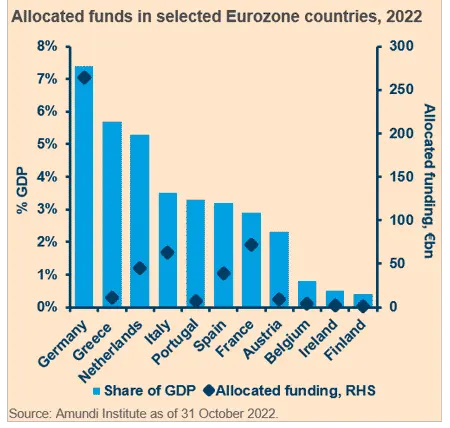

For their part, governments are actively using fiscal policy to limit the recessionary impact of the energy crisis. The rise in energy prices has led them to implement a battery of measures to protect households and businesses, such as reduction of energy tax or VAT, regulation of retail and wholesale prices, transfers to vulnerable groups and taxes on windfall profits. Since the beginning of the year, over €500bn of measures have been announced in the Eurozone, accounting for some 4% of GDP).

The resulting policy mix is ineffective in two ways. Firstly, fiscal measures have not been the subject of any consultation among EU governments. The €200bn German programme (worth 5.5% of GDP) was not well received by other EU members, particularly by countries that do not have the same budgetary means to cope with the energy crisis. In the end, the funds allocated so far this year account for less than 1.0% of GDP (Belgium, Finland, Estonia, Slovenia, and Ireland), 2.3% in France, 3.5% in Italy, and 8% in Germany. If EU governments go down this road, the result will be increased economic and financial fragmentation, a harmful consequence for all Eurozone countries. Secondly, because fiscal and monetary policies work in opposite directions. Fiscal measures will have an inflationary impact, leading the ECB to normalise its monetary policy further. As a result, financial conditions are tightening at a time when governments need to take on more debt.

The recent UK crisis has sent a warning signal to governments. They no longer have the same room for manoeuvre, particularly when CB intend to tighten policy at the same time. Without the quantitative easing (QE) umbrella, risk premiums on sovereign debt would rise in line with public debts and peripheral countries are no longer the only ones concerned.

What next

In our central scenario of a lasting energy crisis, there are two different scenarios on fiscal policy: either EU governments continue to act in an uncoordinated way, or they set up a European fund (common debt) dedicated to the energy crisis. The second scenario is the most likely, for at least two reasons. Firstly, fiscal rules do not provide an adequate framework to effectively deal with the current energy crisis. The challenge of diversifying the energy mix with no Russian gas is an EU-wide challenge and requires a common response, as happened during the Covid-19 crisis. Rising bond yields are preventing governments from spending unlimited funds.

The sums to be mobilised may exceed the borrowing capacity of some states. A Europe-wide approach would reassure investors, as fragile states would benefit from lower risk premiums. However, the conditions for setting up such a fund are not yet in place. Politically, the positions of heads of states remain divergent. A ‘European solution’ would eventually be necessary to avoid a crisis, later in 2023. The ‘new’ fiscal rules need to provide a sufficiently binding framework provide debt sustainability reassurance. A move towards simpler (expenditure-based) fiscal rules is expected. However, the final framework will not be written in stone before mid-2023, as the Stability and Growth Pact rules are suspended until end-2023. A new EU programme would need to compensate for the return of fiscal rules. Finally, EU states should wait for the end of monetary normalisation – expected in Spring 2023 – and a significant slowdown in inflation. Otherwise, the ECB may overreact, which would be counterproductive. New debt issuance (even if it is joint debt) will only be well received by investors if the policy mix is consistent.

In summary, in our central scenario we attach a high probability to the issuance of common debt. However, preconditions will probably not be met before mid-2023.

The SURE (Support to mitigate Unemployment Risks in an Emergency) programme set up in 2020 to avoid mass unemployment following pandemic lockdowns has been well received by investors. The economic results were very positive, and it could serve as a template. German leaders have already indicated that they are no longer opposed to a new EU joint-debt programme, provided it is based on loans (such as SURE) and not grants, a way of making governments fully accountable for their debt.

CENTRAL BANKS IN FOCUS

Markets will watch out for any sign of a hawkish-to-dovish shift

Developed market central banks have hiked rates aggressively in 2022 to tame inflation pressures, but they are unlikely to keep this pace going in 2023.

