Summary

As fiscal support should wane, this could lead to lower inflation pressures in the second half of 2023 and to a faster decline in inflation.

High inflation has not triggered a wage-price spiral in the advanced economies. Monetary tightening has contained inflation expectations and a continued firm stance will bring down inflation, possibly faster than expected.

There is now broad consensus that headline measures of inflation have peaked and are on the way down, both in the United States and in Europe. However, core inflation remains elevated for central banks to take sufficient comfort, and especially in Europe, where it is still rising. Our central case sees the Fed and the ECB continuing to tighten until the second half of 2023 and maintaining a restrictive policy stance. With fiscal support also expected to wane gradually, could this lead to lower inflation pressures in the second half of 2023 and a faster decline in inflation? We consider some of the factors that could exert downward pressures on inflation relative to our central scenario.

In the United States, our central scenario of headline inflation at 4.3% is marginally more positive than official forecasts (the Fed’s median Dot Plot) because of our expectation of a more subdued growth outlook for 2023 and 2024, with a relatively high 40% probability of a recession in the second half of 2023. Among the major components, goods prices are deflating at a faster pace than we had expected, while services inflation and the shelter components will decline only gradually, keeping core inflation stubbornly high for a while longer. That said, both headline and core measures have turned decisively.

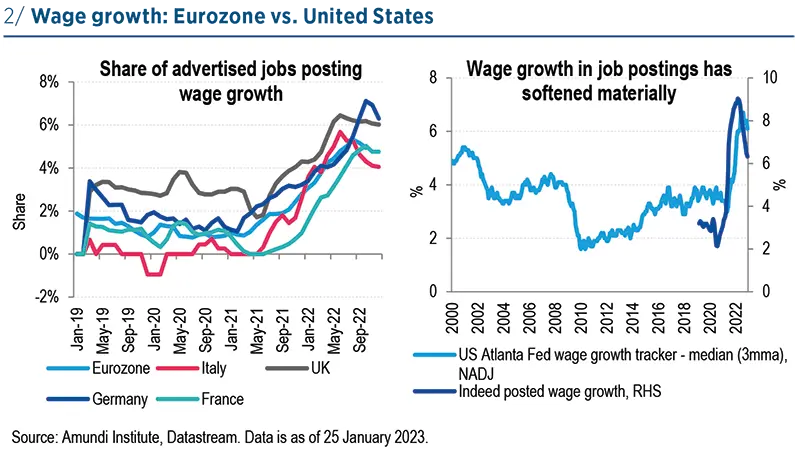

In Europe, we expect lower energy prices to continue to exert significant down pressure on headline inflation, but core inflation to remain elevated and decline very gradually, to a little under 4% at the end of this year. This reflects our expectation that the overall wage bill (employment compensation), which is still moderate, will continue to increase by about 3.5% this year and next. As a result, monetary policy makers will remain cautious on any near-term pause until core inflation is firmly on a downward trend.

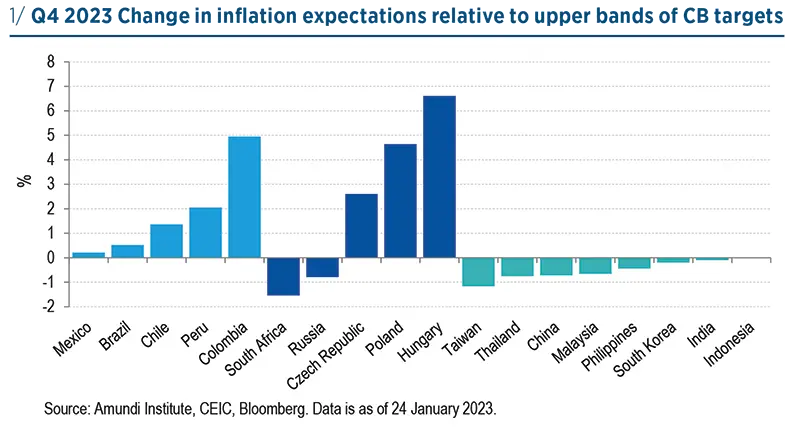

Inflation in emerging markets has also peaked, though from very elevated levels, and with wide differences across countries. On balance, China’s reopening should reduce EM inflation as supply chains continue to normalise, notwithstanding some offset from higher commodity prices.

Why inflation could fall faster?

A scenario of headline and core inflation falling proportionately would be a strong positive for most asset classes.

1. Lower risk this time of a wage-price spiral. In many previous episodes of rising inflation, wage growth did not accelerate when real wages were falling and inflation expectations remained anchored because of monetary tightening. A recent IMF study confirms this for 22 similar periods of rising inflation in advanced economies. The current episode of high inflation, which does not emanate from labour markets, shows similar characteristics, both in Europe and in the United States – real wages falling despite positive nominal wage increases, but with monetary policy expected to remain tight. In the United States, where labour market pressures have been more intense, average earnings are already moderating and there is evidence that employers are offering lower wage increases on advertised job offerings (compared to median wage growth on existing jobs).

2. Financial conditions will get tighter. Despite substantial monetary tightening thus far, financial conditions have eased recently as markets have been cheered by the resilience of growth. However, the typical lags associated with monetary policy will eventually play out, and borrowing costs for firms and households have already tightened substantially. Add to this, little prospect of any sustained fiscal support for demand, overall macro policy will not add to inflation pressures. Even in Europe, many governments will find it difficult to maintain current levels of support for energy bills.

3. China reopening will ease inflation pressures. Economic activity in China gradually normalising will relieve supply chains and reduce inflation pressures globally. On balance, this effect will outweigh higher domestic demand in China, which will largely affect consumption, as compared to significantly higher overall demand for commodities (with the exception for some industrial commodities). Any significant rise in domestic inflation in China could also bring forth some policy tightening.

4. Still weak growth outlook. Growth in the United States and in Europe is projected to remain very subdued (well below potential) for this year and next, with a material probability of a recession in the United States and Europe. With very little policy space to respond, a period of protracted weakness should weigh on inflation.

What if inflation falls faster than expected?

With respect to asset prices, the most favourable scenario would be a proportionate fall in both headline and core measures due to wage moderation, sustained lower energy prices, and the lagged effects of monetary policy tightening already in the pipeline. This would be a strong positive for most asset classes -- essentially a ‘good’ soft landing. By contrast, if core inflation remains sticky (while headline continues to fall), central banks will be in a bind. They will continue to worry about prospective wage inflation and inflation expectations. Central banks being less patient will increase the risks of a harder landing, which will depress equity markets and lead to a bear flattening in rates markets.

However, a faster fall in inflation could be a mixed blessing. If inflation falls because of a sharper than expected decline in growth, the risks of a deeper recession and protracted weakness will be significant, especially as this time there is little room for a policy response. Beyond fixed income, most asset classes will be under sustained pressure.