Summary

Integrating sustainability objectives in factor portfolios

The general philosophy of systematic equity investing and Factor investing is based on the idea that sustained long-term performance can be achieved through a well-diversified exposure to rewarded equity factors which are expected to effectively capture risk premia and optimize the risk budget of a portfolio.

By structuring investment signals into a disciplined investment process, quantitative portfolio managers are generally less susceptible to emotional biases, as they rely on model-driven decisions guided by a systematic approach to portfolio construction.

In that respect, a Multi-Factor process generally consists in combining factors such as Value, Quality, Low Volatility, Momentum, Size, with the objective to:

Capture long-term excess return i.e., risk premium, provided by each individual factor’s payoff profile;

Mitigate risk through the risk-based combination of factors and the diversification they offer due to their different and complementary market cycles.

A systematic quantitative equity strategy can be an effective approach to meet various objectives, including ESG, while simultaneously achieving return and risk targets.

More precisely, alpha could be generated through a combination of Multi-Factor exposure and a wide spectrum of climate and sustainability dimensions. However, sources of alpha, as well as sustainability measures, change over time, making it essential to actively monitor and dynamically adjust the portfolio.

We believe that integrating climate and sustainability KPIs to systematic investing techniques could have benefits, considering that:

The metrics employed in the sustainability evaluation are diverse: quantitative portfolio managers possess the expertise and resources to maximize the insights derived from the data;

Carefully constructed Factor-based portfolios can maintain good portfolio diversification and find the right trade-off between return, risk and sustainability;

Investors can tailor the trade-off in their portfolio to align with their preferences.

In this paper, we first explain how we integrate climate and sustainability considerations into a systematic equity investment process.

We then explore the potential impact that implementing sustainability criteria into an equity portfolio can have on portfolio distortion. Moreover, we explain how portfolio managers can use factors to re-adjust the portfolio balance and how Factor investing can define expected return in a consistent and robust way.

Finally, we delve into how a multi-objective function can be defined to efficiently integrate sustainability dimensions – such as climate risk mitigation for example – into portfolio construction.

Based on this methodology, investors can be well equipped to determine the optimal trade-off between expected return, risk management and sustainability, and to manage a “3D” equity portfolio accordingly.

From a Factor perspective, the “3D” portfolio is very close to the Multi-Factor portfolio, with a much larger Sustainability tilt. This 3D portfolio has a high exposure to sustainability indicators without giving up its expected return, and complying with a given Tracking-Error budget.

Integrating sustainability concerns into portfolio management

Almost forty years ago, the Brundtland Commission defined sustainability as “meeting the needs of the present without compromising the ability of future generations to meet their own needs”.1 Since then, different frameworks have emerged to help translate this definition into reality.

In a portfolio management context, the concept of Responsible Investing (RI) tries to operationalize this definition. Regulators, standard-setting bodies and investorled initiatives have since then defined the matter. European regulation has introduced the concept of double materiality, which distinguishes the elements that directly impact a company’s Profit & Loss Statement (P&L), cash flow or balance sheet, from those which influence the economy through their impact on the environment and on society.

Apart from this regulation-driven definition, sustainability considerations hold significant value for investors. As a responsible investor, Amundi considers both idiosyncratic and systemic risks, as well as growth opportunities when assessing the value of its investments. Environmental, social and governance factors contribute to those risks and opportunities to an important extent. Indeed, some of these factors can contribute to idiosyncratic risks as they might have a direct impact on the value of a specific investment. These factors can also be a source of systemic risk, as their impact on a specific investment could also be delivered through impacts on the economy and society at large.

Economic activities are based on the use of natural resources, including energy, human capital (both labor and creative forces), and financial capital. The value of an investment is the present value of the future cash flows. As a result, ensuring that the economy can benefit on the long run from robust human capital, environmental resources and financial assets is crucial for maintaining the sustainable value of our investment portfolios.

Assessing the potential negative impacts on those economic drivers, the different dependencies, but also the opportunities2 can enable investors to identify issuers that will outperform and distinguish them from their riskier counterparts.

