Summary

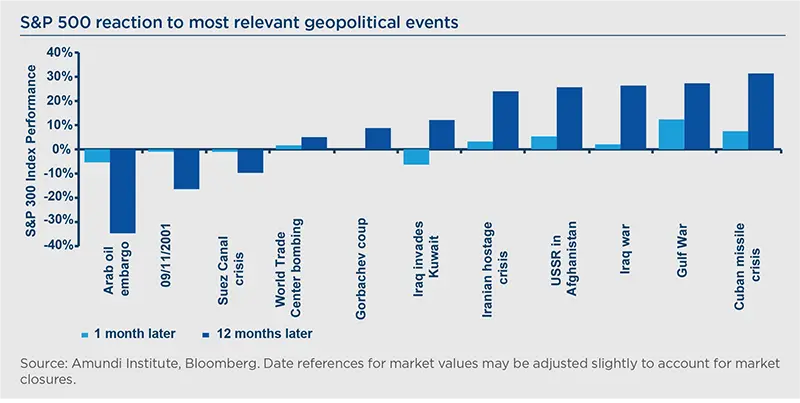

In recent history, geopolitical crises have tended to be short-lived and after an initial sell-off they provide buying opportunities for investors. It’s tempting to see a similar pattern in the Russia-Ukraine conflict, which would explain why markets have been on a roller-coaster, with a fast recovery expected for any perceived positive development, after the initial negative shock when Russia launched its unexpected large scale invasion of Ukraine on 24 February. However, now is not the time to be complacent and buy too much into short-term news, until the picture of how the conflict is evolving becomes clearer.

Most importantly, investors should bear in mind that we are not living in normal times. We are in the middle of a regime shift characterised by unprecedented inflationary forces not seen in the past five decades. The regime we are moving into, that I call the “Road back to 70s”, is not only inflationary in nature. As I have advocated over the past two years, it will come with a harsh readjustment of the geopolitical order (implying higher fragmentation), with the final death of globalisation and the emergence of regionalisation centred on new global powers.

Among the winners will be China, whose economic cycle is gaining independence from the US and with a rising role for the Chinese renminbi as the currency of trade for the region.

The Russia-Ukraine conflict is adding to the case rather than subtracting, with inflation being a particular certainty of the regime and stagflation its main core risk, and Europe being the most impacted area.

How the Russia-Ukraine conflict fits into the regime shift narrative

The Russia-Ukraine conflict opens various scenarios for how the geopolitical crisis could unfold. The timeframe of the crisis and its progression are critical elements to watch. The longer the disorder, the higher the risk of it spreading globally. This suggests that in the short term there is a cynical window of stress relief in the market, driven by any news that reinforces the narrative of a short-term conflict. Markets are buying time before the point is reached when they are able to assess the full implications of this event.

We will therefore face an initial period of markets being driven by short-term news, followed by a second period of market adjustments that will then consider the long-term regime shift and how the current crisis fits into it

For investors, this means that any temptation to seek “entry points” should consider the target equilibrium for risk premia under the new regime. As of today, we are still far away in many market segments, as repricing and reordering have further to go.

Scenario 1. Short-term cynical fixing

Under this scenario, we will have few days that eventually lead a change into a pro-Russian government in Ukraine. The western reaction function will remain limited to sanctions (i.e.; acceptance of the geopolitical change with no military reaction in Ukraine), containment at the NATO border and the isolation of Russia from the global equation.

- Assumptions: Russia can sustain the sanctions (amid limited external vulnerability) and Europe can absorb the negative growth shock (even more if oil and gas supply from Russia remains in place).

- Economic implications: The inflation factor is reinforced, while the growth factor weakens, but with market perception that the inflationary hit will be bigger than the hit to growth.

- Central banks: The drivers of monetary policy after the crisis remain unchanged; implying that central banks at the margin will be inclined to do less and not more, therefore moving ahead with so-called normalisation.

- Market implications: With limited-to-zero global spread and the repricing of global relative risk premia, there will be a time of market relief.

This sequence seems to play out, at least initially. The “Biden acceptance” backs the economic case of a “frozen Russia but alive enough to be useful”. However, any lasting serious resistance from Ukraine would weaken this “short-term cynical fixing” scenario.

- At the time of writing, the odds are for a longer, rather than a shorter, framework, with various elements pointing in this direction:

- The conflict on the ground could last, maybe with some refraining from Russian troops in order to avoid casualties;

- The negotiation process could face challenges. We could firstly see a ceasefire subordinated to the acceptance of some negotiations by Ukraine, but moving ahead much will depend on the internal forces at play in Russia;

- Even assuming a quick fix, there will remain two open points. The first is the need to control an adverse Ukrainian population under a possible pro-Russian government. The second is how to deal with the global European security framework (for both parties).

Therefore, we are likely to face a scenario of short-term relief on any positive news, followed by higher tension, ultimately leading to a longer and more uncertain fixing process.

Scenario 2. Progressive realisation of long-term lasting features in the “Road back to the ‘70s”

This scenario is characterised by lasting security problems in Europe with a de-facto re-involvement of the US, with an unstable pro EU-Ukrainian population and unsustainable coexistence of two socio-political models. Unless Russia is ultimately turned into a sort of western satellite (for example in the case of an internal coup against Putin), something has to give.