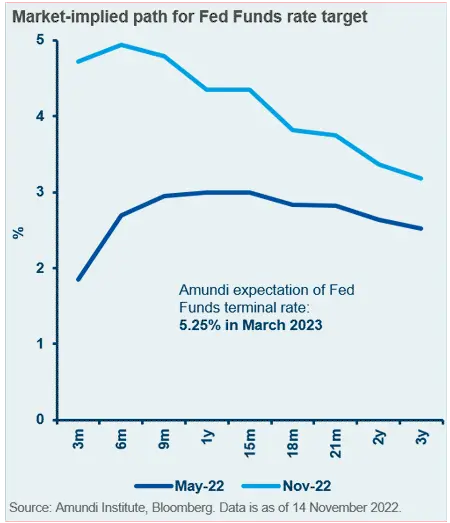

The US Fed hiked its Fed Funds rates to 3.75-4.00% but does not want markets to interpret a slower pace of rate hikes going forward as a dovish pivot, in order to make sure that financial conditions do not ease further (positive market reaction to October CPI data is a case in point). In light of the resilience of the US economy, the inflation persistence and the Fed’s willingness to go into highly restrictive territory, we see a high probability of official rates rising to a terminal policy rate of 5.25%, slightly above what the market is currently pricing in.

How Fed hikes affect the US economy will hinge critically on the terminal rate level. We compare the current level priced in by the market (4.75/5%) against a 6.00% terminal rate scenario. The economic implications for the stress-level scenario are: a longer-than-expected US recession, a higher unemployment rate (above 5% in 2024) which will bring inflation back to 2% in 2024. Regarding financial conditions, we foresee a stronger dollar, higher rates and a continuation of the equity bear market, coupled with higher stress at a corporate level.

The ECB hiked rates as well, with its deposit rate raised to 2.00% in late October. At this meeting, the ECB’s forward guidance sounded dovish, suggesting a less aggressive path ahead. It highlighted how “substantial progress in withdrawing monetary policy accommodation” has been achieved and that lagged effects from monetary policy tightening will be considered too. Consequently, we have cut our terminal rate from 2.75% to 2.50%.

The message on potential QT was dovish as well, as the topic was not discussed at the October meeting. PEPP reinvestments should remain flexible up to end-2024. Over the next few quarters, the ECB balance sheet will shrink thanks to TLTRO repayment and scheduled maturities.

The BoE also hiked rates aggressively, reaching 3.00% in October, along with some dovish communication. Its forward guidance acknowledged the need to tighten more, but less than the level implied by markets. We expect rates to peak at 4.50%.

Moving to Japan, the dollar-yen exchange rate weakened to 150, a 32-year low, prompting the Ministry of Finance to intervene on the FX market to slow such depreciation. Meanwhile, the Bank of Japan (BoJ) had to protect its yield-control targets by offering emergency Japanese Government Bonds (JGB) purchases.

The unprecedented dollar strength and monetary policy gap are exerting upward pressure on JGB yields, as a weaker yen feeds into stronger imported inflation, driving markets to bet that the BoJ will eventually follow up with tightening.

We do not expect any change in the foreseeable future, as the BoJ appears ready to buy time, waiting for US rates to peak.

CHINA'S ECONOMIC CHALLENGES

2023 outlook hinges more on reopening than on housing

Claire Huang

Senior EM Macro Strategist, Amundi Institute

Reopening: patience is a virtue

One of the main unsolved puzzles for markets in 2023 will be when will China reopen its economy, as this matters on multiple levels, for China’s own growth, for regional trade, and for global inflation. Over the past two years, hopes and disappointments have come and gone and market bets have become more and more reliant on the reopening outcome.

The frustrating process itself reflects the unpredictable nature of the reopening question. Predictions on the street are highly speculative. We have a low conviction on various forecasts surrounding the zero-Covid-19 exit roadmap, which the Chinese government says does not exist.

Political willingness is as much – if not more – relevant than the ramping-up of domestic treatments or booster shots for the elderly. As Xi said himself, China puts its people and their lives above everything else. This is a high bar to reach, considering existing medical resources and the virus’ rapid evolution.

Most argue that the vaccination rate is a precondition for reopening, but we caution whether a high vaccination rate will be enough. Taking Singapore as an example, 92% of the population has completed a two-dose vaccine regimen and 79% received booster shots. Still, 0.24% of the fully vaccinated with booster required oxygen supplementation in general wards, in intensive-care units (ICU), or died.