Nevertheless, using these observations to build a robust portfolio is not easy in practice. In the financial world, modelling always comes with challenges. In the RI space, the challenge is even more salient considering data and frameworks are still in their infancy. Moreover, as we are modelling a transition away from a high-carbon economic model, we need to define theoretical transition paths to predict future impacts on cash flows.

Additionally, we are not yet in a situation where a single model can easily describe the climate strategy of an issuer or their contribution to a net zero scenario or any other Sustainable Development Goal (SDG). Using different climate KPIs therefore enables us to produce a more precise analysis of the unique positioning of a given issuer.

Still, the lack of consistency and accuracy of climate-related data, as well as their short history creates additional barriers for investors. As a result, when dealing with large investment universes, understanding unintended biases is key to mitigate risk. By combining a static view with a more dynamic analysis and taking into account factor biases, we expect to improve relevance and accuracy when making investment decisions.

Applied to portfolio management, investing with sustainability criteria in mind involves integrating environmental, social, and governance (ESG) factors into investment decisions in order to generate positive returns, mitigate risks, promote sustainable practices and address global challenges, such as climate change or social inequalities.

A sustainability framework applied to quantitative investing

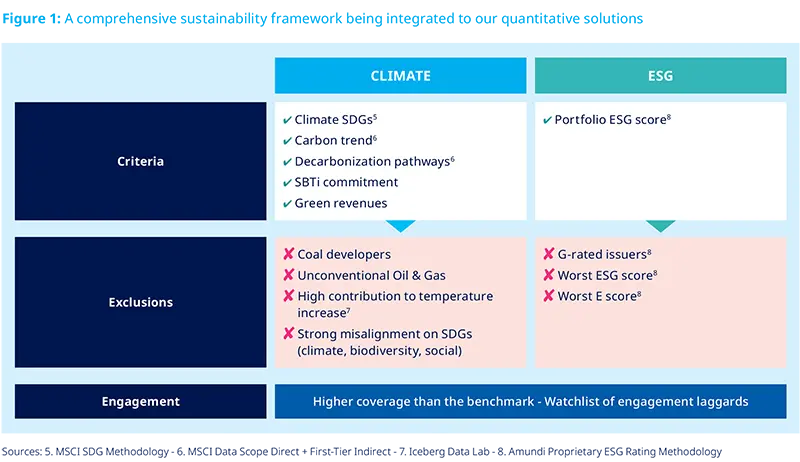

Focusing on climate objectives in particular, Amundi developed a comprehensive Sustainability Framework that our portfolio managers can integrate to quantitative investment solutions.

This framework is built largely on climate KPIs, and combines three dimensions – Exclusion, Decarbonization and Transition – due to the multifaceted dimensions of climate investing.

As an investor in listed markets, we cannot selectively avoid specific activities when investing in a particular issuer. Therefore, a certain degree of exclusion is necessary to mitigate exposure to the most concerning negative impacts.

In practice, the Exclusion dimension involves eliminating from the portfolio companies with the worst ESG and Environmental ratings, and companies whose current transition pathways are too far from the NZE scenario.3 This can include companies involved in coal development or with unsustainable exposure to fossil fuels, as well as assets with a high contribution to global temperature rise or a strong misalignment with climate-related SDGs.

Excluding these assets also helps reducing the global carbon intensity of portfolios and improve their alignment with Net Zero goals. This can also help filter out companies, that do not follow credible carbon reduction pathways.

In addition to exclusions, the Decarbonization and Transition dimensions are essential to any climate-focused investment process. Integrating the Decarbonization dimension involves reducing the portfolio’s carbon intensity by 30% by 2025, compared to the 2019 base year. It also requires defining and monitoring a carbon reduction pathway beyond 2025, in order to gradually converge to Net Zero in 2050.

Roncalli et al. (2022) introduced the concept of self-decarbonization of a portfolio using a carbon trend metric.4 This can lead to endogenous carbon reduction in the portfolio, which complements carbon reduction generated from exogenous sources. The carbon trend is based on a linear regression of carbon emissions (direct and first tier indirect emissions) of each issuer over recent years.

