Summary

Tracking the responsible investment path

The landscape of responsible investment has rapidly evolved in recent years, influenced by stricter regulatory changes, shifting market dynamics, and an increased emphasis on environmental, social, and governance (ESG) factors. In this article, we will explore the current developments in responsible investment, including the growth of the Green, Social, and Sustainability (GSS) debt market and the rising trend of investments in renewable energy, as well as where opportunities lie for pension funds in the sustainable finance space.

In 2024, the growth of assets under management (AUM) for responsible investment funds was relatively subdued, reaching €57 billion in the first three quarters, compared to over €98 billion in the broader non-ESG market in Europe. The market shares of responsible investment funds remained stable across regions, with Article 8 and Article 9 funds holding approximately 59% of the asset market share in Q3 2024, up from 56% in Q3 2023. Additionally, the trend of fewer global responsible investment fund launches continued, reflecting a maturing market that is facing increased scrutiny due to stricter regulatory developments including more rigorous frameworks that establish minimum standards, such as the European Securities and Markets Authority (ESMA) guidelines aimed at promoting transparency in ESG disclosures.

Energy Transition

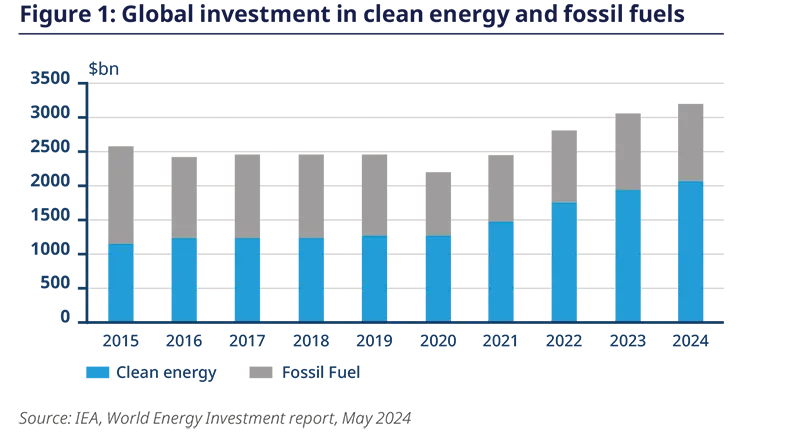

The energy transition sector is experiencing a notable rise in investments, particularly in renewable sectors such as solar and wind, with clean energy investments now outpacing fossil fuels at a 2:1 ratio1. This growth is for a significant part driven by key government policies such as the US Inflation Reduction Act, the EU Green Deal, and China’s “Made in China” initiative.

However, geopolitical shifts, particularly under the Trump administration, are also reshaping the energy landscape. Trump's focus on cheap energy may boost fossil fuel production but could also accelerate green energy development if clean energy becomes more competitive, as the administration’s focus seems to lie on price. While protectionist policies may promote green technology, they could also raise production costs, potentially undermining climate change efforts.

The GSS+ Debt Market

Another key aspect of the responsible investment landscape is the market for labelled bonds. By the end of 2024, the sustainable debt market has shown resilience with the Green, Social, Sustainability market (GSS+) surpassing $5 trillion in cumulative issuances, primarily through green bonds, which account for 80% of sovereign GSS+ volume. Aligned GSS+ bond volumes reached $554 billion in the first half of 2024, with Europe contributing significantly. Africa has also seen a remarkable 412% increase in green bond issuances from 2023, indicating a commitment to sustainable financing.

The green bond market is expected to continue growing in 2025, supported by upcoming regulations like the EU Green Bond Standards and ESMA’s guidelines. Major ESG data providers are consolidating their offerings, leading to the development of tailored, sector-specific indicators that address the complexities of a maturing market.

Responsible investment and regulation

The recent responsible investment market growth is partly driven by stricter regulatory frameworks that establish minimum standards. At a European level, the ESMA guidelines aim to establish minimum standards for ESG disclosures and promote transparency for investment solutions. Whilst at a country level, there are initiatives such as France’s ISR label, which can be obtained by investment funds that meet specific social and environmental criteria. Moreover, the upcoming Corporate Sustainability Reporting Directive (CSRD) will further enhance corporate accountability through additional disclosure requirements on sustainability practices, risks and impacts. For pension fund investors, this evolution is important as it promotes greater transparency, allowing for more informed decision-making based on reliable ESG data. Enhanced reporting helps identify potential risks and aligns investments with personal values, while also tapping into a growing market demand for sustainable practices.