This translates into at least 3.1mn ICU beds or wards with ventilators in China’s case. The number could easily jump to over 10mn considering the difference in vaccine efficacy. However, China only has an estimated 60,000 ICU beds. Even it can increase the number of beds significantly, there will not be enough ICU nurses and doctors, who take a few years to train.

Even after China successfully boosts vaccinations for the elderly or starts importing Western mRNA vaccines, we need to be cautious, as a scenario featuring a significant amount of deaths or strained hospitals is likely to stay. It appears to us that it is not the death rate, but the death toll that matters in the minds of China’s top leaders. This will have to change in future policy calculations, otherwise China is likely to end up on a mission impossible.

In 2023, the zero Covid-19 doctrine is likely to stay. The ‘dynamic clearing’ or ‘dynamic zero-Covid-19’ is set as a guiding principal for Covid-19 prevention and control, which is unlikely to change before China can declare victory against Covid-19. That victory could be when the WHO announces the end of the pandemic.

Despite the ongoing ‘dynamic clearing’ goal, we could see adjustments at the execution level. We expect this to be a baseline scenario, i.e., disruptions without paralysing the whole economy. This assumption underpins our growth forecast for China.

The pace of recovery is not great and much lower than pre-Covid-19 levels, but a recession can be avoided.

Housing: nearly out of woods

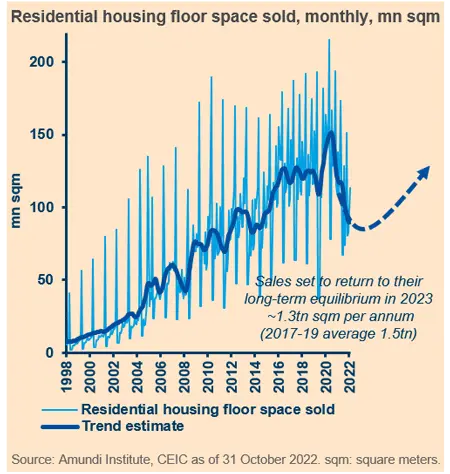

The housing market is another major concern for investors. From the peak in Q4 2020 to Q3 2022, new home sales volume fell 40%, wiping out all growth from the previous five years. The monthly sales volume dropped back to mid-2015 levels and government entities continued to step up their easing efforts. In a year, mortgage rates declined by 162bp and 109bp, respectively, to 4.1% and 4.9%, for first and second home buyers. Now it takes on average 25 days for an individual to gain a mortgage approval. Local purchase restrictions have been relaxed to cyclical lows.

Signs of stabilisation are emerging. The Q3 PBoC survey shows that the share of households planning to buy homes increased for the first time since mid-2021. New home sales volume, after seasonal adjustments, increased for the second consecutive month in September. Our trend estimate indicates that the fall has slowed significantly. Meanwhile, high-frequency October data suggests the housing market has become more resilient to lockdown shocks, thanks to the continuous easing efforts from PBoC and the Ministry of Finance. This evidence points to a stabilisation of housing sales at end-2022. Hence, we hold the view that housing sales are near their cyclical bottom. The transmission of housing policy easing has improved. In 2023, we expect housing sales to register a small gain and become less of a drag on GDP growth. Having said that, at a more structural level, a down-sized housing market will not resume being the effective (if not efficient) growth engine it used to be in the past.

INFLATION IN PORTFOLIO CONSTRUCTION

How the “inflation-parity” approach could benefit investors

Lorenzo Portelli

Head of Cross Asset Strategy, Amundi Institute

For decades investors have not focused on aspects related to inflation, as this was not on their radar. Unfortunately, 2022 put this topic back in the spotlight and we believe this will remain relevant in 2023 despite the expected slowdown in inflation.

There are four key themes that investors should consider when assessing the impact of inflation dynamics on portfolio construction:

- Inflation is more persistent and unpredictable than growth: inflation dynamics are less regular than growth ones, with swings and shifts proving more persistent;

- Inflation is multi-faceted: different forces can generate inflation and, by nature, they can have different impacts in terms of persistency in the swings, preventing linear mean reversion.

- Inflation is driven by both endogenous and exogenous forces, meaning that some are originated internally in the economic system, while others are external, e.g., due to a shock (positive or negative) in the economic system.

- Central banks are more effective in addressing endogenous forces and less effective in absorbing external shocks; often, rather than absorbing shocks, they tend to exacerbate and amplify them in the economic system.