Related to this endogenous carbon footprint reduction, and to introduce a strong forwardlooking view, we integrate the Transition dimension to our portfolios. This dimension refers to the objective of supporting the transition to a low-carbon economy, by selecting companies offering solutions that work towards this goal.

Different metrics can be used when integrating this transition dimension and notably “Green revenues” which measures the share of a company’s revenues generated from green activities according to the European Taxonomy classification.

Additionally, avoiding the most harmful exposure to non-climate-related ESG risks is a way to limit potential downside risk and ensure a baseline ESG quality for the portfolio.

Based on this approach, we optimize a number of guidelines that have been translated into linear holding-based optimizing constraints using available metrics and data:

UN Sustainable Development Goals (SDGs) alignment (climate SDGs such as SDG 6, 7, 12, 13, 14, 15) • Science Based Target Initiative (SBTi)

Green revenues

Weighted average carbon intensity (WACI)

Carbon trend

Minimum exposure to High climate impact sectors

Amundi Proprietary ESG scores

Additional layer of exclusion criteria ( activity exclusions, temperature exclusions, SDG misalignment)

In order to favor the portfolio’s endogenous carbon reduction, it is key to encourage issuers to strengthen their climate strategy, both by limiting their negative impact and by accelerating their transition towards a low carbon business model. This can be done through our stewardship activities.

We believe that this enables us, over time, to increase the exposure of the portfolio to ESG factors and climate characteristics, without increasing the constraints we apply in our investment process.

For more detail on Amundi’s stewardship activities on climate, please refer to the Annex at the end of this paper.

Factors to re-adjust portfolio balance

In this section, we introduce the use of factors to re-adjust the portfolio balance which was initially distorted when applying Sustainability criteria into the investment process.

Diversification is an important consideration in portfolio construction, as it can help to reduce risk by spreading investments across different rewarded factors, sectors, and regions. One way to diversify an equity portfolio is to invest in stocks exposed to different factors. These factors are expected to deliver positive performance over the long-term but have different performance cycles due to their underlying characteristics.

Quantitative portfolio managers may also try to apply a dynamic allocation on these factors depending on the market cycle.

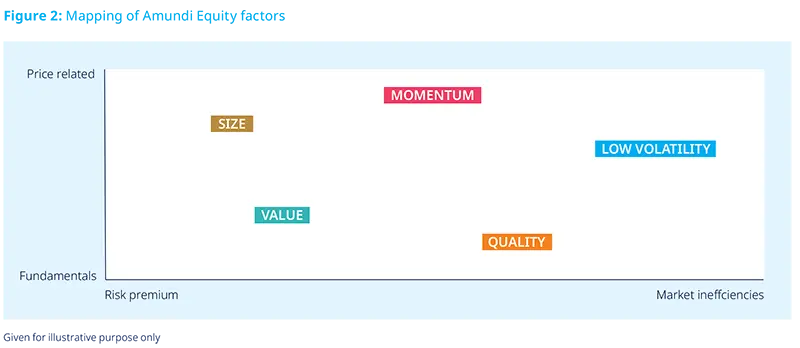

These factors provide a robust framework to analyze an Equity portfolio, making sure that it is well exposed to rewarded factors. Factors such as Low volatility, Value, High quality, Momentum (as seen in Figure 2) are based on different data (vertical axis) and sources of performance (horizontal axis).

