Summary

- Macroeconomic context: Commodity trends are driven by fundamental, geopolitical, structural and cyclical factors. Today, these are all supportive. Our constructive structural view on commodities is based on the green transition and potentially long-lasting demandsupply mismatches among those base metals that are key to it. If we adjust the main commodity valuations for growth and inventories, they remain cheap (despite the recent rally) and are among the cheapest asset classes. Moreover, sanctions on Russia and impaired activity in Ukraine ports are creating a generalised shortage across a wide spectrum of commodities. The most acute issue for the Eurozone is the huge dependency on Russian natural gas for several European countries, exacerbated by increasing competition among buyers in markets such as China. The reduction of gas imports from Russia should favour its replacement with other sources, although technical and infrastructure issues prevent a cheap and quick solution. Current Eurozone storage levels are high enough to prevent a power crunch over the next few months, but refilling storage requirements for the winter season may be more challenging and could require coordination across European countries to seek alternative sources. At a global level, the oil market looks more balanced than the gas market. The announcement of US Strategic Petroleum Reserve (SPR) releases should provide some relief. However, it cannot be sustainable in the long run, as inventories are at historically low levels.

- Investment implications and portfolio strategies: We foresee a regime shift, in which inflation will be persistently high for several reasons. As inflation is more vulnerable to external and unpredictable shocks, real assets will likely become ever more relevant in asset allocation and commodities will play a crucial role in portfolio diversification. Historically, during an inflationary regime, global commodities have provided a better pay-off than equities despite higher volatility when markets go up. Also, under an inflationary regime, global commodities have outperformed equities during market corrections, with the only exception being cyclical ones. Investors have different ways to play a positive view on commodities. The easiest one is investing in commodity funds or exchange traded funds (ETFs). However, using a specific commodities vehicle can often limit choice, which may be beneficial at the beginning of a commodity cycle while waiting for further clarification on its drivers. When visibility improves, it is preferable to focus on details by using exchange traded commodities (ETCs) on sub-indices. It may be the case that, in a specific industry and during certain market phases, equity fundamentals are supportive and operational leverage is high. As such, playing the commodity theme through equity investments may be preferred. In the current economic phase, playing energy is a tactical choice, given the underinvestment in the oil sector over the past few years. We look into the most cyclical part of this asset class constructively. In the near term, gold may be an interesting diversifier when upward pressure on rates fades, as well as considering it might be in demand from central banks as a reserve for value.

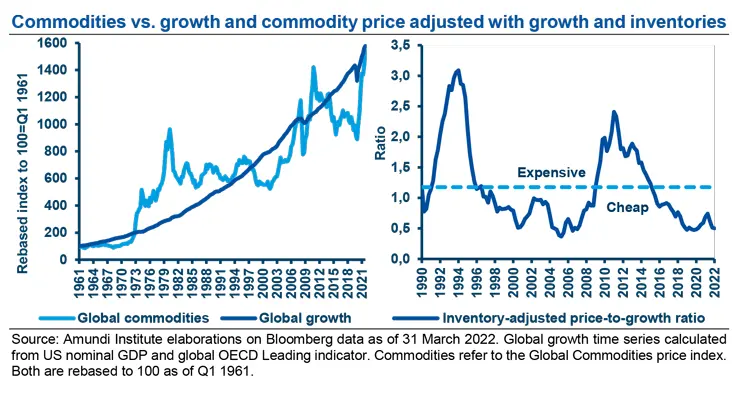

Commodity trends are driven by four sets of factors: fundamental, geopolitical, structural and cyclical. Today, these are all supportive and underpin commodity price trends, especially for base metals and energy. Among the historical drivers, we have GDP growth and economic cycles. During the recovery phase, commodities – mainly cyclical ones – have performed well, driven by fundamentals such as improving economic activity, infrastructure and cyclical demand in general. Not surprisingly, in 2021 commodities closed the significant undervaluation gap with growth that had been built during previous years and caught up during the economic recovery.

Commodities tend to suffer when growth decelerates. However, this has not been the case this time for structural reasons. Indeed, a sustainable upside in commodities cannot be based solely on the recovery narrative. Our constructive structural view on commodities is based on the green transition and on potentially long-lasting demand-supply mismatches in those base metals that are key to it. Inventories for these metals are at historic lows, with no signs of improvement. If we adjust the main commodity valuations for growth and inventories, they remain cheap despite the recent rally and are among the cheapest asset classes.

Our structural constructive view on commodities is based on the green transition and on potentially long-lasting demand-supply mismatches in those base metals that are key to it.