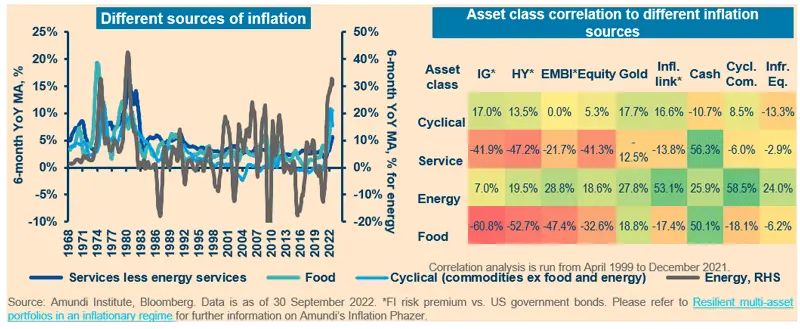

There are four important inflation sources to consider: cyclical (demand driven), services, energy and food. They originate from different factors and respond to different forces. Some reflect economic demand recovery (cyclical), others often lead to a recession (e.g., services) due to aggressive CB response, while others (e.g., food and energy) may end up in stagflation. Not surprisingly, different inflation sources and CB responses also result in different asset class behaviour, due to varying sensitivity to these four inflationary sources.

As such, the ‘inflation parity’ concept allows these differences in the asset allocation to be factored in.

In 2022, returns gyration in several market segments (e.g., sectors) occurred when inflation pressures shifted from cyclical to services and labour. Services inflation forced CB to act aggressively, generating a less market friendly environment, where risky assets suffered significantly and traditional safe havens did not work properly. As we expect services and other persistent inflation components to persist in 2023, a more balanced and diversified portfolio should be among the primary focuses of 2023 asset allocation. The inflation parity concept principles are:

- A thematic asset allocation based on asset class correlations to all inflation sources.

- The allocation gives the same importance to the four inflation sources (parity concept) balancing the traditional cyclical tilt with less growth-friendly ones such as services, food and energy. This results in a less concentrated allocation that helps mitigate macroeconomic risks.

- Sensitivities to inflation sources are dispersed within asset classes and, specifically in equities, at a sector level (as some of them are directly impacted, including energy, staples and materials), at the regional level (given different sector composition), and at the factor level (e.g., preference for value in demand inflation and for quality in less-market friendly environments due to its pricing power capacity).

- Infrastructure – and real assets in general – are good inflation diversifiers as they exhibit stable correlation dynamics amid rising inflation.

- In inflationary times, calibrating weights according to an equal-weight approach based around assets’ correlation to the various inflation sources can help generate extra performance.

ASSET CLASS VIEWS

Source: Amundi as of 16 November 2022.

DEVELOPED MARKET EQUITIES

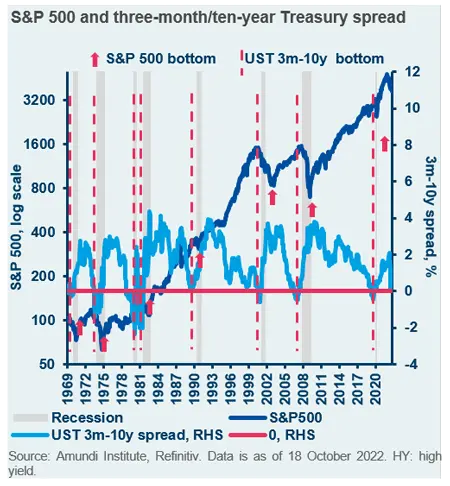

Cautious stance confirmed; bottom might materialise in mid-2023

2022 has been a bear-market year, mainly driven by a sharp fall in price-earnings (PE) ratios. Earnings downgrades eventually started, mainly driven by margin compression. As such, caution is still needed, but a bottom in 2023 should lead to a radical reversal of positions. Two conditions are needed: primarily, the Fed has to shift its focus from too much inflation to not enough growth; equities cyclically bottom out during bull steepening, not flattening. Secondly, the process of earnings revisions has to be more advanced. Often, it leads to a volatility spike of HY spreads and outflows.

On regions, the shift to profit downgrades makes the case for the United States over Eurozone for now but non-US equity is expected to outperform later in the recovery stage. On styles, quality value is a core position, but should eventually leave the floor to deep value. High dividends and low volatility are complementary but will have to be replaced by small caps and high beta later on. On sectors, defensives should continue to outperform a while but, looking into granularity, some quality cyclicals are already worth considering.

