Summary

- Recent developments: Disagreements over France’s 2025 budget have triggered some market volatility. Prime Minister Michel Barnier proposed a budget which targeted a reducing in the deficit to 5% in 2025 and below 3% by 2029, a plan considered credible by the European Commission. He invoked Article 49.3 to pass the social security budget without a parliamentary vote, but the opposition parties then brought down the government by passing a motion of censure. President Macron is now looking for a new Prime Minister. There are several possible scenarios from this point, but France's institutional framework ensures that a budget law will be enacted regardless of the outcome, making the rollover of the 2024 budget law a probable scenario in our view.

- Market impact: This phase of political uncertainty is weighing on French assets, with short-term volatility expected to continue, but we don’t see any contagion as there is no risk to debt sustainability. The French economy remains resilient and inflation is on a downward path.

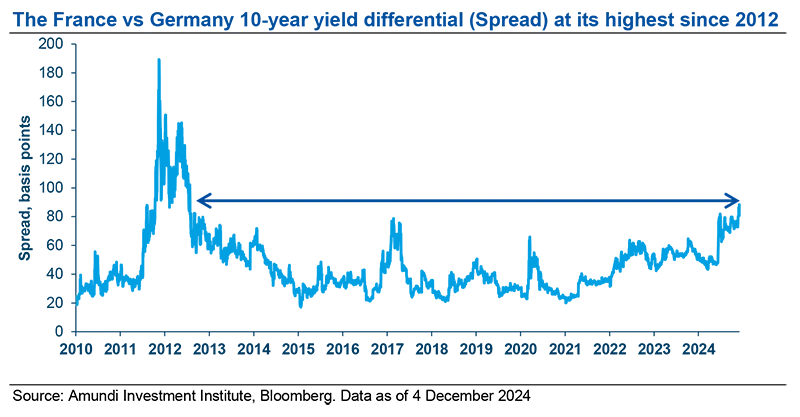

- Views on French government bonds: Recently, the cost of French debt has risen relative to German debt, with the yield spread between French OATs and German Bunds slightly above the summer peak of 80 basis points. The French debt market is characterised by its liquidity and depth, making French government bonds a valuable choice among global investors. All major rating agencies have reaffirmed France's quality rating, with S&P maintaining its assessment of 'AA-/A-1+' and a stable outlook (on 29 November). French bonds will benefit from the favourable environment for European bonds amid the ECB’s easing policy and slowing inflation. With the current level of spreads already pricing ongoing uncertainty, any further spread widening could offer an attractive entry point for long-term investors.

