Summary

Exploring Retail Investor Preferences: Insights from a Unique Partnership

The Amundi Investment Institute, in partnership with Crédit Agricole du Languedoc, the University of Montpellier, and Montpellier Business School (MBS), has forged a unique collaboration dedicated to advancing our understanding of individual investors’ financial preferences and needs. This partnership combines academic rigor with practical insights from the financial industry, creating a rich foundation for exploring the evolving landscape of retail investment behavior.

Our approach is multi-faceted and comprehensive. It includes conducting regular, large-scale surveys to capture retail investors’ appetite and attitudes toward various investment strategies; performing quantitative analyses to uncover patterns in consumption and savings behavior; and implementing innovative online experiments to test the effectiveness of different incentives aimed at developing investment participation. A particular emphasis is placed on responsible investment behavior, reflecting the growing importance of sustainable finance in individual decision-making.

These research initiatives are conducted in close collaboration with the CSR and responsible investment, sales and marketing teams at Crédit Agricole Languedoc and Amundi. This integrated effort ensures that our findings are not only academically robust but also directly relevant and actionable for financial institutions seeking to better serve their clients.

We are pleased to share the first results of this ongoing research endeavor. In this initial chapter, we present findings from a survey of 1,080 Crédit Agricole Languedoc clients, focusing specifically on their socially responsible investment behaviors. This paper provides unique insights into the profile of responsible investors, explores their primary motivations for engaging in sustainable investment, highlights the crucial role financial advisors play in guiding these decisions, and identifies the types of sustainable investment approaches most favored by retail clients.

Together, these insights enhance our understanding of the key factors driving retail investors toward responsible investment. We aim to support financial institutions in better tailoring their advisory services and product offerings to meet evolving client demands in a rapidly changing market.