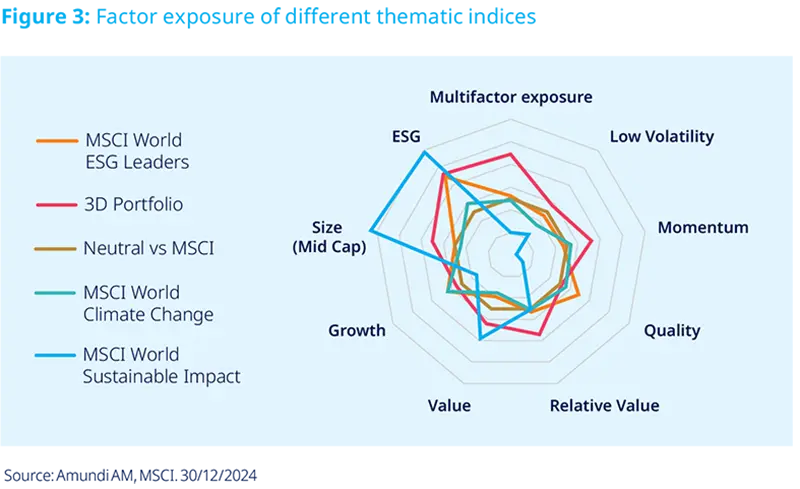

Applying a factor lens on equity portfolios and indices is a good way to assess their relevance and their balance across several dimensions. However, integrating constraining sustainability criteria into an investment process can create significant portfolio distortion and generate unintended biases, which may affect the expected return of the portfolio.

As seen in Figure 3, the integration of additional constraints to an optimized process may lead to a significant distortion of the portfolio, by affecting factor and sector exposures and the risk-return profile.

Indeed, integrating Net Zero or other sustainability objectives in a quantitative investment process can be complex as it redefines the objective function. The impact will ultimately depend on the portfolio structure and the set of constraints applied to reach carbon neutrality and other KPIs.

Factor investing is an efficient and robust way to define expected returns

At Amundi, we aim for consistent performance over the long-term, by building a welldiversified exposure to rewarded equity factors, in order to harvest risk premia and mitigate the portfolio’s global risk. Thanks to their ability to structure investment signals into a disciplined investment process, systematic portfolio managers tend to be less exposed to emotional bias as they apply model-driven decisions.

Since the seminal research of Fama and French (1992, 1992), it is accepted that the market factor defined by Sharpe (1964) is not the only common risk factor that explains the crosssection variance of expected returns. Among these factors, we find the low Beta factor (Black, 1972), the Value factor (Basu, 1977), the Size factor (Banz, 1981), the Momentum factor (Jegadeesh and Titman, 1993) or the Quality factor (Piotroski, 2000). More recently, the concept of factor investing has been further popularized by Ang (2014) and other academic papers. As explained by Roncalli (2017)9, factor investing consists in building long-only equity portfolios, which are directly exposed to these common risk factors.

Usually, a Multi-Factor investment process consists in assembling different factors such as Value, Quality, Low Volatility, Momentum, and Size through a systematic factor combination. Factor-based managers aim to capture the long-term excess return, i.e., risk premium, provided by each individual factor’s payoff profile while mitigating market risk through the diversification they provide due to their different and complementary market cycles.

In Equities, factors have different sensitivity to the evolution of the market context and the macro-economic environment. For instance, it is well accepted that the Low Volatility factor tends to be exposed to interest rates, and performs better when interest rates are low or at least going down as illustrated by Stagnol and Taillardat. (2017).10 By contrast, the Value factor tends to have a more robust performance when interest rates and inflation are rising as explained by Stagnol et al.11 (2021).

Over the long-term, factor performance is highly cyclical and is generated through different sources. This is the basis through which we can build well-diversified portfolios in order to navigate Equity market cycles. 9. Roncalli (Amundi Investment Institute). “Alternative Risk Premia: What Do We Know?”, 2017. 10. Stagnol and Taillardat. “Analysing the Exposure of Low-volatility Equity Strategies to Interest Rates”, 2017. 11. Stagnol et al. “Understanding the Performance of the Equity Value Factor”, 2021.

In Factor investing, portfolio construction is key. Multi-factor strategies can be built following three key steps:

Constructing factor equity portfolios with different characteristics and hence that can offer a good ground for diversification

Assembling and weighting these factors in accordance with the investor’s objective (for example, applying a Risk budgeting allocation may provide a well-diversified portfolio and an optimal risk profile)

Applying optimization techniques to further reinforce the Multi-Factor exposure of the portfolio, and limit potential dilution of assembling factor portfolios which have very different compositions

Thanks to this investment process, multi-factor portfolios tend to have a higher and more diversified exposure to rewarded factors. As such, they tend to deliver higher expected returns.

