Banking sector under the spotlight

Today’s banks are very different to fifteen years ago, before the Lehman crisis. Stricter regulation including higher capital ratio levels and lower leverage mean large and international banks are solid and have less interconnecting counterparty risk. Systemic risks should not be anyone’s base case, and markets are not pricing in a systemic event. In our view, the recent turmoil in the banking sector is more of a confidence crisis in smaller US banks having lighter capital regulations, and is most recently driven by a repricing of the economic outlook.

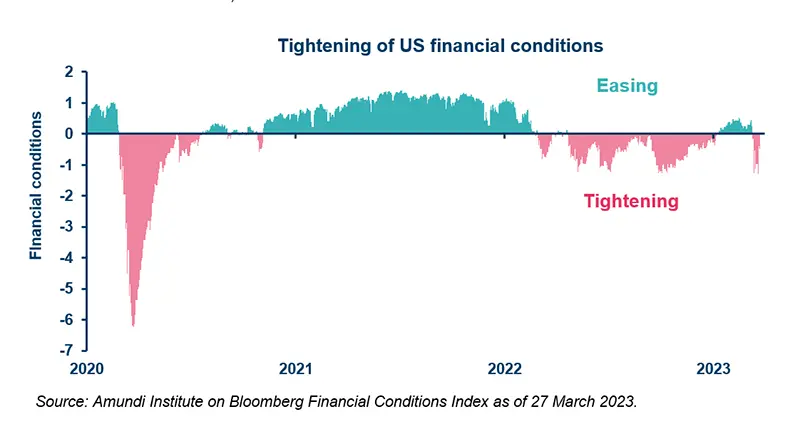

Markets are now starting to reassess the impact of a more challenging economic outlook. Stresses in the banking system will lead to a tightening in credit conditions and higher borrowing costs for consumers and businesses, particularly in the US. We expect such developments to act as a brake on economic activity and have knock-on implications for monetary policy. Here are our latest views:

1. A harder economic landing than initially thought for the US

The recent stress in large parts of the US banking sector adds to pressure on funding costs and profitability stemming from the fastest monetary tightening on record and the protracted period of an inverted yield curve. These stresses will constrain many banks’ ability to lend and will have a material impact on the outlook. As a result, we now expect a recession in the US in the course of 2023, rather than mild weakness.

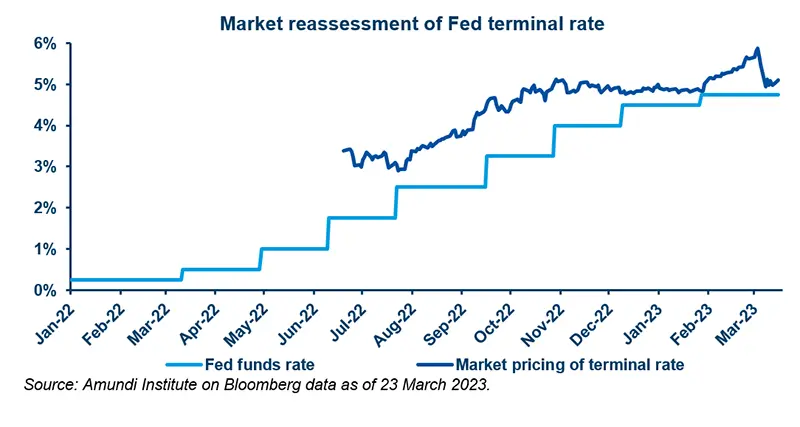

2. Central banks taking the turmoil seriously

Central banks are showing a willingness to differentiate their monetary policy pathways (which aim to fight inflation) from the actions taken to deal with the banking sector storm. We are entering uncharted waters and we expect central banks to keep an even more data-dependent approach, with little to no policy guidance. This will continue to keep volatility high in the bond markets.

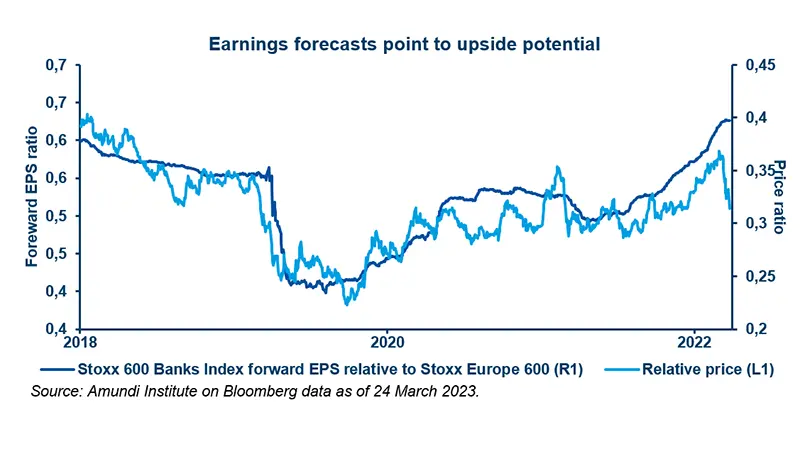

3. European banks’ earnings growth to deteriorate, but still positive

The key to sector profitability will be whether the European economy is able to avoid a recession over the coming years and if labour markets can remain robust. While fears about credit crunches may increase amid higher funding costs, the strong liquidity profile and capital position of the European Banking sector should ensure that new lending facilities remain available to support the economy.

4. Key takeaways for investors in this environment

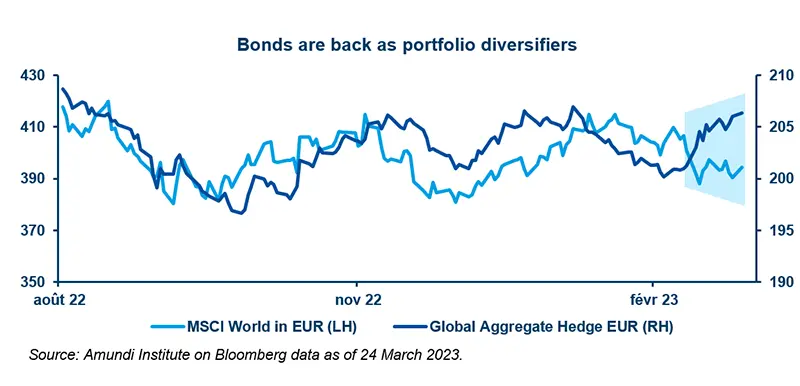

A more uncertain economic outlook, with a higher risk of recession and little guidance on central banks’ actions, calls for an increasingly cautious stance overall. Investors should look to strengthen portfolio protection and stay diversified as inflation, growth and earnings concerns remain, with additional volatility now to be considered.

In particular:

We confirm our cautious view on equities and favour value, quality, and high-dividend oriented names.