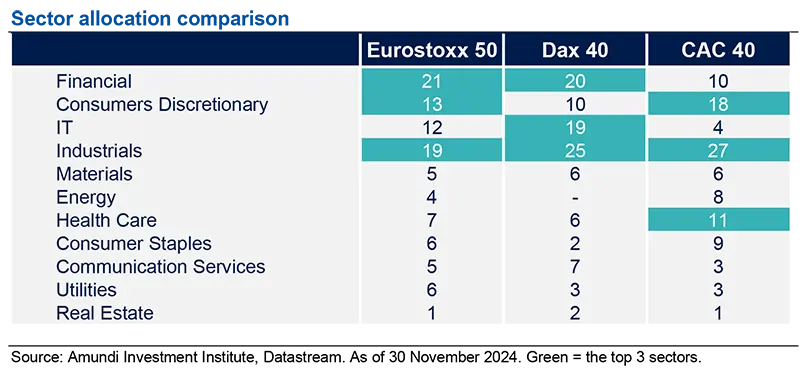

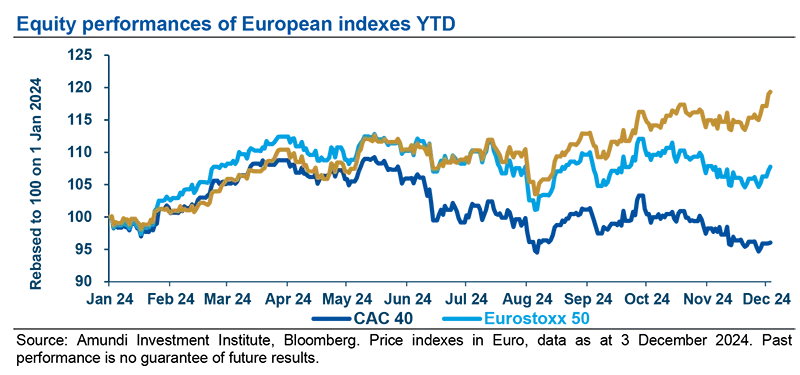

- Views on French equities: The recent underperformance of the CAC40 Index is largely attributed to its composition, which is heavily weighted towards consumer discretionary and luxury goods stocks, and has lower allocations to the financial and technology sectors that have performed best recently. We expect French equities to eventually recover in line with earnings growth.

What are the recent developments in French politics?

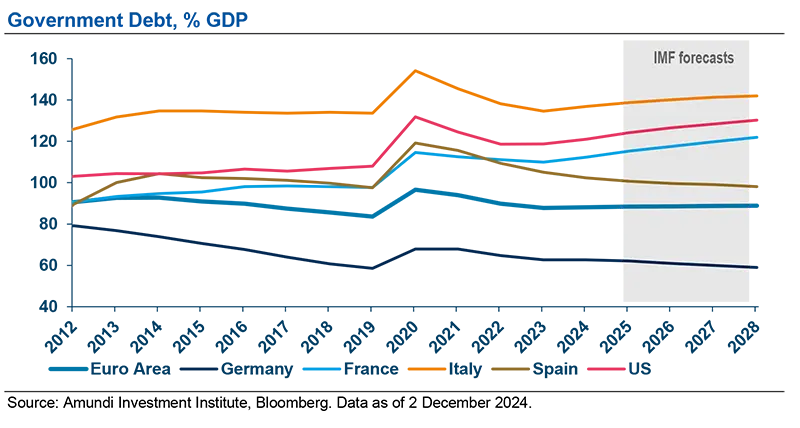

The French fiscal situation deteriorated post-Covid. Public debt as a percentage of GDP now surpasses levels in the Euro Area, including Germany and Spain, even if it remains lower than the ratio in the US (which exceeds 120%).

The government, led by Michel Barnier, proposed a draft budget for 2025 which aimed at reducing the deficit to 5% in 2025 and below 3% by 2029. The European Commission deemed the plan compliant and "credible", even though France remained subject to the excessive deficit procedure.

But the government failed to reach an agreement on the budget with the opposition parties, including the National Rally (RN) led by Marine Le Pen. French Prime Minister Michel Barnier therefore invoked Article 49.3 of the Constitution to pass the first part of the budget, the social security budget (PLFSS), without a parliamentary vote. Although this mechanism allows the Prime Minister to advance legislation without a vote, it also allows opposition parties to propose a motion of no confidence. They did so, and the motion passed last night.

What happens next and what may be the potential impact on the deficit?

These are unprecedented times. The Constitution was not written to deal with such a circumstance. Following the no-confidence vote there are at least three possible scenarios:

- The most likely is a vote to roll over 2024 budget provisions into 2025 under Article 45 of the Constitution. This could be done either under a new government or by the existing government, acting as caretaker. Under this scenario, we believe the deficit would rise to between 6% and 6.5% of GDP. The tax take would likely rise, but social security spending would also probably increase, keeping the deficit close to 2024 levels.

- If parliament does not act on the budget within 70 days, the government can use Article 47 of the Constitution to pass the 2025 budget proposed by Barnier by ordinance without a vote.

- President Macron enacts a budget by decree, invoking Article 16. This remains a very unlikely scenario.