- Market triggers: rising rates and profit downgrades.

- To watch: credible Fed pivot, volatility spike.

- Risks: geopolitics, deeper- and longer-than-anticipated recession.

DEVELOPED MARKET FIXED INCOME

CB to set the course for credibility, anchoring inflation expectations

In a deteriorating growth environment, CB will move away from peak monetary synchronisation. The trade-off between inflation and financial stability will increase. However, CB will only be credible when implementing dovish surprises if inflation rates progress satisfactorily towards targets. Otherwise, a more accommodative tone is likely to be accompanied by increased pressure on currencies and inflation expectations. We expect the Fed to pause at 5.25% in March 2023, supported by core inflation being on a downward trend and by cooling labour market conditions. Risks remain for an upward revision of terminal rates given the resilience of the US economy and the persistence of inflation. The Fed dovish pivot will reduce pressure on other G10 CB. However, persistent inflation driven by energy prices will remain a key determinant.

In the coming months, the short end of the US yield curve should remain under pressure. At some point in 2023, the deterioration in growth prospects will put downward pressure on long-term rates. In the Eurozone, the impact of the new supply of government debt should be monitored closely. We expect credit spreads to widen and default rates to rise moderately. We favour IG over HY with no main regional relative preferences.

- Market triggers: inflation peak, Fed pivot, European fiscal policy.

- To watch: inflation, labour market, energy prices.

- Risks: US recession, persistent energy crisis in Europe.

EMERGING MARKETS

Stabilising global conditions will likely improve sentiment in EM assets

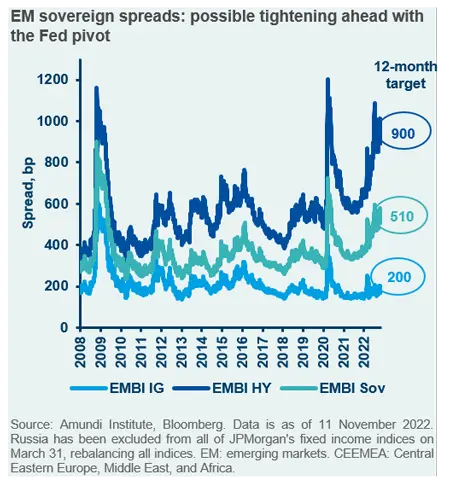

As we head into 2023, the EM domestic macroeconomic backdrop is expected to show subdued growth – even recession in several cases – and relatively high, albeit moderating, headline inflation. Such a scenario, which is unfavourable for risky assets, will join forces with tightening global financial conditions, triggering a late-cycle bear market, with widening EM spreads and likely higher EM local bond yields in the very short term.

The aforementioned gloomy backdrop should result in already stretched sovereign balance sheets sinking under the weight of poor negotiation outcomes between sovereign debtors and their main creditors (the Common Framework is barely proceeding). The pandemic, the energy and food price shocks, and rising interest rates have pushed many countries onto an unsustainable debt path, especially low-income countries. The EMBI diversified spread has widened to levels not seen since the 2008 Great Financial Crisis (GFC) and the 2020 Covid-19 crisis. Geopolitical tensions have been showing up in high market volatility and are adding to risk premium. Against this backdrop, IG spreads have widened much less than HY ones. For 2023, we foresee narrowing EMBI spreads (by some 50bp), driven mostly by the HY segment on the back of a favourable EM-DM GDP growth gap (for the former) and stabilising financial conditions thanks to moderating inflation.