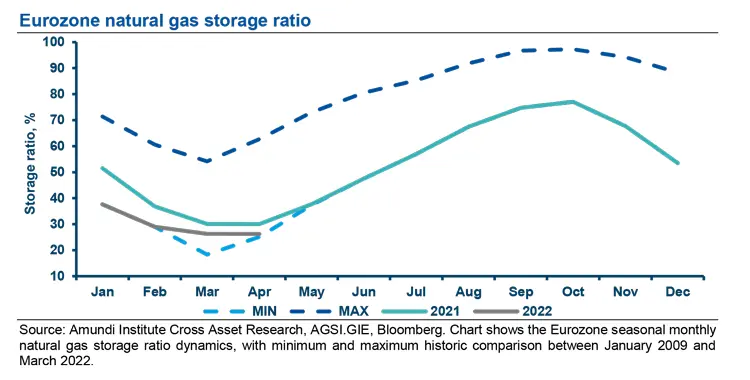

The geopolitical factor is also critical these days. Natural gas is under pressure due to undersupply issues relating to the events in Ukraine. Sanctions on Russia and impaired activity in Ukraine ports are creating a generalised shortage across a wide spectrum of commodities, from grain to steel. Russia and Ukraine combined account for 30% of global wheat exports. The most acute issue for the Eurozone is the huge dependency on Russian natural gas for several European countries, exacerbated by increasing competition among buyers in markets such as China. This is another implication of the green transition efforts, as China is expected to boost its gas imports to speed up coal substitution with energy sources that are less brown. The events in Ukraine have exacerbated trends already in place over the past ten years and provide more arguments for the increasing strategic relevance of the Black Sea for commodity transportation out of Russia. The fallout from the reduction of gas imports from Russia on Eurozone countries – or even a complete halt – should favour its replacement with other sources in order to reduce the Eurozone’s dependence on Russia, although technical and infrastructure issues prevent a cheap and quick solution. Current Eurozone storage levels are high enough to prevent a power crunch over the next few months, but refilling storage requirements for the winter season may be more challenging and could require coordination across European countries to seek alternative energy sources.

Even if the war has accelerated Europe’s efforts to increase its energy independence through renewables, in the near term the trade-off between the ban on Russian gas imports and economic disruption becomes onerous in terms of GDP growth. Stagflation is becoming the central-case scenario in the Eurozone and a profit recession will dramatically hit the most energy-intensive countries and sectors.

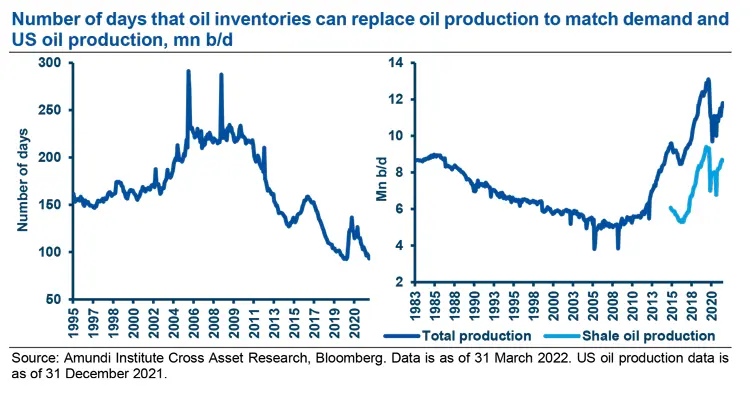

At a global level, the oil market looks more balanced and less Russia-dependent than the gas market. Nevertheless, it has also been overshot due to geopolitical concerns and the potential oil undersupply. We should bear in mind that Russia helped facilitate an agreement on regular oil production increases in the usually litigious OPEC+ group and surpassed Saudi Arabia in overall oil production, with over 12mn barrels per day (b/d). The recent announcement of US SPR releases will add 1mn b/d to the US oil market over the next six months and should provide some relief to oil price pressure. However, it cannot be sustainable in the long run, as inventories are at historically low levels. Moreover, such a decision seems aimed towards cooling down the gasoline price for political reasons. The convergence of the oil price being below $100 per barrel that we were anticipating will be driven by cooling demand as economic growth decelerates alongside an increase in US oil production.

The recent announcement of US SPR releases will add 1mn b/d to the US oil market over the next six months and should provide some relief to oil price pressure. However, it cannot be sustainable in the long run, as inventories are at historically low levels.

Investment implications

Going forward, we foresee a regime shift, in which inflation will be persistently high for several reasons, not necessarily related to benign factors such as economic growth and buoyant labour markets. As inflation is more vulnerable to external and unpredictable shocks, real assets will become ever more relevant in asset allocation and commodities will play a crucial role in portfolio diversification for a variety of reasons:

- A stagflationary environment is usually caused by an external shock from the commodity universe; hence, commodities can perform well when some traditional asset classes fail.

