Summary

With persistent inflation and a resilient economy in the US, the Federal Reserve is in no rush to cut rates.

- Inflation will remain sticky in the first half of the year, and should move higher in the second half.

- The new administration’s policy should affect expected inflation, not actual inflation for now.

- The Fed could be patient on holding rates at the current level.

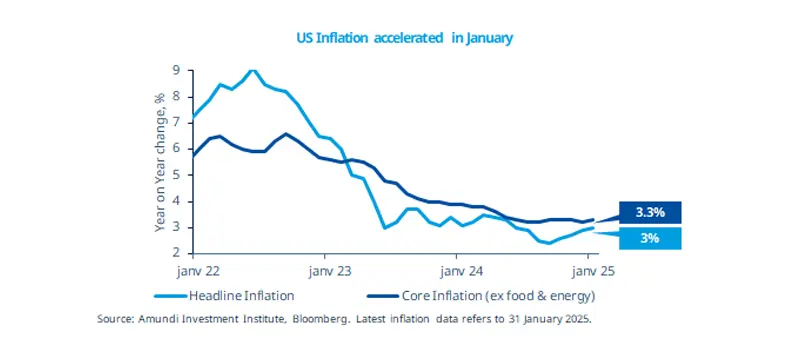

January's US Consumer Price Index (CPI) came in above expectations, with a monthly gain of 0.5%, pushing the annual inflation rate to 3.0%. Core inflation, which excludes food and energy, also accelerated. This first inflation report of the year may reflect some seasonal effects, along with annual price increases that typically roll out at the start of the year. Besides the yearly noise, the biggest surprise was in core inflation, driven by strong gains in prescription drugs and used cars. The report highlighted factors that could pose medium-term inflation risks, such as the recent halt in disinflation for housing costs, which may establish a floor for overall inflation. The Fed will likely remain patient.

Actionable ideas

- Income investing in focus

With uncertainty on inflation, income investors can exploit opportunities across the board ,including in global equity dividends.

- Explore opportunities across global bonds

Different inflation dynamics across regions and diverging central bank policies create opportunities in global bond and currency investing.

This week at a glance

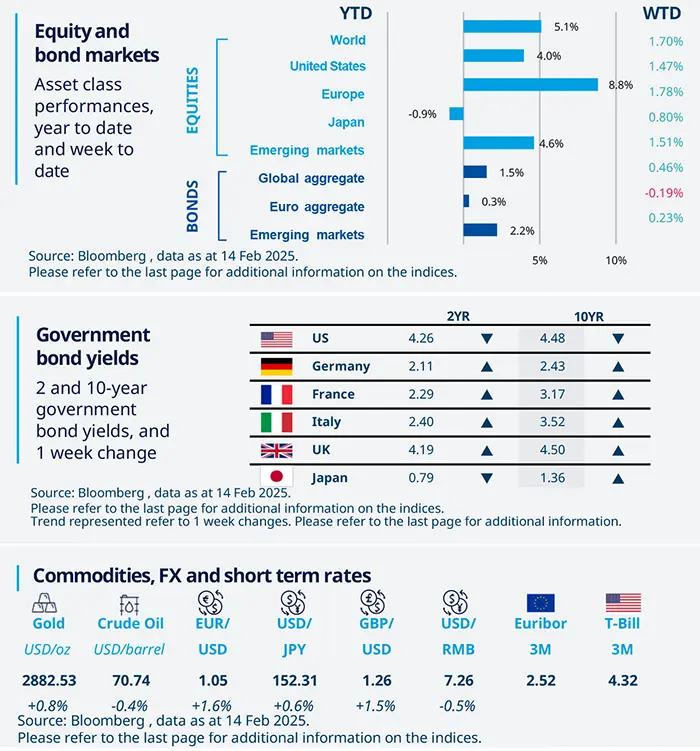

Global stocks are near record highs amid hopes for US tariff negotiations, with European indices poised for their eighth positive week, driven by peace prospects in Ukraine. Hot US inflation data has raised yields on government bonds, while gold is on track for a seven-week positive streak, supported by persistent safe-haven demand.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 14 February 2025. The chart shows US CPI YoY growth. *Diversification does not guarantee a profit or protect against a loss.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

Fed in no hurry to cut rates

In his semi-annual testimony before the Congress, Fed Chair Jerome Powell highlighted how the central bank is not in a hurry to cut rates. He added that, if the economy and labour market stay strong and inflation does not move substantially lower towards target, they can keep policy restraint for longer. He also cautioned that a monthly rise in inflation shouldn't be seen as a reversal of the disinflation trend.

Europe

EZ industrial production stays weak

December Eurozone industrial production declined by 1.1% MoM after a small rise in November. The production level in December was some 7% lower than in early 2022, before Russia’s invasion of Ukraine. This result means that the sector contracted again in Q4 2024. Surveys suggest that production should stay weak in early 2025 as well, as the structural issues persist.

Asia

China rate cuts may be coming soon

Despite ongoing deflationary pressures, the PBoC has not cut rates since September. As currency stability emerges as a near-term priority, we have adjusted our expectation for a PBoC rate cut from February to May. Given the potential for a slowdown in Q2, anticipated negative CPI prints, and the threat of looming tariffs, the PBoC cannot afford to delay action for too long.

Key dates

18 Feb UK unemployment, French inflation, US Empire State manufact | 19 Feb UK inflation, US housing starts and building permits, PBoC Loan Prime Rate (20 Feb) | 21 Feb JP inflation, EZ and UK flash PMIs, US existing home sales |