Over the course of 2023, EM LC bonds (GBI) should benefit from falling yields, resulting in a positive total-return performance. GBI yields have surprised to the upside for most of 2022 and still, in the very short term, the adverse backdrop is not fully priced in or could unveil further adverse surprises (e.g., GEM monetary policy tightening not over yet, US yields rising further, weak EM FX). However, EM inflation seems to have peaked in late 2022 (in GBI-weighted terms) and real yields have been bottoming out. As such, over a three-to-six-month horizon, nominal yields should be lower. A more cautious stance is warranted on EM Asian rates, where CB started hiking later and will finish later and FX reserves positioning has worsened due to dollar strength and rising US rates. In areas where the monetary policy cycle is more mature, inflation should decline earlier and more persistently and brighter growth conditions should return in H2 2023. Here, we have moderately positive views on EMEA and Latam. EM currencies appear undervalued and should provide a slightly positive contribution – in GBI-weighted terms – to the asset class’s total return, especially commodity currencies, even though volatility should remain elevated. Overall in 2023, equity returns are expected to be marginally positive. In the short term, the macro financial backdrop suggests a preference for quality and profitability, mainly Latam and quality in EM Asia, such as Indonesia. As we move into the second half of 2023, we expect equity performance to improve – though below its historical average – suggesting a shift in valuation styles (EMEA and EM Asia, focus on themes and countries linked to technology, such as Korea). Following the strong recovery in YoY earnings growth experienced in H1 2022, YoY earnings are now slightly negative. We expect GEM earnings to recover in 2023, mostly in the second half of the year. Such a move should be driven by EM Asia, which is less affected by any base effects.

- Market triggers: global economic and profit slowdown.

- To watch: inflation peak (Latam first) and next Fed pivot.

- Risks: geopolitics and policy mistakes leading to a recession.

Key EM convictions

- Challenging macro-financial backdrop should evolve gradually into a more constructive environment.

- The geopolitical backdrop is heightening fragmentation; different alliances to watch.

- Caution in the short term. Constructive on HC even though we see less upside than previously expected (watch for catalysts of liquidity withdrawal exacerbating distressed situations, not systemic ones).

- Stabilising global macro-financial backdrop should put EM asset classes under the spotlight. On local currency duration, some Latam and CEEMEA countries still offer attractive valuations. EM equity and FX allocation to increase on a more favourable backdrop. Equity valuations more attractive than FX.

ESG THEMES FOR 2023

DEVELOPED MARKETS CURRENCIES

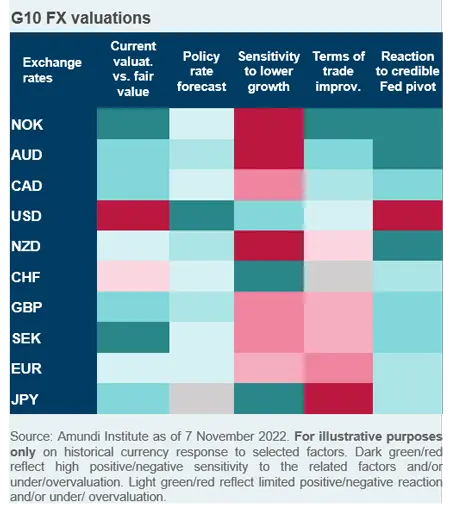

USD: from a lack of positive catalysts to excessive valuation

The USD is becoming vulnerable to pullbacks, as it is expensive compared to historical standards and the Fed’s tightening cycle is entering its mature stage. Yet, with inflation remaining the Fed’s top priority and the economic slowdown possibly extending globally, things may get worse before improving. The greenback is the only high-yielding currency with safe-haven features and, given the structural shocks elsewhere (Eurozone, United Kingdom, and Japan), we see no credible catalysts for a proper mean reversion towards fair valuation.

With no sharp fall in US inflation, we expect the USD to prove strong in the short run and see inflection points around the end of the Fed’s tightening cycle. The Fed will be key in defining relative winners and losers. With no credible pivot expected in 2023, JPY and CHF could be safe spots to start reducing USD exposure, while riskier positions may come through at a later stage. Yet financial instability can quickly turn into a dominant market mover, given the thin level of USD reserves across international players. Any attempt by the Fed or the US Treasury to mitigate the burden (by pumping liquidity into the system) would be a clear-cut trigger for a broader USD sell-off.

- Market triggers: global economic slowdown, tightening Fed.

- To watch: inflation and global growth dynamics.

- Risks: financial instability, inconsistent policy mix, geopolitical tensions.