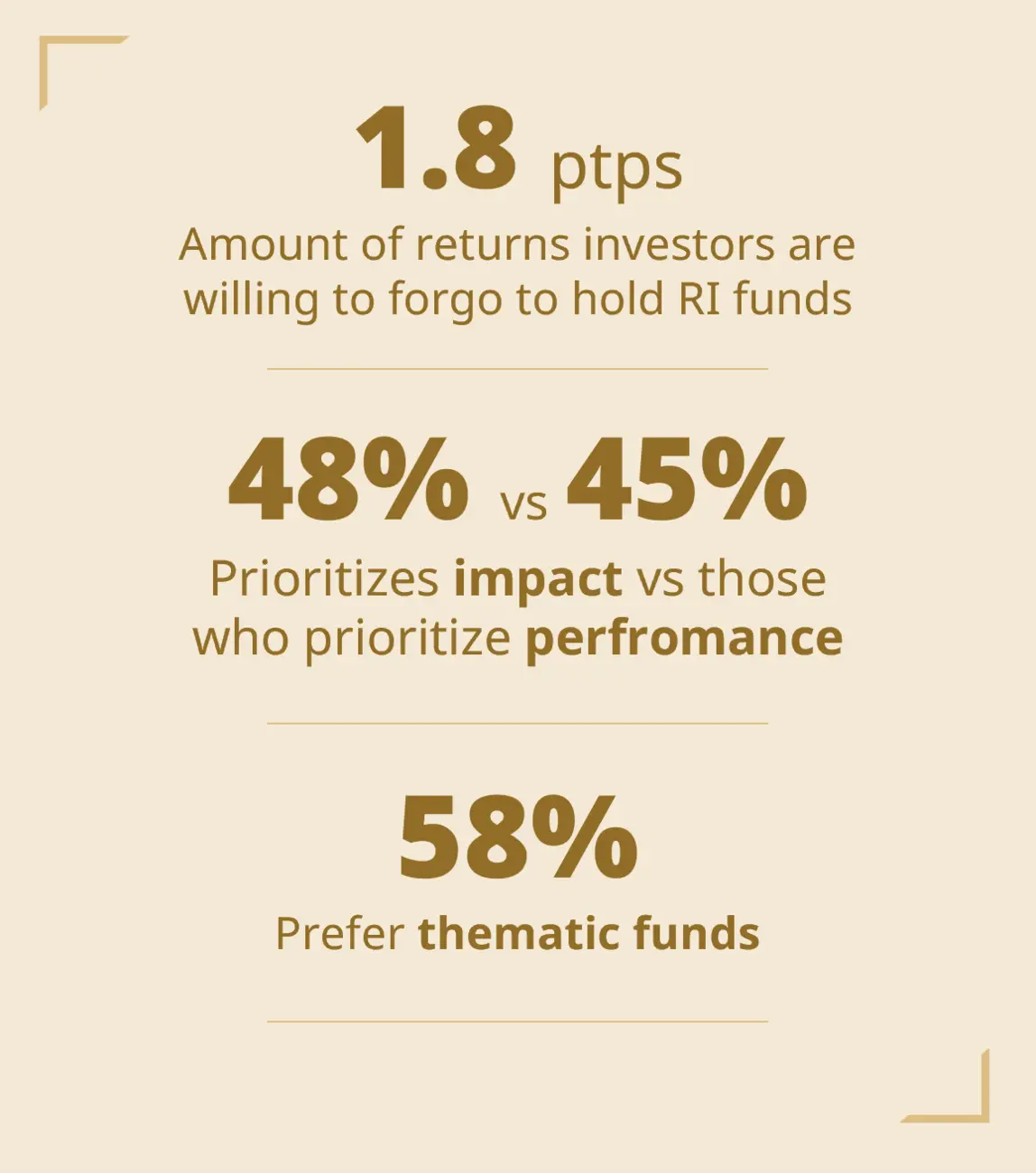

Survey highlights

Survey Results

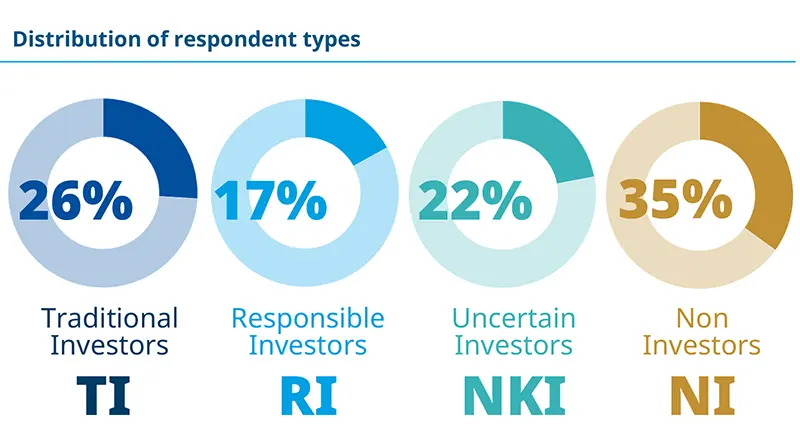

| We surveyed 1,080 clients of Crédit Agricole Languedoc bank on their socially responsible investment behaviors. A minority of clients are responsible investors: among the 1,080 respondents, 65% reported holding financial investments, but only 26% of these investors, which equates to 17% of the total respondents, qualify as responsible investors. |

Characteristics of Responsible Investors

| Responsible investors tend to be: | ||

|

| |

Motivations for Responsible Investment

| Motivations for investing in responsible investment: | ||

|

| |

Abstract

We conducted a survey in June 2024, targeting 50,000 randomly selected clients from the Crédit Agricole Languedoc client base to examine their socially responsible investment (SRI) behaviors. The survey received 1,080 responses, corresponding to a response rate of 2.16%. In addition to survey responses, administrative data on clients’ consumption and savings behaviors during the same period were collected to complement the analysis1.

The sample includes 698 individuals who report holding at least one financial product2. Among them, 284 are traditional investors (TI), representing 26% of the survey respondents, who report holding no responsible investment products; 182 (17%) are responsible investors (RI), who report holding at least one responsible investment product; and 232 (22%) uncertain investors (NKI), who are unsure whether they hold any responsible investment products. In addition, the sample includes 378 (35%) non-investors (NI), who report holding none of the aforementioned financial products.

We begin by asking respondents an open-ended question: what words or expressions come to their mind when they hear the term “responsible investment”? The responses indicate that most associate the term with positive and relevant concepts such as “ecology”, “sustainable”, “environment”, “responsible”, and “solidarity”. A few respondents also link responsible investment to financial performance, mentioning terms like “returns” or “risks”.

Conclusion

In conclusion, Responsible Investors stand out to be the most financially sophisticated group of respondents.

They also exhibit stronger ethical and social orientation, along with more positive belief regarding the performance and impact of responsible investment.

Financial advisors remain the most influential channel in promoting responsible investment products. Communication strategies should highlight both the societal and environmental impact of responsible investments, as well as the potential for value conservation and risk reduction—an aspect to which clients appear particularly sensitive.

In terms of product strategy, thematic funds are especially appealing, but greater emphasis could also be placed on negative screening and shareholder engagement approaches.

Financial education efforts are also essential, especially to raise awareness among retail clients about responsible finance and investment practices.

1. Tables 1 and 2 in the appendix present descriptive statistics comparing survey respondents with the full sample of 50,000 selected clients. Respondents tend to be slightly older, wealthier, and more likely to be women.

2. Such as a life insurance policy, a regular securities account (compte-titres ordinaire, CTO), an equity saving plan (Plan d’Épargne en Actions, PEA), an employee savings plan (plan d’épargne entreprise, PEE), or a retirement savings plan (plan d’épargne retraite, PER)