Emerging and Developing Economies (EMDEs)

Emerging and developing economies (EMDEs) are crucial for global climate change mitigation, projected to contribute significantly to CO2 emissions while leading future clean energy investments. With rapid urbanization and economic growth, EMDEs could attract up to $5 trillion in investments, particularly in solar and wind energy. The physical impacts of climate change are worsening, with projected damages reaching $1.8 trillion by the century's end and current economic costs estimated at $300 billion. The degradation of natural ecosystems exacerbates climate risks. Advancements in clean technology, particularly in batteries and power grid optimization, have benefited from rapid electrification. While solutions like green steel are technically feasible, they remain economically unviable under current policies, highlighting the need for increased global investment to effectively address climate change.

China's Influence on Decarbonisation Goals

The push for decarbonisation and sustainable development for a large part depends on a few key actors, notably China. It plays a significant role in renewable energy, production, holding about 80% of the world's solar photovoltaic capacity, 60% of wind power, and 70% of electric vehicle battery manufacturing. However, despite its advancements, China's emissions rose in 2023 due to increased energy demand and reliance on coal, showing the difficulties in meeting global climate targets. This situation highlights the complexities of the energy transition, revealing the delicate balance between advancing renewable technologies and the ongoing challenges of achieving these targets. It is essential to understand China's pivotal role in this landscape, particularly because of its substantial impact on the energy transition and its implications for global sustainability efforts.

The crucial role of corporates in the energy transition

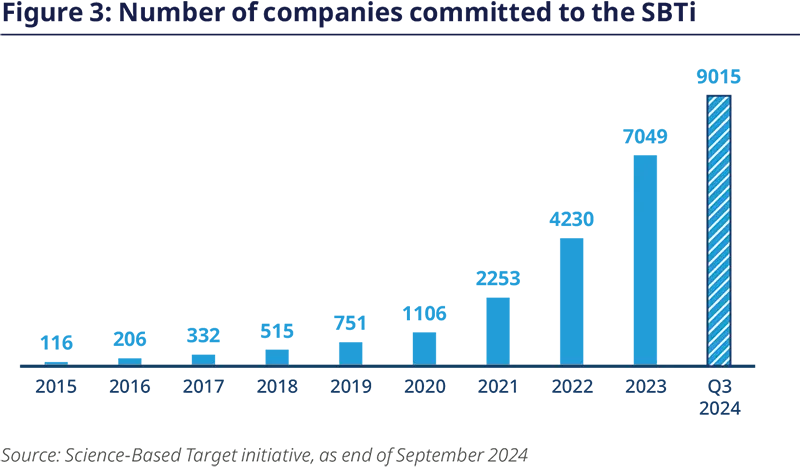

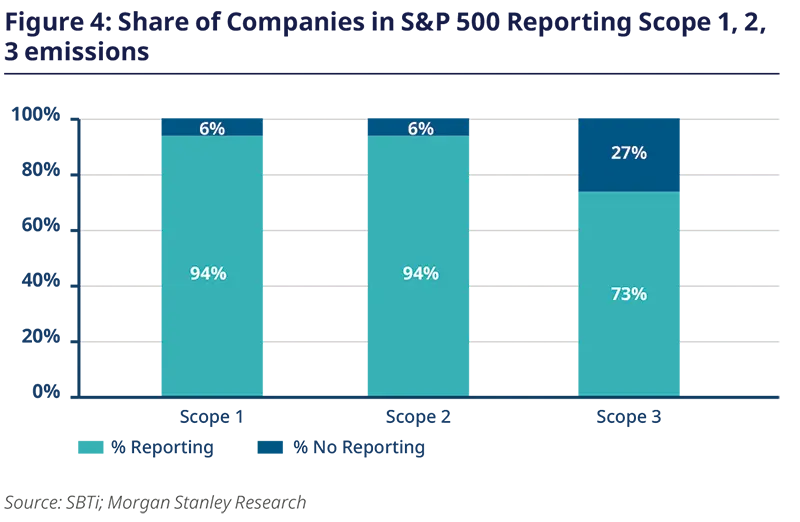

Corporates are increasingly integrating climate and nature risks into their investment strategies, with a 30% increase in the first three quarters of 2024, as over 2,000 new companies joined the Science Based Targets Initiative (SBTI). As shown in figure 3, there is an increasing focus on corporate climate accountability, for companies to report their Scope 1, 2, and 3 emissions. Nearly all S&P500 firms disclose Scope 1 and 2 emissions, while scope 3 reporting remains comparatively a bit lower at 73%. This momentum is fuelled by the growing awareness of the impact of climate change and the current sluggish pace of the energy transition, which can negatively affect a company's value chains, potentially leading to increased costs. Rising regulatory requirements, especially in Europe, mandate due diligence on climate risks and public disclosures, pushing corporations to enhance their reporting practices.

Overall, there is positive momentum toward clean energy investments, recognized for their contribution to GDP growth through job creation and economic resilience. However, significant challenges remain, particularly in infrastructure development in the U.S. and Europe, where complex administrative procedures delay renewable energy projects. Another factor will be artificial intelligence, which is expected to enhance efficiency by optimizing energy management and improving grid operations.