- Assumptions: The western geopolitical reaction function is deeply unclear and fragmented across internal diverging forces, within Europe and within the US. Western countries are driven by economic interests (to the extent of partially limited or ineffective sanctions), Russia by a balance of power logic.

- Economic implications: This event is a reminder that the risk, in essence, is that the new macro financial regime is stagflationary. Russia, under this scenario, will be an accelerator of the regime shift, giving reasons or excuses. China will be the objective geopolitical winner. The crisis will further foster a role for the Chinese renminbi as the currency of trade in the region and a store of value for investors. This will reinforce the case for Chinese assets as a global diversifier providing an oasis of positive returns.

- Central banks: As time goes on, central banks will continue to keep an attitude of benign neglect, with an asymmetric bias towards growth versus inflation challenges. This will determine a continuation of the fiscal dominance and financial repression framework. Hence, expect more, not less accommodation. The same applies to budgetary stances.

- Market implications: This scenario can justify a geopolitical premium on European assets and an allocation view that favours US and Chinese assets.

All in all, even if short-term containment is ensured, Russia will occupy a more than proportionate importance in the markets, because risk premia are too tight and provide little insurance to compensate for virtually anything that might happen. This occurs at a time when the fundamental forces of repricing ‘the regime shift’ will unfold, adding further volatility in the market.

Ten investment implications for investors

In this context, there are ten key investment implications that investors should consider:

- The probability of repricing spreading globally is not low. This calls for hedges being kept in place against more unfavourable developments. The longer the “short-term fixing” the higher the probability of long-lasting readjustment. This would certainly lead central banks to retreat from their current perceived aggressive stance.

- Credit is the primary candidate for repricing. Discrimination will intensify together with looming market liquidity mismatches calling for a cautious, selective stance in this space.

- Long-term inflationary expectations will be challenged by the Russian sequence (starting from rising energy prices, spreading into agricultural, global commodities…), leading to rising bond volatility.

- Investors should look for assets that can provide positive real returns. In the even more fragmented Emerging Markets (EM), amid different degrees of impact from the conflict, select EM debt will be relevant income engines. In addition, investors should aim to get exposure that is positively correlated to inflation (commodities, value, high dividend stocks, real assets proxies, securitised credit, floating rates…).

- Equities will be strategically attractive because they offer a source of liquid real returns. Here investors should favour the value/quality tilt and move away from long duration equities. In the case of a global spread, global equities may sell-off first because of their high liquidity profile, but they will eventually recover. A sell-off in credit will follow, but here the potential for a recovery will be lower, given current valuations.

- Changing risk/return profile of traditional asset classes will lead to the emergence of new hybrid cross-asset segments that will play a key role in portfolio construction. The big challenge from a portfolio construction perspective will be what to place as a core “safe” allocation replacing bonds, which are challenged by increasing inflationary pressure. The “bondification” of equities offers a space for stocks with bond features that could gain the status of “safe” core assets. These are names with high earnings visibility and low debt.

- Investors should resist the temptation (high in phases of turmoil calling for a risk-off tilt) to re-embrace bonds as the core dominant diversifier in light of their safe haven appeal. The status of core government bonds has definitively changed and their apparent renewed attractiveness in the Russian-Ukraine escalation is a trap. There is room for more flexibility in duration management, but the short duration trend is your friend. In the intensified search for safe, liquid, attractively valued assets Chinese government bonds will emerge as candidates, while Treasuries can still be considered, but at the price of unsustainable overvaluation. In addition, we see a non-consensual case for steeper curves building. First, at the short end of the curve we may see downward pressure on yields as central banks are likely to do less and not more. At the long end, instead, markets will start to reprice terminal rates recognising that the “benign inflation neglect” as gone on for too long and the reality is a higher inflationary environment that is going to last longer.

- In the currency space, the increasing insulation of the Chinese economic cycle from the west, and the rising power of China in Asia confirms the view of a depreciating US dollar versus the Chinese renminbi. In addition, the Russian crisis points to an increasing appetite to diversify central bank holdings away from the US dollar and euro. All these trends will drive an erosion of value for the US, not of status.

- Expect a great return for the benefits of international diversification. Initiated first by the retreat of global trade from the global growth structure, we will see increasing dispersion in cross-country returns.

- Holding cash makes sense in the first part of the sequence. There is a critical trade-off at a total portfolio level between locking-in liquid capital for looming liquidity asset/liability mismatches and deploying it into attractively valued long-term risky assets. So far, limited price actions have taken place, implying that we should not consider markets being cheap overall, as value has not been fully restored. Keeping your dry powder makes sense in the face of risk premia adjustments. In addition, as the structure of central bank reserves evolve in favour of gold for geo-political considerations and inflation, a sequence of gold monetisation is likely.

Bibliography

- Blanqué, P. (2014, 2019 3rd ed.), Essays in Positive Investment Management, Economica, Paris

- Blanqué, P. (October 2021), Shifts & Narratives #10 - China is finally emerging from the US’s shadow, Amundi Publications

- Blanqué, P. (May 2020), The day after #1 - Covid-19: the invisible hand pointing investors down the road to the 70s, Amundi Publications

- Blanqué, P. (June 2019), The Road Back to the 70s Implications for Investors Amundi Publications