The constitutional procedure is becoming extremely complex, because the conditions for recourse to certain articles and the time limits are subject to interpretation. Ultimately, it will be up to the Constitutional Council to rule on the legality of certain provisions that may be adopted in the coming weeks.

A resigning government tasked with dealing with current affairs can take the measures required for the ‘continuity of national life’. This imperative of ‘continuity of national life’ is fundamental to the Constitution and should enable the adoption of a budget before 31 December, although it is not yet possible to say much about the content of this budget (several options are possible).

As a last resort, if all efforts to provide the country with a budget by 2025 fail, the President may resort to Article 16 of the Constitution, which gives him (and him alone) exceptional executive powers for a limited period, subject to review by the Constitutional Council.

Multiple scenarios are opening up, with the most likely possibility being that the 2024 budget is rolled over in 2025.

Economic outlook for France

Resilient growth in 2024, but likely to slow in 2025

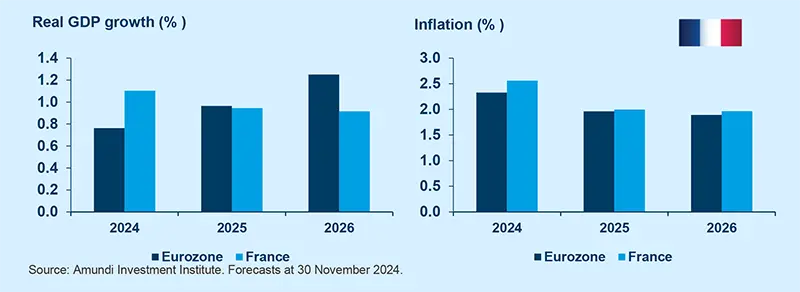

- The French economy has remained relatively resilient in the face of financial tightening and falling foreign demand. France is projected to grow by 1.1% in 2024, aided by the Olympic Games, followed by a potentially significant slowdown in 2025.France's merchandise exports to the US account for 7.3% of total exports (2023). The impact of potential tariffs could be partly offset by domestic demand benefiting from disinflation and the easing of credit conditions.

Inflation under control

- The disinflation process is expected to continue in France and the Eurozone.

- The inflation rate (projected at 2.6% in 2024 with risks of downside revision) should slow to 2.0% in 2025 (as in the Eurozone as a whole).

Investment implications

Since the announcement of a snap election and the establishment of a new divided government, French assets have faced increased uncertainty, leading to periods of overreaction in the markets. Uncertainty about the French political situation sent the premium for holding French 10-year yield bonds vs German bunds to the highest level since 2012. Some political risk premium is expected to remain, due to the ongoing uncertainty, but we don’t expect any contagion to the wider Eurozone. While France demonstrates resilient growth, its public finances are weakening, suggesting that the premium is more likely to persist in French bonds than equities. The latter are less influenced by domestic factors but may be more sensitive to forthcoming tariff developments.

The political risk premium is likely to persist in French bond markets.

Bonds: Volatility to persist, with possible entry points opening up for investors

Recently, the cost of French debt has risen relative to German debt, with the yield spread between French OATs and German Bunds slightly above the summer peak of 80 basis points. This reflects the ongoing political uncertainty around the path of fiscal policy.

Despite this, the yield on the ten-year OAT remains stable at around 3%. The context remains very favourable for bond investing. Demand for European bonds remains solid: investors want to take advantage of higher interest rates before the ECB cuts rates further. We expect the ECB to continue to lower its key interest rates. Total inflation has returned close to 2%, and the ECB's monetary policy is far too restrictive for European economic activity.