Plotting the responsible investing landscape for pension funds

The rising awareness of responsible investment among pension funds

According to the 2024 Amundi/CREATE research survey of global pension funds2, many respondents allocate their assets toward impact investing funds targeting financial, social, and environmental benefits through private markets, especially private equity and private debt. For pension funds, private markets are particularly suitable for ESG investing, as their investments are more effective in targeting impacts through direct investments in pure-play companies whose business models are solely focused on chosen themes.

There is a growing emphasis on ESG factors, with 56% of respondents targeting a triple bottom line from their private market allocations. For 78% of respondents, maintaining a good track record of delivering clients’ financial and ESG goals is the most important criteria, indicating a growing demand for ESG-related topics. When it comes to manager selection, survey participants rank delivering clients’ financial and ESG goals as a top priority (63%). Moreover, thematic funds investing in renewable energy and sustainable bond funds are the preferred options for pension funds to access Asian emerging markets.

The influence of geopolitical factors on pension fund’s investment strategy

However, geopolitical changes will affect pension funds' investment strategies. Positions for or against sustainable investing influence the management of state public pension funds. Several US states have introduced or passed legislation aimed at restricting pension funds from incorporating sustainability factors into their investment strategies. Therefore, the current geopolitical landscape in regions such as the US may not favour investment strategies toward sustainable solutions among pension funds.

Pension funds resilience in responsible investment

Tensions have risen between long-term investors and US asset managers, who have downgraded ESG investing after Donald Trump's election3. While many large asset managers in the US, including State Street, BlackRock, Fidelity, and Vanguard, have withdrawn a large part of their ESG investments, pension funds have, conversely, decided to further engage in responsible investment. A notable example of an asset owner pushing back against the retreat from ESG is The People’s Pension, one of the largest UK pension funds4, which pulled £28 billion from State Street after a review of its responsible investment policy to engage with more responsible investors such as Amundi and Invesco. This defined contribution scheme aims to run the funds with a focus on responsible investment.

Furthermore, in March 2025, a group of 26 financial institutions and pension funds launched a responsible investment campaign, urging their asset managers to engage more actively with companies they are invested in regarding their climate risk. Some major US pension funds, including Calpers (California Public Employees’ Retirement System) and the California State Teachers’ Retirement System, have also warned against the dilution of climate reporting standards.

Conclusion

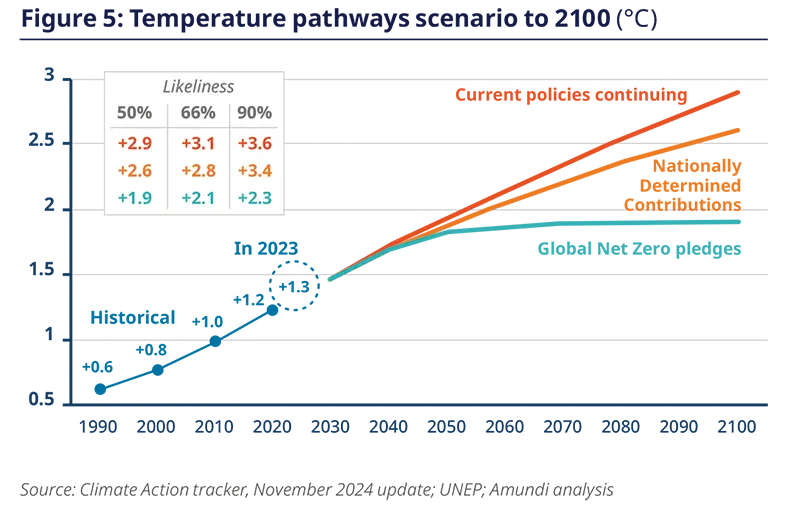

While the geopolitical context will undoubtedly influence responsible investment for pension funds, there is a notable and growing commitment to ESG principles among pension funds in Europe, distinguishing them from their US counterparts. These funds are increasingly turning to private markets to align their ESG investments with long-term objectives, underscoring a broader recognition of sustainability's importance in investment strategies. As pension funds strive to balance financial performance with positive social and environmental outcomes, a recent review indicates a significant gap between current policies and climate goals. The UN warns of potentially catastrophic warming scenarios if mitigation efforts are not intensified; if current policies persist, global temperatures could rise by 2.9°C by 2100, with only a 3% chance of limiting increases to below 2°C (Figure 5).

This evolving landscape reflects a shared commitment among pension funds to responsible investment, highlighting the urgent need to increase efforts in responsible investing to meet the critical targets necessary for a sustainable future.

- IEA, World Energy Investment report, May 2024

- Amundi. (2024). Where will returns come from in pensions' new economic regime? Amundi Research Center.

- Financial Times. (2024, March 17). Looking ahead: Continued interest in private markets.

- Financial Times. (2024, March 17). Top UK pension fund mandate changes hands.

Read more