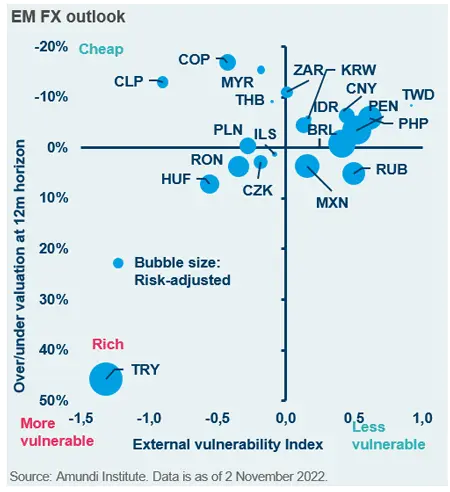

EMERGING MARKETS CURRENCIES

EM central banks are in no rush to ease

Acting as the most powerful shock absorber across EM asset classes, EM FX have been showing oversold signals. With the USD expected to depreciate mildly and based on attractive valuations, the outlook is supportive for the asset class in 2023. Moderating inflation accompanied by a prudent monetary policy shift (starting with the most mature hiking cycles) will result in neutral / positive real rates, which are more appealing than the extremely negative levels seen in the recent past. On the other hand, a premature shift in the EM CB stance (vis-a-vis inflation and the Fed) could trigger some underperformance due to existing vulnerabilities, as highlighted by twin-deficit positions.

While we do expect volatility to be high, supportive elements can translate into positive performance for the most undervalued currencies, starting with Latam, when the leading tightening cycle will finally result in slowing inflation. Investors should closely monitor the pace of easing on the back of moderating inflation in order to avoid ending up in real rates which may turn out to be less attractive than expected.

- Market triggers: global economic and profit recession.

- To watch: inflation peak and next Fed pivot.

- Risks: geopolitics and policy mistakes leading to a recession.

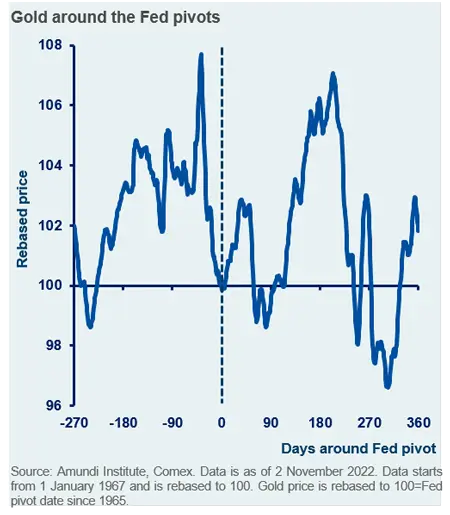

COMMODITIES

Tight oil markets, gold mean reversion

While oil prices may remain capped by slowing growth in early 2023, supply issues could return to the fore. Tight OPEC+ production and spare capacity, the EU ban on Russian crude, low oil stocks and rebuilding US strategic reserves could lead to supply scarcity. Brent prices could trade around $95/barrell on average, with upside risks in late-2023. Given US producers’ improving financial health, US output could matter again. Refiled storage and EU solidarity efforts suggest hard gas rationing will not be necessary this winter. Yet, with no quick fixes to replace lost Russian supply, curbing demand will be required, keeping gas prices high until late 2023 (€100-150Mwh on average). Base metals could be pressured in H1, due to their cyclicality. In H2, a moderating dollar and rising production costs could help a rally. Longer-run prospects remain promising. Supply may struggle to meet demand from the energy transition, which could accelerate in the EU. When nearing the Fed pivot, focus should turn on slowing growth. Gold would be in demand, with valuation and positioning providing attractive entry points.

- Market triggers: investors looking through the recession.

- To watch: rate peak, core inflation trends.

- Risks: Chinese property markets, US oil production up.

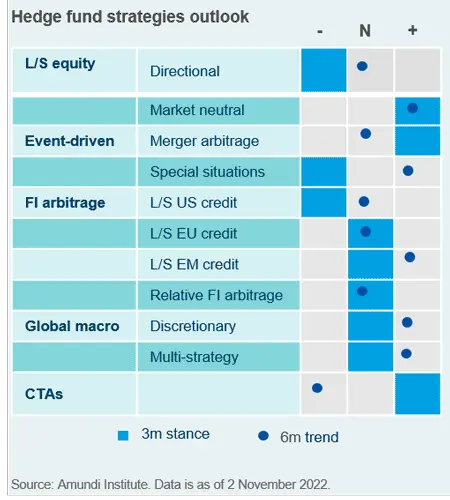

HEDGE FUNDS

Intensifying search for alpha

Hedge funds’ appeal is likely to persist in 2023. The multi-year bond bull market has likely ended, making diversification more challenging. Given their low volatility, market beta and sensitivity to duration, hedge funds are attractive. For 2023, the table on the right gives an overview of the outlook for different strategies. Besides, higher short-term yields provide a growing return contribution for hedge-funds, which are long cash. Rising geopolitical risks, peaking globalisation, the energy transition, ballooning sovereign debt, and ageing population would all contribute to above-par inflation, sub-par growth, shorter economic cycles, and above-par asset volatility.