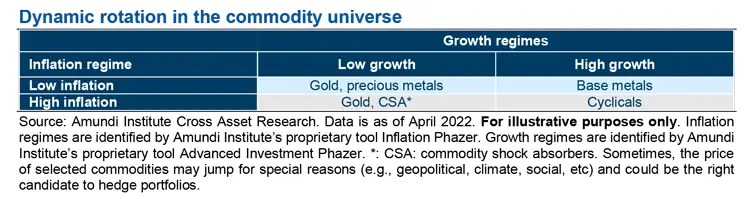

- A dynamic commodity rotation can provide opportunities during every economic cycle.

- In specific segments, commodity demand will remain strong as it will be needed for the green transition and world electrification.

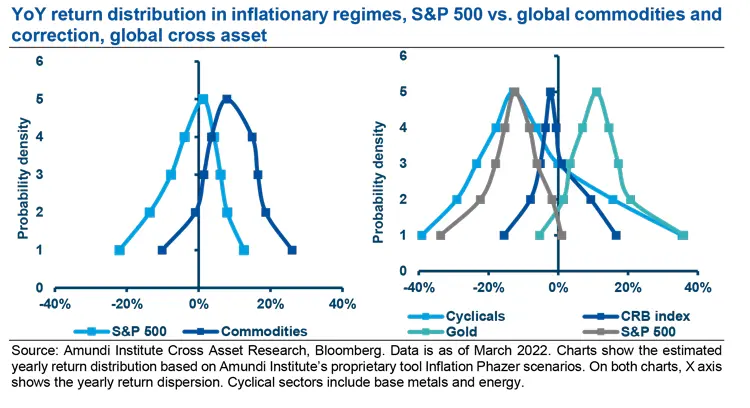

Historically, under an inflationary regime, global commodities have provided a better pay-off than equities despite higher volatility when markets go up, as shown on the lefthand chart below. Also, under an inflationary regime, global commodities have outperformed equities during market corrections, with the only exception being cyclical ones (see right-hand chart).

Historically, under an inflationary regime, global commodities have provided a better pay-off than equities despite higher volatility.

Portfolio strategies

Investors have different ways to play a positive view on commodities, as is the case currently. The easiest one is to invest in commodity funds or ETFs. Often, these solutions differ from each other as the benchmark, which may be tilted towards spot markets or adopts constantmaturity benchmarks, seeks positions – actively or passively – along the future curves. Using such a vehicle for commodities can often limit choice, which may be beneficial at the beginning of a commodity cycle while waiting for further clarification on its drivers. Commodity indices often blend mixed commodity groups, e.g., agriculture, industrial metals, precious metals and energy. As such, when visibility on the cycle and its drivers improves (drivers may include infrastructure plans, the green transition and monetary easing, among others), it is preferable to focus on details by using ETCs on sub-indices (e.g., copper, nickel, natural gas, gold). It may be the case that, in a specific industry and during certain market phases, equity fundamentals are supportive and operational leverage is high. As such, playing the commodity theme through equity investments may be preferred. For instance, investors may consider buying gold miners rather than gold if they have a positive view on the metal.

It may be the case that, in a specific industry and during certain market phases, equity fundamentals are supportive and operational leverage is high. As such, playing the commodity theme through equity investments may be preferred.

In the current phase of the economic cycle, we have a positive view on commodities, especially after the end-March sell-off. The green transition in Europe and Net Zero goals are supportive for industrial metals such as copper, nickel and palladium. Playing energy (both oil and gas) is a tactical choice, appealing in the short term given the underinvestment in the oil sector over the past few years. Risks lie in the high volatility of their prices. Commodities may have multiple natures: they are goods, but are also speculative vehicles and can be reserves for value. Gold is the best example of this. Sometimes, commodities may become expensive and crowded by speculative investors, possibly driving them away from fundamentals, with high volatility and severe sell-offs. The current situation presents an interesting framework for commodities, with disruptions related to the war in Ukraine, but also from the new geopolitical landscape that will follow during the next few years. We look into the most cyclical part of this asset class constructively. In the near term, gold may be an interesting diversifier when the upward pressure on rates fades, as well as considering it might be in demand from central banks as a reserve for value.

Definitons

Exchange-traded commodity (ETC): It is a security that can offer traders and investors without direct access to spot or derivatives commodities markets exposure to commodities such as metals, energy, and livestock. An ETC can track individual commodities or a basket of several commodities and can provide an interesting alternative to trading commodities in the futures market.

Exchange-traded fund (ETF): It is a type of pooled investment security that operates like a mutual fund. ETFs track a particular index, sector, commodity, or other asset, but unlike mutual funds, ETFs can be purchased or sold on a stock exchange the same way that a regular stock can.