Defining 3-Dimensional (“3D”) portfolio construction

It is generally expected that a portfolio that integrates ESG criteria will have different factor and sector exposures compared to a portfolio without those considerations. Indeed, in the case of a portfolio integrating sustainability concerns, the investment universe is reduced, notably due to asset exclusions, carbon and energy transition metrics, or other ESG KPIs.

Nonetheless, we believe it is possible to build a sustainability-driven equity strategy, while controlling the impact on factor and sector deviations vis-à-vis the initial Multi- Factor portfolio.

Our quantitative investment process designed to target climate objectives goes beyond a simple carbon intensity reduction approach. As previously outlined, a thorough methodology has been established to assist portfolio managers in constructing a Multi- Factor portfolio that meets specific ESG criteria, carbon intensity, and transition objectives, while also taking into account factors like risk and diversification across rewarded elements.

We believe sustainability-driven investing and systematic and quantitative investing to be a good match, considering that:

Achieving sustainability goals such as climate risk mitigation requires capacity to adapt to some rapid changes in the equity asset pricing;

Beyond decarbonization, investors can target other objectives, such as SDG alignment, energy transition financing, engagement and more;

Carefully constructed factor-based portfolios can maintain good portfolio diversification and find the right trade-off between return, risk and sustainability; • Investors can tailor the trade-off in their portfolio to align with their own preferences;

The metrics used as part of the sustainability assessment are multi-faceted: quantitative portfolio managers have the tools and experience to extract the best from available data.

Besides, we believe that the time horizons behind Sustainability and Factor investing are well aligned. Reaching sustainability objectives defined with a variety of climate metrics requires a long-term horizon. The diversification embedded in Multi- Factor portfolios also requires a long-term perspective. In particular, the natural balance between different factors enables portfolio managers to limit their portfolio turnover and to maintain a consistent and stable exposure to climate KPIs.

The investment approach we present in this paper has been designed to achieve the optimal trade-off between three key dimensions: return, risk and sustainability. We incorporate sustainability KPIs in a diversified Multi-Factor exposure through a rules-based optimization process.

These three dimensions or “3D” are balanced concomitantly through a top-down approach combined with bottom-up optimization. To do so, a 3D portfolio is constructed based on multiple objectives.

In a first step, two portfolios are optimized in such a way that they can maximize their own KPIs:

One “Multi-Factor” model portfolio maximizing the expected return via Factor exposures

One “Sustainability-maximized” model portfolio that aligns with the required sustainability objectives (Climate SDG alignment, Net Zero trajectory alignment, ESG score, green revenues, exclusions, etc.)

In a second step, optimal combinations of the two portfolios are simulated in order to find the most efficient blended solution that fulfills all the required objectives within the Tracking- Error budget. At the last stage of the process, we use a bottom-up portfolio optimization to further enhance the model portfolio:

Computing, for each constituent of the two intermediate model portfolios, the proportion of weight coming from the Sustainabilitymaximized model portfolio and the one coming from the Multi-Factor model portfolio;

Resampling the final model portfolio by adding all remaining features (Tracking-Error budget, weighting limits, turnover, transaction costs) while ensuring that:

- The weighted average proportion of each intermediate model portfolios in the final model portfolio is well respected throughout the optimization;

- All sustainability objectives are effectively enforced.

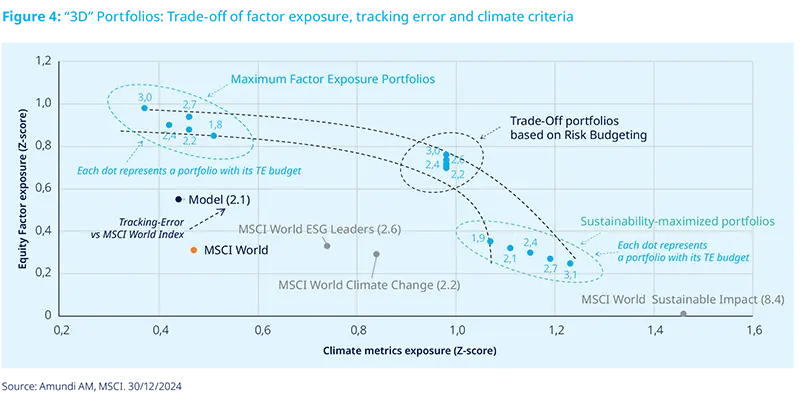

Figure 4 provides a view of the different portfolios and their Tracking-Error versus the MSCI World Index. Their factor exposure is shown vertically, while their sustainability alignment is shown horizontally.