Thus, amid milder traditional assets’ returns, the search for alpha would intensify. For several years, alpha generation was eroded by a series of atypical shocks, including the trade war, Brexit, the pandemic, supply-chain disruptions, and anomalies from massive stimulus. We expect some of these hurdles to lift. Shrinking global liquidity would result in greater asset dispersion, sharper valuation discrimination, more fundamental pricing, and more room for thematic trading, which would bode well for alpha.

- Market triggers: continued liquidity tightening and asset valuations reset.

- To watch: rate peak, corporate activity.

- Risks: fast market rally, another ‘atypical’ shock.

PRIVATE MARKETS

Shields against inflation and low growth

The current environment of rising rates, decelerating global growth and ongoing sustained inflation will continue to put corporate earnings under pressure, potentially leading to further market adjustments across the board. Against this backdrop, investors should consider private markets to seek exposure to assets that appear more resilient in this phase (i.e., infrastructure), while also starting to look for longer term opportunities with a very selective approach given the likely increased dispersion of returns within each asset class. Indeed, there is no such thing as one single private assets market.

Infrastructure investment can provide a shield as well as enhance portfolio diversification. Strong volume growth, as well as stable pricing is very evident, while there are several growth trends that will support this area of investing in the year ahead and beyond. For instance, decarbonisation is a key focus of governments, but private capital is needed to complement public funding. Massive new investments are required, not only in building solar plants and wind farms, but in the digitalisation of networks as they adapt to new types of power generation. Furthermore, for EU leaders to achieve energy independence from Russia and fossil fuels, substantial new infrastructure investment will be required. The deconsolidation of assets by corporates and governments is also a key growth driver. As soon as such an asset enters the market, value can be created through strategies such as management optimisation or contract renegotiation. Turning to inflation, infrastructure exposure can protect against it by generating indexed cash flows: for example, long-term contracts awarded by regulators to toll road operators often contain clauses for adjusting tolls, so as to link the company’s revenue to inflation. In addition, for some companies a link with energy prices can provide a shield, as those prices are a large component of inflation.

With regard to private debt, this asset class has experienced some repricing, as spreads have widened, but it also continues to benefit from fundamentals remaining strong. Currently, the private debt market’s liquidity premium is low compared to listed corporate debt, but we are very confident that it will increase again. When there has been a large move in the listed market, as we have seen recently, it takes times for private debt valuation levels to adjust. Overall, current valuations offer an attractive entry point for investors with medium to long-term investment horizons. Furthermore, private debt is typically structured around floating-rate notes, offering protection against rising rates and inflation. As interest rates rise, the corporate debt burden can be heavy, but direct lending funds often request corporates to hedge their interest rate risk. Looking ahead, these funds should benefit from strong bargaining power in negotiating lending contracts, as bank-financing remains constrained. In fact, banks are less active in the lending space, due to a notable amount of leveraged loans on their balance sheets that have declined in value, making the banks reluctant to sell them.

The lower lending activity from banks also affects the private equity space where transaction volumes and pricing are slowing, a trend that we expect will continue for some time. In fact, the slowdown is mainly due to the difficulty in finding financing from banks. Despite this, sectors such as healthcare and technology have trading levels only marginally lower than those that existed before the crisis. These companies are experiencing strong growth trends and usually protect from higher inflation due to pricing power. Despite declining prices and a lack of trading across many sectors, we believe that over the next five years – the typical investment period of a private equity fund – private equity markets will start to offer some selective entry points for investors with an appropriate time horizon.

Real estate, another good diversifier within a portfolio, should profit from both indexed rents and resilience in the demand for the best buildings in terms of location and energy performance. However, globally this benefit may not be sufficient to offset the impact of expected yield increases, at least in the first months of 2023. For new investments in existing buildings, revised valuations nevertheless create opportunities.

To summarise, the buy-and-hold nature of investing in these asset classes, and their ability to absorb or pass on cost increases means that they can provide protection against inflation and low growth. Furthermore, they offer opportunities to find yield and access returns, although selectively. We believe they will play an increasingly important role for investors who are looking for attractive real returns.

ECONOMIC AND CENTRAL BANK FORECASTS

MACROECONOMICS FORECAST

FINANCIAL MARKET FORECASTS