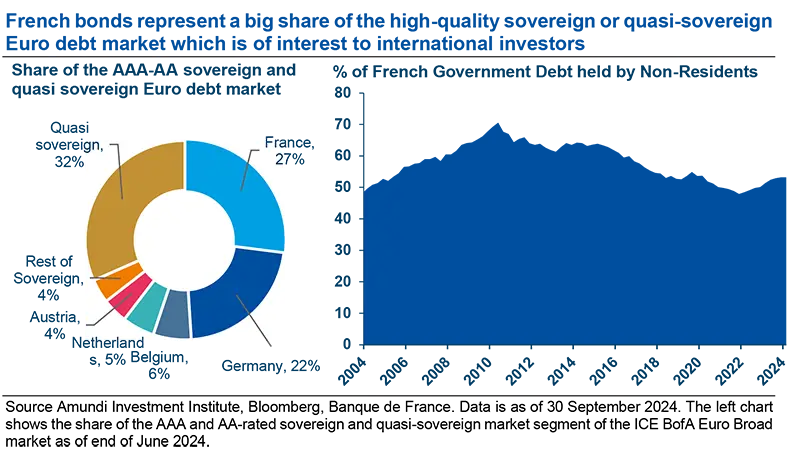

French bonds represent a significant share of the high-quality sovereign or quasi-sovereign market. The French debt market is characterised by its liquidity and depth, making French government bonds a valuable choice among global investors (which currently hold around 55% of French government debt). All major rating agencies have reaffirmed France's quality rating, with S&P maintaining its assessment of 'AA-/A-1+' and a stable outlook (on 29 November).

In addition, the yield gap between Germany and peripheral countries also remains stable. The financing costs of peripheral states have fallen. Peripheral spreads are close to the lowest levels recorded in the last three years.

Looking ahead, we expect markets to be driven by the following three main themes: (1) The risk of budgetary slippage and political instability; (2) the ECB's monetary policy; and (3) rating agencies' next moves. In the short term, we expect the political risk premium to persist in French bonds. More volatility on spreads should be expected if the government is unable to address its significant budget deficits.

French bonds benefit from the favourable environment for European bonds amid ECB policy easing and slowing inflation.

Should the spread on the French 10-year OAT compared to the German Bund rise further, this could represent an attractive entry point for long-term investors, such as insurance companies or pension funds. This would allow them to secure a higher yield and benefit from a potential normalisation of the current market conditions. The ECB would likely intervene if there is any contagion and risk that the transmission of ECB monetary policy could be disrupted.

In this context, credit markets remain quite resilient, with only marginal spread widening being seen in the Euro Investment Grade and Euro High Yield indices since the lows reached at the end of October.

French equities have suffered, but should recover in line with the expected earnings growth

French equities have suffered from this political uncertainty, with the CAC40 in negative territory year-to-date at around -4%, contrasting with the broader Stoxx600 index at +7.6% and the German Dax benchmark which is up +19% year-to-date. The performance gap has widened notably since the announcement of early elections in France

The unexpected announcement of the election has clearly accounted for part of this underperformance, but the index’s composition also plays a significant role.

The French index is heavily weighted towards consumer discretionary and luxury goods stocks, which have been adversely affected by their exposure to China, among other factors. In contrast, it has a lower allocation to financial stocks compared to the Eurostoxx50, sectors which have performed strongly in Europe this year. Additionally, the CAC40 has minimal exposure to technology stocks, unlike the DAX.

In the coming 12 months, earnings expectations for the CAC40 will align more closely with those of the Eurostoxx 50, projected at +7% (according to Ibes). However, these expectations remain lower than those for the DAX, which stands at +10%, and significantly below the US S&P 500 index, expected to grow by +14%.

From a valuation standpoint, the price-to-earnings (P/E) ratio of the CAC40, based on this earnings growth assumption, is currently at 12.8x, which is one point below its 10-year historical average of 13.8x. This suggests that by the end of 2025, the CAC40 could potentially return to positive performance, roughly in line with the anticipated growth in profits.

As long-term investors, we aim to maintain diversified portfolios of high-quality businesses. During episodes of volatility, we will seek opportunities where market prices do not reflect the long-term strength of these companies.

We expect French equities to eventually recover.

With earnings expectations improving, we see opportunities where market prices may not reflect the true strength of quality businesses.