A Tracking-Error budget is defined for each portfolio on which the exposure to factors and / or to sustainability is maximized.

There are 3 main groups of portfolios:

On the top left, “pure Multi-Factor” portfolios with, by design, a high factor exposure but lower sustainability alignment;

On the bottom right, pure “Sustainabilitymaximized” portfolios with, by design, high alignment to sustainability and climate objectives but lower factor exposure;

In between, so-called “Trade-off portfolios” maximizing both factor exposure and sustainability alignment under various Tracking-Error budgets, thus optimizing the 3 dimensions objective.

Additionally, there is a trade-off between Factor exposure, Tracking-Trror and sustainability objectives: the higher the Factor exposure, the higher the Tracking-Error and the lower the sustainability exposure. Conversely, a higher sustainability criteria exposure (especially to asset exclusions) comes with lower diversification, i.e., higher risk and lower Factor exposure which may lead to lower return upside over a full market cycle.

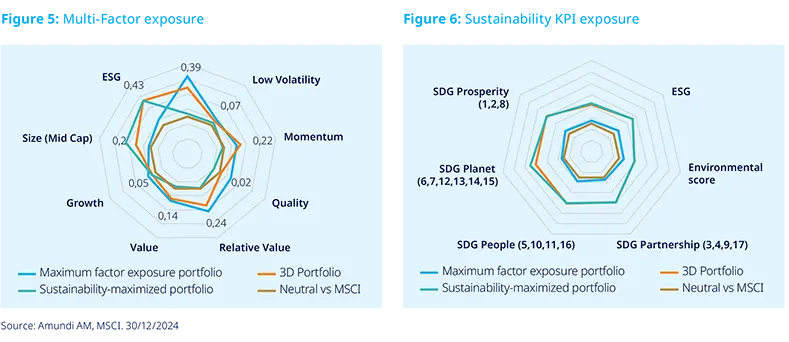

These trade-offs are outlined in the spider charts above (Figures 5 and 6). They compare factors exposure (Figure 5) and Sustainability exposure (Figure 6) of a pure Multi-Factor Maximized Portfolio, a pure Sustainability Maximized Portfolio, and a Trade-off portfolio (or 3D portfolio) versus the MSCI World Index:

From a Factor perspective, the 3D portfolio is very close to the Multi-Factor portfolio, with a larger ESG tilt, while the Sustainability -Maximized portfolio has a mid-cap bias with a high ESG profile, but very poor Multi-Factor exposure overall.

From an ESG perspective, the Multi-Factor Maximized Portfolio is neutral (at the same level as the MSCI World Index), the 3D portfolio has a higher ESG exposure, and the Sustainability -Maximized Portfolio has very significant overall ESG exposure. With this portfolio construction articulated around “3D” objectives, we can thus see that our Trade-off portfolio has a high exposure to sustainability indicators without sacrificing its expected return, and complying with a given Tracking-Error budget.

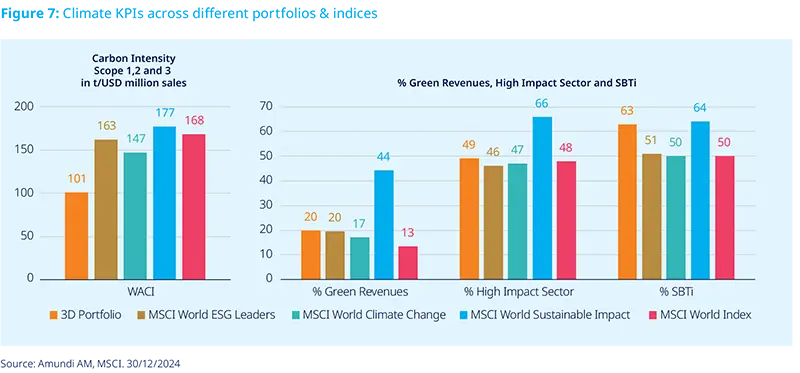

As seen in Figure 7, climate indicators vary to an important extent depending on the portfolio or index considered and their associated sustainability targets. In the 3D Portfolio, carbon intensity is significantly lower than in others due to the decarbonization constraint imposed in the portfolio construction process. The 3D Portfolio also has a relatively higher share of companies belonging to high impact climate sectors and companies with SBTi validated targets (versus the ESG Leaders and Climate Change MSCI indices). On the other hand, MSCI World Sustainable Impact has a stronger Transition dimension, selecting companies offering solutions that work towards the goal of Net Zero emissions by 2050, and therefore has the highest share of green revenues compared to other portfolios.

These climate KPIs are useful to understand how 3D portfolios can contribute to different sustainability objectives. Still, we acknowledge that issues related to data quality and transparency represent significant challenges to integrating sustainability criteria in quantitative portfolios. This is notably the case for indicators related to carbon emissions measurement12, as well as for the degree of alignment of companies to climate SDGs. Quantitative investors have the tools and the knowledge to tackle data quality issues by applying time-tested filtering techniques and statistical modelling into robust portfolio optimization. Besides, our sustainability framework will evolve with time, as new metrics are adopted and data quality improves.

In the meantime, we believe our 3D investment process to be well positioned to offer an optimal trade-off between multifactor exposure, as a source of return and risk mitigation, and sustainability alignment.

By adopting this sustainability framework in quantitative investing, portfolio managers closely analyze the different eligible “Tradeoff” portfolios. They can work on mitigating negative correlations between factor tilt and sustainability alignment by ”favoring” a pool of stocks and corresponding weights that maximizes all required objectives.

On top of reconciling factor and climate objectives, the 3D approach enables to reinforce risk mitigation. Indeed, mixing financial data embedded in the equity factors and extra-financial data such as climate KPIs brings additional diversification to the portfolio. Besides, this is done on various Tracking-Error budgets which provides the investor with the opportunity to build this portfolio with the desired level of relative risk. While this 3D approach aims at constructing the most optimal portfolio on an ex-ante basis, it is also critical to carry out ex post performance attribution, in order to decompose past performance across well-identified pillars. This allows investors to monitor the sources of performance emerging from equity factors and/or from the sustainability dimension.

It means that portfolio managers need to develop dedicated risk models which can integrate the different dimensions of sustainability objectives such as carbon emissions, climate transition metrics, SDGs, etc. alongside more traditional factors such as Country, Currency, Sector, Style (e.g., “factors”) and specific risk. Hence, investors can have a close scrutiny on the added value of all their investment signals and can have an informed conversation with their stakeholders on the contribution of sustainability objectives to their risk-adjusted performance. In our view, this is a crucial piece that should be embedded in their “3D” portfolio construction.

Conclusion

Achieving sustainability objectives, such as decarbonization and SDG alignment, is ambitious and will require a material change in investment processes used by asset managers. Moreover, metrics used within sustainability frameworks are multi-faceted, complex and often not fully mature.

For instance, in Equity portfolio management, climate indicators go beyond a simple and static reduction of the portfolio carbon footprint: a Climate investment framework should be comprehensive and focus on both the decarbonization and energy transition aspects.

Besides, this Sustainability framework will have to evolve over time with the emergence of new data, as well as with the development of new guidelines provided by governmental bodies or regulatory entities. In this context, it is crucial to design an investment process that can adapt to this evolving landscape.

We believe that quantitative portfolio managers have an edge as they have the tools and the experience to handle different variables from different sources and to use them to structure a disciplined investment process. Factors are a good way to maintain good portfolio diversification and to find the right trade-off between sustainability objectives and positive expected returns offered by Equities over the long-term.

As a result, we believe that Factor Investing combined with the integration of climate criteria can allow portfolio manage to address three investment dimensions at once: risk, return and sustainability.